Mastering one setup is how Market Wizards & US Investing Champions make millions.

If you’re struggling to find a setup, look no further than the High Tight Flag (US Investing Champ Leif Soreide @LeifSoreide's go to pattern).

Here’s everything you need to know :

If you’re struggling to find a setup, look no further than the High Tight Flag (US Investing Champ Leif Soreide @LeifSoreide's go to pattern).

Here’s everything you need to know :

Leif’s go to setup is known as the High Tight Flag, a powerful momentum based setup that has resulted in massive gains over his lifecycle as a trader.

Here's more on Leif's background if you're unfamiliar with him:

Here's more on Leif's background if you're unfamiliar with him:

The HTF pattern is one of the most rare but powerful patterns in technical analysis.

Here are the key traits:

→ Flagpole to be 90% or more, higher the better

→ Flag that forms over 3-5 weeks

→ Declining volume

These patterns also form the foundation for rocket bases.

Here are the key traits:

→ Flagpole to be 90% or more, higher the better

→ Flag that forms over 3-5 weeks

→ Declining volume

These patterns also form the foundation for rocket bases.

Here's an easy visual of the above characteristics with $CELH from 2020:

1. Flagpole

2. Flag

3. Volume decreasing in pattern

4. Diagonals / trendlines form pivot

5. Increased volume through the pivot

1. Flagpole

2. Flag

3. Volume decreasing in pattern

4. Diagonals / trendlines form pivot

5. Increased volume through the pivot

Before we get into a handful of examples, what factors does Leif look for to increase the probability that the setup is going to work?

→ Studies the daily/weekly

→ Ensures there's group strength

→ Finds relative volume through pivot

More using $AMRS:

→ Studies the daily/weekly

→ Ensures there's group strength

→ Finds relative volume through pivot

More using $AMRS:

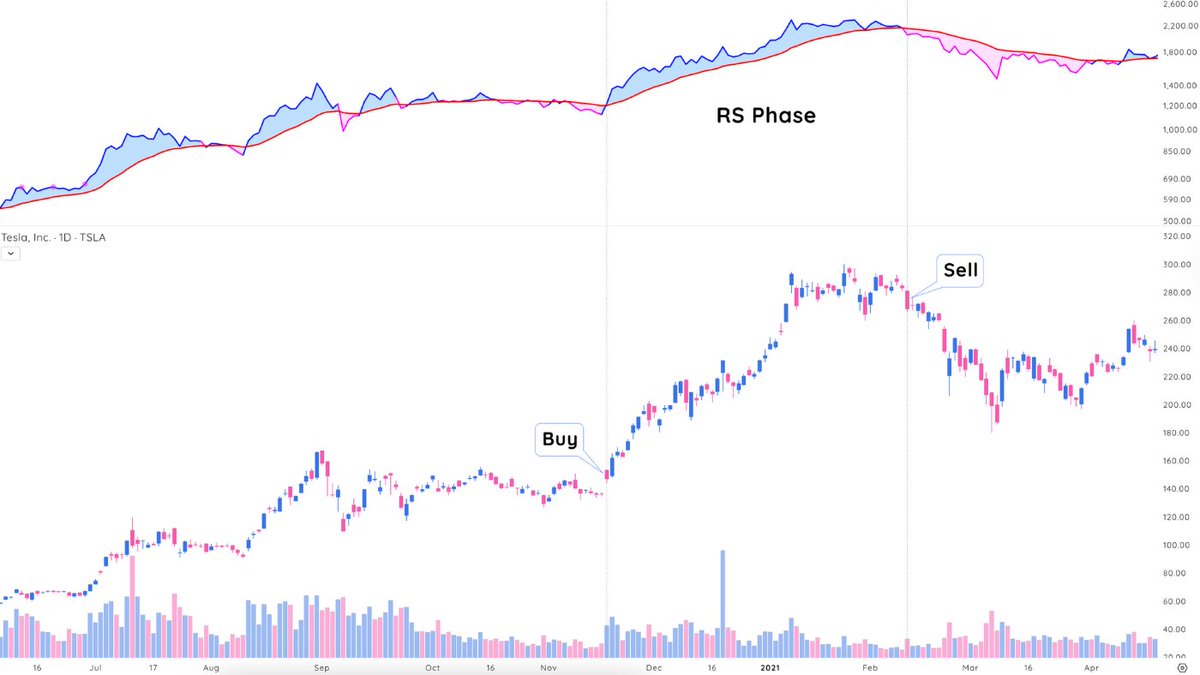

Let's now get into concrete examples of some successful HTF trades (as well as ones that didn't work out exactly as planned):

$CRSR

→ IPO rule: cut the duration in half

→ How Leif knew to get out

→ Selling into strength (26R)

$CRSR

→ IPO rule: cut the duration in half

→ How Leif knew to get out

→ Selling into strength (26R)

$DQ is a great example to study because...

→ Context is always key when analyzing patterns

→ Leif describes where he measures the flagpole from

→ Tiny pauses are okay, sloppiness may mean it won't work

You have to adapt to what the market is giving you & respond to price!

→ Context is always key when analyzing patterns

→ Leif describes where he measures the flagpole from

→ Tiny pauses are okay, sloppiness may mean it won't work

You have to adapt to what the market is giving you & respond to price!

$TIGR

The more powerful the rise, the more you can be lenient with the depth of the flag.

Volatility may be higher, but if the stock makes a new high on huge relative volume through the pivot you have to give it the benefit of the doubt.

The more powerful the rise, the more you can be lenient with the depth of the flag.

Volatility may be higher, but if the stock makes a new high on huge relative volume through the pivot you have to give it the benefit of the doubt.

$ZIM is an interesting HTF example because of the length of base.

It consolidated for much shorter than 3-5 weeks before blasting off, which is common with young IPOs (like previous example $CRSR).

Pattern worked beautifully nonetheless.

It consolidated for much shorter than 3-5 weeks before blasting off, which is common with young IPOs (like previous example $CRSR).

Pattern worked beautifully nonetheless.

Our last example is $UAN:

Here we see:

· Multiple buy points

· Using ATR to identify tight areas

These types of tight areas give potential for great R/R as pattern pressure builds up.

Any sort of buying power drive this thing higher.

Here's more through the eyes of Leif:

Here we see:

· Multiple buy points

· Using ATR to identify tight areas

These types of tight areas give potential for great R/R as pattern pressure builds up.

Any sort of buying power drive this thing higher.

Here's more through the eyes of Leif:

Analyzing the one of the market's strongest technical patterns through the eyes of a US Investing Champion is priceless.

If you're looking for more, we have the perfect resource for you:

The High Tight Flag Masterclass with Leif himself ↓

If you're looking for more, we have the perfect resource for you:

The High Tight Flag Masterclass with Leif himself ↓

This is an exclusive 10-lesson live event, guiding you to mastery of:

→ The setup

→ Entry/exit tactics

→ Avoiding faulty patterns & costly mistakes

→ Proper position sizing of HTFs

You’ll also receive lifetime access to the content + a model book of real-world examples.

→ The setup

→ Entry/exit tactics

→ Avoiding faulty patterns & costly mistakes

→ Proper position sizing of HTFs

You’ll also receive lifetime access to the content + a model book of real-world examples.

Early bird pricing ($99) is only available for 20 more hours, so take advantage of it while it lasts!

You can get access & learn much more about the live event + accompanying content here:

traderlion.com/high-tight-fla…

You can get access & learn much more about the live event + accompanying content here:

traderlion.com/high-tight-fla…

If you’re willing to put in the work, you too can master one setup and give yourself the chance to become as successful as market wizards and US Investing Champions.

All it takes is a commitment & discipline.

We’ve done the dirty work for you!

All it takes is a commitment & discipline.

We’ve done the dirty work for you!

Boom! That's it.

If you've learned something new about HTFs today, and are excited for the exclusive live event, give the first tweet below a share:

We couldn’t be more excited to bring you this experience & education!

If you've learned something new about HTFs today, and are excited for the exclusive live event, give the first tweet below a share:

We couldn’t be more excited to bring you this experience & education!

https://x.com/TraderLion_/status/1840491739460796822

• • •

Missing some Tweet in this thread? You can try to

force a refresh