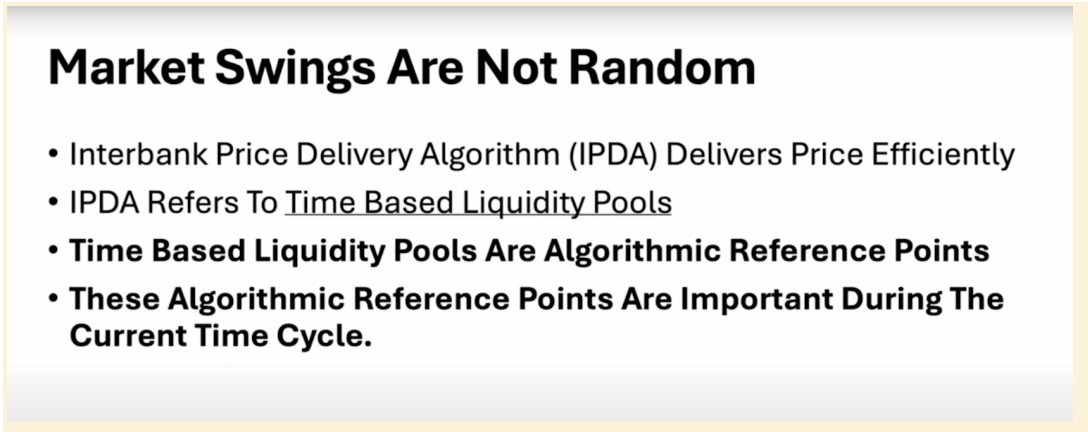

In this thread, we will take a deep dive into Time Cycles & Market Swings.

We will discuss everything you need to know to be efficient in the markets based on Time & Price.

Let's begin!

We will discuss everything you need to know to be efficient in the markets based on Time & Price.

Let's begin!

There are so many opportunities when you use Time Cycles to frame High Probability Setups.

If you understand this, you would no longer fear missing a move.

This thread will change your perspective on liquidity completely...

If you understand this, you would no longer fear missing a move.

This thread will change your perspective on liquidity completely...

The Highest Probability Trade Setups contain the following:

- Very specific Time cycle

- Very specific Signatures In Price Action

When combining the two, THIS is where the precision comes in.

- Very specific Time cycle

- Very specific Signatures In Price Action

When combining the two, THIS is where the precision comes in.

During A Time Cycle, we refer to the Previous Cycle for Key Liquidity Pools.

Once the New Time Cycle opens…

- Smart Money Accumulates,

- Manipulates a Previous Cycle's High/Low,

- Distributes towards the Opposing Low/High.

Ideally, we want to position ourselves AFTER the manipulation.

Once the New Time Cycle opens…

- Smart Money Accumulates,

- Manipulates a Previous Cycle's High/Low,

- Distributes towards the Opposing Low/High.

Ideally, we want to position ourselves AFTER the manipulation.

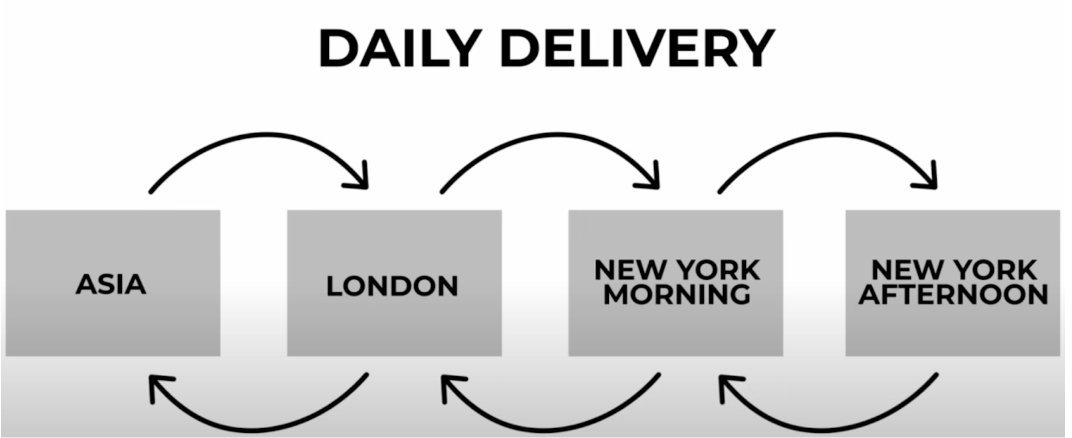

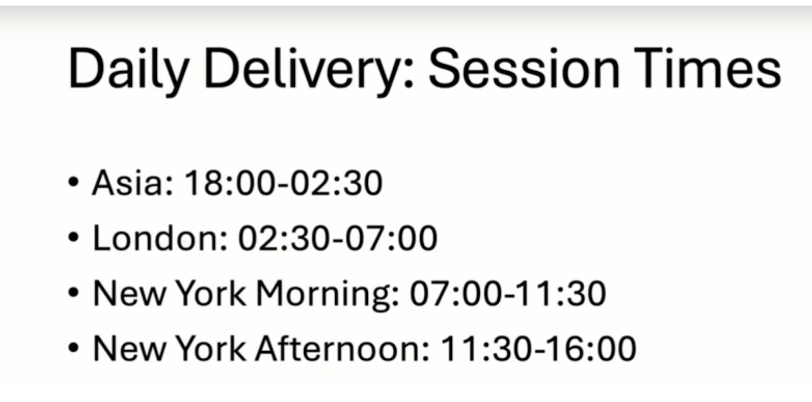

When looking at the daily delivery, we can anticipate how the next session will deliver based on the current session.

Meaning that if one session Accumulates, expect the next to Manipulate and the next to Distribute.

Each previous session/cycle will provide objective targets.

Meaning that if one session Accumulates, expect the next to Manipulate and the next to Distribute.

Each previous session/cycle will provide objective targets.

I look at markets through the lens of 90 minute cycles.

This allows me to see clearly where the key highs and lows are located based on Time.

Listed below are each session’s timings through 90 minute intervals.

Now, let’s take a look at some chart examples…

This allows me to see clearly where the key highs and lows are located based on Time.

Listed below are each session’s timings through 90 minute intervals.

Now, let’s take a look at some chart examples…

Example #1:

London & New York sessions.

London & New York sessions.

Morning Session 90 Minute Cycles:

7:00-8:30

8:30-10:00

10:00-11:30

7:00-8:30

8:30-10:00

10:00-11:30

Morning Session Middle/Manipulation Cycle:

8:30-9:00

9:00-9:30

9:30-10:00

8:30-9:00

9:00-9:30

9:30-10:00

Morning Session Final/Distribution Cycle:

10:00-10:30

10:30-11:00

11:00-11:30

10:00-10:30

10:30-11:00

11:00-11:30

Afternoon Session:

11:30-13:00

13:00-14:30

14:30-16:00

11:30-13:00

13:00-14:30

14:30-16:00

Afternoon Session Final (Distribution) Cycle:

14:30-15:00

15:00-15:30

15:30-16:00

14:30-15:00

15:00-15:30

15:30-16:00

Studying this thread will allow you to be efficient in the markets,

Because you’ll know exactly When and Where High Probability Setups form.

But if you want to step up your understanding of Time & Price even more, my mentorship will give you that:

timethenprice.com

Because you’ll know exactly When and Where High Probability Setups form.

But if you want to step up your understanding of Time & Price even more, my mentorship will give you that:

timethenprice.com

Full lecture: Time Cycles & Market Swings Explained

Good-luck with your studies!

Let me know in the replies if you would like to see more threads like this.

Let me know in the replies if you would like to see more threads like this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh