Top down analysis is a stock screening method which is very popular🔥 among trading community

BUT HOW TO DO IT?🤔

Today, we’ll present examples and frameworks that will help you perform top-down analysis🔍 in just 15 minutes.

Bookmark this thread 🧵

BUT HOW TO DO IT?🤔

Today, we’ll present examples and frameworks that will help you perform top-down analysis🔍 in just 15 minutes.

Bookmark this thread 🧵

#1 Scrolling through Indices Charts - 3 min🧐

What to look for?

Start with indices charts and check which ones are improving📈

Observation

Many indices are struggling near their moving averages, while Nifty Realty is bouncing from key moving average levels.

Note

Indices lag, so one need not wait till breakout; many leaders will have already moved by then.

What to look for?

Start with indices charts and check which ones are improving📈

Observation

Many indices are struggling near their moving averages, while Nifty Realty is bouncing from key moving average levels.

Note

Indices lag, so one need not wait till breakout; many leaders will have already moved by then.

#2 Find the strong industries in the sector - 2 min🏭

What to look for?

Review all industries in the sector and select the industry with the highest no of stocks with relative strength > 80 or70💪

Observation

There are only 2 industries: real estate & Construction residential and commercial. With real estate industry contributing 23.9% out of 28%, where 28% of realty stocks have Relative strength above 80.

What to look for?

Review all industries in the sector and select the industry with the highest no of stocks with relative strength > 80 or70💪

Observation

There are only 2 industries: real estate & Construction residential and commercial. With real estate industry contributing 23.9% out of 28%, where 28% of realty stocks have Relative strength above 80.

#3 Scanning for stocks in industry - 10 min👨💼

What to look for?

High Relative Strength, non circuit stocks which are near Breakout levels or providing low risk entry opportunities (and any other characteristic you may like)

Action

Scroll🏃 through charts and transfer the names that match your setup criteria to watch list

What to look for?

High Relative Strength, non circuit stocks which are near Breakout levels or providing low risk entry opportunities (and any other characteristic you may like)

Action

Scroll🏃 through charts and transfer the names that match your setup criteria to watch list

#4 Summary

Boom🚀just in 15min couple of watch list worthy setups from the improving realty sector were gathered through top down analysis

Disclaimer

Examples mentioned are not recommendations, just for educational purpose only

Boom🚀just in 15min couple of watch list worthy setups from the improving realty sector were gathered through top down analysis

Disclaimer

Examples mentioned are not recommendations, just for educational purpose only

#5 Alternative approaches

What to look for?

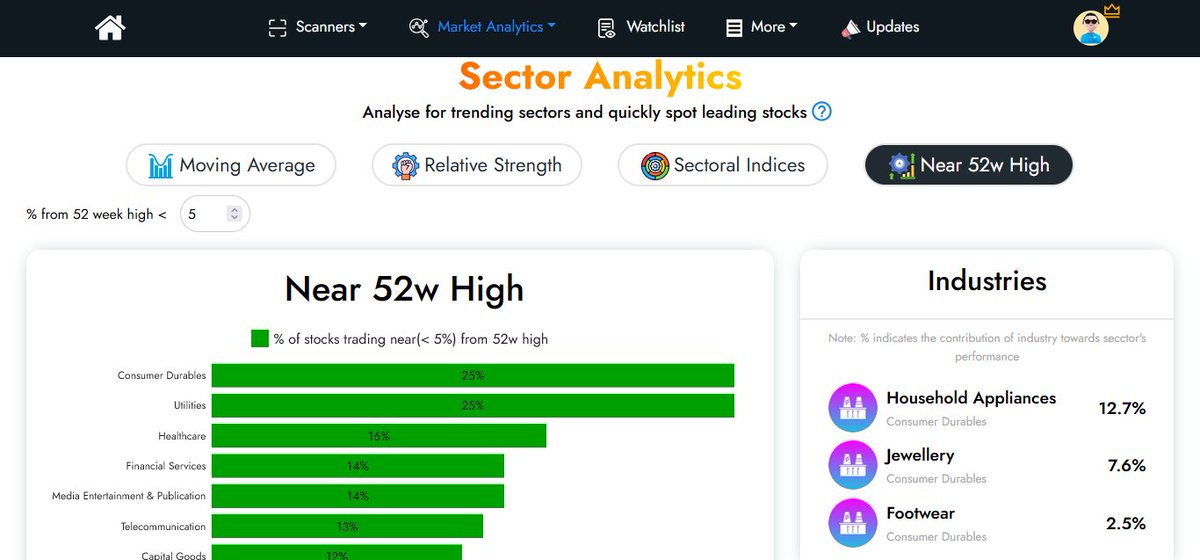

1. Check which sector has most no of stocks near 52 w high and repeat steps 2,3

OR

2. Pick Sector with highest proportion of RS>80 stocks and repeat steps 2,3

Observation

Both of above point towards Consumer Durables sector with Household appliances, jewellery and foot wear as top industries

What to look for?

1. Check which sector has most no of stocks near 52 w high and repeat steps 2,3

OR

2. Pick Sector with highest proportion of RS>80 stocks and repeat steps 2,3

Observation

Both of above point towards Consumer Durables sector with Household appliances, jewellery and foot wear as top industries

• • •

Missing some Tweet in this thread? You can try to

force a refresh