1/ This new paper is a true declaration of war: the ECB claims that early #bitcoin adopters steal economic value from latecomers. I strongly believe authorities will use this luddite argument to enact harsh taxes or bans. Check 🧵 for why:

2/ Rather than praising bitcoin as a tech paradigm shift à la petroleum and the internet, the authors introduce the blatantly luddite argument that "early adopters" ... "increase their real wealth and consumption" ... "at the expense of [latecomers]".

3/ Then they go on to brazenly advocate for legislation ... "to prevent bitcoin prices from rising or to see bitcoin disappear altogether" in order to prevent "the division of society".

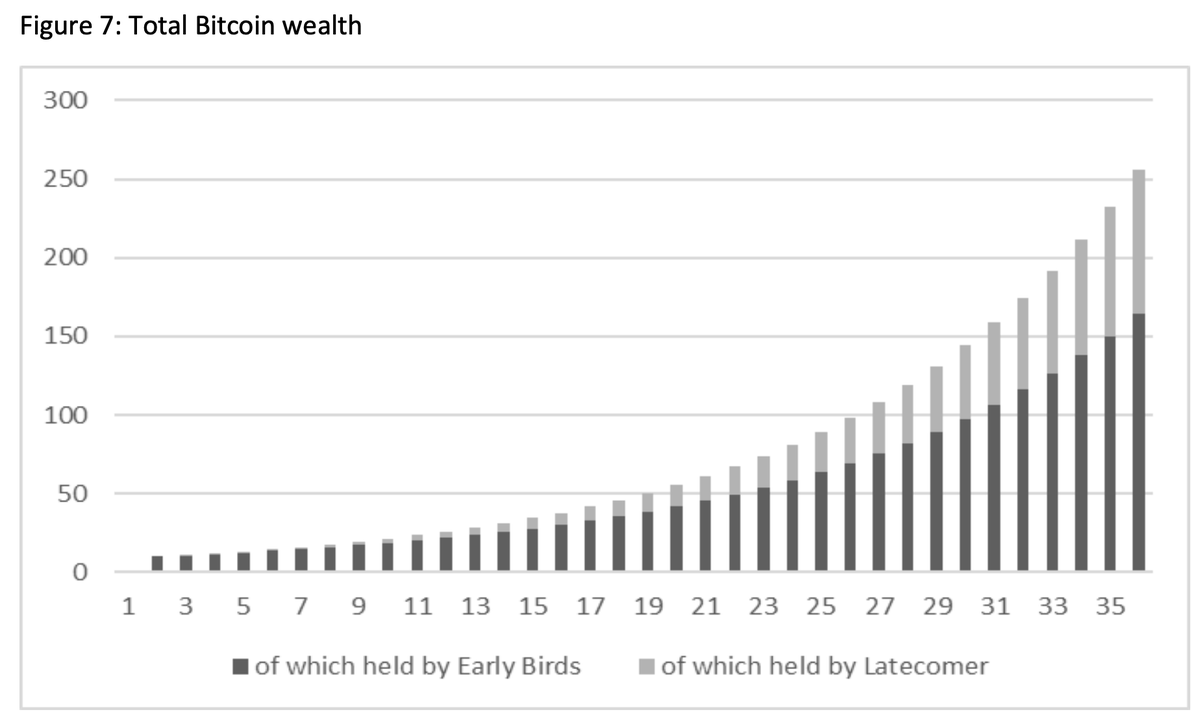

4/ The authors also model some projections, to illustrate the paltry amount of BTC that will remain available for latecomers. (Woe is me! Conspicuously left out is the reason that has driven 15 years of bitcoin adoption & development: it's simply better tech.)

5/ In all the years I've been monitoring the bitcoin space, this is by far the most aggressive paper to come from authorities. The gloves are off. It's clear that these central bank economists now see bitcoin as an existential threat, to be attacked with any means possible.

6/ Many of us have warned that this was coming: bitcoin as a major political fault line both in national and international elections. Well here it is. It means that us HODLers must take action to insure that governments respect our basic right to hold property.

7/ And no, this won't be a war between haves and have-nots. Rather this will be a historic clash between those who stand for the natural rights of the individual, and those who clutch at the failed ideologies of collectivism and central planning.

8/ Here's the download link to the paper: "The distributional consequences of Bitcoin". (We need detailed rebuttals. Who's writing one?) papers.ssrn.com/sol3/papers.cf…

• • •

Missing some Tweet in this thread? You can try to

force a refresh