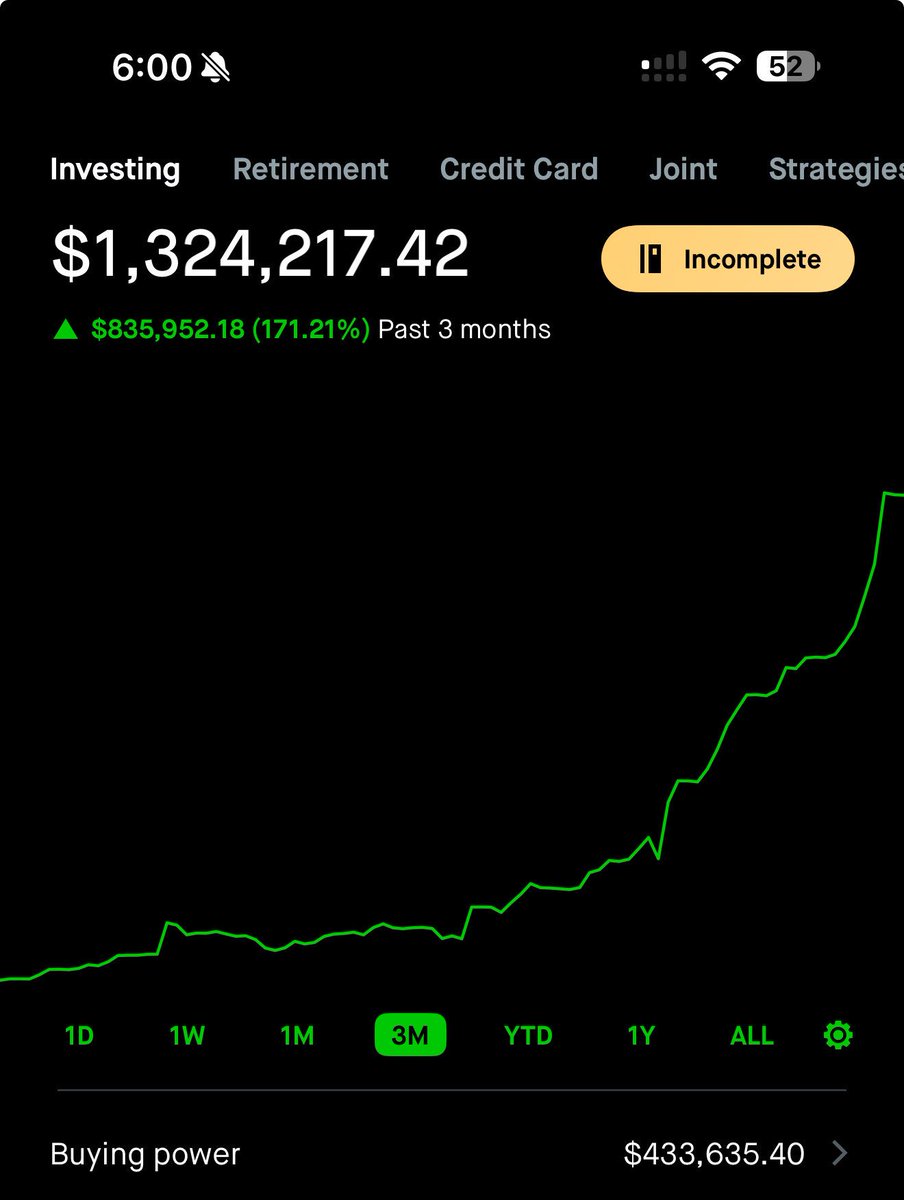

My first 2 years as a day trader, I lost -$10,000

Its not until I started swing trading that things really clicked for me

Fast forward 4 years

&

Now I make 5 figures every month

Below you can steal my exact swing trading strategy:🧵

Its not until I started swing trading that things really clicked for me

Fast forward 4 years

&

Now I make 5 figures every month

Below you can steal my exact swing trading strategy:🧵

To start off, we have to understand the point of this strategy..

We are trying to make trading super simple and keep things repeatable

We want to take advantage of strong market trends & use the leverage of options for a low risk high reward approach

We then want to de risk when markets are weaker, and no strong themes are present

We are trying to make trading super simple and keep things repeatable

We want to take advantage of strong market trends & use the leverage of options for a low risk high reward approach

We then want to de risk when markets are weaker, and no strong themes are present

1. Finding market strength and weakness

The easiest way to find out if the markets are trending is to:

Pull up a chart on

and add the 8, 21, 50 EMA's

EMA's can be used as a momentum gauge for when the markets are the hottest and stocks follow through the most.tradingview.com

The easiest way to find out if the markets are trending is to:

Pull up a chart on

and add the 8, 21, 50 EMA's

EMA's can be used as a momentum gauge for when the markets are the hottest and stocks follow through the most.tradingview.com

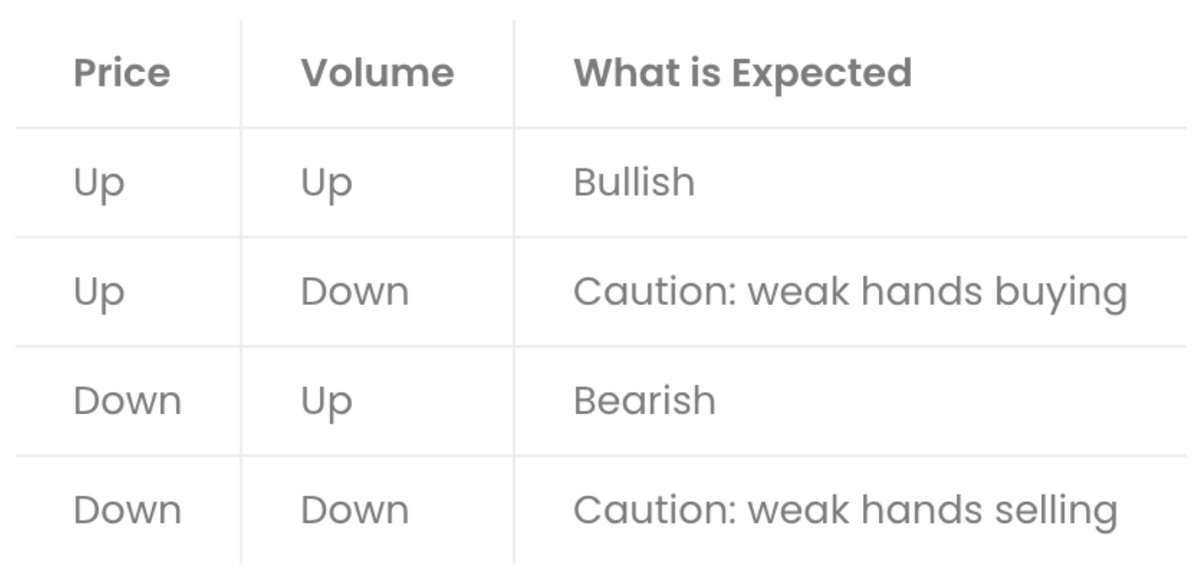

2. Framework

Now that we have the EMA's on the chart, we can make some rules for when we want to be active in the markets.

Use $SPY / $QQQ

1) Whenever $SPY / $QQQ are above the 8/21/50 EMA's, we want to be long with full size/conviction

2) Whenever $SPY / $QQQ are below the 8/21/50 EMA's, we want to use smaller size or completely avoid trading

This way we have a guide for when markets are going to be following through, and our strategy will be the most effective.

We can also use this on the individual names we are swing trading to narrow down our criteria.

Now that we have the EMA's on the chart, we can make some rules for when we want to be active in the markets.

Use $SPY / $QQQ

1) Whenever $SPY / $QQQ are above the 8/21/50 EMA's, we want to be long with full size/conviction

2) Whenever $SPY / $QQQ are below the 8/21/50 EMA's, we want to use smaller size or completely avoid trading

This way we have a guide for when markets are going to be following through, and our strategy will be the most effective.

We can also use this on the individual names we are swing trading to narrow down our criteria.

3. Sizing

-Size 5% of account when markets are trending above moving averages

-Size 2.5% of account when market is in between moving averages

Size 1% of account or avoid trading when markets are below moving averages

The goal is to be aggressive when the markets are in a strong trend

-Size 5% of account when markets are trending above moving averages

-Size 2.5% of account when market is in between moving averages

Size 1% of account or avoid trading when markets are below moving averages

The goal is to be aggressive when the markets are in a strong trend

4. Scanning for leading stocks

Once we see that markets are staying above their moving averages...

We start to look for leading stocks ideally in strong themes

Easiest way to scan for leading stocks is to use: finviz.com/groups.ashx

Click on screener

We want to narrow it down our search to liquid stocks that are leading the market higher on volume

Here are the parameters I use in my scan:

Price: Over $5

Market cap: Over $2b+

Average volume: Over 500k

Relative volume: Over 1

Current volume: Over 1 million

And most importantly, above the 20,50,200 SMA to find leading names in the sector

Once we see that markets are staying above their moving averages...

We start to look for leading stocks ideally in strong themes

Easiest way to scan for leading stocks is to use: finviz.com/groups.ashx

Click on screener

We want to narrow it down our search to liquid stocks that are leading the market higher on volume

Here are the parameters I use in my scan:

Price: Over $5

Market cap: Over $2b+

Average volume: Over 500k

Relative volume: Over 1

Current volume: Over 1 million

And most importantly, above the 20,50,200 SMA to find leading names in the sector

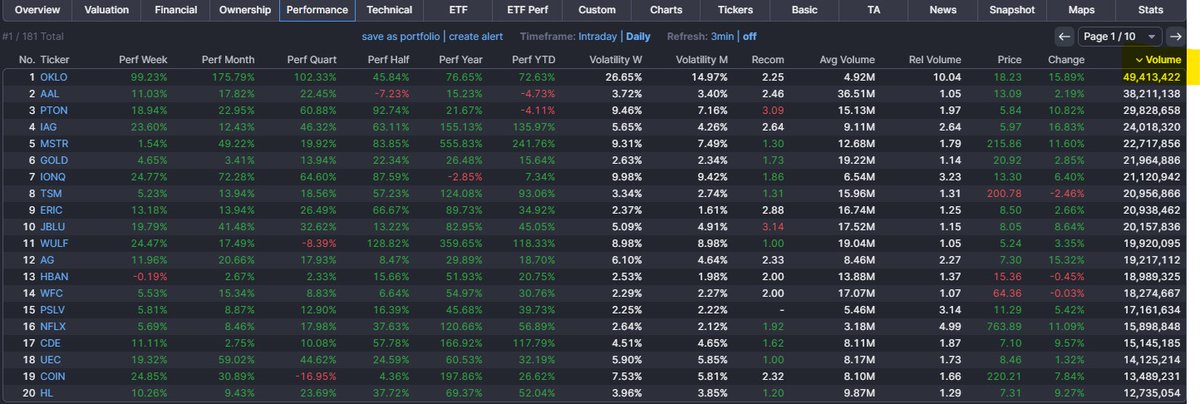

Now we have some of the most liquid & strong names in the market

To make our scanning even easier, we can head to the performance tab and sort the volume by highest

To make our scanning even easier, we can head to the performance tab and sort the volume by highest

Head back over to charts and you should see a list of the strongest names that are breaking out.

You are now looking for a chart that is setting up in a tight base with some sort of chart pattern forming

The goal is to find names that have not broken out yet, and are still setting up for a strong move out of their base

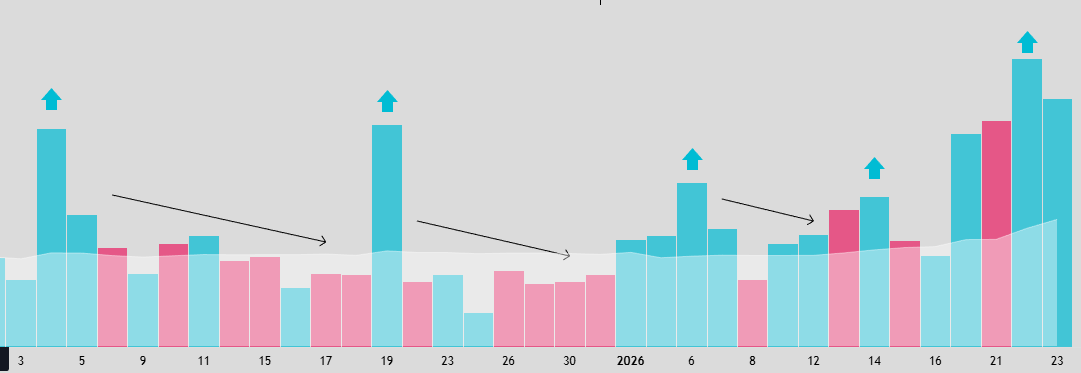

Below are some examples of bases I look for

Ideally you want to see accumulation volume patterns within the base

You are now looking for a chart that is setting up in a tight base with some sort of chart pattern forming

The goal is to find names that have not broken out yet, and are still setting up for a strong move out of their base

Below are some examples of bases I look for

Ideally you want to see accumulation volume patterns within the base

The name that caught my attention is:

$WULF

The stock is setting up in a big daily pennant base

Showing signs of accumulation volume in the base

& setting up for a big breakout through the pennant

$WULF

The stock is setting up in a big daily pennant base

Showing signs of accumulation volume in the base

& setting up for a big breakout through the pennant

6. Entry

We can now pull up $WULF on trading view

We need to choose a level to trigger our entry

What I look for, is a previous level of resistance that price has rejected multiple times

In this example, you can see the $5.36 level is a big spot for price

Price rejected $5.36 multiple times

If price breaks over that level, then we can assume a daily breakout is likely to occur

We want to confirm the breakout with lots of volume over the trigger level

We can now pull up $WULF on trading view

We need to choose a level to trigger our entry

What I look for, is a previous level of resistance that price has rejected multiple times

In this example, you can see the $5.36 level is a big spot for price

Price rejected $5.36 multiple times

If price breaks over that level, then we can assume a daily breakout is likely to occur

We want to confirm the breakout with lots of volume over the trigger level

Entry is taken on a break above the highs of the base... For confirmation, we want to see high volume on a break out of the base.

For example $MSTR recent base breakout:

Leading stock in an emerging theme (Crypto)

Breaking out of a daily base with volume

Enter long at the break above the base.

For example $MSTR recent base breakout:

Leading stock in an emerging theme (Crypto)

Breaking out of a daily base with volume

Enter long at the break above the base.

We can use the 5m time frame to confirm our entry.

First 5m close above our level triggers long entry.

First 5m close above our level triggers long entry.

Stop loss is placed on the low of the daily breakout candle to make sure that we manage our risk in case of a failed breakout.

Alternatively for a higher win rate

Wait for price to comeback and retest the breakout level

(Only downside of this entry model is sometimes you will miss the breakout)

Wait for price to comeback and retest the breakout level

(Only downside of this entry model is sometimes you will miss the breakout)

7. Targets

Take profits at previous resistance levels

If price is making new all time highs, use Fibonacci levels to scale out.

My scale out strategy is 25% of the position at a time and moving up stop to break even after first trim.

If markets aren't following through, I trim 50% on the first target.

Take profits at previous resistance levels

If price is making new all time highs, use Fibonacci levels to scale out.

My scale out strategy is 25% of the position at a time and moving up stop to break even after first trim.

If markets aren't following through, I trim 50% on the first target.

The goal is to hold onto the trade until targets are hit or you are stopped out

This will help you make trading emotionless

Everything is preplanned and you are taking amazing risk to reward trades

Breakouts allow you to capture huge moves and using options contracts you can use the leverage they provide to risk small amounts of money for bigger hits

We want more risk when markets are strong and hot

&

We want smaller risk when conditions are choppier/less follow through.

We also want to find about 4-5 names of these names and create a watchlist/focus list to use to trigger our entries

Everything should be pre planned

This will help you make trading emotionless

Everything is preplanned and you are taking amazing risk to reward trades

Breakouts allow you to capture huge moves and using options contracts you can use the leverage they provide to risk small amounts of money for bigger hits

We want more risk when markets are strong and hot

&

We want smaller risk when conditions are choppier/less follow through.

We also want to find about 4-5 names of these names and create a watchlist/focus list to use to trigger our entries

Everything should be pre planned

The reason this strategy works so well is because we are trading the stocks that are leading the market higher and emerging out of strong sectors and themes.

We are also taking advantage of the strongest environments in the markets when stocks are breaking out and following through.

We are also taking advantage of the strongest environments in the markets when stocks are breaking out and following through.

Like any other strategy this is not a holy grail strategy but there's a reason why some of the best traders in the world swing strong names, and buy leading stocks in leading sectors.

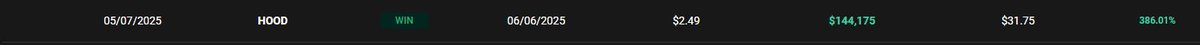

I've personally used this strategy to trade names like:

$NVDA From $500-$1000

$SMCI $300-$1000

$MSTR $170-$220

$MU $106-$150

$CVNA $10-$100

Just this year and caught huge 25%+ breakouts

I've personally used this strategy to trade names like:

$NVDA From $500-$1000

$SMCI $300-$1000

$MSTR $170-$220

$MU $106-$150

$CVNA $10-$100

Just this year and caught huge 25%+ breakouts

I post these setups every night on my twitter with trigger levels, option contracts, and targets.

So you can follow along, and learn the strategy.

If you enjoyed and learned something from this thread LIKE+RT❤️for more trade plans and educational threads.

So you can follow along, and learn the strategy.

If you enjoyed and learned something from this thread LIKE+RT❤️for more trade plans and educational threads.

• • •

Missing some Tweet in this thread? You can try to

force a refresh