1/

AVAX’s Value Capture Problem:

With the launch and success of @playoffthegrid , 🫵may have considered AVAX as a way to gain exposure.

Unfortunately @avax struggles to accrue value from their chain/L1 (prev. subnet) offering.

AVAX’s Value Capture Problem:

With the launch and success of @playoffthegrid , 🫵may have considered AVAX as a way to gain exposure.

Unfortunately @avax struggles to accrue value from their chain/L1 (prev. subnet) offering.

2/

As of date, Avalanche has two ways of offering validators to their L1s: The stake-to-validate model, or the pay-as-you-go model (which hasn't gone into effect yet).

Under these models, Avalanche faces a trade-off:

1. They can maintain high upfront costs for L1s through stake-to-validate, reducing demand to build under Avalanche and making it more difficult and costly.

2. They can lower costs dramatically through PAYG for the foreseeable future to increase demand for the Avalanche L1 offering, but lose out on revenue.

As of date, Avalanche has two ways of offering validators to their L1s: The stake-to-validate model, or the pay-as-you-go model (which hasn't gone into effect yet).

Under these models, Avalanche faces a trade-off:

1. They can maintain high upfront costs for L1s through stake-to-validate, reducing demand to build under Avalanche and making it more difficult and costly.

2. They can lower costs dramatically through PAYG for the foreseeable future to increase demand for the Avalanche L1 offering, but lose out on revenue.

3/

Under the old stake-to-validate model, Avalanche would benefit from validators buying and staking AVAX to secure the network. The amount of buy pressure and AVAX placed into supply sinks would depend on the number of validators GUNZ requires.

Under the old stake-to-validate model, Avalanche would benefit from validators buying and staking AVAX to secure the network. The amount of buy pressure and AVAX placed into supply sinks would depend on the number of validators GUNZ requires.

4/

As GUNZ is a gaming L1, it likely does not need to be very decentralized: gamers would prefer low latency. Just in case, the following figures account for up to 128 validators for GUNZ, even though 8 validators would make more sense:

- 8 validators: 16K AVAX ($453,600 USD)

- 16 validators: 32K AVAX ($907,200 USD)

- 32 validators: 64K AVAX ($1,814,400 USD)

- 64 validators: 128K AVAX ($3,628,800 USD)

- 128 validators: 256K AVAX ($7,257,600 USD)

As GUNZ is a gaming L1, it likely does not need to be very decentralized: gamers would prefer low latency. Just in case, the following figures account for up to 128 validators for GUNZ, even though 8 validators would make more sense:

- 8 validators: 16K AVAX ($453,600 USD)

- 16 validators: 32K AVAX ($907,200 USD)

- 32 validators: 64K AVAX ($1,814,400 USD)

- 64 validators: 128K AVAX ($3,628,800 USD)

- 128 validators: 256K AVAX ($7,257,600 USD)

5/

These figures represent significant buy pressure on AVAX. However, most of this AVAX would likely be sold to validators at a discount OTC. The stake-to-validate model's high upfront costs resulted in low demand for launching L1s on Avalanche.

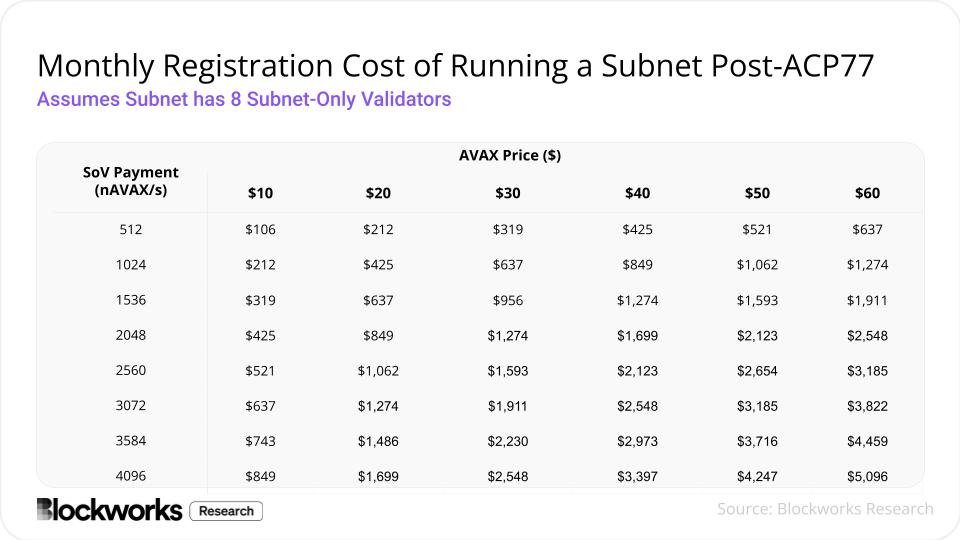

Avalanche plans to introduce PAYG with ACP-77. If implemented before GUNZ Mainnet launches and GUNZ opts in, the costs for the minimum 8 validator set would be as follows:

These figures represent significant buy pressure on AVAX. However, most of this AVAX would likely be sold to validators at a discount OTC. The stake-to-validate model's high upfront costs resulted in low demand for launching L1s on Avalanche.

Avalanche plans to introduce PAYG with ACP-77. If implemented before GUNZ Mainnet launches and GUNZ opts in, the costs for the minimum 8 validator set would be as follows:

6/

One nAVAX equals one-billionth of one AVAX. The monthly costs for GUNZ subnet at the minimum base fee of 512 nAVAX per second (based on current AVAX prices) would be:

- 8 validators: 10.77 AVAX ($305.33 USD)

- 16 validators: 21.53 AVAX ($610.37 USD)

- 32 validators: 43.06 AVAX ($1,220.75 USD)

- 64 validators: 86.12 AVAX ($2,441.50 USD)

- 128 validators: 172.25 AVAX ($4,883.29 USD)

One nAVAX equals one-billionth of one AVAX. The monthly costs for GUNZ subnet at the minimum base fee of 512 nAVAX per second (based on current AVAX prices) would be:

- 8 validators: 10.77 AVAX ($305.33 USD)

- 16 validators: 21.53 AVAX ($610.37 USD)

- 32 validators: 43.06 AVAX ($1,220.75 USD)

- 64 validators: 86.12 AVAX ($2,441.50 USD)

- 128 validators: 172.25 AVAX ($4,883.29 USD)

7/

The stake-to-validate costs equal 1486 months of PAYG costs. Economically, it makes more sense for GUNZ to pay monthly, as the upfront cost would require running the chain for 124 years to be more economically feasible.

Although the PAYG model is beneficial for chains who choose to launch as an Avalanche L1, very little value accrues to AVAX.

The stake-to-validate costs equal 1486 months of PAYG costs. Economically, it makes more sense for GUNZ to pay monthly, as the upfront cost would require running the chain for 124 years to be more economically feasible.

Although the PAYG model is beneficial for chains who choose to launch as an Avalanche L1, very little value accrues to AVAX.

8/

One argument against this analysis is that Avalanche L1 revenues should be considered as additional revenue on top of the base Avalanche C-Chain fees: i.e. that Avalanche will benefit from both the L1 base fee economics, as well as an additional revenue stream coming from L1s choosing to launch on their chain.

Although this makes sense, we’ve seen Avalanche lose significant activity and attention over the past year, and shift focus to their L1 offering, by going after financial institutions and gaming.

One argument against this analysis is that Avalanche L1 revenues should be considered as additional revenue on top of the base Avalanche C-Chain fees: i.e. that Avalanche will benefit from both the L1 base fee economics, as well as an additional revenue stream coming from L1s choosing to launch on their chain.

Although this makes sense, we’ve seen Avalanche lose significant activity and attention over the past year, and shift focus to their L1 offering, by going after financial institutions and gaming.

9/

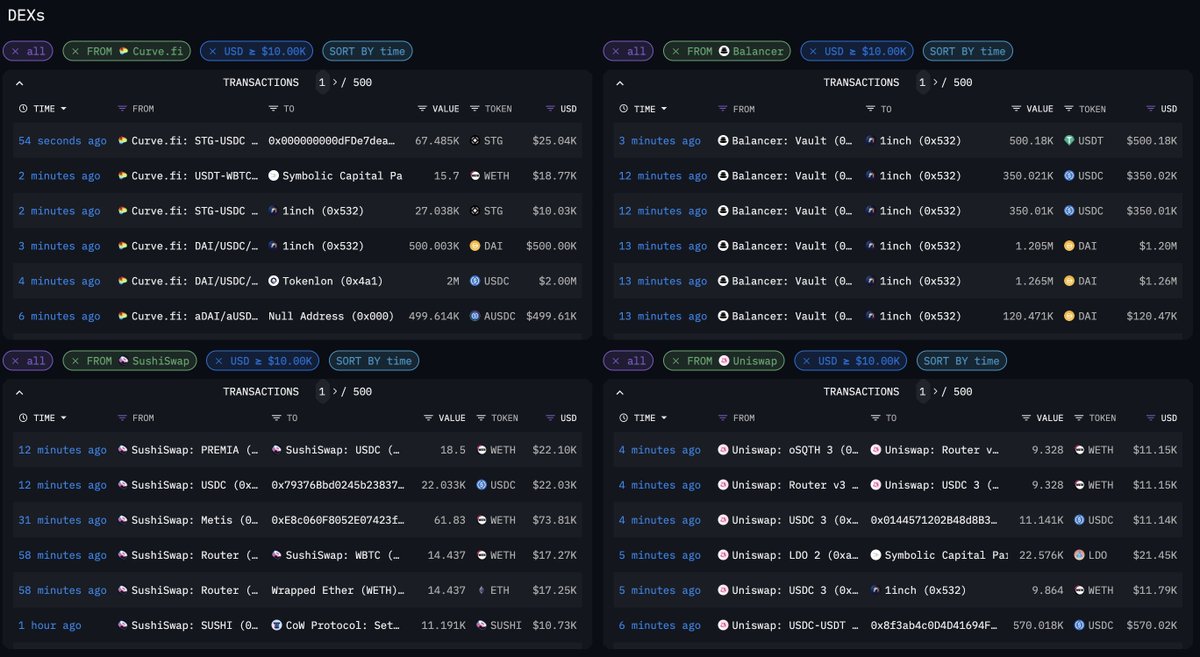

Avalanche C-Chains revenue is significantly lower than Base, Solana and Ethereum Mainnet. This highlights a relatively significant issue for Avalanche.

The chain needs to offer a cost-effective L1 deployment solution to ensure there’s demand to launch L1s under Avalanche. On the other hand, the chain is struggling in terms of revenue, in particular in terms of execution-related fees earned.

Avalanche C-Chains revenue is significantly lower than Base, Solana and Ethereum Mainnet. This highlights a relatively significant issue for Avalanche.

The chain needs to offer a cost-effective L1 deployment solution to ensure there’s demand to launch L1s under Avalanche. On the other hand, the chain is struggling in terms of revenue, in particular in terms of execution-related fees earned.

10/

They’ve forgone most fees and activity on their Mainnet, and have instead chosen to focus most of their attention to becoming a hub for gaming and institutional L1s (which is directionally correct).

Unfortunately, this has placed them in a position where they need to offer their new offering (Avalanche L1s) at a discounted price to ensure demand.

They’ve forgone most fees and activity on their Mainnet, and have instead chosen to focus most of their attention to becoming a hub for gaming and institutional L1s (which is directionally correct).

Unfortunately, this has placed them in a position where they need to offer their new offering (Avalanche L1s) at a discounted price to ensure demand.

for what it's worth i think making good interoperable cost-effective L1s is a great approach especially with the direction they are taking (gaming and permissioned institutional chains) - but in the long run

maybe not best for the time being, at least until we get the first few chains

maybe not best for the time being, at least until we get the first few chains

• • •

Missing some Tweet in this thread? You can try to

force a refresh