This one setup allows me to trade full-time.

ICT traders always fail to catch the full move, but not after this thread.

You can instantly make more money with this setup…

🧵

ICT traders always fail to catch the full move, but not after this thread.

You can instantly make more money with this setup…

🧵

‘Triple Premium Theory’

Not only will this strategy allow you to pick the tops and bottoms,

But these are high-probability plays, and they’ll give you a higher win rate.

Save this thread and take notes…

Not only will this strategy allow you to pick the tops and bottoms,

But these are high-probability plays, and they’ll give you a higher win rate.

Save this thread and take notes…

Now, before we get started…

I know how hard it is to trade these markets, and I wish I had more guidance when I first started.

If I had to start all over again, I’d join this newsletter to help me along the way:

cartershuck.substack.com

I know how hard it is to trade these markets, and I wish I had more guidance when I first started.

If I had to start all over again, I’d join this newsletter to help me along the way:

cartershuck.substack.com

Criteria:

*Bearish example*

Premium of price swing

Above swing high

Above previous day’s high

Start by measuring the recent price swing (low/high that swept liquidity)

We want to be looking for an entry in the upper half of the range...

*Bearish example*

Premium of price swing

Above swing high

Above previous day’s high

Start by measuring the recent price swing (low/high that swept liquidity)

We want to be looking for an entry in the upper half of the range...

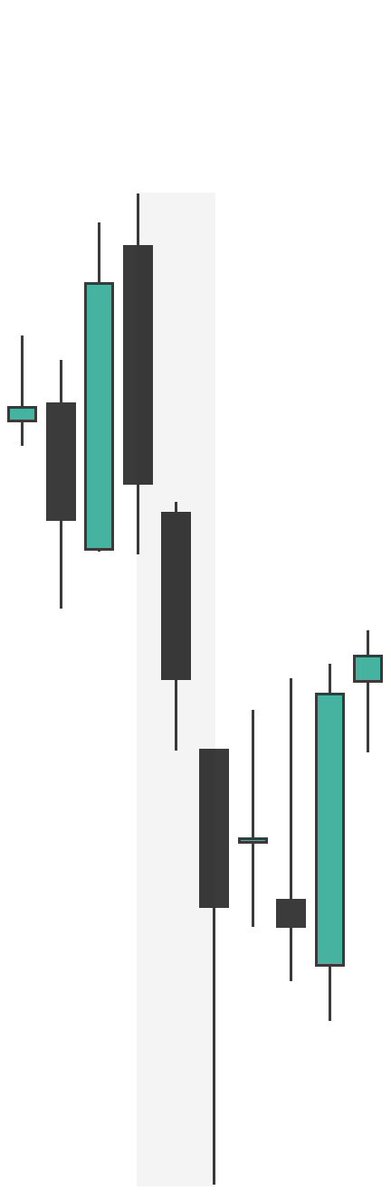

If we are in a premium AND above a recent swing high, we are in a double premium.

Then, if price is also above the previous day’s high, it’s a “triple premium”.

This is a very high-probability condition.

Look at what happens after - price moves straight down.

Then, if price is also above the previous day’s high, it’s a “triple premium”.

This is a very high-probability condition.

Look at what happens after - price moves straight down.

Sell inside of the wick.

Once price closes below the previous candle, we can expect the next few candles to expand lower (opposite if bullish)

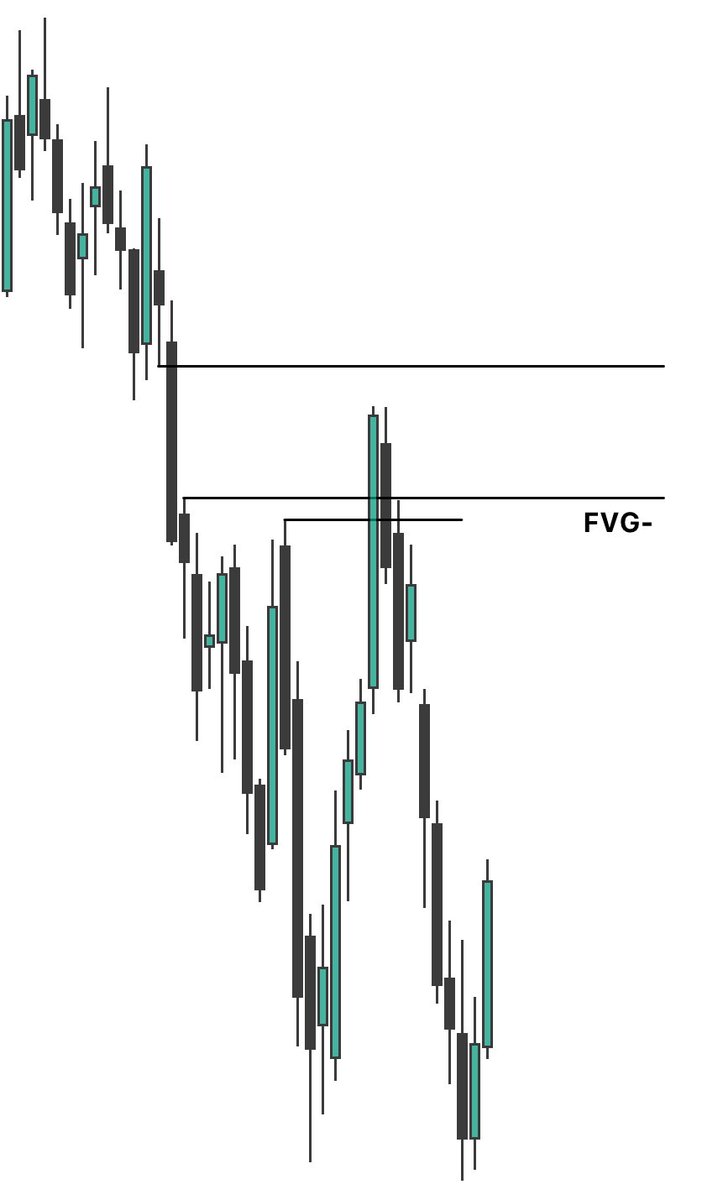

And you can look to target the first discount PD array (FVG, liquidity)

Once you identify price is in a premium, drop-down timeframes…

Once price closes below the previous candle, we can expect the next few candles to expand lower (opposite if bullish)

And you can look to target the first discount PD array (FVG, liquidity)

Once you identify price is in a premium, drop-down timeframes…

Look for an entry model.

Wait for a change in the state of delivery - confirmation is a close below the last consecutive up-closed candles.

Our entry will be inside the range of the consecutive up-closed candles,

And you can enter in any PD Array on a retracement…

Wait for a change in the state of delivery - confirmation is a close below the last consecutive up-closed candles.

Our entry will be inside the range of the consecutive up-closed candles,

And you can enter in any PD Array on a retracement…

This framework is very simple,

And these trades are extremely high probability, all from double and triple premium.

Not only will these trades make you money, but if you only look for these trades,

You will be extremely confident.

And these trades are extremely high probability, all from double and triple premium.

Not only will these trades make you money, but if you only look for these trades,

You will be extremely confident.

Here’s a bearish example:

Checklist:

Discount of price swing

Below a swing low

Below previous day’s low

The same as the bullish example, very high probability…

Checklist:

Discount of price swing

Below a swing low

Below previous day’s low

The same as the bullish example, very high probability…

Keep it simple, and only look for this setup.

Your win rate will be high, and your confidence will be too.

But if you want to become a more well-rounded trader,

I’ll teach you everything I know as a 5-figure trader here:

whop.com/checkout/plan_…

Your win rate will be high, and your confidence will be too.

But if you want to become a more well-rounded trader,

I’ll teach you everything I know as a 5-figure trader here:

whop.com/checkout/plan_…

• • •

Missing some Tweet in this thread? You can try to

force a refresh