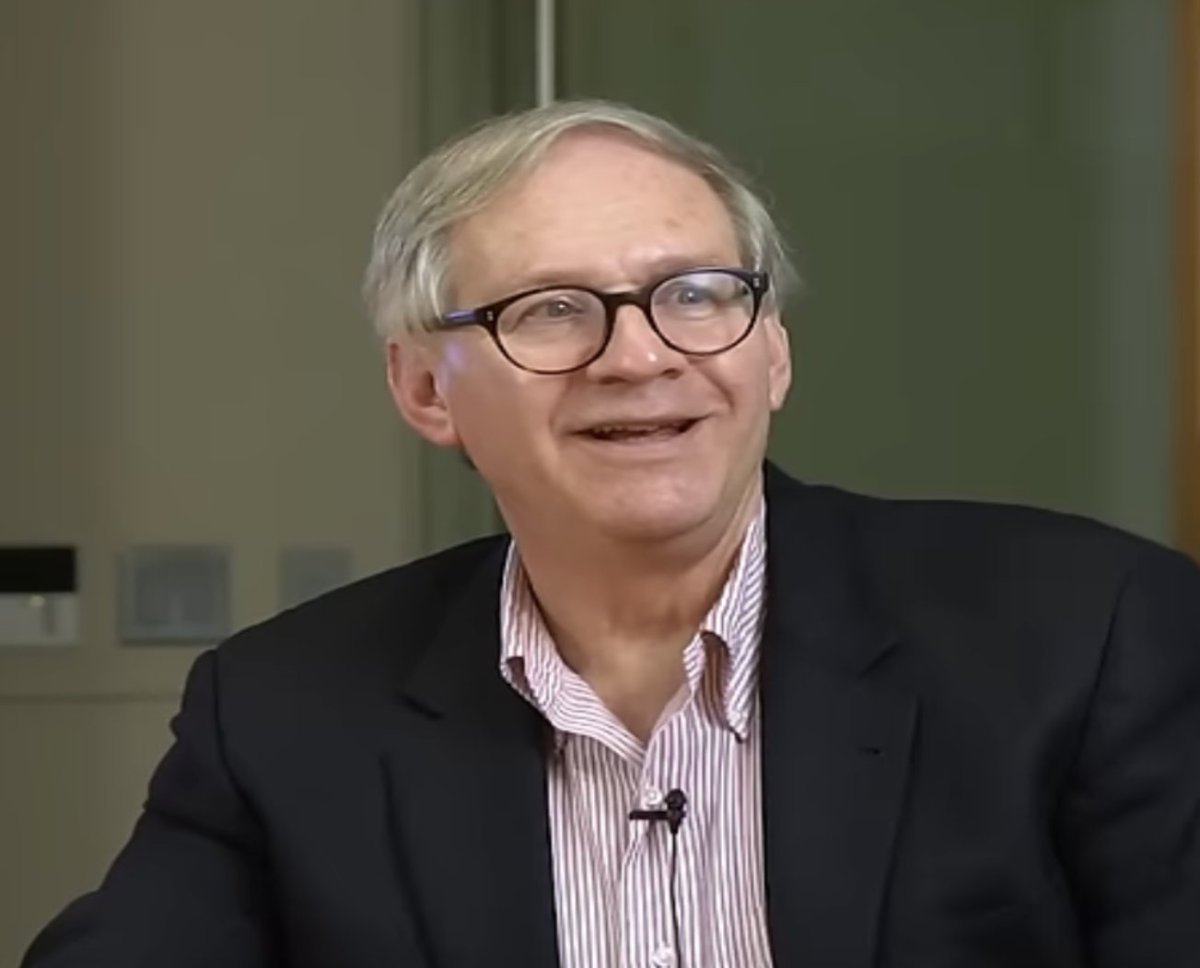

Dr. Steenbarger has studied trading psychology for 60 years,

And he gave an hour masterclass on the secrets to trading psychology.

His philosophies will make you rich…

Here’s the entire lecture in 2 minutes:

And he gave an hour masterclass on the secrets to trading psychology.

His philosophies will make you rich…

Here’s the entire lecture in 2 minutes:

1) FOMO

FOMO = fear, and occurs when we perceive threat.

Our brain goes into “fight or flight” mode when it feels threatened or stressed,

So the key to overcoming fear is removing threats.

FOMO = fear, and occurs when we perceive threat.

Our brain goes into “fight or flight” mode when it feels threatened or stressed,

So the key to overcoming fear is removing threats.

2) Motivation

If p&l is the measure of success or our worth, we will constantly feel worse about ourselves.

We have to find a motivation that’s greater than p&l, which should be “the desire to learn and grow”

The greatest traders are always learning and developing.

If p&l is the measure of success or our worth, we will constantly feel worse about ourselves.

We have to find a motivation that’s greater than p&l, which should be “the desire to learn and grow”

The greatest traders are always learning and developing.

3) Breaking Habits

The secret to breaking any bad habit is to love something greater than the habit.

Giving yourself an ultimatum will help you to pick whichever is more important…

Example: Trading or drinking? Which one will be your future?

The secret to breaking any bad habit is to love something greater than the habit.

Giving yourself an ultimatum will help you to pick whichever is more important…

Example: Trading or drinking? Which one will be your future?

4) Exposure

Train yourself in relaxation by visualizing something peaceful and relaxing - do this before and during trading.

Practice relaxation (outside of trading) and start to visualize stressful/scary situations while still being calm and relaxed.

Train your brain to be calm when it should be stressed.

Train yourself in relaxation by visualizing something peaceful and relaxing - do this before and during trading.

Practice relaxation (outside of trading) and start to visualize stressful/scary situations while still being calm and relaxed.

Train your brain to be calm when it should be stressed.

5) Cognitive Work

Our thinking creates our fears and responses, so we need to change our thinking…

You can control the way you think about the event by disputing the negative thinking.

“It’s like you talking back at that negative thinking.”

Our thinking creates our fears and responses, so we need to change our thinking…

You can control the way you think about the event by disputing the negative thinking.

“It’s like you talking back at that negative thinking.”

6) Broaden and Build

Traders get so caught up in p&l because they have nothing else interesting going on in their life.

Dr. Steenbarger explains the importance of having a life outside of trading.

Traders get so caught up in p&l because they have nothing else interesting going on in their life.

Dr. Steenbarger explains the importance of having a life outside of trading.

7) Growth and Improvement

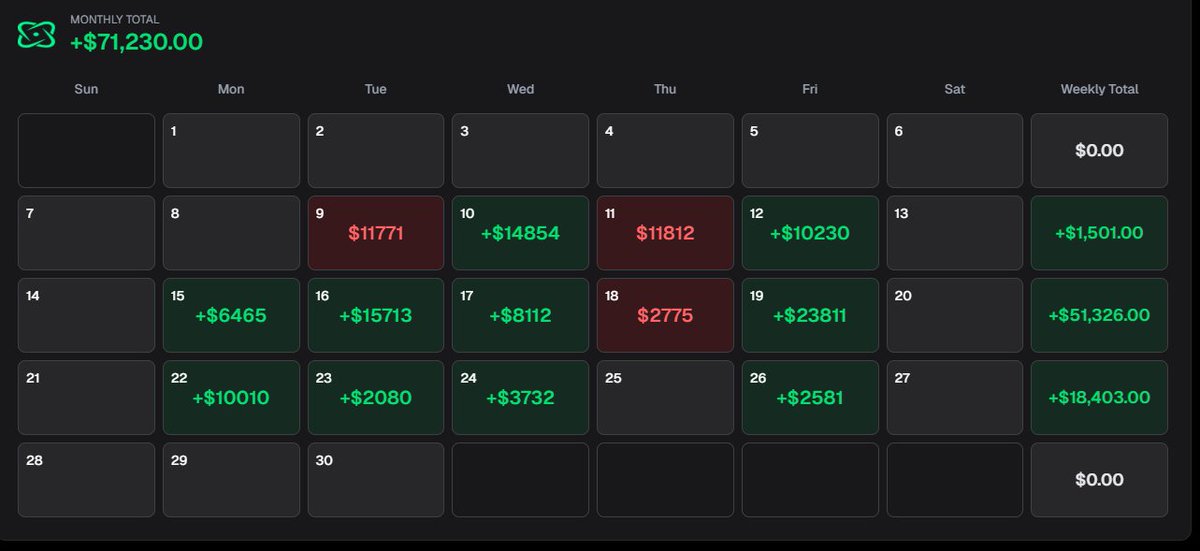

“What gets measured gets improved.”

Track you trading, and evaluate (relative to opportunity)

Set a few “high priority goals” and work hard at them each month.

“What gets measured gets improved.”

Track you trading, and evaluate (relative to opportunity)

Set a few “high priority goals” and work hard at them each month.

8) Personality Traits

There’s emotional balance, and the opposite of that would be neuroticism.

Some people have an even temperament (emotional balance) and others have highs and lows…

Those with highs and lows are more prone to be emotionally reactive.

Recognize which traits you have in order to understand them.

There’s emotional balance, and the opposite of that would be neuroticism.

Some people have an even temperament (emotional balance) and others have highs and lows…

Those with highs and lows are more prone to be emotionally reactive.

Recognize which traits you have in order to understand them.

Now that you’ve finished reading this thread, study these concepts…

Apply them, don’t just forget about them.

And if you need a proven high probability strategy, I’ll give you mine here:

whop.com/tradeproelite/…

Apply them, don’t just forget about them.

And if you need a proven high probability strategy, I’ll give you mine here:

whop.com/tradeproelite/…

Video Credits:

• • •

Missing some Tweet in this thread? You can try to

force a refresh