There are 3 volume patterns you must be on the lookout for as a momentum trader.

· Gap Up Volume

· Pocket Pivots

· ANTS

Everything else is just noise.

Let's break down each, talk about why they're important, and how you can classify useful volume vs. noise:

—

Gap Up Volume

Not all gap ups are created equal, and one easy way to classify a tradeable gap vs. not tradeable gap is the magnitude of the volume on gap day.

You want to be looking for:

→ The Highest Volume Ever (HVE)

→ The Highest Volume Since IPO Day/Week (HVIPO)

→ The Highest Volume In The Past Year (HV1)

→ The Highest Volume Since Last Earnings (HVLE)

When you couple one of these 4 volume signatures above with a huge gap up in price (with a strong closing range), it's likely the name will be much higher over the coming days/weeks if the market holds up.

Why?

When new information is brought to the market via earnings or a news report, institutions are required to either increase or decrease their positions based on this info.

The buying they do as a result clearly shows up in the end of day volume total, and a name that registers one of the 4 volume signatures above is likely going to see Follow On Follow Through Volume (repeat buying from institutions) in the coming days/weeks.

$OKLO is great recent example of this:

· Highest Volume Ever Gap Up

· Follow On Follow Through Volume

Price has now doubled and was easy to spot on the initial breakout day!

Let's now look at the next classification of volume you should be looking for:

—

Pocket Pivots

The Pocket Pivots concept was first made popular by famous investor William O'Neil and still shows up on charts today.

Institutions buy within consolidation periods and during uptrends. This buying will leave behind a volume signature, and that volume signature is often called a pocket pivot.

Here's the exact criteria for a pocket pivot:

→ Current up day’s volume > any of the down volume days in the prior 10 days.

It allows us to view when institutions are in the accumulation phase, and tells us to pay close attention to the name (as you look for a buy point that fits your strategy).

$SOFI is a great example of this accumulation volume signature in action:

Once you've spotted a pocket pivot on a chart, it's time to add the name to a watchlist and stalk over the coming days/weeks for a proper entry.

On to volume signature #3:

—

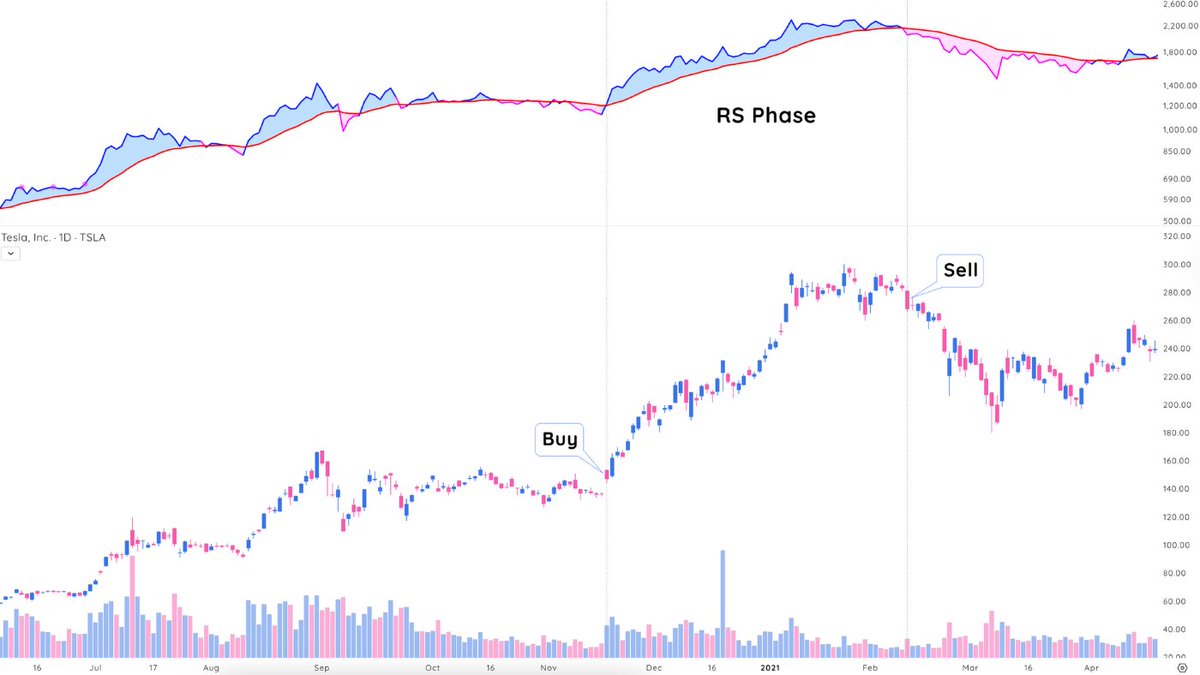

ANTS

First created by US Investing Champion @dryan310, the ANTS indicator looks for a stock exhibiting:

· 20-25% increase in price

· 20-25% increase in volume

· 12 out of the past 15 days are up

The overwhelming increase in price and volume in a short time span represents large institutional accumulation in the stock.

Institutions can’t just buy a full position in a day or two as they manage huge amounts of money. Instead, they will take multiple days to weeks to enter a stock.

Here's a current example using $ALAB (which also registered the HVIPO Signature on October 9th, 2024):

Huge gap → volume follows → price much higher weeks later...

Rinse & repeat!

—

It's easy to get caught up in analyzing every day's volume along with price, but all you need to do is look for these 3 volume signatures:

→ High Volume On Gap Ups

→ Pocket Pivots

→ ANTS

Institutional accumulation is easy to spot when you know what to look for, and now you do 💪🦁

—

That's it! If you've made it this far, let us know what questions you have about volume in the replies below!

And, if you learned something new, go ahead and repost this resource for other traders to study ↓

· Gap Up Volume

· Pocket Pivots

· ANTS

Everything else is just noise.

Let's break down each, talk about why they're important, and how you can classify useful volume vs. noise:

—

Gap Up Volume

Not all gap ups are created equal, and one easy way to classify a tradeable gap vs. not tradeable gap is the magnitude of the volume on gap day.

You want to be looking for:

→ The Highest Volume Ever (HVE)

→ The Highest Volume Since IPO Day/Week (HVIPO)

→ The Highest Volume In The Past Year (HV1)

→ The Highest Volume Since Last Earnings (HVLE)

When you couple one of these 4 volume signatures above with a huge gap up in price (with a strong closing range), it's likely the name will be much higher over the coming days/weeks if the market holds up.

Why?

When new information is brought to the market via earnings or a news report, institutions are required to either increase or decrease their positions based on this info.

The buying they do as a result clearly shows up in the end of day volume total, and a name that registers one of the 4 volume signatures above is likely going to see Follow On Follow Through Volume (repeat buying from institutions) in the coming days/weeks.

$OKLO is great recent example of this:

· Highest Volume Ever Gap Up

· Follow On Follow Through Volume

Price has now doubled and was easy to spot on the initial breakout day!

Let's now look at the next classification of volume you should be looking for:

—

Pocket Pivots

The Pocket Pivots concept was first made popular by famous investor William O'Neil and still shows up on charts today.

Institutions buy within consolidation periods and during uptrends. This buying will leave behind a volume signature, and that volume signature is often called a pocket pivot.

Here's the exact criteria for a pocket pivot:

→ Current up day’s volume > any of the down volume days in the prior 10 days.

It allows us to view when institutions are in the accumulation phase, and tells us to pay close attention to the name (as you look for a buy point that fits your strategy).

$SOFI is a great example of this accumulation volume signature in action:

Once you've spotted a pocket pivot on a chart, it's time to add the name to a watchlist and stalk over the coming days/weeks for a proper entry.

On to volume signature #3:

—

ANTS

First created by US Investing Champion @dryan310, the ANTS indicator looks for a stock exhibiting:

· 20-25% increase in price

· 20-25% increase in volume

· 12 out of the past 15 days are up

The overwhelming increase in price and volume in a short time span represents large institutional accumulation in the stock.

Institutions can’t just buy a full position in a day or two as they manage huge amounts of money. Instead, they will take multiple days to weeks to enter a stock.

Here's a current example using $ALAB (which also registered the HVIPO Signature on October 9th, 2024):

Huge gap → volume follows → price much higher weeks later...

Rinse & repeat!

—

It's easy to get caught up in analyzing every day's volume along with price, but all you need to do is look for these 3 volume signatures:

→ High Volume On Gap Ups

→ Pocket Pivots

→ ANTS

Institutional accumulation is easy to spot when you know what to look for, and now you do 💪🦁

—

That's it! If you've made it this far, let us know what questions you have about volume in the replies below!

And, if you learned something new, go ahead and repost this resource for other traders to study ↓

• • •

Missing some Tweet in this thread? You can try to

force a refresh