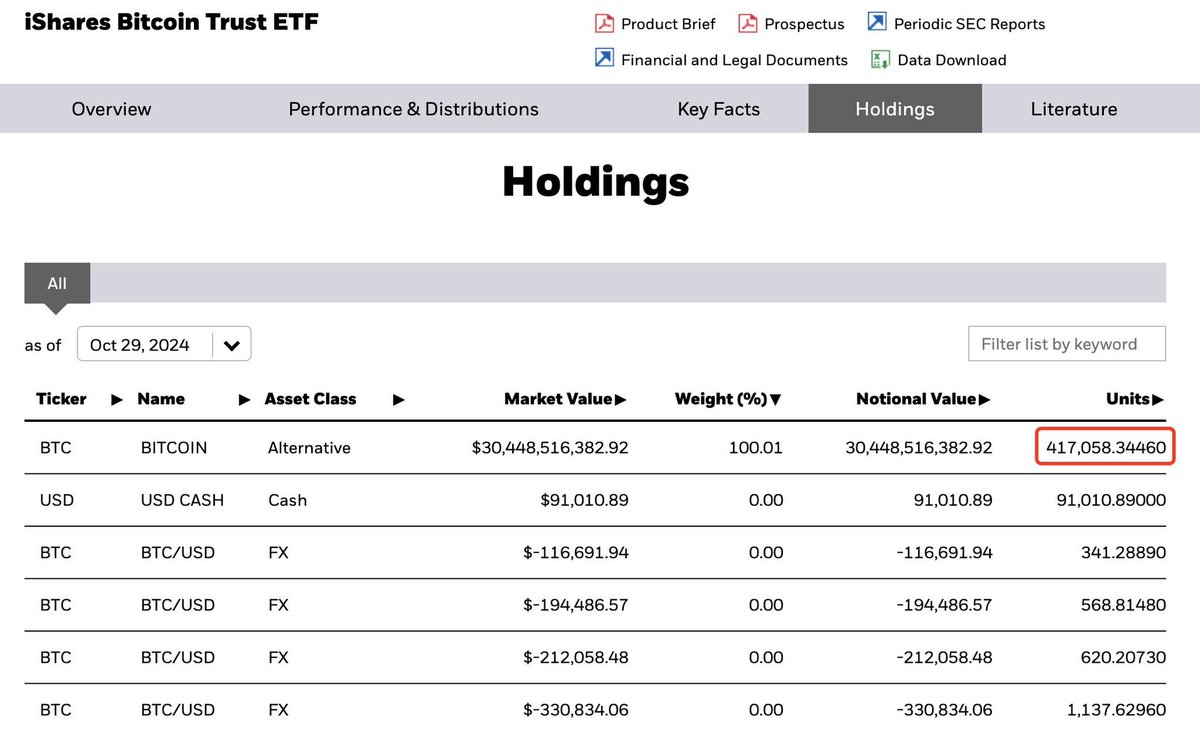

It’s important to understand that Blackrock isn’t buying Bitcoin as a speculative investment. It’s buying because of ETF inflow demand. It has to buy when there’s investor demand. And it has to sell when investors redeem fund units by selling the ETF.

What’s critical to note is that ETF buy and sell actions corresponding to fund inflows and outflows occur in real time in the spot Bitcoin market. This isn’t OTC. Market price reacts in an exaggerated fashion. This is an all new dynamic and hasn’t been tested on the downside in a grand scale yet. It will be tested though. You can count on that.

Up or down, Blackrock is raking in fee revenue. It’s the real winner. And it takes no risk. Blackrock isn’t long Bitcoin. It’s long the marketing of its ETF product.

What drives interest to the Bitcoin market among TradFi investors is volatility. But volatility works both ways. Up and down. Afterall, the Bitcoin ETF is now just a high beta and high liquidity financial asset. Just like what Blackrock envisioned. The marketing has worked.

However, the ETF is a double edged sword. When there’s ETF outflows, the Bitcoin must be market sold. A liquidation cascade can be catastrophic to Bitcoin price. That’s the black swan. We’ll see this ome day. Add leveraged Microstrategy, and all the other countless ETFs and derivs to the mix, and think about how quickly things can turn for the worse.

To put it into perspective, recall the time Terra sold its Bitcoin reserves in a desperate attempt to save Luna / UST. And FTX did the same to try to prop up a crashing FTT following the Coindesk article. It was also widely reported that Binance sold Bitcoin to defend BNB price from reaching a key liquidation level. We also saw Germany recentlly selling a relatively small amount of seized Bitcoin, which caused the price to crash below $50k.

All these actions, which were relatively tiny in scale to current ETF exposure, absolutely obliterated the Bitcoin price in a short period of time. It’s important to note that ETF investors are trend followers.

Thesre aren’t the same traders as Bitcoin maximalists that will hodl up and down during good times and bad like a cult. ETF traders cut bait quickly and move on to the next opportunity to try to make it back.

This isn’t a Bitcoin bear post. If you recall, I was one of the only people here pounding the table to buy the recent Bitcoin move under $60k. The support seemed obvious. And the technical level held when everybody was max bearish and making fun of the Uptober meme. That was only a few weeks ago.

But narratives shift quickly. And now the narrative is that Blackrock is buying your Bitcoin. Which isn’t exactly factual. The ETF investors are buying it. And they’re a fickle bunch. What is guaranteed is that the blade will cut the other way at some point and this will provide a great entry to those that are patient.

Remember, you only need to make a few trades a year. I’ve been preaching the virtues of not over trading since I started this account. It’s the best and most consistent advice I can provide.

There’s not many exceptionally lopsided +EV bets every year. Right now the Bitcoin market can go either way. Trend is up. But sentiment is too bullish for my liking. To me there’s no bet to be made at this current level. It’s just a guessing game. And guessed are -EV or neutral at best.

Can Bitcoin go to $100k? Absolutely. But I’d rather buy again at $50k. And I’m ok if I miss the rest of this move. Because there will always be another financial opportunity with better upside odds. I like to buy assets when hated and sell when less hated. Bitcoin was hated a few weeks ago. It’s clearly not hated anymore.

What’s critical to note is that ETF buy and sell actions corresponding to fund inflows and outflows occur in real time in the spot Bitcoin market. This isn’t OTC. Market price reacts in an exaggerated fashion. This is an all new dynamic and hasn’t been tested on the downside in a grand scale yet. It will be tested though. You can count on that.

Up or down, Blackrock is raking in fee revenue. It’s the real winner. And it takes no risk. Blackrock isn’t long Bitcoin. It’s long the marketing of its ETF product.

What drives interest to the Bitcoin market among TradFi investors is volatility. But volatility works both ways. Up and down. Afterall, the Bitcoin ETF is now just a high beta and high liquidity financial asset. Just like what Blackrock envisioned. The marketing has worked.

However, the ETF is a double edged sword. When there’s ETF outflows, the Bitcoin must be market sold. A liquidation cascade can be catastrophic to Bitcoin price. That’s the black swan. We’ll see this ome day. Add leveraged Microstrategy, and all the other countless ETFs and derivs to the mix, and think about how quickly things can turn for the worse.

To put it into perspective, recall the time Terra sold its Bitcoin reserves in a desperate attempt to save Luna / UST. And FTX did the same to try to prop up a crashing FTT following the Coindesk article. It was also widely reported that Binance sold Bitcoin to defend BNB price from reaching a key liquidation level. We also saw Germany recentlly selling a relatively small amount of seized Bitcoin, which caused the price to crash below $50k.

All these actions, which were relatively tiny in scale to current ETF exposure, absolutely obliterated the Bitcoin price in a short period of time. It’s important to note that ETF investors are trend followers.

Thesre aren’t the same traders as Bitcoin maximalists that will hodl up and down during good times and bad like a cult. ETF traders cut bait quickly and move on to the next opportunity to try to make it back.

This isn’t a Bitcoin bear post. If you recall, I was one of the only people here pounding the table to buy the recent Bitcoin move under $60k. The support seemed obvious. And the technical level held when everybody was max bearish and making fun of the Uptober meme. That was only a few weeks ago.

But narratives shift quickly. And now the narrative is that Blackrock is buying your Bitcoin. Which isn’t exactly factual. The ETF investors are buying it. And they’re a fickle bunch. What is guaranteed is that the blade will cut the other way at some point and this will provide a great entry to those that are patient.

Remember, you only need to make a few trades a year. I’ve been preaching the virtues of not over trading since I started this account. It’s the best and most consistent advice I can provide.

There’s not many exceptionally lopsided +EV bets every year. Right now the Bitcoin market can go either way. Trend is up. But sentiment is too bullish for my liking. To me there’s no bet to be made at this current level. It’s just a guessing game. And guessed are -EV or neutral at best.

Can Bitcoin go to $100k? Absolutely. But I’d rather buy again at $50k. And I’m ok if I miss the rest of this move. Because there will always be another financial opportunity with better upside odds. I like to buy assets when hated and sell when less hated. Bitcoin was hated a few weeks ago. It’s clearly not hated anymore.

• • •

Missing some Tweet in this thread? You can try to

force a refresh