1/ Last night, @variantfund hosted a demo night showcasing 9 teams working at the intersection of Crypto and AI. Here’s a little taste of what these builders are cooking up:

2/ Leading off, we had @hyperbolic_labs. @zjasper666 demoed their inference platform and GPU marketplace. They are my go-to inference solution for my personal AI projects and open source models.

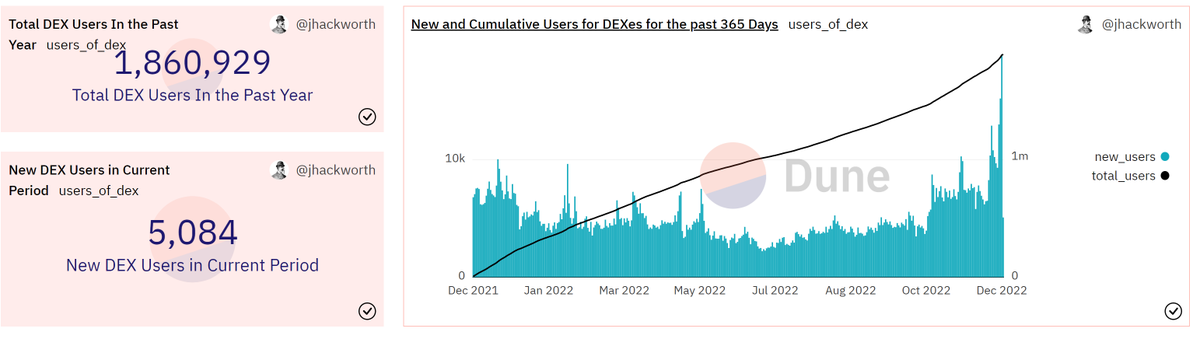

3/ Next we had @RyanKuhel from @DLPLabs, a Vana Data DAO. He demoed how users can earn tokens by uploading their financial and LinkedIn data, which can then be sold to data providers or AI companies as training data.

4/ @MurrLincoln presented @CoinbaseDev SDK and Based Agent, an AI that can autonomously interact onchain.

I’m super excited to try this out myself and start building agents with their SDK.

I’m super excited to try this out myself and start building agents with their SDK.

5/ @ashlan_ahmed showed how @getaxal can automate action onchain with notifications and other integrations through verifiable agents.

6/ Jai from @NousResearch presented World Sim, allowing anyone to use inference to customize the web to their preferences.

7/ @ericxtang from @Livepeer demoed some of their new AI video editing capabilities. Eric used Livepeer’s platform to present as the viral Turkish Olympian Yusuf Dikec.

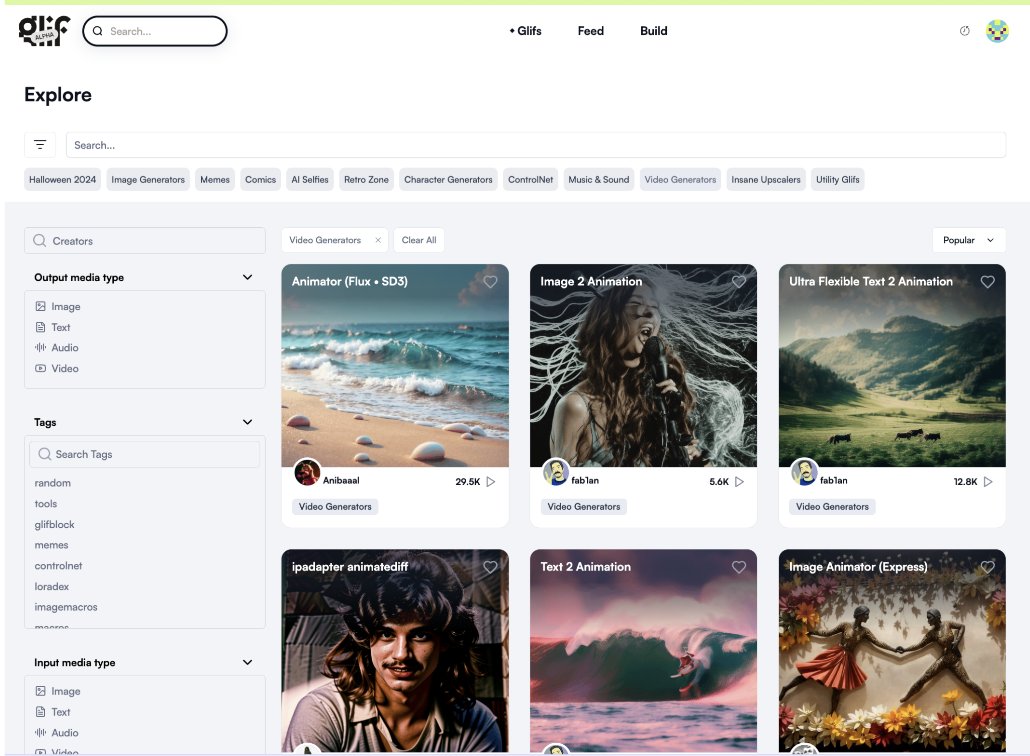

8/ @heyglif presented a plethora of AI-building tools and applications. One of my favorite tools was their Infinite Backrooms tool based on Seinfeld. AI Seinfeld characters were talking to each other around an episode of George getting into crypto.

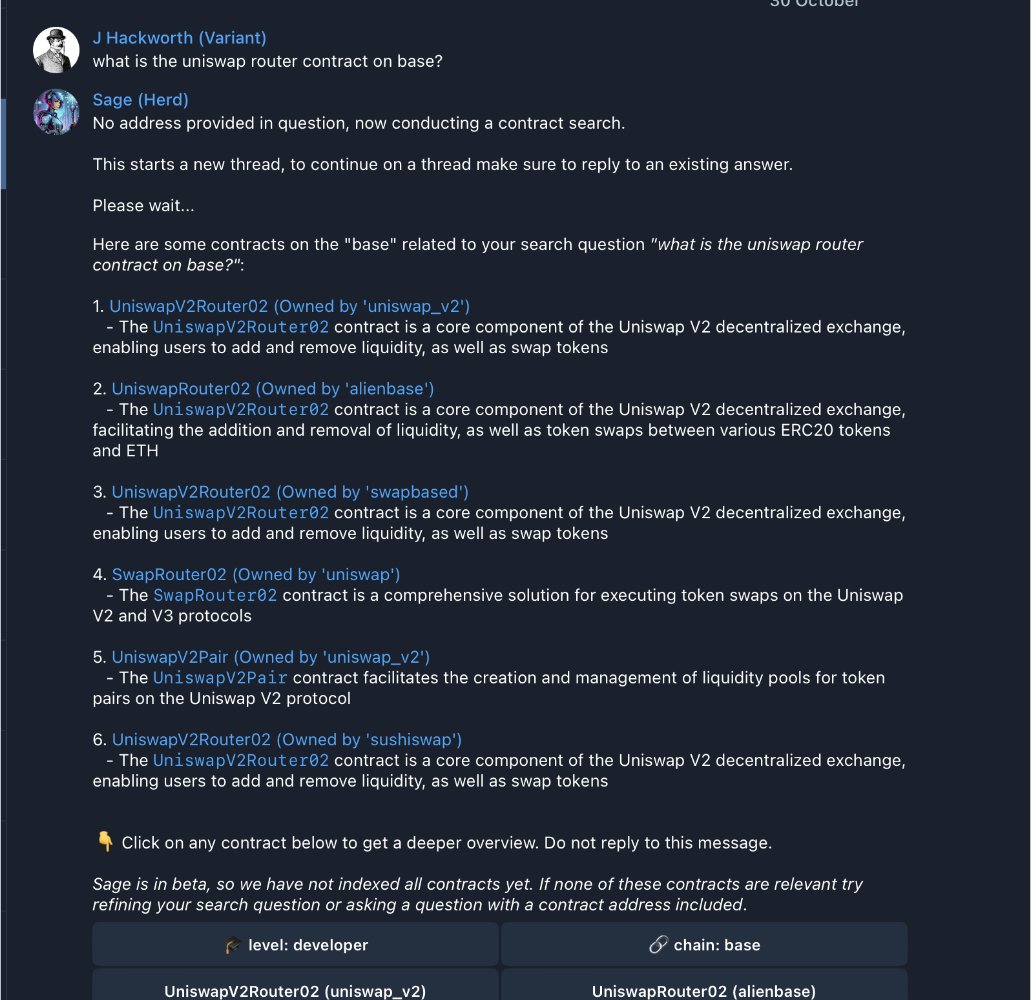

9/ @andrewhong5297 showcased Sage, an AI tool to help you find and explain any smart contract or function, making manual etherscan searching a thing of the past. As an onchain analyst, this has been a game changer and has saved me hours.

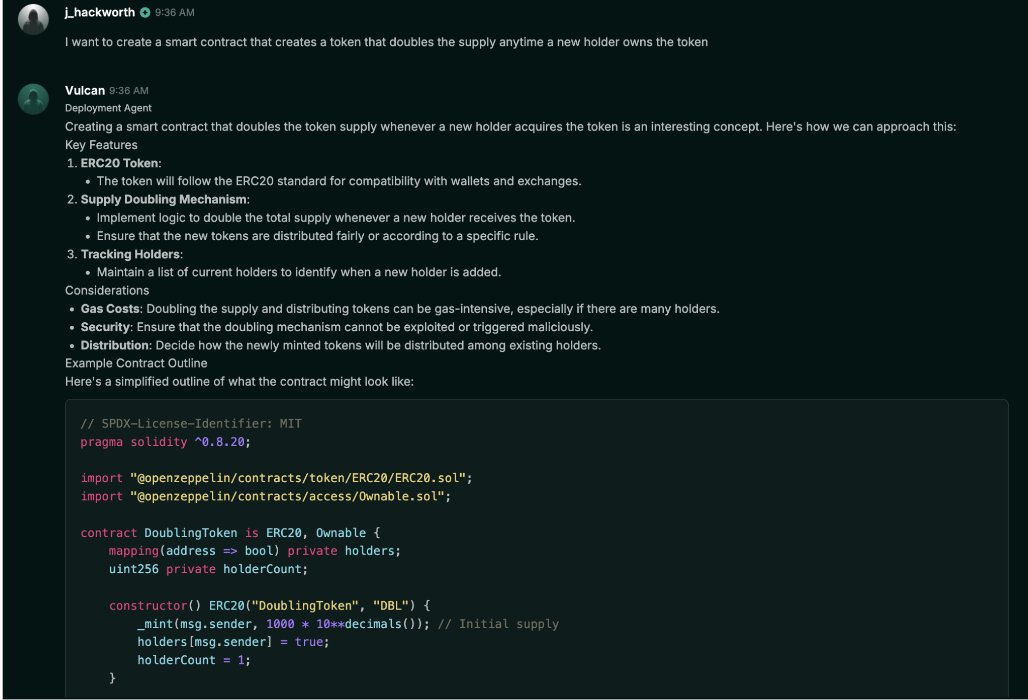

10/ Finally, Anant presented @AIWayfinder. Wayfinder allows anyone to use natural language to transact onchain and to build custom smart contracts based on whatever their heart desires. Excited to see their community unleash a wave of new creative smart contracts.

11/ Thank you to all our presenters and those who came out! I loved seeing so many practical Crypto x AI applications that can be used today. If you are building in this space - my DMs are open.

• • •

Missing some Tweet in this thread? You can try to

force a refresh