What Polymarket got Right that the Experts Got Wrong

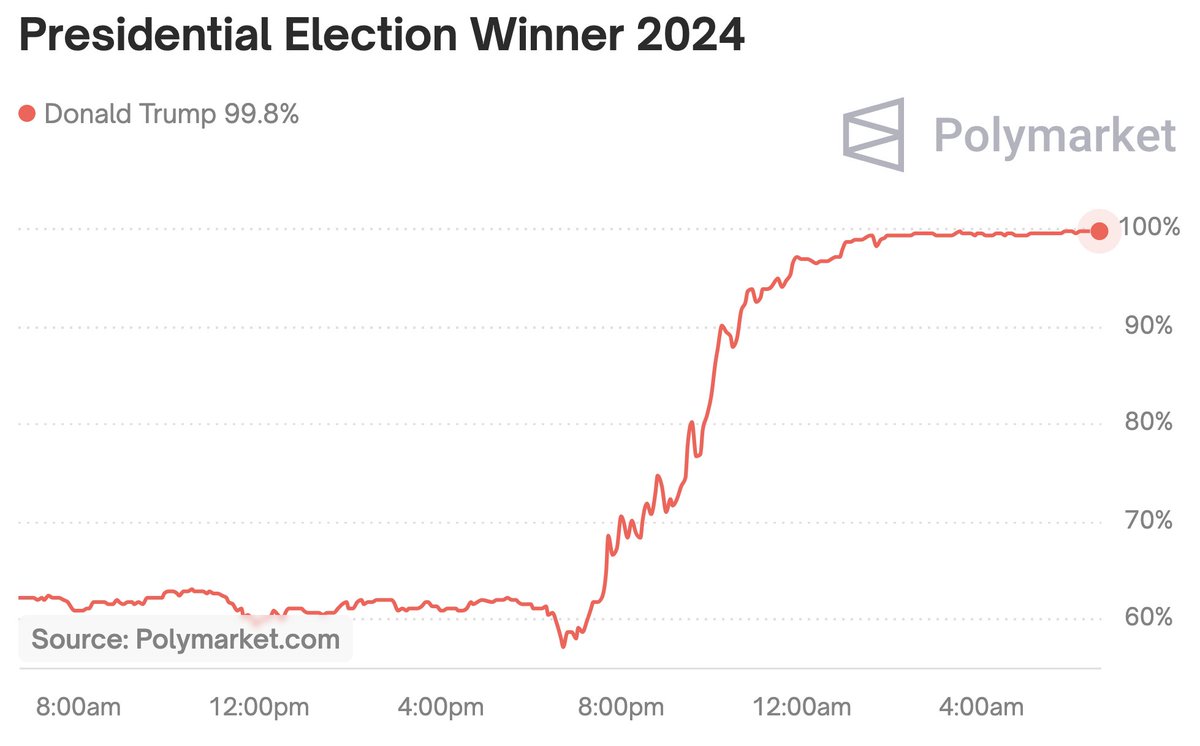

As the dust settles on the election, there’s a story that the WSJ and NYT didn’t tell you. While the mainstream news was busy with their TV pageantry and hedging on calling key swing states, Polymarket, the world’s biggest prediction market, had already delivered its verdict by midnight EST, declaring Trump was 97% likely to win. This was before the media called even a single swing state.

All throughout this election, Polymarket was always one step ahead. I want to explain why this is, because judging from the Twitter responses I was getting last night, most people deeply misunderstand this.

There are two fundamental things that Polymarket did better than the media.

1. Polymarket was more accurate on the forecast going into the election.

Let’s take the pollsters and analysts. Election poll-based models claimed the race was a dead-even 50/50. Polymarket meanwhile was priced Trump with a distinct edge—going into the election, he was priced around 62% to win.

If you remember, the mainstream media derided Polymarket for this difference. Polymarket should be the same as the modelers, they said! Obviously it means you can’t trust Polymarket. It’s priced differently because it’s a bunch of Trump-loving crypto bros. It’s invested by Peter Thiel. Only foreigners trade on it. It's unregulated, so it must be being manipulated. There's a whale pushing up the price of Trump. And on and on.

Implicit in this dismissal is a deep distrust of markets. As though markets cannot be trusted unless affirmatively proven otherwise. And of course, if you actually trusted the markets, you might not trust the media anymore. And their whole business model is predicated on you distrusting anyone but them—why else would you continue to click on their never-ending stream of clickbait?

But anyone with experience with markets knows: it doesn’t fucking matter if a market is composed of Republicans, or Democrats, or foreigners, or whatever. In reality, we know that JP Morgan was using Polymarket, as were some of the largest hedge funds in the world (most have non-US subsidiaries). It was integrated into Bloomberg Terminal, it was being quoted on CNN. And yet the media spoke of Polymarket as though it was 4chan.

Understand, Polymarket traded $3.6 BILLION dollars on the presidential election. This was the largest election betting market by volume IN HISTORY and AN ORDER OF MAGNITUDE more than any other election market ever. There was more riding on this than any single modelers’ career prospects. Understand—markets work because of how much is riding on getting the answer right.

These supposed biases—being Trump-aligned crypto-pilled non-Americans—didn’t skew the market’s accuracy. (It seems obvious in retrospect that being non-American might improve your ability to dispassionately predict an election.)

But the identities of the bettors didn't matter. Prediction markets distill input from many diverse actors to produce prices that transcend biases. Markets don't care about ideology, they only care about being right.

And as it turns out, Polymarket was more right than any pollster or modeler.

Now, I want to be clear what I’m not saying: the difference between 60/40 and 50/50 sounds big, but it’s not. Elections are noisy. High school statistics will tell you that if you want to tell if a coin is rigged to be 60/40 rather than 50/50, you would need over 100 coin flips to have 90% certainty. The outcome of “Trump won this election” does not tell you whether the coin was 60/40 or 50/50.

My point is not that Polymarket was right and the models were wrong. They actually didn't disagree with each other by much. I'm making a more subtle point: the market was consistently pricing Trump’s odds higher than the polls. Remember, the market knows what the polls and analysts are saying. Markets incorporate all existing information—but Polymarket disagreed with with the pollsters. The only explanation that analysts could come up with for this was: Polymarket is biased.

They didn’t have the humility to imagine, maybe, just maybe, Polymarket knew something that was not being captured by the polls.

Polling sucks. This is all well established now. In the pre-Internet era, polling was much more accurate. Landline poll response rates were often above 60%. Today, poll response rates are around 5%. This means pollsters are getting massive sampling biases, and there is no possible way to correct these biases without baking in clumsy statistical corrections. (Plus pollsters—who are ultimately selling a product and have reputations to keep up—frequently herd their estimates together to avoid being an outlier, which fucks up poll aggregation.)

Plus, Trump is special. He is uniquely divisive in American politics. So for three elections in a row, we have seen massive polling errors that underestimated his support—the so called “Shy Trump Voter” effect.

Polymarket presumably believed that the polls were missing this. The pollsters said, no: we’ve updated our models and corrected for it. Polymarket said: I don't buy it. Polymarket was right.

Now, again! Polymarket did not say the election was 90% for Trump to win. 62% is not a sure thing, and elections are genuinely uncertain. But what irks me is that there was not even a tinge of curiosity from the media about the delta. Maybe Polymarket knows something we don’t? Maybe there’s information we’re missing that’s not being captured in the polls?

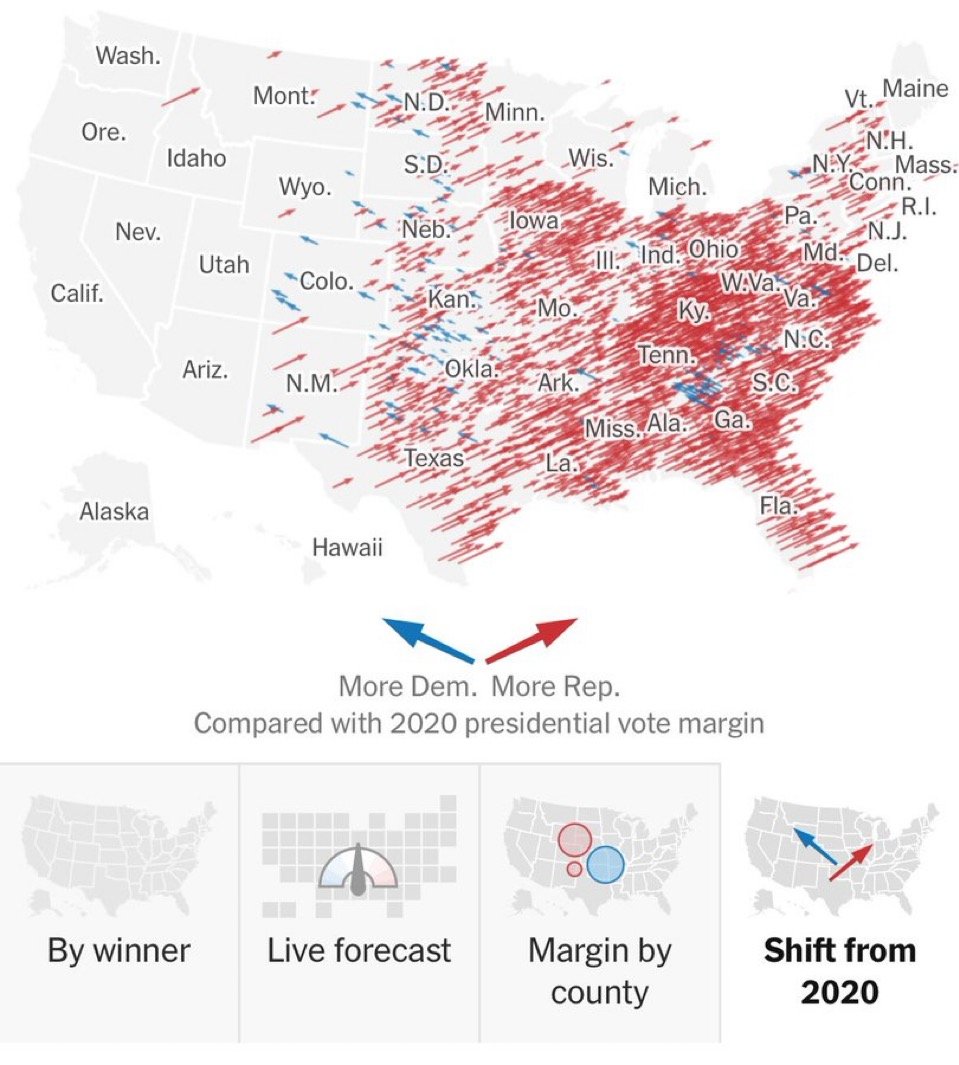

Remember, Trump massively outperformed his polls all across the country, in both red states and blue ones. He sweeped every single swing state, and even won the popular vote—something most people thought impossible.

Are you really so confident that there was no way to detect this—the sentiment of tens of millions of Americans—that didn’t involve the same old pollsters running the same old Internet surveys?

This is what being a student of the markets teaches you. Markets are smart. But they don’t explain themselves—they just show you the outcome.

That brings us to the second way that Polymarket outperformed the media.

2. Polymarket called the election in real-time, way before the media did.

The inscrutability of markets came in full force on election night. Polymarket moved quickly and violently before a single swing state was ever called. According to Polymarket, the election was over by midnight, while the mainstream media was milking the drama until the election was officially called at 6AM the next morning. Why was this?

First, Polymarket saw an important correlation that the mainstream media was not willing to explain to their viewers. You see, polling errors are seldom random; they are usually correlated across states. So when traders saw that Trump was massively outperforming his polls in states that were not themselves competitive—picking up huge vote share in NYC (cleanly blue) or Florida (cleanly red), this meant that there must be a massive polling miss across the country.

Polymarket immediately picked up on this and realized that the swing states could not possibly be competitive anymore. Polymarket priced Trump to win Pennsylvania at 90% by 11:30PM, when only a small portion of the Pennsylvania vote had been counted.

Prediction markets don’t wait for pageantry or pundits. It doesn’t care if it invalidates the sacred ritual of waiting for the votes to be counted. Remember in 2020 when Fox News called Arizona early (which turned out to be correct), viewers were outraged. Trump vowed to boycott the network over it. This reinforced the lesson—the networks must sit there and dutifully count up the votes. Don’t be too clever.

But markets don’t care about drama. They only care about outcomes. Obviously, it would be incredibly difficult to explain to a CNN viewer that the election is over, the polling error in non-competitive states is too big, Kamala is doomed and you should go to sleep and not bother to wait for swing states. It goes against the narrative that the media has been reinforcing for months. The public wants simple, explainable stories, and everyone knows how the narrative is supposed to go—you wait for the swing states and until one of the little colored bars crosses the 270 line.

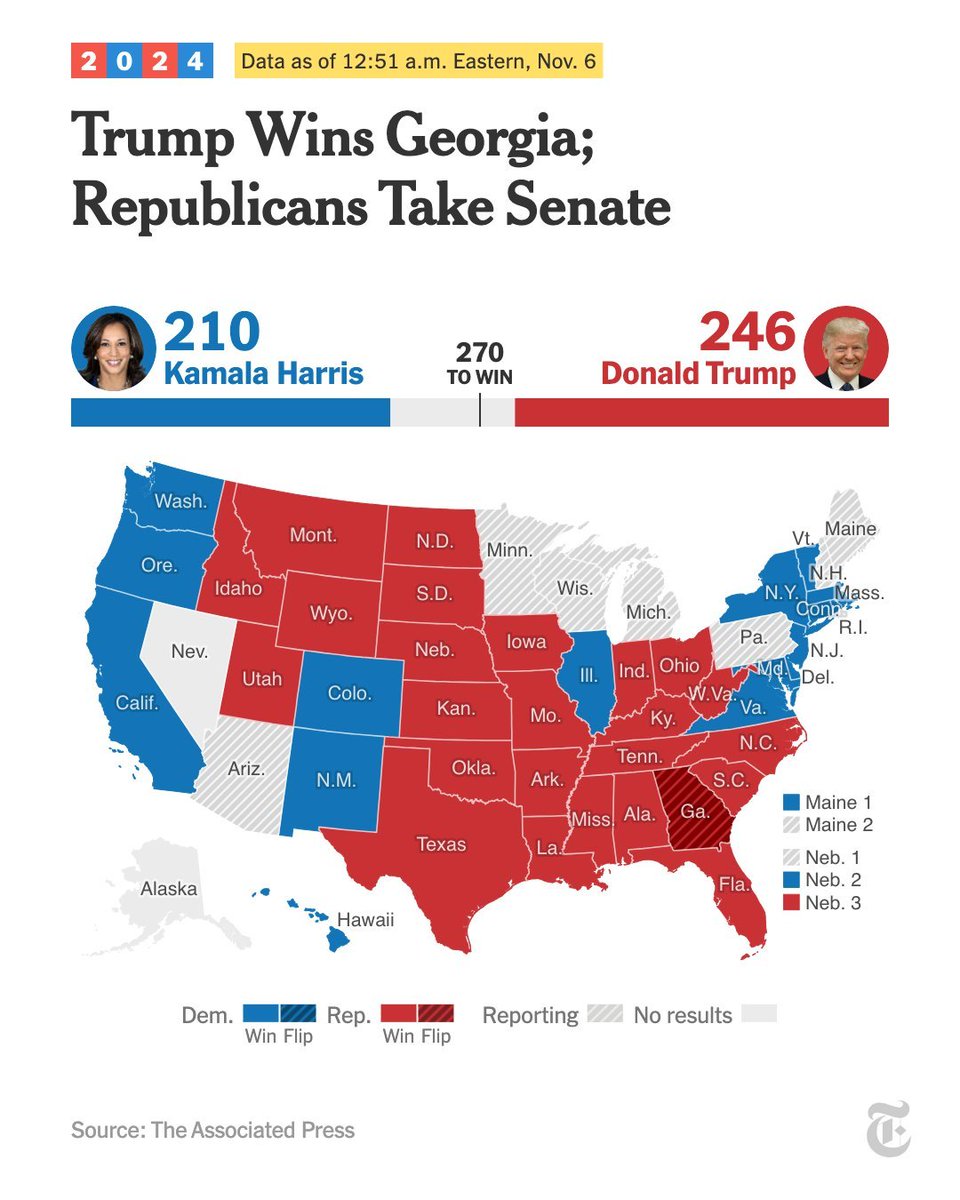

At 12:51AM, the NYT was still showing this dramatic chart and headline. By then Polymarket already had Trump priced at 98% to win.

So election watchers dutifully stayed up through the night so the media could complete its empty ritual of filling up the bars.

Polymarket’s traders have no loyalty to narrative and no incentive to play up the drama for ratings—they just call it straight. @shayne_coplan, Polymarket’s founder, said that Trump’s campaign team was reading Polymarket to try to understand how to actually interpret the odds. The media even had the gall to complain that Trump was declaring victory when his electoral count was at 267—at that point, the Polymarket odds were so low that they registered as 100%.

The beauty of markets is they respond instantly to new information. The fastest trader who incorporates the information gets a prize—profit. This is something traditional media fundamentally is not set up to do. They have to filter events through layers of interpretation, narrative making, and internal politics (recall Murdoch’s intercession into the 2020 Arizona call).

The decentralized nature of Polymarket bypasses all this bullshit. It lets information flow without any interference.

There is a lot to reflect on from last night. This election was a resounding reprimand of the Democratic party, a rejection of the expert class, and an immune response against an arrogant media.

But for Polymarket, it was a night of pure vindication.

For me, the lesson is this: the next time something important is going on in the world, skip the op eds and check the Polymarket odds.

As the dust settles on the election, there’s a story that the WSJ and NYT didn’t tell you. While the mainstream news was busy with their TV pageantry and hedging on calling key swing states, Polymarket, the world’s biggest prediction market, had already delivered its verdict by midnight EST, declaring Trump was 97% likely to win. This was before the media called even a single swing state.

All throughout this election, Polymarket was always one step ahead. I want to explain why this is, because judging from the Twitter responses I was getting last night, most people deeply misunderstand this.

There are two fundamental things that Polymarket did better than the media.

1. Polymarket was more accurate on the forecast going into the election.

Let’s take the pollsters and analysts. Election poll-based models claimed the race was a dead-even 50/50. Polymarket meanwhile was priced Trump with a distinct edge—going into the election, he was priced around 62% to win.

If you remember, the mainstream media derided Polymarket for this difference. Polymarket should be the same as the modelers, they said! Obviously it means you can’t trust Polymarket. It’s priced differently because it’s a bunch of Trump-loving crypto bros. It’s invested by Peter Thiel. Only foreigners trade on it. It's unregulated, so it must be being manipulated. There's a whale pushing up the price of Trump. And on and on.

Implicit in this dismissal is a deep distrust of markets. As though markets cannot be trusted unless affirmatively proven otherwise. And of course, if you actually trusted the markets, you might not trust the media anymore. And their whole business model is predicated on you distrusting anyone but them—why else would you continue to click on their never-ending stream of clickbait?

But anyone with experience with markets knows: it doesn’t fucking matter if a market is composed of Republicans, or Democrats, or foreigners, or whatever. In reality, we know that JP Morgan was using Polymarket, as were some of the largest hedge funds in the world (most have non-US subsidiaries). It was integrated into Bloomberg Terminal, it was being quoted on CNN. And yet the media spoke of Polymarket as though it was 4chan.

Understand, Polymarket traded $3.6 BILLION dollars on the presidential election. This was the largest election betting market by volume IN HISTORY and AN ORDER OF MAGNITUDE more than any other election market ever. There was more riding on this than any single modelers’ career prospects. Understand—markets work because of how much is riding on getting the answer right.

These supposed biases—being Trump-aligned crypto-pilled non-Americans—didn’t skew the market’s accuracy. (It seems obvious in retrospect that being non-American might improve your ability to dispassionately predict an election.)

But the identities of the bettors didn't matter. Prediction markets distill input from many diverse actors to produce prices that transcend biases. Markets don't care about ideology, they only care about being right.

And as it turns out, Polymarket was more right than any pollster or modeler.

Now, I want to be clear what I’m not saying: the difference between 60/40 and 50/50 sounds big, but it’s not. Elections are noisy. High school statistics will tell you that if you want to tell if a coin is rigged to be 60/40 rather than 50/50, you would need over 100 coin flips to have 90% certainty. The outcome of “Trump won this election” does not tell you whether the coin was 60/40 or 50/50.

My point is not that Polymarket was right and the models were wrong. They actually didn't disagree with each other by much. I'm making a more subtle point: the market was consistently pricing Trump’s odds higher than the polls. Remember, the market knows what the polls and analysts are saying. Markets incorporate all existing information—but Polymarket disagreed with with the pollsters. The only explanation that analysts could come up with for this was: Polymarket is biased.

They didn’t have the humility to imagine, maybe, just maybe, Polymarket knew something that was not being captured by the polls.

Polling sucks. This is all well established now. In the pre-Internet era, polling was much more accurate. Landline poll response rates were often above 60%. Today, poll response rates are around 5%. This means pollsters are getting massive sampling biases, and there is no possible way to correct these biases without baking in clumsy statistical corrections. (Plus pollsters—who are ultimately selling a product and have reputations to keep up—frequently herd their estimates together to avoid being an outlier, which fucks up poll aggregation.)

Plus, Trump is special. He is uniquely divisive in American politics. So for three elections in a row, we have seen massive polling errors that underestimated his support—the so called “Shy Trump Voter” effect.

Polymarket presumably believed that the polls were missing this. The pollsters said, no: we’ve updated our models and corrected for it. Polymarket said: I don't buy it. Polymarket was right.

Now, again! Polymarket did not say the election was 90% for Trump to win. 62% is not a sure thing, and elections are genuinely uncertain. But what irks me is that there was not even a tinge of curiosity from the media about the delta. Maybe Polymarket knows something we don’t? Maybe there’s information we’re missing that’s not being captured in the polls?

Remember, Trump massively outperformed his polls all across the country, in both red states and blue ones. He sweeped every single swing state, and even won the popular vote—something most people thought impossible.

Are you really so confident that there was no way to detect this—the sentiment of tens of millions of Americans—that didn’t involve the same old pollsters running the same old Internet surveys?

This is what being a student of the markets teaches you. Markets are smart. But they don’t explain themselves—they just show you the outcome.

That brings us to the second way that Polymarket outperformed the media.

2. Polymarket called the election in real-time, way before the media did.

The inscrutability of markets came in full force on election night. Polymarket moved quickly and violently before a single swing state was ever called. According to Polymarket, the election was over by midnight, while the mainstream media was milking the drama until the election was officially called at 6AM the next morning. Why was this?

First, Polymarket saw an important correlation that the mainstream media was not willing to explain to their viewers. You see, polling errors are seldom random; they are usually correlated across states. So when traders saw that Trump was massively outperforming his polls in states that were not themselves competitive—picking up huge vote share in NYC (cleanly blue) or Florida (cleanly red), this meant that there must be a massive polling miss across the country.

Polymarket immediately picked up on this and realized that the swing states could not possibly be competitive anymore. Polymarket priced Trump to win Pennsylvania at 90% by 11:30PM, when only a small portion of the Pennsylvania vote had been counted.

Prediction markets don’t wait for pageantry or pundits. It doesn’t care if it invalidates the sacred ritual of waiting for the votes to be counted. Remember in 2020 when Fox News called Arizona early (which turned out to be correct), viewers were outraged. Trump vowed to boycott the network over it. This reinforced the lesson—the networks must sit there and dutifully count up the votes. Don’t be too clever.

But markets don’t care about drama. They only care about outcomes. Obviously, it would be incredibly difficult to explain to a CNN viewer that the election is over, the polling error in non-competitive states is too big, Kamala is doomed and you should go to sleep and not bother to wait for swing states. It goes against the narrative that the media has been reinforcing for months. The public wants simple, explainable stories, and everyone knows how the narrative is supposed to go—you wait for the swing states and until one of the little colored bars crosses the 270 line.

At 12:51AM, the NYT was still showing this dramatic chart and headline. By then Polymarket already had Trump priced at 98% to win.

So election watchers dutifully stayed up through the night so the media could complete its empty ritual of filling up the bars.

Polymarket’s traders have no loyalty to narrative and no incentive to play up the drama for ratings—they just call it straight. @shayne_coplan, Polymarket’s founder, said that Trump’s campaign team was reading Polymarket to try to understand how to actually interpret the odds. The media even had the gall to complain that Trump was declaring victory when his electoral count was at 267—at that point, the Polymarket odds were so low that they registered as 100%.

The beauty of markets is they respond instantly to new information. The fastest trader who incorporates the information gets a prize—profit. This is something traditional media fundamentally is not set up to do. They have to filter events through layers of interpretation, narrative making, and internal politics (recall Murdoch’s intercession into the 2020 Arizona call).

The decentralized nature of Polymarket bypasses all this bullshit. It lets information flow without any interference.

There is a lot to reflect on from last night. This election was a resounding reprimand of the Democratic party, a rejection of the expert class, and an immune response against an arrogant media.

But for Polymarket, it was a night of pure vindication.

For me, the lesson is this: the next time something important is going on in the world, skip the op eds and check the Polymarket odds.

Disclosure: I’m an investor in Polymarket. I’ve also been passionate about prediction markets for a long time, and I am so happy that they are finally being recognized for their value. Also, I might be wrong on some of the details here as I’m very sleep deprived, but you get the drift.

Tried to write it for people I know who came in very skeptical of prediction markets and bought the media's dismissal of Polymarkets. If you know anyone who was skeptical of prediction markets, feel free to send them this.

Tried to write it for people I know who came in very skeptical of prediction markets and bought the media's dismissal of Polymarkets. If you know anyone who was skeptical of prediction markets, feel free to send them this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh