Back in 2021, $HIMS acquired Honest Health for $4.8m to expand their footprint in the UK.

Since then, they’ve taken a slow approach - until now.

For 2025, I estimate that $HIMS expects their UK business to grow by approximately 180%, reaching £24m (or $30m) in annual revenue.

Since then, they’ve taken a slow approach - until now.

For 2025, I estimate that $HIMS expects their UK business to grow by approximately 180%, reaching £24m (or $30m) in annual revenue.

Now, £24m in annual revenue isn’t much, considering $HIMS is expected to reach ~$1.5bn this year. However, with a rapid growth trajectory, that business could scale quickly.

That said, it won’t be profitable & will weigh on their bottom line.

So, how do I know this?

That said, it won’t be profitable & will weigh on their bottom line.

So, how do I know this?

Well, I don’t know it for sure.

It’s based on a few assumptions (obviously), as well as information from the job advertisement for the new Head of Growth position in the UK and the last two balance sheets for $HIMS UK, which are available through British authorities.

It’s based on a few assumptions (obviously), as well as information from the job advertisement for the new Head of Growth position in the UK and the last two balance sheets for $HIMS UK, which are available through British authorities.

First things first:

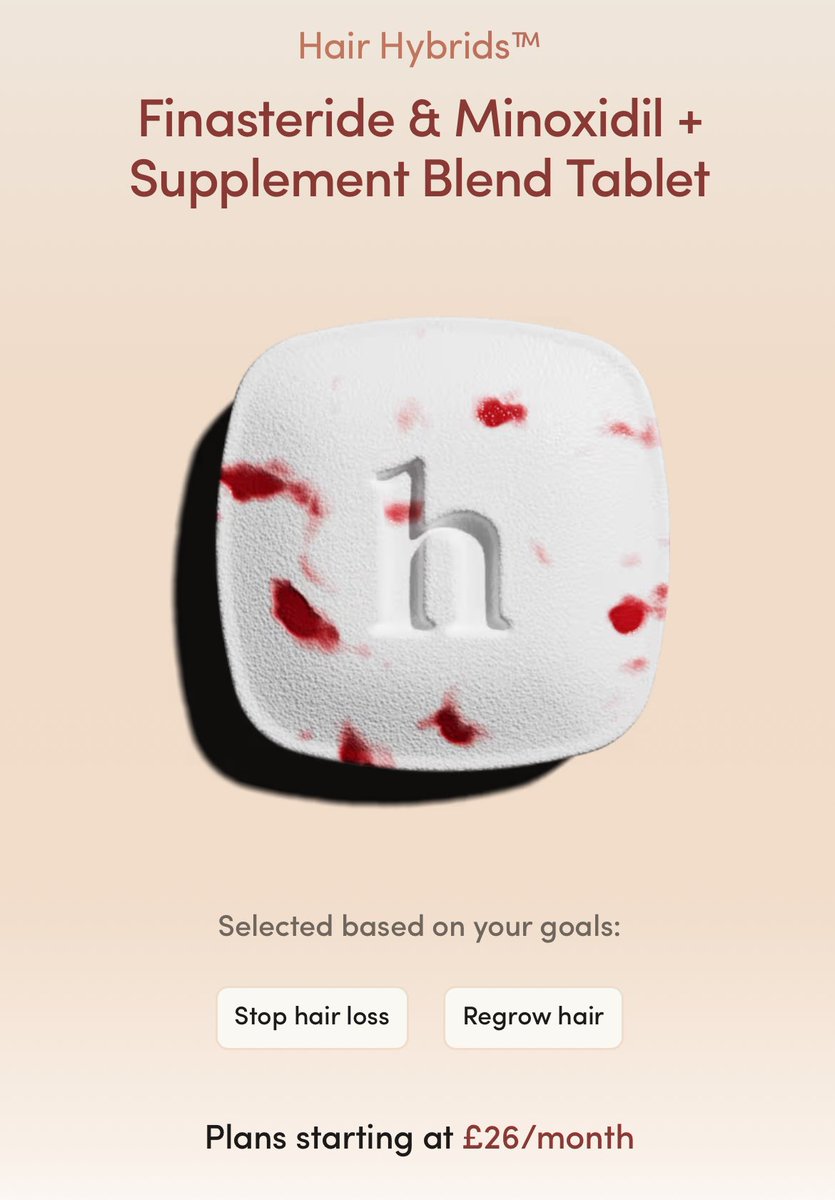

$HIMS does have a presence in the UK, primarily selling products for ED and MPB, both prescription and OTC.

They haven’t expanded their Hers business line - yet (rumored to be launching soon though, possibly in 2025).

$HIMS does have a presence in the UK, primarily selling products for ED and MPB, both prescription and OTC.

They haven’t expanded their Hers business line - yet (rumored to be launching soon though, possibly in 2025).

$HIMS isn’t very transparent about their UK business, and not a single analyst has raised questions about it.

The headcount reported to British authorities includes only management (4) and doesn’t account for any practitioners.

This makes it somewhat of an uphill battle for me.

The headcount reported to British authorities includes only management (4) and doesn’t account for any practitioners.

This makes it somewhat of an uphill battle for me.

But let’s dive in anyway.

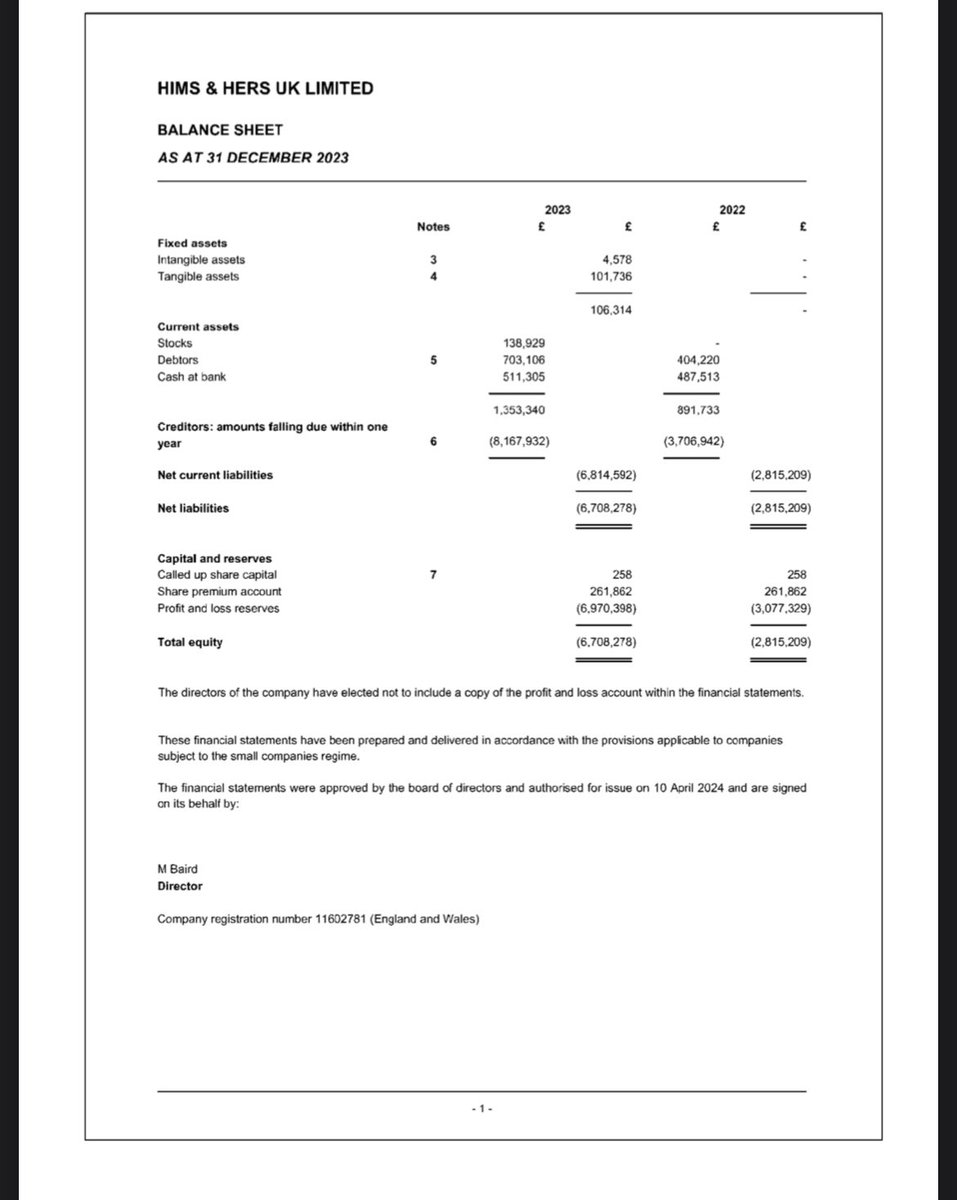

Here’s the balance sheet for $HIMS UK. Since the subsidiary is a small company (with revenue below £10m), they aren’t required to submit an income statement.

However, debtors are included in the balance sheet, allowing us to make some assumptions.

Here’s the balance sheet for $HIMS UK. Since the subsidiary is a small company (with revenue below £10m), they aren’t required to submit an income statement.

However, debtors are included in the balance sheet, allowing us to make some assumptions.

Before we get into that, let’s take a closer look. As you can see, the subsidiary is small, with roughly £100k in assets and £7m in debts (primarily owed to the parent company in the US).

Keep this in mind as we proceed.

Keep this in mind as we proceed.

The £700k in debtors could suggest (based on my estimate) an annual revenue of around £8.5m for FY23 for $HIMS UK.

This is however a bold statement as I simplify and interpret it fully as trade receivables from customer payments (which could be dead wrong).

This is however a bold statement as I simplify and interpret it fully as trade receivables from customer payments (which could be dead wrong).

Since they haven’t submitted their report for FY24 (and won’t until April 2025), it’s difficult to estimate their revenue for FY24.

Therefore, the 180% growth projection is based on their estimated revenue for FY23.

Therefore, the 180% growth projection is based on their estimated revenue for FY23.

$HIMS debtors, however, grew by 74% between 2022 and 2023. I could make another assumption based on this, but let’s not, it’s enough with one bold assumption.

That said, I do believe $HIMS will submit an income statement for FY24 (indicating at least 20% growth).

That said, I do believe $HIMS will submit an income statement for FY24 (indicating at least 20% growth).

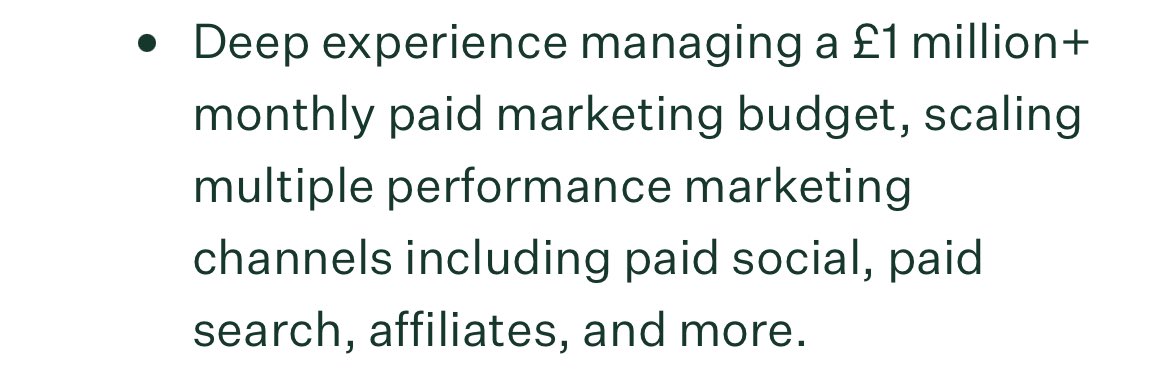

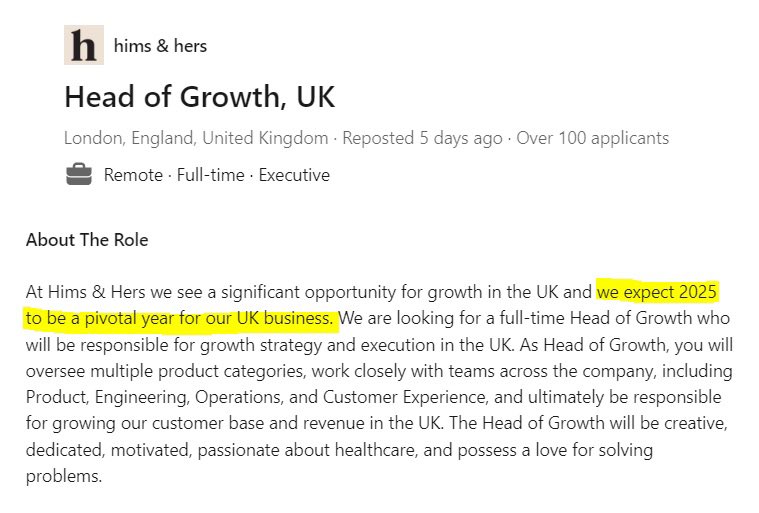

Now let’s move on to the job advertisement, the final piece of information. One of the requirements for applicants was this:

£1m+ monthly paid marketing budget.

That’s a minimum of £12m annually - far exceeding any other entry on $HIMS UK balance sheet.

£1m+ monthly paid marketing budget.

That’s a minimum of £12m annually - far exceeding any other entry on $HIMS UK balance sheet.

Now, this doesn’t necessarily mean they’ll immediately start spending over £12m on marketing.

However, considering they stated in the ad that 2025 will be a pivotal year and have already begun running TV ads on Sky, I believe $HIMS is gearing up to spend significantly.

However, considering they stated in the ad that 2025 will be a pivotal year and have already begun running TV ads on Sky, I believe $HIMS is gearing up to spend significantly.

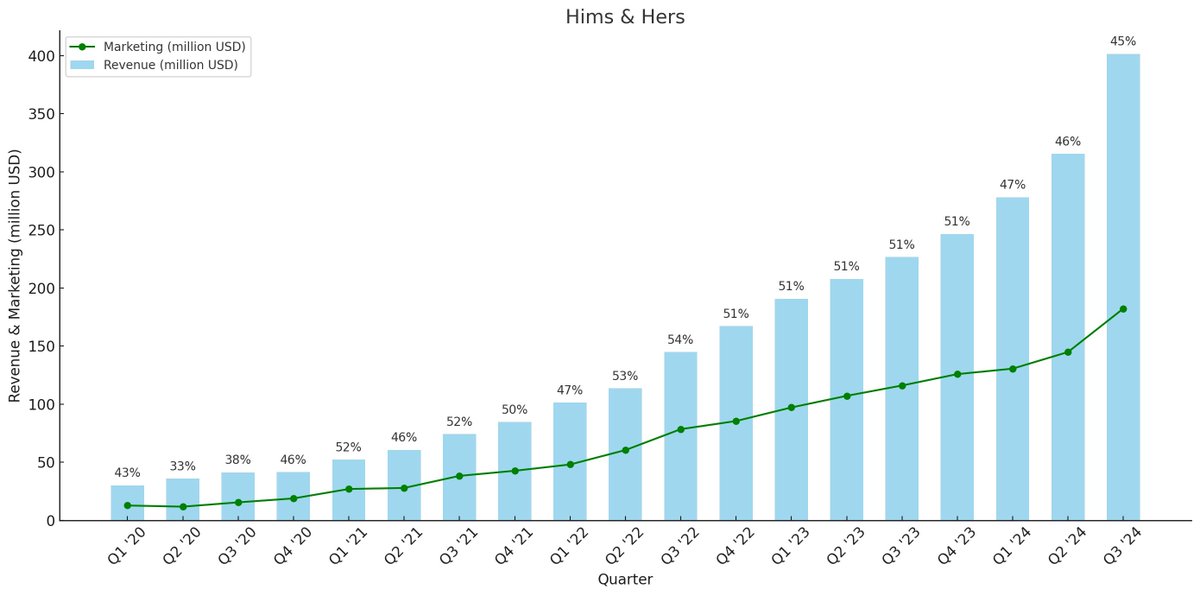

Marketing expenses for $HIMS UK are estimated to be around £12m. Let’s assume this represents approximately 50% of their revenue, based on historical data from their US operations.

If that’s the case, their revenue would be £24m, a 182% increase from £8.5m.

If that’s the case, their revenue would be £24m, a 182% increase from £8.5m.

I estimate that most of this will impact $HIMS in the second half of 2025, potentially offsetting some of the potential loss in sales from compounded semaglutide (if the shortage ends).

Now, as I mentioned, £24m (or $30m) isn’t a huge amount, but if $HIMS achieves a growth trajectory of anywhere between 80% & 140%, it could scale quickly.

After three years of such growth, their annual revenue could exceed £200m (or $250m).

After three years of such growth, their annual revenue could exceed £200m (or $250m).

And that’s where I’ll wrap it up. I do hope at least one analyst asks something about $HIMS UK business soon.

I also tried to verify a few details and gather additional information from $HIMS investor relations team (and UK press), but unfortunately, they chose to ghost me.

I also tried to verify a few details and gather additional information from $HIMS investor relations team (and UK press), but unfortunately, they chose to ghost me.

Oh, before I forget:

Does $HIMS mention international expansion in their latest 10-K?

Yes, they do.

They state that it’s important for their long-term growth and that they anticipate significantly expanding their operations & head count in the near term.

Does $HIMS mention international expansion in their latest 10-K?

Yes, they do.

They state that it’s important for their long-term growth and that they anticipate significantly expanding their operations & head count in the near term.

Not sure if this made anyone any wiser, but I wanted to share it anyway.

Hopefully, @AndrewDudum can shed some light on their UK business (and other international expansions) soon - and maybe even receive his very first question about it on a conference call.

Hopefully, @AndrewDudum can shed some light on their UK business (and other international expansions) soon - and maybe even receive his very first question about it on a conference call.

• • •

Missing some Tweet in this thread? You can try to

force a refresh