Great thread from @joshua_j_lim on what USDe starts to unlock on @DeribitExchange

Some additional ideas below:

Some additional ideas below:

https://twitter.com/862457408773160961/status/1860573429595873577

This is an important point

@DeribitExchange client base and funding mechanics are very different to more retail focused venues eg @Bybit_Official where baseline funding exists

Lack of baseline funding at ~11% APY causes Deribit funding to sit well below market in most "normal" funding environments closer to ~0%

@DeribitExchange client base and funding mechanics are very different to more retail focused venues eg @Bybit_Official where baseline funding exists

Lack of baseline funding at ~11% APY causes Deribit funding to sit well below market in most "normal" funding environments closer to ~0%

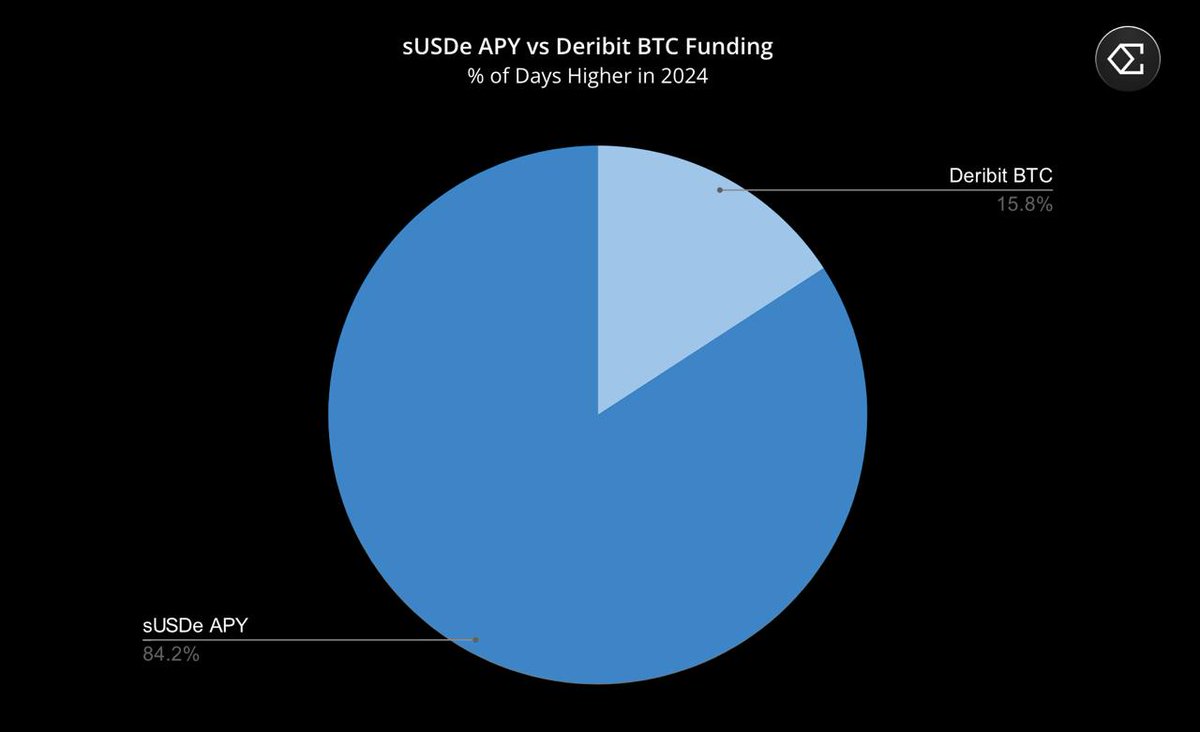

Using the average data from this year we have sUSDe ~18.5% and Deribit BTC funding at ~7.5% for an average net positive carry of ~+11.0%

This is a complete game changer for anyone on the venue

This is a complete game changer for anyone on the venue

Data below makes this clear where the sUSDe spread to Deribit funding is several % wide, and ~85% of the time in 2024 sUSDe was strictly better than executing the basis on Deribit itself

As @joshua_j_lim highlights, this now unlocks the ability to use USDe to capture positive carry on a long BTC / ETH position where before the majority of the time you would be slightly negative carry -7.5% on average

For dealers the improved capital efficiency is obvious where capital is "trapped" on Deribit to margin their option portfolio and can now benefit from the basis on other CEX venues in addition to option premiums

On the taker side USDe also allows you to construct interesting structured products using the USDe APY to fund premium and theta cost on calls

This episode covered one strategy in an old podcasts from 2020 28min in

open.spotify.com/episode/2lsrAs…

This episode covered one strategy in an old podcasts from 2020 28min in

open.spotify.com/episode/2lsrAs…

In 2020 you could generate >50% APY on size farming $CRV

They described selling their BTC holdings to USD farming $CRV and then using the farming rewards to buy strips of calls on BTC to replicate the long delta of spot BTC with added convexity and downside protection of cash

They described selling their BTC holdings to USD farming $CRV and then using the farming rewards to buy strips of calls on BTC to replicate the long delta of spot BTC with added convexity and downside protection of cash

For a given level of USDe APY and BTC IV you can begin to construct and fund a strip of options that resemble holding spot delta but with:

-higher convexity at the tail if the market pumped

-higher optionality to buy the dip with your cash if the market dumped

-higher convexity at the tail if the market pumped

-higher optionality to buy the dip with your cash if the market dumped

With BTC DVOL trending down since 2021 bull market highs from ~90 in Q1'21 to ~60 Q4'24 this strategy is relatively cheaper and likely continues to cheapen as IBIT option markets mature and IV tightens further

Similarly if you want to sell a put using USDe collateral v limit order

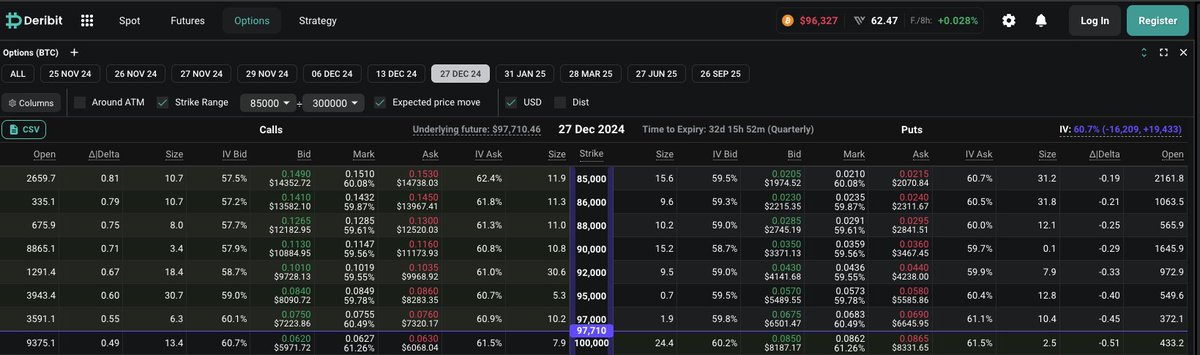

Simple example for a 30 delta 90k 27th December '24 put:

USDe APY: ~25%

Premium on $90k Dec put: [3400/96000*31/33] = 3.3%

Total one month ROI: 5.4%

Simple example for a 30 delta 90k 27th December '24 put:

USDe APY: ~25%

Premium on $90k Dec put: [3400/96000*31/33] = 3.3%

Total one month ROI: 5.4%

These are just some simple examples and I am sure we will begin to see a whole suite of new structured products emerge built on USDe as the collateral asset

• • •

Missing some Tweet in this thread? You can try to

force a refresh