🚨Retail Investors Are Back: Top Mainstream Altcoins to Watch🚨

Why are the same coins that dominated the last cycle - $XRP, $ADA, $DOT - leading the charge now?

With Bitcoin nearing $100K, retail investors are flooding back. Here’s how to position for what’s coming 🧵👇

Why are the same coins that dominated the last cycle - $XRP, $ADA, $DOT - leading the charge now?

With Bitcoin nearing $100K, retail investors are flooding back. Here’s how to position for what’s coming 🧵👇

1/x We’re seeing a huge shift in the market. Coins that were popular during the 2021 bull run are seeing billions of dollars in inflows.

These coins appeal to returning retail investors:

• They’re simple.

• They’re familiar.

• They’re easy to buy.

This is just the start of alt season.

These coins appeal to returning retail investors:

• They’re simple.

• They’re familiar.

• They’re easy to buy.

This is just the start of alt season.

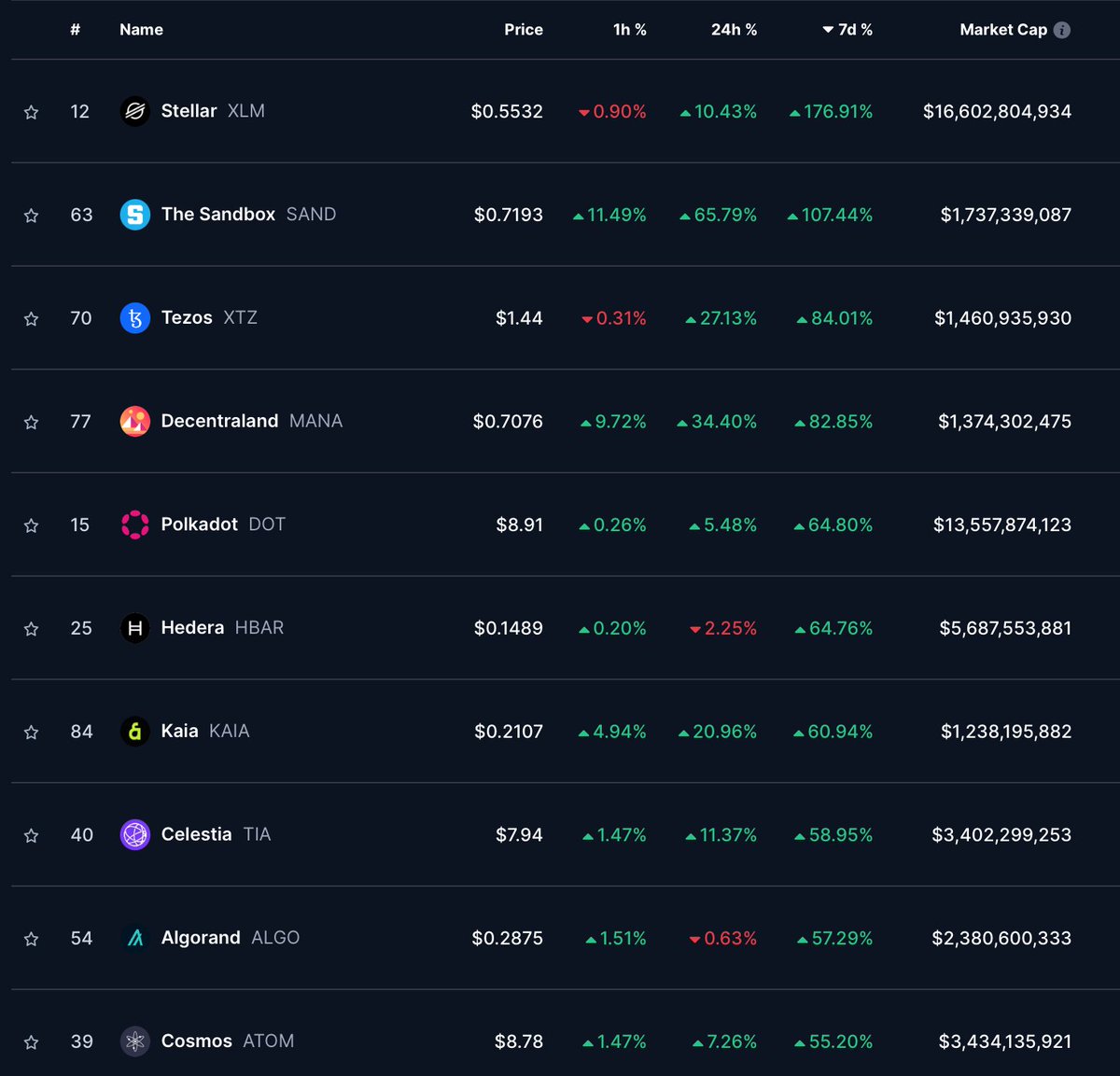

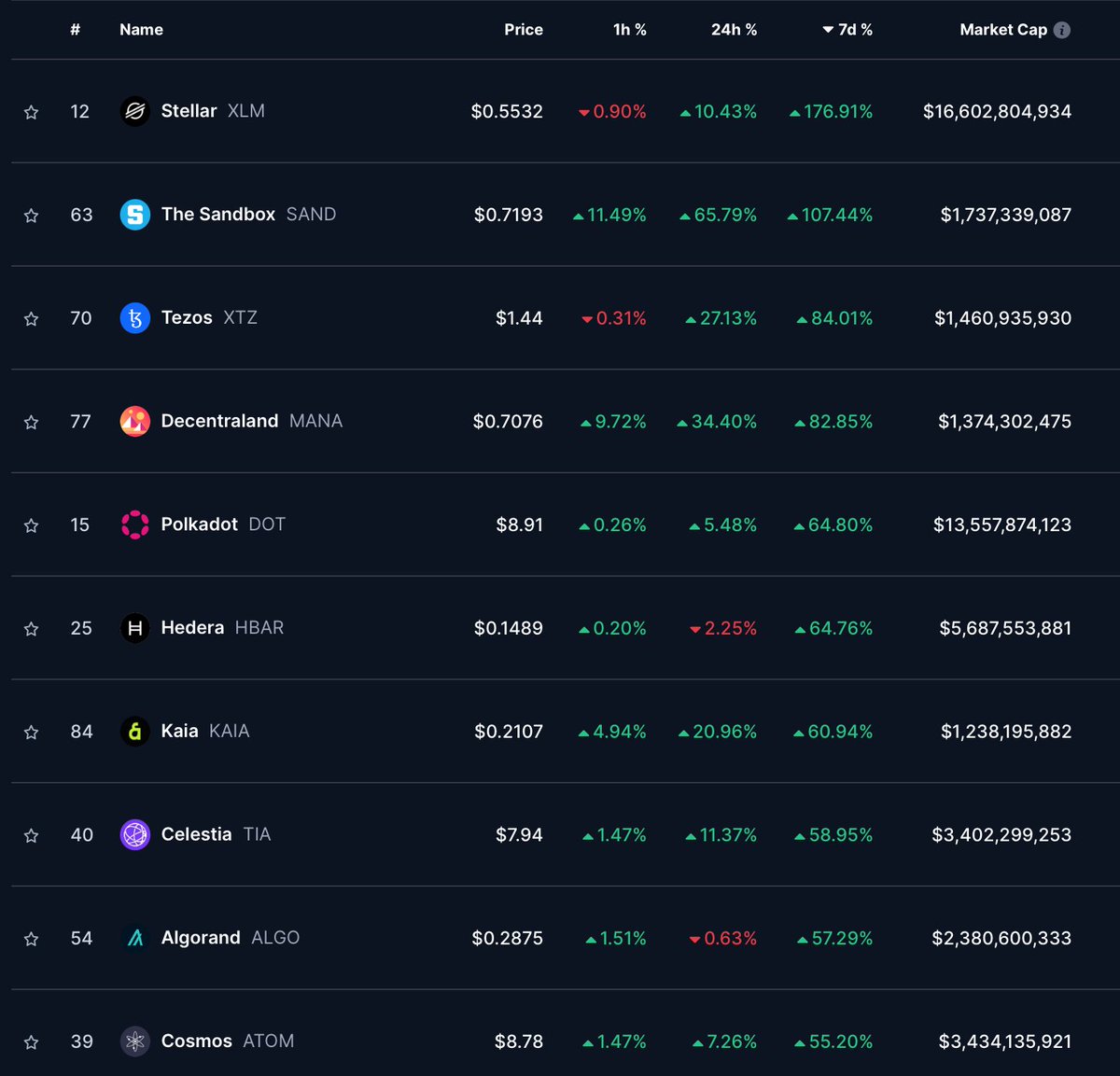

2/x If you look at the top-performing coins this week, it’s clear:

$XRP

$ADA

$XLM

$DOT

$XTZ

$SAND

$MANA

These coins were top performers in the last cycle, and retail investors are buying what they know.

But this is just the first wave.

$XRP

$ADA

$XLM

$DOT

$XTZ

$SAND

$MANA

These coins were top performers in the last cycle, and retail investors are buying what they know.

But this is just the first wave.

3/x Retail investors don’t analyze tokenomics or fundamentals. Their decisions are based on:

• Familiar names

• Easy-to-access platforms

• Charts that look “cheap”

When retail sees a coin priced at $0.30 that once hit $5, they think: “Wow, this can go 10x!”

They don’t consider market cap or circulating supply - they focus on simplicity. And that’s why certain coins are surging.

• Familiar names

• Easy-to-access platforms

• Charts that look “cheap”

When retail sees a coin priced at $0.30 that once hit $5, they think: “Wow, this can go 10x!”

They don’t consider market cap or circulating supply - they focus on simplicity. And that’s why certain coins are surging.

4/x To identify coins that will benefit from retail-driven liquidity, I use these 9 criteria:

1️⃣ Top 100 coins: Visible on major trackers and easy to find.

2️⃣ Familiar narratives: AI, gaming, and Layer-1s.

3️⃣ Listed on major platforms: Robinhood, Coinbase, and PayPal are key.

4️⃣ Low unit bias: Coins priced at $0.10 feel more “affordable” than $50.

5️⃣ Big gap to ATH: Retail loves coins that appear to have room to grow.

6️⃣ Centralized exchange listings: Decentralized platforms are too technical for many.

7️⃣ English-friendly names: Simple names that are easy to remember.

8️⃣ 2021 cycle favorites: Coins that already proved themselves in the last bull run.

9️⃣ First-mover narratives: Coins tied to familiar categories like metaverse or payments.

1️⃣ Top 100 coins: Visible on major trackers and easy to find.

2️⃣ Familiar narratives: AI, gaming, and Layer-1s.

3️⃣ Listed on major platforms: Robinhood, Coinbase, and PayPal are key.

4️⃣ Low unit bias: Coins priced at $0.10 feel more “affordable” than $50.

5️⃣ Big gap to ATH: Retail loves coins that appear to have room to grow.

6️⃣ Centralized exchange listings: Decentralized platforms are too technical for many.

7️⃣ English-friendly names: Simple names that are easy to remember.

8️⃣ 2021 cycle favorites: Coins that already proved themselves in the last bull run.

9️⃣ First-mover narratives: Coins tied to familiar categories like metaverse or payments.

5/x Layer-1 altcoins are the backbone of crypto narratives, offering scalability, diverse ecosystems, and mainstream appeal.

Top Picks:

1️⃣ $AVAX: Combines gaming and AI narratives with scalability. Positioned to follow $SOL's momentum.

2️⃣ $DOT: A retail favorite with its $50 ATH vs. today’s $8. Strong U.S. branding keeps it top-of-mind for investors.

3️⃣ $FTM: Retail loves its low price (~$1) and history of explosive growth ($0.20 → $3).

4️⃣ $ICP: Now bridging the AI and Layer-1 categories, with a massive gap from its $490 ATH to today’s $11.

5️⃣ $ALGO: At just $0.26, $ALGO offers significant upside with an 11x gap to its ATH.

6️⃣ $QNT: Quant offers interoperability for Layer-1 blockchains, making it a strong infrastructure play.

7️⃣ $XDC: A highly scalable network with real-world enterprise adoption, appealing to both retail and institutions.

Top Picks:

1️⃣ $AVAX: Combines gaming and AI narratives with scalability. Positioned to follow $SOL's momentum.

2️⃣ $DOT: A retail favorite with its $50 ATH vs. today’s $8. Strong U.S. branding keeps it top-of-mind for investors.

3️⃣ $FTM: Retail loves its low price (~$1) and history of explosive growth ($0.20 → $3).

4️⃣ $ICP: Now bridging the AI and Layer-1 categories, with a massive gap from its $490 ATH to today’s $11.

5️⃣ $ALGO: At just $0.26, $ALGO offers significant upside with an 11x gap to its ATH.

6️⃣ $QNT: Quant offers interoperability for Layer-1 blockchains, making it a strong infrastructure play.

7️⃣ $XDC: A highly scalable network with real-world enterprise adoption, appealing to both retail and institutions.

6/x Hidden Gems in Layer-1s:

🔹 $APTOS: A strong competitor to $SUI with cutting-edge tech.

🔹 $METIS: Poised to rally with ETH and $AVAX, blending Layer-2 and Layer-1 tech.

🔹 $SEI: A hyperscalable blockchain (10k TPS) with untapped potential.

Layer-1 Ecosystem Plays:

🔹 $BRETT: As the main meme coin on Coinbase’s Base ecosystem, $BRETT is primed for retail interest as Base adoption grows.

🔹 $INJ: A strong infrastructure play with deep ties to DeFi and high performance on Layer-1s.

These coins are uniquely positioned as the Layer-1 ecosystems expand.

🔹 $APTOS: A strong competitor to $SUI with cutting-edge tech.

🔹 $METIS: Poised to rally with ETH and $AVAX, blending Layer-2 and Layer-1 tech.

🔹 $SEI: A hyperscalable blockchain (10k TPS) with untapped potential.

Layer-1 Ecosystem Plays:

🔹 $BRETT: As the main meme coin on Coinbase’s Base ecosystem, $BRETT is primed for retail interest as Base adoption grows.

🔹 $INJ: A strong infrastructure play with deep ties to DeFi and high performance on Layer-1s.

These coins are uniquely positioned as the Layer-1 ecosystems expand.

7/x Gaming altcoins are retail favorites, driven by nostalgia and their association with the 2021 bull run.

Mainstream Picks:

1️⃣ $AXS: Despite struggles, Axie Infinity remains synonymous with crypto gaming. Its sharp drop from ATH ensures retail attention.

2️⃣ $MANA & $SAND: These metaverse coins are listed on major exchanges and resonate even with non-crypto audiences.

3️⃣ $IMX: A gaming infrastructure project with U.S.-centric appeal and growing adoption.

4️⃣ $GALA: A decentralized gaming platform with a low unit price and strong retail recognition.

Mainstream Picks:

1️⃣ $AXS: Despite struggles, Axie Infinity remains synonymous with crypto gaming. Its sharp drop from ATH ensures retail attention.

2️⃣ $MANA & $SAND: These metaverse coins are listed on major exchanges and resonate even with non-crypto audiences.

3️⃣ $IMX: A gaming infrastructure project with U.S.-centric appeal and growing adoption.

4️⃣ $GALA: A decentralized gaming platform with a low unit price and strong retail recognition.

8/x Long-Term Plays:

🔹 $SUPER: A strong long-term gaming infrastructure project.

🔹 $SWORLD & $PRIME: Gaining momentum among more informed investors.

🔹 $XBG: A lesser-known but highly promising project in the blockchain gaming space.

Retail will focus on the mainstream picks first, but $SUPER, $XBG and $SWORLD and others will shine as narratives mature.

🔹 $SUPER: A strong long-term gaming infrastructure project.

🔹 $SWORLD & $PRIME: Gaining momentum among more informed investors.

🔹 $XBG: A lesser-known but highly promising project in the blockchain gaming space.

Retail will focus on the mainstream picks first, but $SUPER, $XBG and $SWORLD and others will shine as narratives mature.

9/x The AI narrative is growing, but retail is starting with legacy decentralized computing and storage coins.

Legacy AI Leaders:

1️⃣ $RNDR: A go-to for decentralized GPU rendering. Perfectly positioned for the AI boom.

2️⃣ $GRT: The Graph is foundational to Web3 and highly accessible for retail.

3️⃣ $FIL: Decentralized storage for AI data. A low-cost, retail-friendly option.

4️⃣ $HNT & $THETA: Legacy names from 2021 that are seeing renewed interest as retail returns.

5️⃣ $ICP: Bridging Layer-1 tech with decentralized AI applications.

Legacy AI Leaders:

1️⃣ $RNDR: A go-to for decentralized GPU rendering. Perfectly positioned for the AI boom.

2️⃣ $GRT: The Graph is foundational to Web3 and highly accessible for retail.

3️⃣ $FIL: Decentralized storage for AI data. A low-cost, retail-friendly option.

4️⃣ $HNT & $THETA: Legacy names from 2021 that are seeing renewed interest as retail returns.

5️⃣ $ICP: Bridging Layer-1 tech with decentralized AI applications.

10/x Emerging AI Plays:

🔹 $NEAR: Combining Layer-1 and AI capabilities, $NEAR is gaining traction.

🔹 $TAO: Advanced decentralized AI training project for niche investors.

🔹 $AR: Permanent storage for decentralized data, supporting AI applications.

🔹 $AKT: Decentralized cloud computing, critical for powering AI systems.

Retail will begin with legacy AI coins for retail-driven momentum before rotating into more niche projects.

🔹 $NEAR: Combining Layer-1 and AI capabilities, $NEAR is gaining traction.

🔹 $TAO: Advanced decentralized AI training project for niche investors.

🔹 $AR: Permanent storage for decentralized data, supporting AI applications.

🔹 $AKT: Decentralized cloud computing, critical for powering AI systems.

Retail will begin with legacy AI coins for retail-driven momentum before rotating into more niche projects.

11/x $LINK is a wildcard. Its loyal fanbase, the "Link Marines," is one of the strongest communities in crypto.

This coin isn’t tied to gaming or AI, but it has staying power.

It pumped in 2017 and again in 2021. Don’t be surprised if $LINK rallies as retail liquidity floods in.

This coin isn’t tied to gaming or AI, but it has staying power.

It pumped in 2017 and again in 2021. Don’t be surprised if $LINK rallies as retail liquidity floods in.

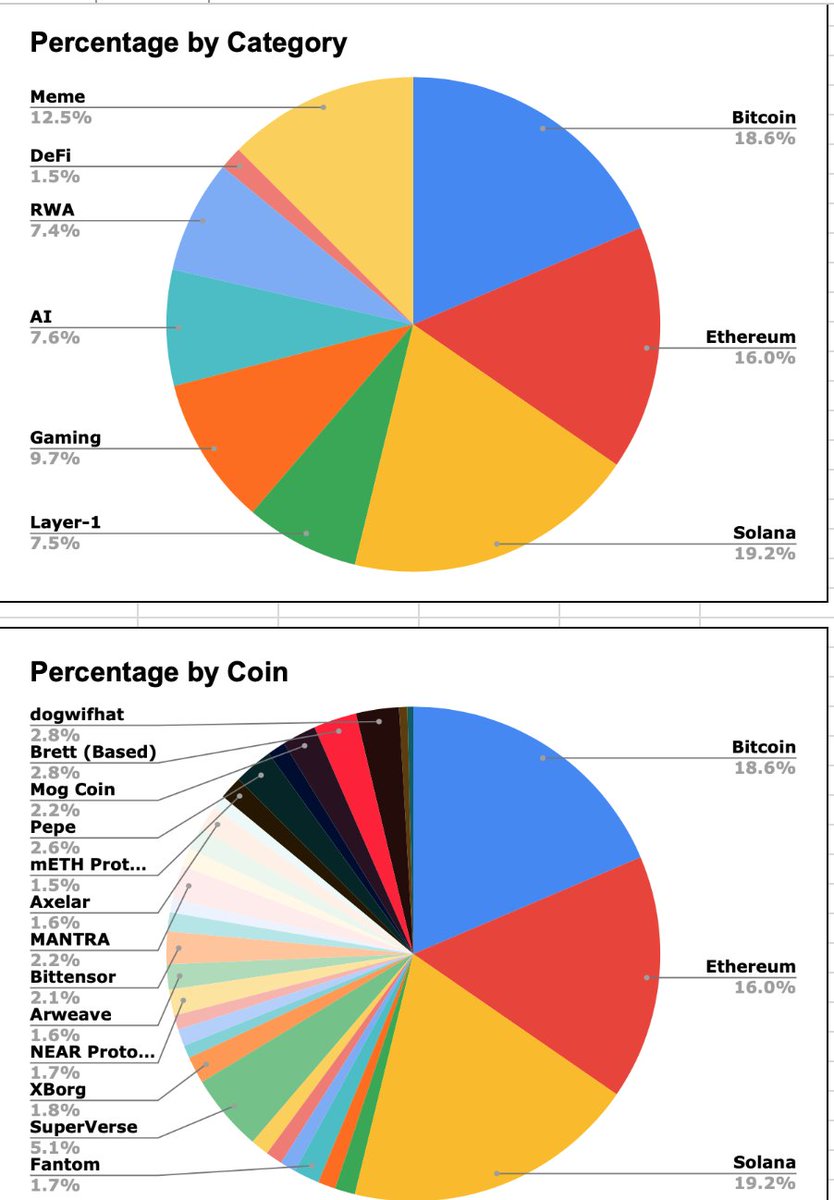

12/x Final Shortlist - Here are my retail-friendly picks for the coming weeks:

Layer-1s:

$AVAX, $DOT, $FTM, $ICP, $ALGO, $QNT, $XDC, $APTOS, $METIS, $SEI

Layer-1 Ecosystem Plays:

$BRETT, $INJ

Gaming:

$AXS, $MANA, $SAND, $IMX, $GALA, $SWORLD, $SUPER, $XBG

AI:

$RNDR, $GRT, $FIL, $HNT, $THETA, $ICP, $NEAR, $TAO, $AR, $AKT

Legacy Favorite:

$LINK

These coins have retail appeal and significant upside as Bitcoin pushes higher.

Layer-1s:

$AVAX, $DOT, $FTM, $ICP, $ALGO, $QNT, $XDC, $APTOS, $METIS, $SEI

Layer-1 Ecosystem Plays:

$BRETT, $INJ

Gaming:

$AXS, $MANA, $SAND, $IMX, $GALA, $SWORLD, $SUPER, $XBG

AI:

$RNDR, $GRT, $FIL, $HNT, $THETA, $ICP, $NEAR, $TAO, $AR, $AKT

Legacy Favorite:

$LINK

These coins have retail appeal and significant upside as Bitcoin pushes higher.

13/x Coins with familiarity, accessibility, and simple narratives will lead the next wave.

If you want to position yourself for success, start with these categories.

Which coins are on your radar? Let’s discuss👇

If you want to position yourself for success, start with these categories.

Which coins are on your radar? Let’s discuss👇

14/x Before we wrap up - don’t forget to apply for our Pro Insider Community for more in-depth insights:

pro.thecoiners.io

pro.thecoiners.io

• • •

Missing some Tweet in this thread? You can try to

force a refresh