Base & Global Onchain Economy

The onchain economy is no longer a niche — onchain innovation is changing how we interact, trade, and create, from financial systems to gaming and collectibles.

An excerpt on Base’s role in the growing onchain economy. 👇🧵

The onchain economy is no longer a niche — onchain innovation is changing how we interact, trade, and create, from financial systems to gaming and collectibles.

An excerpt on Base’s role in the growing onchain economy. 👇🧵

Our latest consulting report dives into the recent growth of the onchain economy across major networks, with a focus Base’s position therein.

Overall, the data is clear: the onchain economy is growing rapidly. ⤵️

delphi.link/BaseOnchainEco…

Overall, the data is clear: the onchain economy is growing rapidly. ⤵️

delphi.link/BaseOnchainEco…

🚨Disclaimer🚨

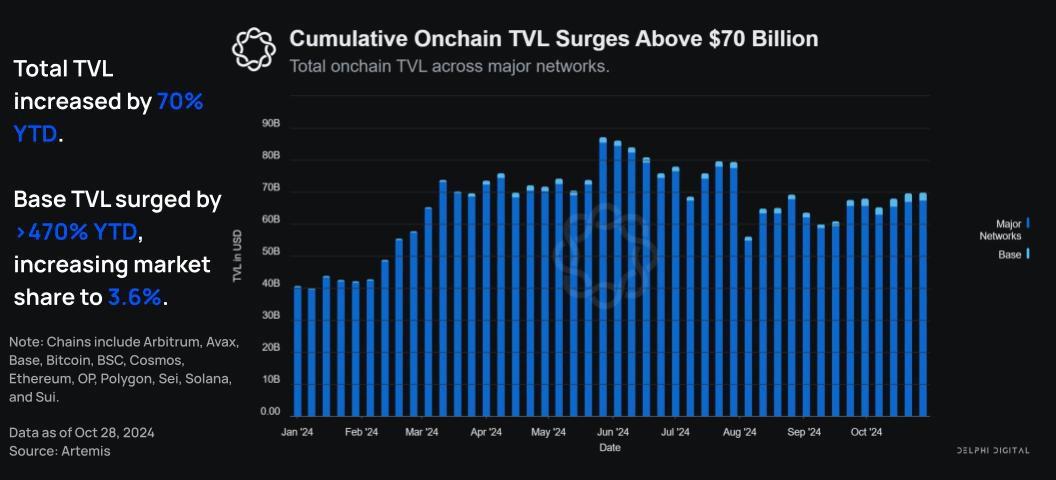

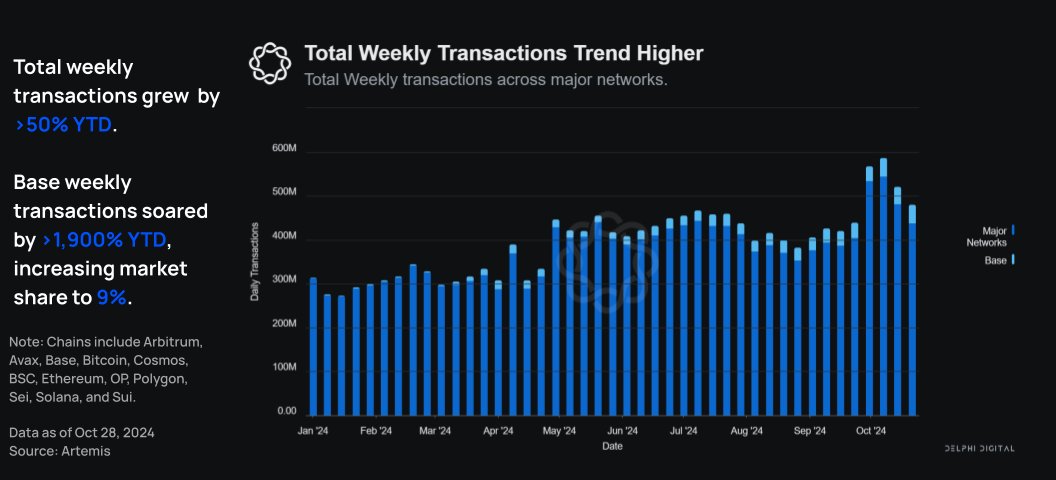

Most graphs cover data from January 2024 to October 2024. Metrics have continued to spike in November! Major networks analyzed include Bitcoin, Ethereum, Solana, Arbitrum, Avax, Base, Binance Smart Chain (BSC), Cosmos, Optimism, Polygon, Sei, and Sui.

Most graphs cover data from January 2024 to October 2024. Metrics have continued to spike in November! Major networks analyzed include Bitcoin, Ethereum, Solana, Arbitrum, Avax, Base, Binance Smart Chain (BSC), Cosmos, Optimism, Polygon, Sei, and Sui.

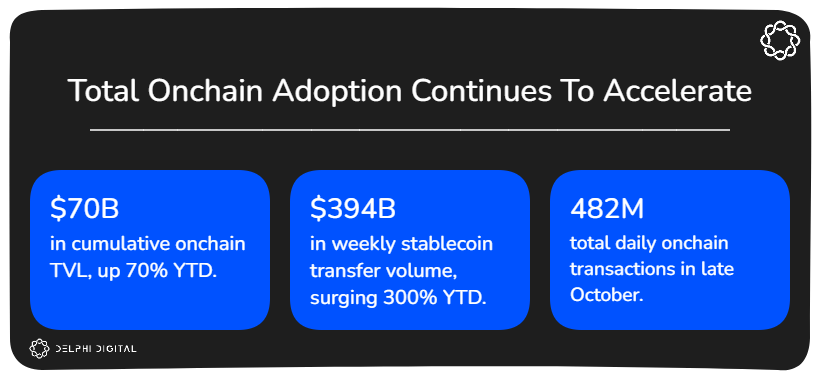

In 2024, the onchain economy surged with daily txs up 50% YTD and TVL rising 70% to $70B+ across major networks.

Highlighting a global shift to digital infrastructure, as projected by the WEF, which estimates 10% of global GDP will be onchain by 2027.

Highlighting a global shift to digital infrastructure, as projected by the WEF, which estimates 10% of global GDP will be onchain by 2027.

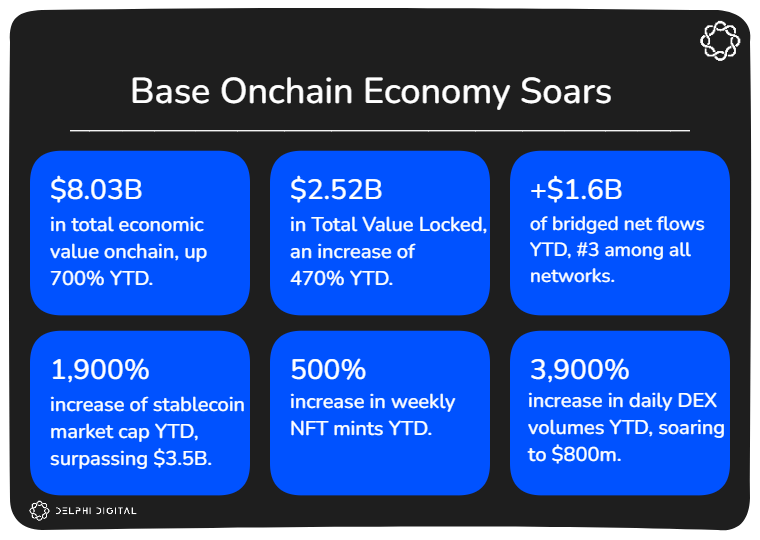

As total TVL onchain surges, Base’s growth in particular stands out.

Base’s onchain TVL increased from $439M in Jan. 2024 to $2.51B at the end of Oct. 2024 – a 470% increase.

Subsequently, Baseʼs market share rose from 1.07% of total onchain TVL to 3.59%.

Base’s onchain TVL increased from $439M in Jan. 2024 to $2.51B at the end of Oct. 2024 – a 470% increase.

Subsequently, Baseʼs market share rose from 1.07% of total onchain TVL to 3.59%.

YTD, cumulative weekly transactions have gone from 315M at the start of the year to 531M as of Nov 19, >60% YTD increase in total weekly onchain txs. 👇

In the same timeframe, Base has gone from 2.1M daily transactions at the start of the year to 42.34M at the end of October, a gain of over 1,900%.

This has increased Baseʼs market share from .67% to 9%.

This rise shows its growing popularity and affordability, highlighting its success while still enabling other networks to be successful (e.g., other networks in the Superchain).

In the same timeframe, Base has gone from 2.1M daily transactions at the start of the year to 42.34M at the end of October, a gain of over 1,900%.

This has increased Baseʼs market share from .67% to 9%.

This rise shows its growing popularity and affordability, highlighting its success while still enabling other networks to be successful (e.g., other networks in the Superchain).

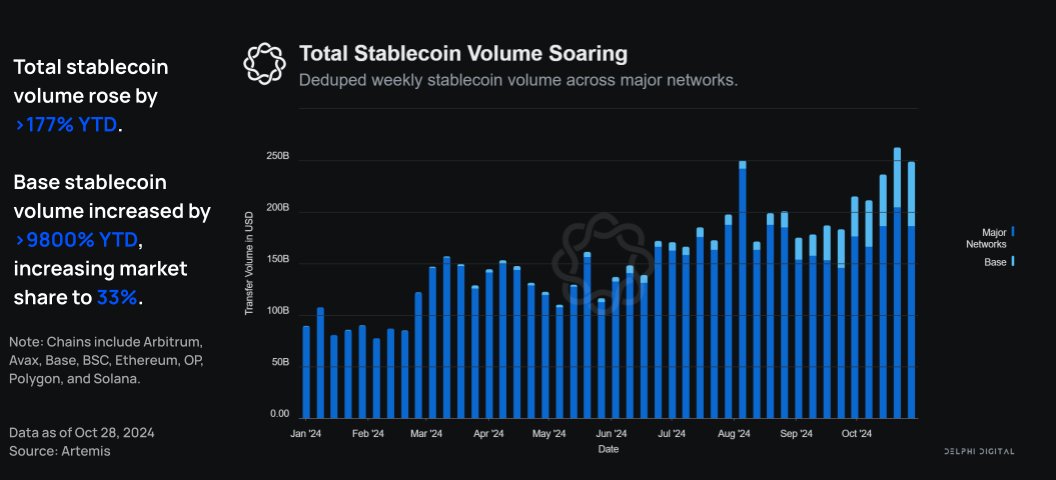

One key area of onchain economy growth is stablecoins — YTD, total deduped onchain stablecoin weekly volume has gone from $89.7B to $249B, a gain of over 177%.

Stablecoin growth is also rapidly accelerating on Base: in that same timeframe, Base's cumulative weekly stablecoin volume went from $620M in January to $62B at the end of October, a gain of >9,800%.

This has increased Baseʼs market share from 0.7% to 33%, a multiple of 47x.

Stablecoin growth is also rapidly accelerating on Base: in that same timeframe, Base's cumulative weekly stablecoin volume went from $620M in January to $62B at the end of October, a gain of >9,800%.

This has increased Baseʼs market share from 0.7% to 33%, a multiple of 47x.

Zooming in on Base

Base is rapidly growing in correlation with the total onchain activity surge:

🔹 Daily txs on Base have surged 1,600%.

🔹 Base TVL has risen 470%.

In comparison, total onchain transactions grew 50% and TVL rose 70% across major networks.

Base is rapidly growing in correlation with the total onchain activity surge:

🔹 Daily txs on Base have surged 1,600%.

🔹 Base TVL has risen 470%.

In comparison, total onchain transactions grew 50% and TVL rose 70% across major networks.

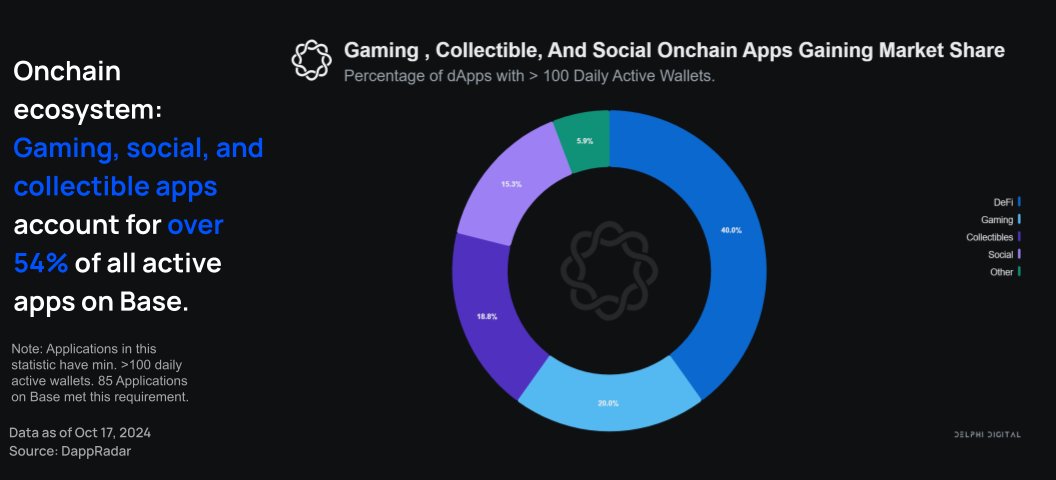

Base is more than a DeFi hub — it's a thriving ecosystem where diverse onchain applications can flourish, fostering the growth of a true digital economy:

Over 60% of Base's onchain apps cater to use cases beyond DeFi, with 20% focused on gaming, 18.8% on collectibles, 15.3% on social, and 5.9% in other categories.

Over 60% of Base's onchain apps cater to use cases beyond DeFi, with 20% focused on gaming, 18.8% on collectibles, 15.3% on social, and 5.9% in other categories.

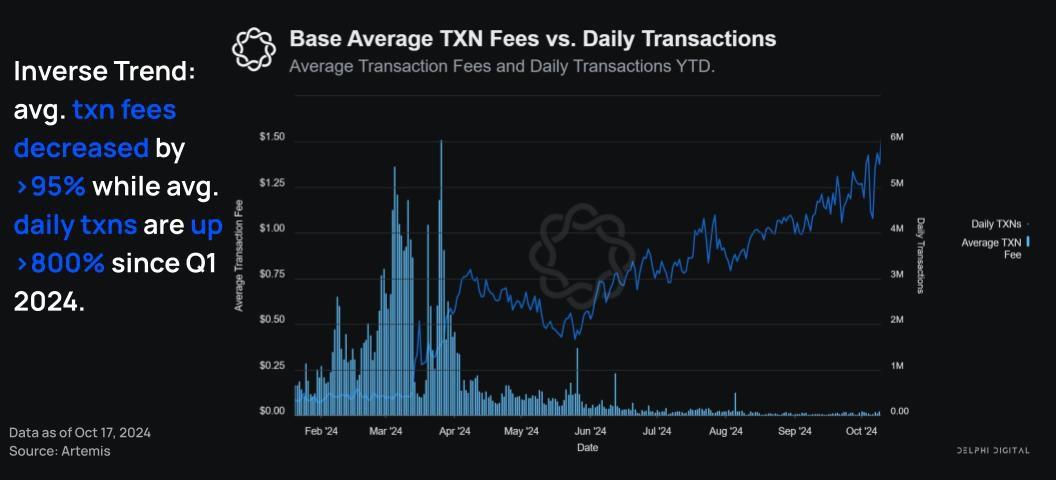

Contrary to Web2 dynamics, the cost of doing business on Base has decreased despite soaring demand:

Base's avg fee dropped 95% YTD, from $0.44 in Q1 to $0.019 by Oct 17, driven by EIP-4844 & scaling efforts while daily txs surged 800% (615K to 5.6M).

Base's avg fee dropped 95% YTD, from $0.44 in Q1 to $0.019 by Oct 17, driven by EIP-4844 & scaling efforts while daily txs surged 800% (615K to 5.6M).

In just over a year, Base has solidified its position as a leading L2.

By establishing a developer-friendly ecosystem with minimal transaction fees, Base has created an environment that not only attracts developers and users, but also sees robust retention. 👇

By establishing a developer-friendly ecosystem with minimal transaction fees, Base has created an environment that not only attracts developers and users, but also sees robust retention. 👇

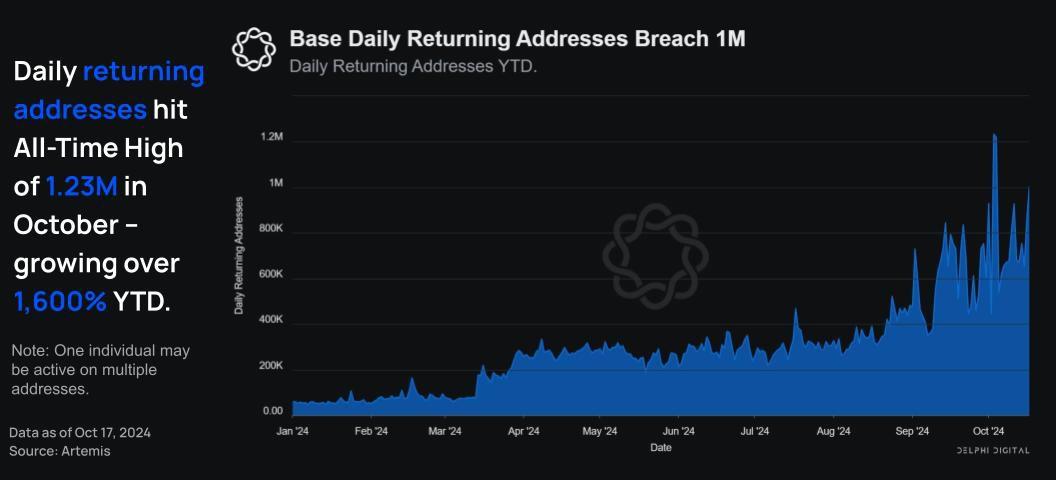

Base’s daily returning addresses rose from 59,000 in Jan to over 1M in Oct, with a peak of 1.23M on Oct 3rd.

Over 1,600% YTD growth — a clear indicator of explosive activity paired with strong user retention.

Over 1,600% YTD growth — a clear indicator of explosive activity paired with strong user retention.

Curious to learn more about the key drivers behind the growing global onchain economy and Base's role within? Don’t miss the full @base consulting report!

Unlocked & available for everyone to read for free🔓

delphi.link/BaseOnchainEco…

Unlocked & available for everyone to read for free🔓

delphi.link/BaseOnchainEco…

• • •

Missing some Tweet in this thread? You can try to

force a refresh