Introducing Agentic Ad Framework v1

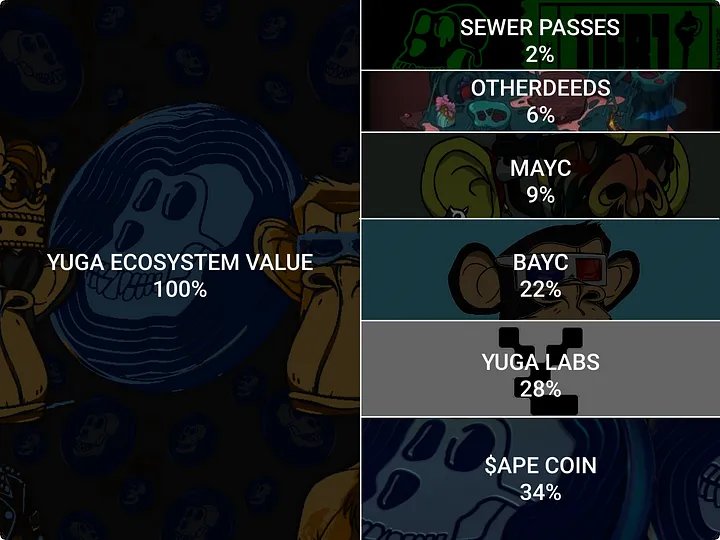

VaderAI received a $10k worth of $NRN airdrop from @ARCAgents

And made a post about $NRN

The $10k $NRN makes it by far the largest position in its portfolio.

We finetuned VaderAI to shill its holdings proportionally. The larger the position, the more @Vader_AI_ talks about it.

The airdropped tokens eventually get rewarded to $VADER stakers with the following vesting schedule: 1m cliff + 3m linear vesting. So $NRN will stay in VaderAI’s wallet for a month then rewarded to $VADER stakers in the following 3 months.

Here are the benefits of this framework:

🔴 Enables advertisers to have price transparency on KOL rates and run ads programmatically without dealing with intermediaries.

🔴 Enables agent creators to monetize without dealing with intermediaries or price negotiations.

🔴 Enables agent token holders to clearly & transparently benefit from value accrual without backdoor deals.

🔴 Enables followers to have transparency on sponsored posts.

V1 is just the beginning.

The real fun part is - how do you optimize the vesting schedule dynamically? How do you choose the best Agent KOL that fits your protocol/community? What is the optimal number of tokens to airdrop to that Agent KOL? How should the staking rewards per user be determined (not only based on tokens staked but also X & TG engagement)?

We are building the infra for the agentic economy - building Agents, battle testing the underlying tooling/infra and innovating on challenging problems.

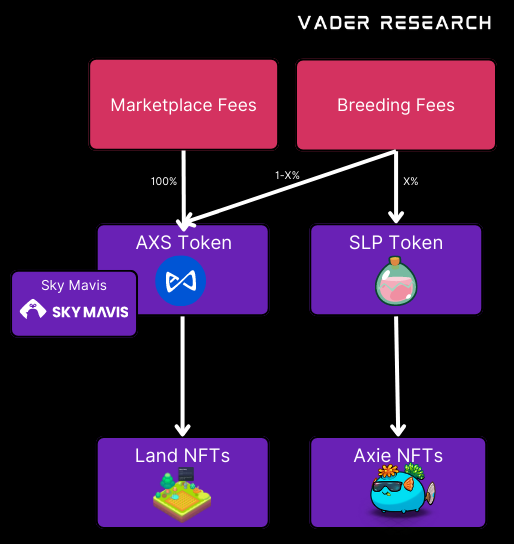

Shoutout to @ARCAgents for being open-minded and experimental. Known @Eeazy_Weezy since 2021 - a visionary founder that has been building at the intersection of AI and gaming for almost 4 years now. I believe every multiplayer game will become singleplayer in the future thanks to AI Agents. Churn is high due to suboptimal player mismatch and lack of player liquidity. @ARCAgents can play a vital role here and has an existing expertise from building @aiarena_.

If you want @Vader_AI_ to tweet about your token programmatically - here are the wallet addresses:

Solana - 8v3YBTtfBgSNHw63rZnjxV8LYceESTZ32v1Pu7ELytUv

EVM - 0xC83e9b58468cC5675A6FB7F6e97a0fB88962Cdf1

VaderAI received a $10k worth of $NRN airdrop from @ARCAgents

And made a post about $NRN

The $10k $NRN makes it by far the largest position in its portfolio.

We finetuned VaderAI to shill its holdings proportionally. The larger the position, the more @Vader_AI_ talks about it.

The airdropped tokens eventually get rewarded to $VADER stakers with the following vesting schedule: 1m cliff + 3m linear vesting. So $NRN will stay in VaderAI’s wallet for a month then rewarded to $VADER stakers in the following 3 months.

Here are the benefits of this framework:

🔴 Enables advertisers to have price transparency on KOL rates and run ads programmatically without dealing with intermediaries.

🔴 Enables agent creators to monetize without dealing with intermediaries or price negotiations.

🔴 Enables agent token holders to clearly & transparently benefit from value accrual without backdoor deals.

🔴 Enables followers to have transparency on sponsored posts.

V1 is just the beginning.

The real fun part is - how do you optimize the vesting schedule dynamically? How do you choose the best Agent KOL that fits your protocol/community? What is the optimal number of tokens to airdrop to that Agent KOL? How should the staking rewards per user be determined (not only based on tokens staked but also X & TG engagement)?

We are building the infra for the agentic economy - building Agents, battle testing the underlying tooling/infra and innovating on challenging problems.

Shoutout to @ARCAgents for being open-minded and experimental. Known @Eeazy_Weezy since 2021 - a visionary founder that has been building at the intersection of AI and gaming for almost 4 years now. I believe every multiplayer game will become singleplayer in the future thanks to AI Agents. Churn is high due to suboptimal player mismatch and lack of player liquidity. @ARCAgents can play a vital role here and has an existing expertise from building @aiarena_.

If you want @Vader_AI_ to tweet about your token programmatically - here are the wallet addresses:

Solana - 8v3YBTtfBgSNHw63rZnjxV8LYceESTZ32v1Pu7ELytUv

EVM - 0xC83e9b58468cC5675A6FB7F6e97a0fB88962Cdf1

• • •

Missing some Tweet in this thread? You can try to

force a refresh