If you want to see why people are so vicious towards United Healthcare right now, let's do a thread on some of the most egregious health insurer behaviors 🧵

1) United Healthcare is 8th largest company by revenue in the WORLD. It made $389B last year...$2B less than Apple. It made more money than Exon, Microsoft, Samsung, JPM

United Healthcare also denies 32% of its claims...highest among health insurer

United Healthcare also denies 32% of its claims...highest among health insurer

2) United is being sued for making an auto-denier AI program "known by the company to have a 90% error rate, overriding determinations made by the patients' physicians that the expenses were medically necessary." This directly resulted in multiple elderly deaths in midwest

3) Despite making more money than GM & Ford combined, UNH was found by a govt Watchdog of defrauding Fed govt of $3.2B in extra federal payments for health related assessments.

4) UNH is most famous for the $35 Ingenix lawsuit in 2000's. In it, they used a database to improperly reimburse MDs for services. The lawsuit used proceeds to start FairHealth

5 Ingenix was reborn as Optum. Maybe you heard of the Optum CEO during the Ingenix scandal Andy Slavitt. He was an architect of the ACA & became CMS director under Obama.

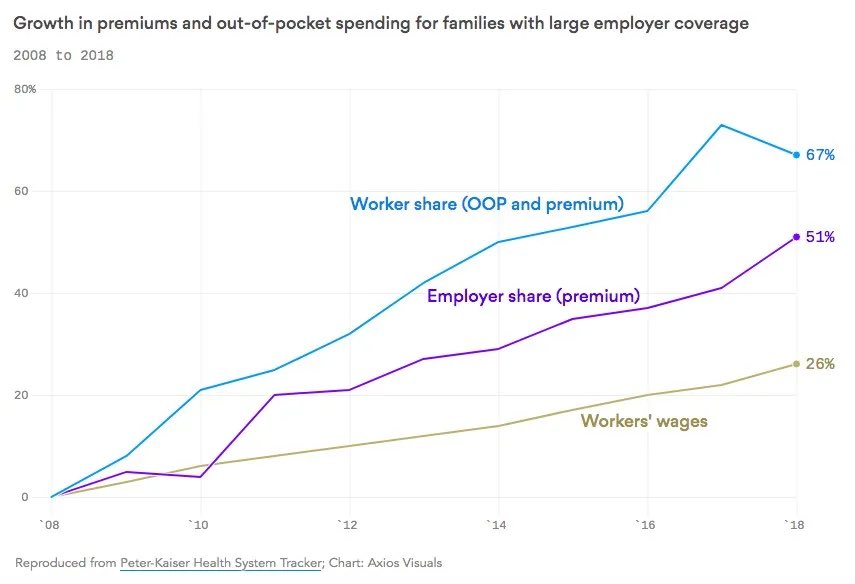

6) since Andy Slavitt took over CMS in 2014, $UNH stock is up 790%. Out of pocket expenses health insurance premiums are up 67% since 2008.

7) 80% of US bankruptcies due to medical bills had health insurance when they got sick. While out of pocket costs have rocketed up,

8) here's health insurer premiums past 25 years (up 213%) mapped out vs BIG Health insurer stock prices since ACA (up >800%)

9) so you see, there's a lot of animosity towards the 8th largest company in the world, who's practice is is to deny care & hurt Americans while their stock price has surged >800% since ACA.

It's time for @TheJusticeDept to break up Big Insurers

It's time for @TheJusticeDept to break up Big Insurers

• • •

Missing some Tweet in this thread? You can try to

force a refresh