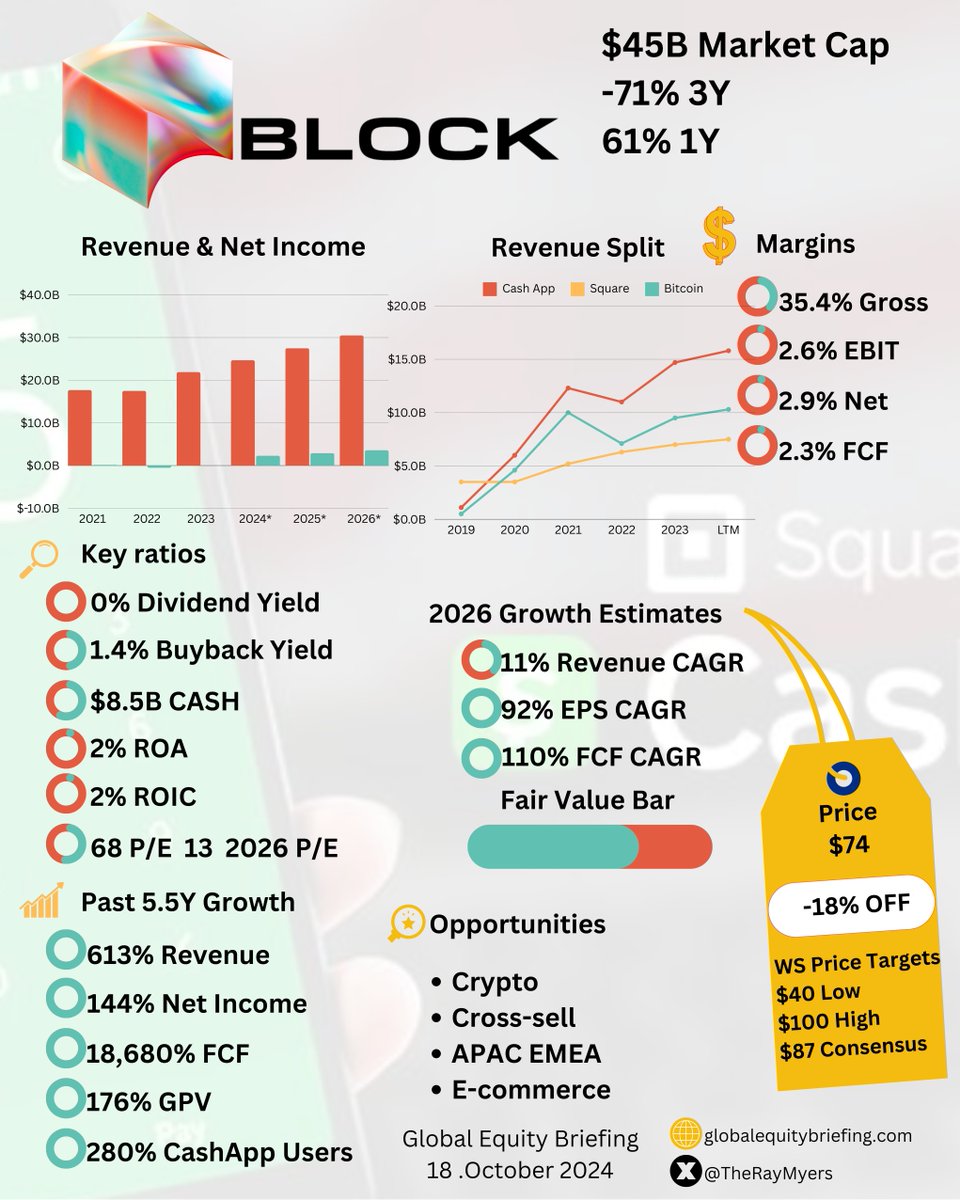

Block is a $57B financial technology innovator popular with millions of users!

In the last year, $SQ is up 43%!

Let's take a look at Block's business!👇🧵

In the last year, $SQ is up 43%!

Let's take a look at Block's business!👇🧵

$SQ Block formerly known as Square was founded by Jack Dorsey and has evolved from a payment processing company into a financial ecosystem that provides a wide range of financial services to both businesses and individuals.🧵

$SQ Block's business is split into 2 segments.

Square - It's original payments processing and software business.

Cash App - Innovative consumer-facing payments and financial technology app.🧵

Square - It's original payments processing and software business.

Cash App - Innovative consumer-facing payments and financial technology app.🧵

Block's $SQ products have been widely adopted, due to the main tenets of its business model.

Bitcoin

Scale

Product Innovation

Network Effects

Ecosystem

Cross-sale

Subscriptions🧵

Bitcoin

Scale

Product Innovation

Network Effects

Ecosystem

Cross-sale

Subscriptions🧵

(Bitcoin) $SQ Jack Dorsey is extremely bullish on Crypto and even changed the name of Square to Block to strengthen this message. The company develops new Crypto products and is investing 10% of its Bitcoin gross profits into Bitcoin.🧵

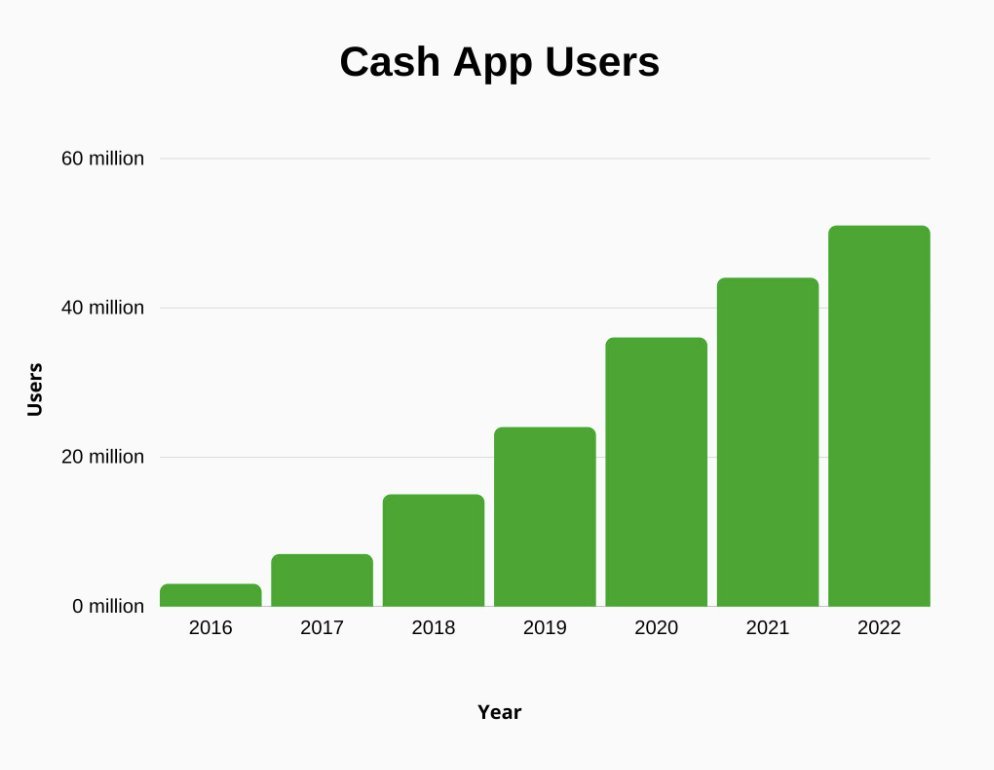

(Scale) $SQ Cash App had 57 million monthly active users in Q3 2024. Additionally, Block's network processed $236B of payments in the last 12 months. Scale enables superior unit economics and better product development. 🧵

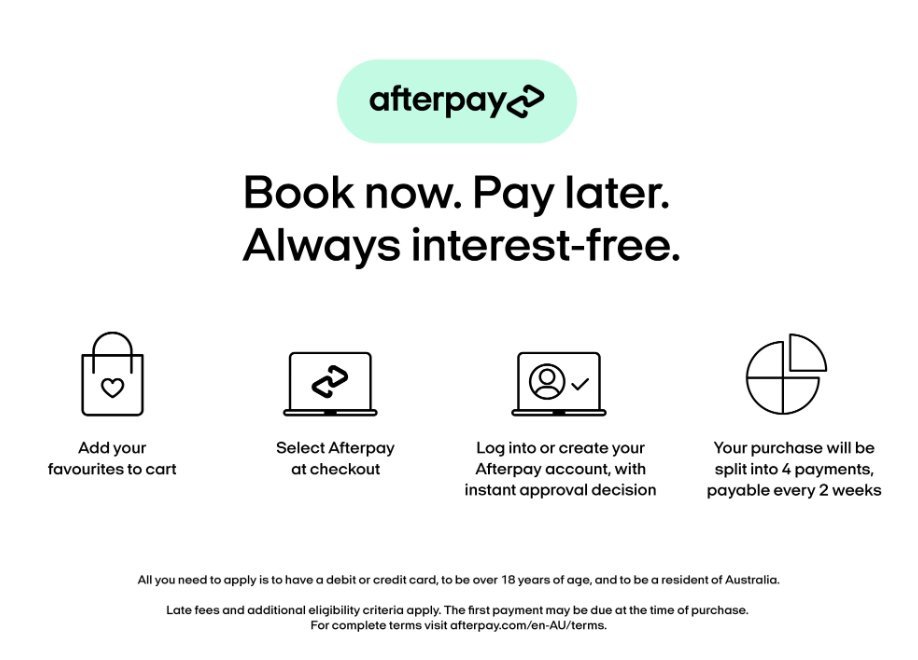

(Product Innovation) $SQ Block has shown an impressive ability to innovate and adapt to an ever-changing market, such as the early adoption of crypto, peer-to-peer payments with Cash App, BNPL, and Square software integrations. 🧵

(Network Effects) $SQ The value of each product increases with each additional user. As more people use Cash App, It becomes more useful. Each new business using Square software gives the company data to improve. Better products drive more businesses to join. 🧵

(Ecosystem) $SQ Block has built an ecosystem of various services. This integrated ecosystem of financial services connects to create a seamless user experience and increase customer loyalty and lifetime value. 🧵

(Cross-sale) $SQ Once a customer joins the ecosystem, they are offered other services. Square cross-sales loans with payroll, invoicing, appointment, and other software. Cash App offers debit and credit cards, BNPL, stock, and crypto trading.🧵

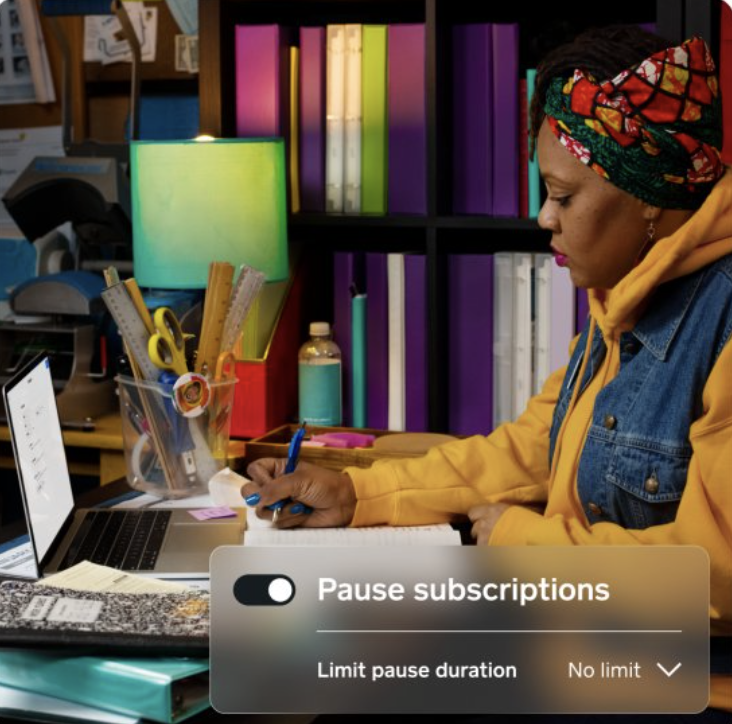

(Subscriptions) $SQ Subscriptions generate predictable, high-margin, reoccurring revenue. By offering various subscriptions in its Square business, the company increases the stickiness of it, reducing customer churn. 🧵

$SQ LTM revenue as of Q3 2024 is $23.9B.

The growth has slowed down, but historically it has been explosive, growing by 2,707% from 2014, a CAGR of 41%!🧵

The growth has slowed down, but historically it has been explosive, growing by 2,707% from 2014, a CAGR of 41%!🧵

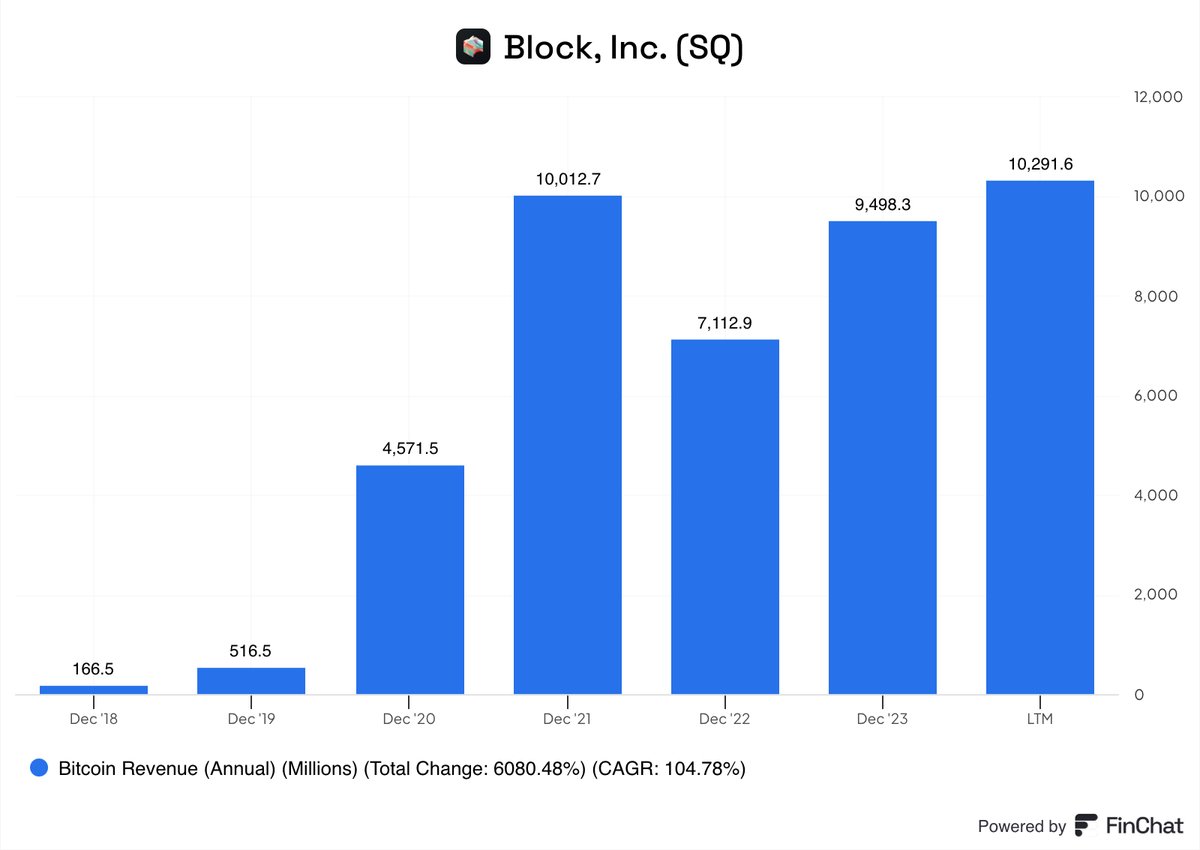

In the last 7 years $SQ growth has been driven by its Bitcoin business. The company generated $10.3B of LTM Bitcoin revenue. Since 2018, it has grown by a whopping 6,080%!🧵

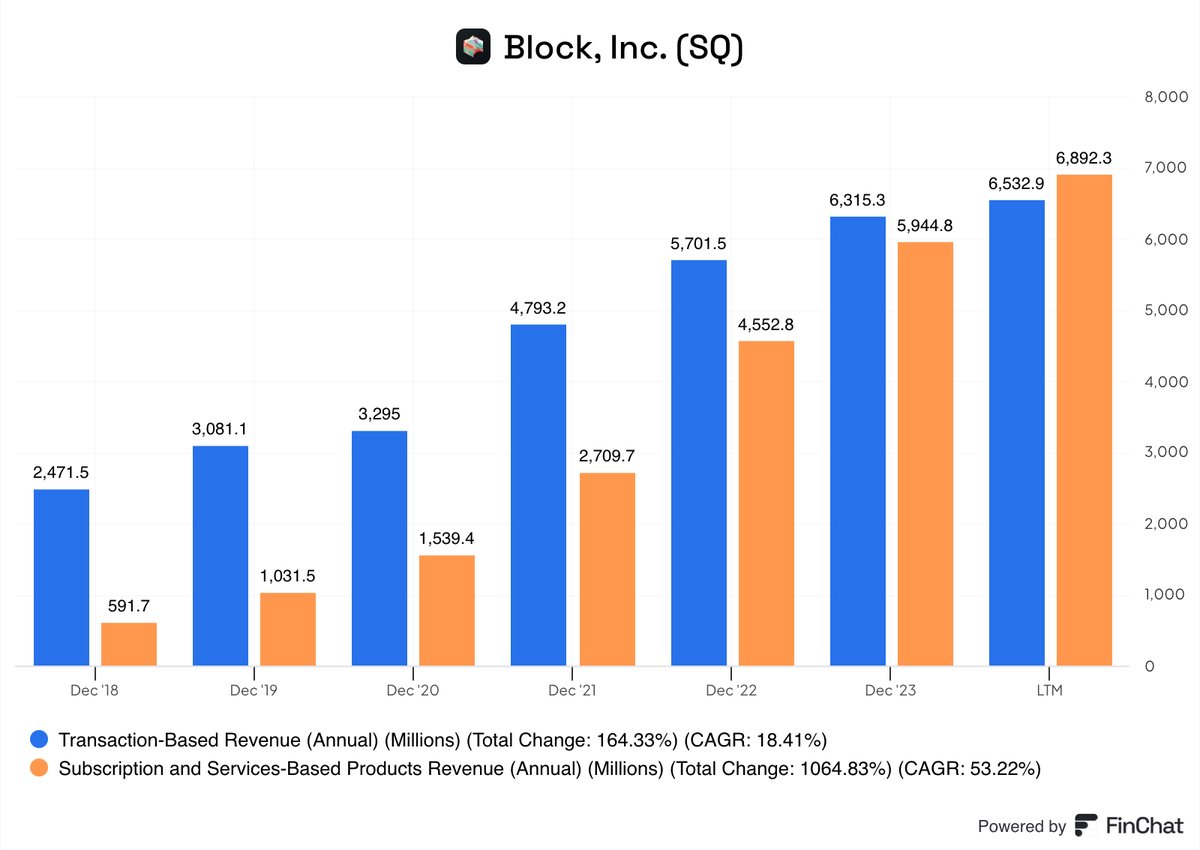

$SQ generated around $6.7B each from its Subscriptions and Transactions businesses

In the last few years Subscription growth has been quite impressive, 1,065%, a CAGR of 53%!

Meanwhile, Transaction revenue has grown slower, with a 18% CAGR.🧵

In the last few years Subscription growth has been quite impressive, 1,065%, a CAGR of 53%!

Meanwhile, Transaction revenue has grown slower, with a 18% CAGR.🧵

Looking at how the two main segments of $SQ perform in terms of revenue we see that Cash App has grown with a 88% CAGR since 2018 and has overtaken the Square business which has grown at a 19% CAGR.🧵

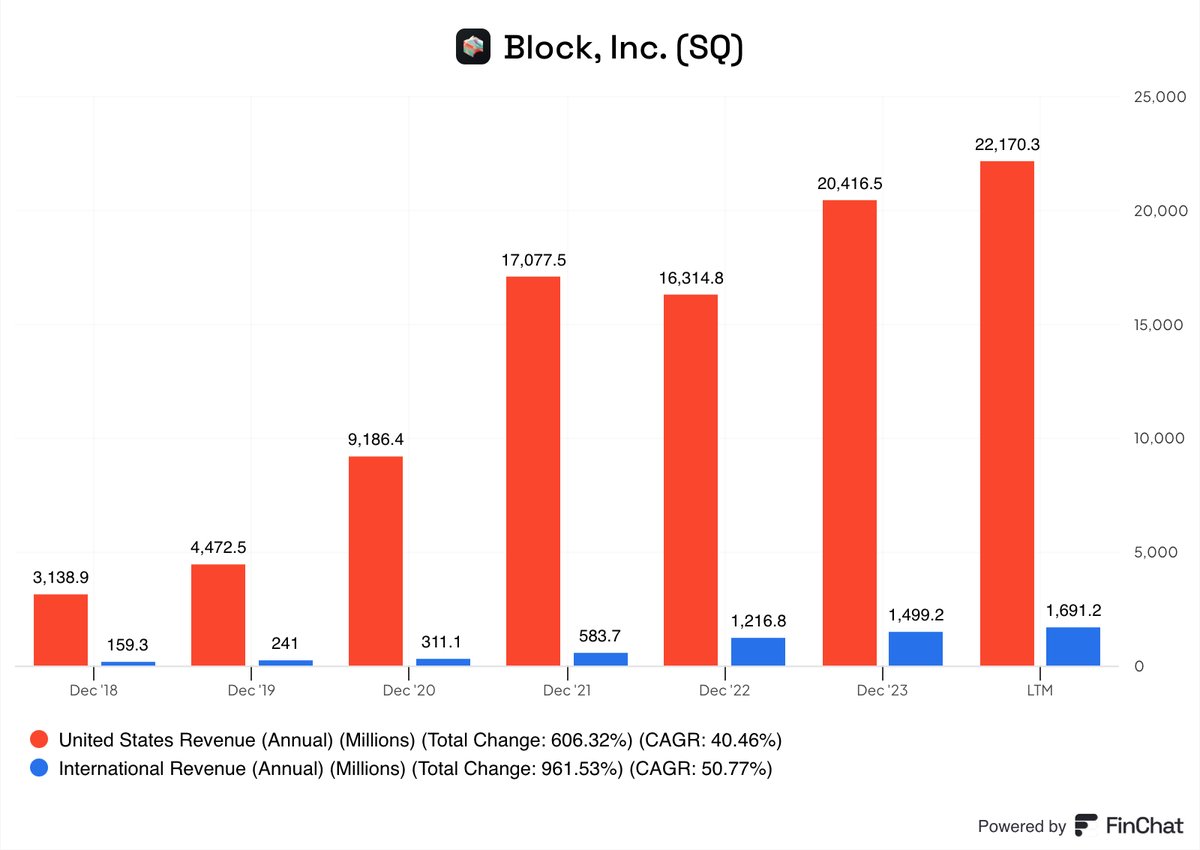

$SQ is fundamentally a US-based business, with over 90% of revenue being generated domestically!

The international segment is growing slightly faster than the US, so it could become a more meaningful part of the story in the future. 🧵

The international segment is growing slightly faster than the US, so it could become a more meaningful part of the story in the future. 🧵

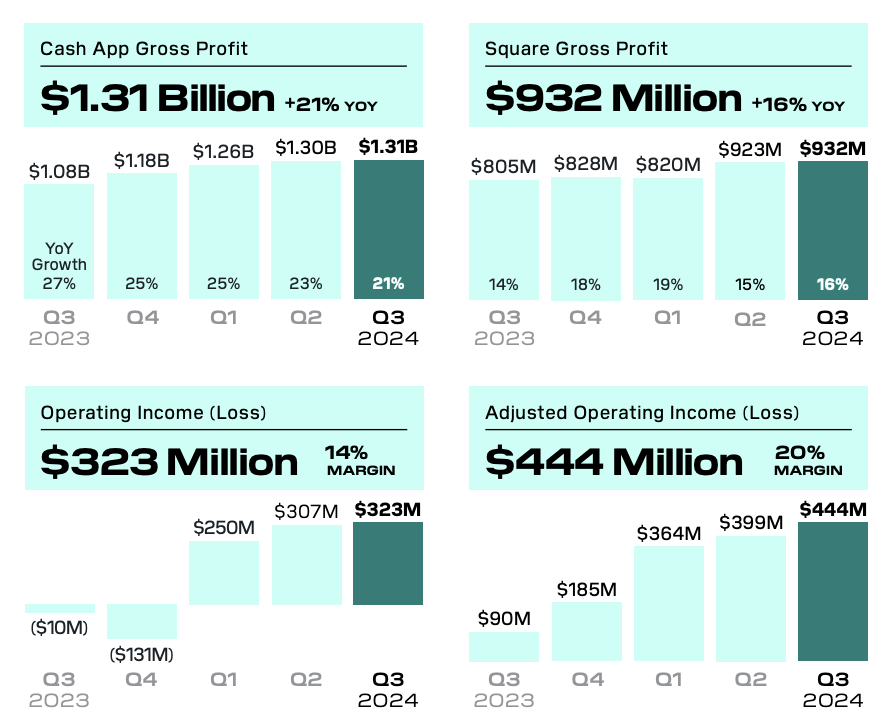

$SQ showed strong profitability and FCF in Q3 2024!

$323M Operating Income

$284M Net Income

$628M FCF🧵

$323M Operating Income

$284M Net Income

$628M FCF🧵

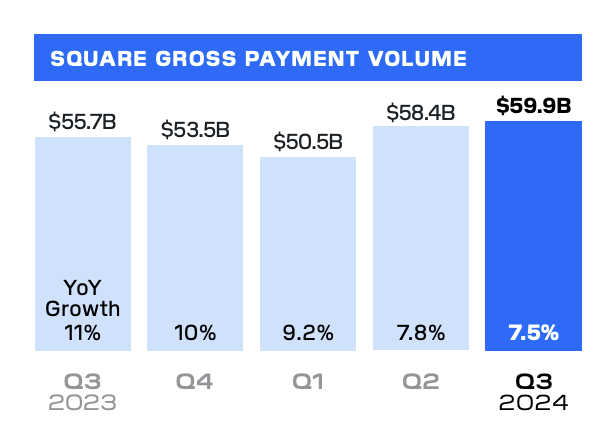

Gross Payment Volume is one of the most important KPI's for $SQ.

The company processed $60B in Q3, up just 7.5% Y/Y, showing weak performance! 🧵

The company processed $60B in Q3, up just 7.5% Y/Y, showing weak performance! 🧵

Cash App Month Actives is another important metric for $SQ.

Cash App has 57 monthly users, growing just 6M users in from 2022.

While the growth has slowed down, the company still managed to add 2 million users Y/Y in Q3 2024. 🧵

Cash App has 57 monthly users, growing just 6M users in from 2022.

While the growth has slowed down, the company still managed to add 2 million users Y/Y in Q3 2024. 🧵

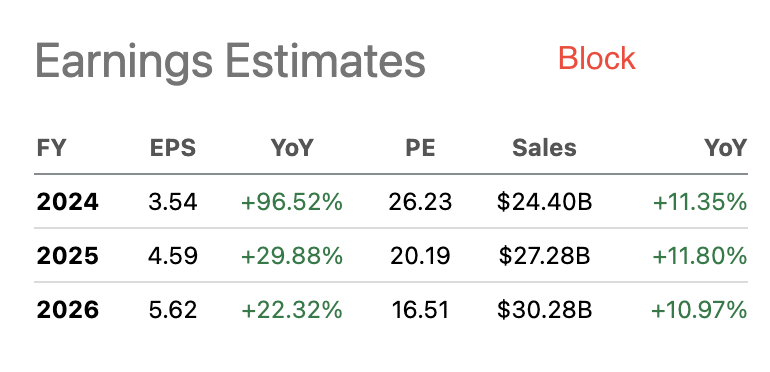

Looking at $SQ valuation we see that the company is not expensive at all!

Currently trading for a 2026 P/E of 17.

WS expects Block to grow its top line by around 11% per year. However, the margins should improve meaningfully, resulting in strong EPS growth.🧵

Currently trading for a 2026 P/E of 17.

WS expects Block to grow its top line by around 11% per year. However, the margins should improve meaningfully, resulting in strong EPS growth.🧵

🐙Network effects make their Apps extremely sticky!

🌏Huge potential to expand geographically to APAC and EMEA!

🌏Huge potential to expand geographically to APAC and EMEA!

📊Ability to cross-sell new services to the existing user base could drive meaningful growth!

🛍️E-commerce integrations with existing apps and services could support revenue potential!

🛍️E-commerce integrations with existing apps and services could support revenue potential!

What is your view on $SQ?

I liked its Square business, however, the growth there has stagnated. Cash App is too crypto-focused for my liking.

End of Thread...

I liked its Square business, however, the growth there has stagnated. Cash App is too crypto-focused for my liking.

End of Thread...

Thank you for reading!

Follow my account for more interesting Threads!

Follow my account for more interesting Threads!

• • •

Missing some Tweet in this thread? You can try to

force a refresh