1/20 🧵 Migration to OECD countries reached record levels in 2023. Over a third of these nations saw the highest inflows ever, including the UK, Canada, and France. This is excluding refugees and asylum seekers. This surge wasn’t accidental—it was part of a broader economic strategy. My piece in the Spectator recently explored what I call "the third lever" of economic policymaking, after fiscal and monetary policy. (1/20)

spectator.co.uk/article/we-can…

spectator.co.uk/article/we-can…

2/20 After COVID, fears of economic slowdown loomed large. Policymakers in countries like the U.S. turned to two key tools to stave off recession: fiscal stimulus and increased migration. These were deliberate, strategic choices. (2/20)

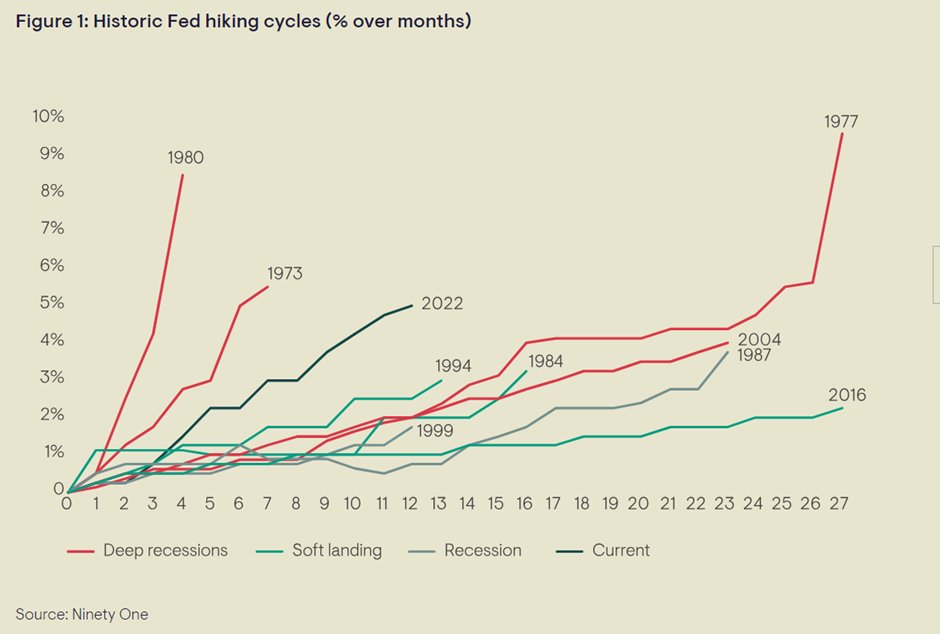

3/20 In 2022, many forecasters predicted extraordinarily high (90%+) chance of recession in 2023. Central banks implemented the third most aggressive rate hikes in 50 years, raising fears of a sharp economic contraction. (3/20)

4/20 U.S. policymakers, led by Ron Klain, Brian Deese, and Janet Yellen, acted decisively. They used fiscal policy to cushion the blow of monetary tightening, raising the discretionary component of the fiscal deficit by 1.5% of GDP from 2022-2023. (4/20)

5/20 Fiscal measures worked alongside consumers spending pandemic-era savings, which counteracted about 3 percentage points of tightening. Adjustments to debt issuance also lowered borrowing costs by 0.25% according to @nouriel and @SteveMiran. (5/20)

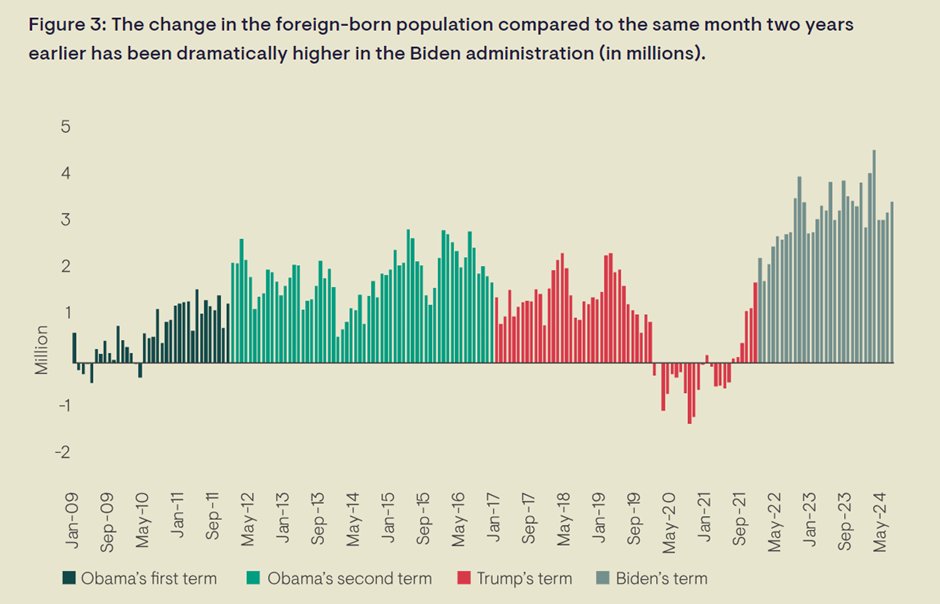

6/20 Migration was the second lever. We only learned how large it was this year, when the CBO released numbers showing that net migration in the US for 2023 was close to 3.3 million people, 2 million *more* people than prior Census data had indicated. Policies eased entry restrictions, increasing inflows to four times the levels seen during the Obama years. (6/20)

7/20 The migration surge boosted overall GDP immediately, as adding hands and feet to the economy always does. Specifically 0.75 pp to GDP. It boosted the economy’s capacity to grow without sparking inflation, complicating labour market signals. (7/20)

8/20 But migration is a complex tool, and it comes with significant trade-offs. Let’s explore three of the key challenges it presents as a tool of economic policymaking. (8/20)

9/20 Challenge #1: Wage suppression. The increased labour supply at a time of high inflation reduced wage growth by 0.4% overall and by 1% in high-migrant industries like food services, according to GS. Higher wage growth would have kept rates higher for longer, so wage reduction is by design. (9/20)

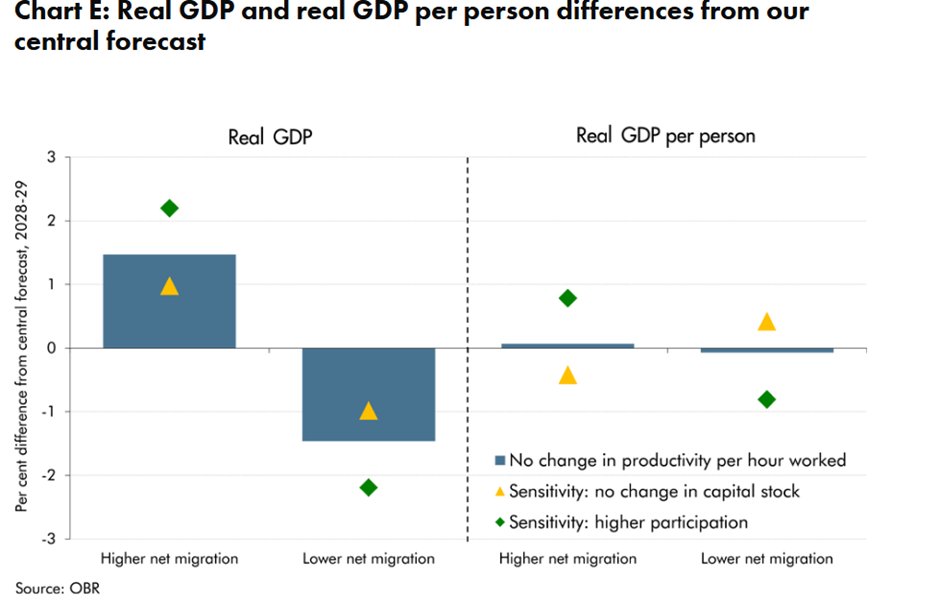

10/20 Challenge #2: Capital stock. Migrants can work and pay taxes but they cannot bring with them houses or motorways. Ergo migration lowers living conditions if the capital stock doesn’t keep pace, as the UK OBR has pointed out. Housing deficits in the U.S. and UK exceed 4M homes, and will drive up shelter costs and inflation for years to come. (10/20)

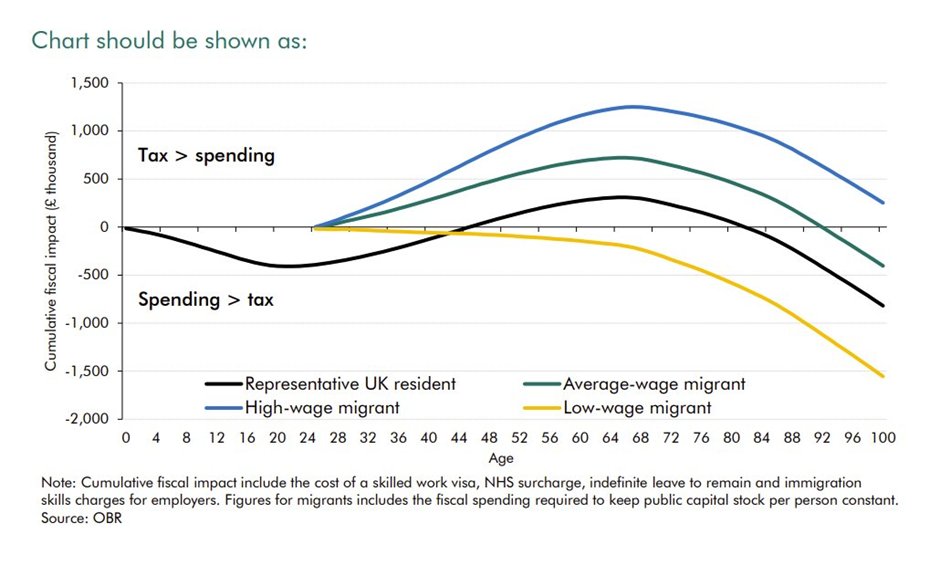

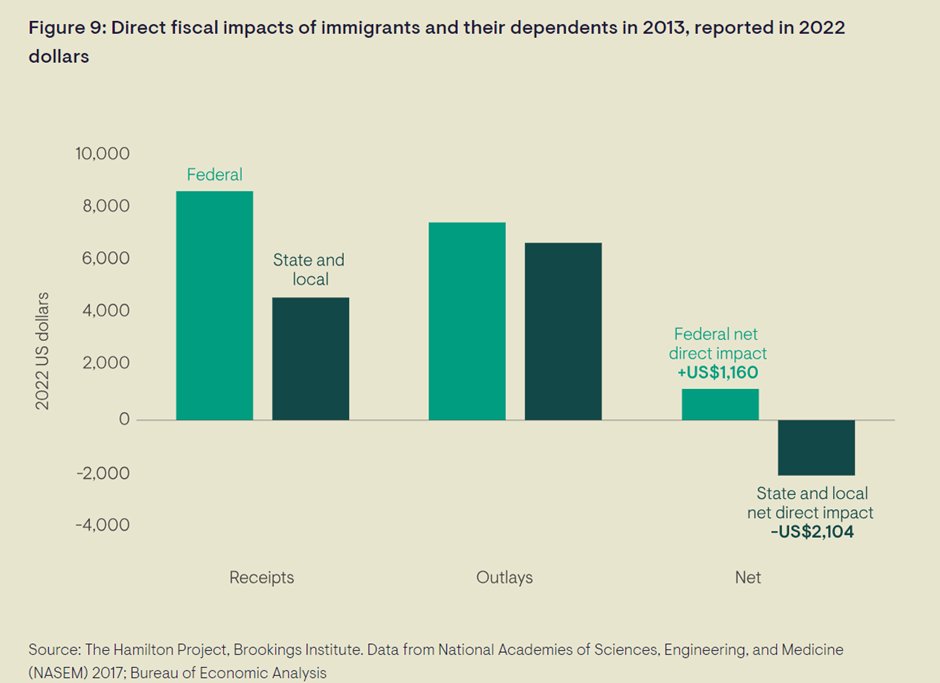

11/20 Trade-off #3: Fiscal burden. Low-skilled migration generate long-term net fiscal costs in complex welfare states. In the U.S., Brookings Institute/Hamilton pointed out that migrants and dependents cost the government $900 per capita annually, concentrated among lower wage migrants. The OBR made a similar point in their September report, and had to extend the y axis in a correction because the impact was even more negative than they expected. (11/20)

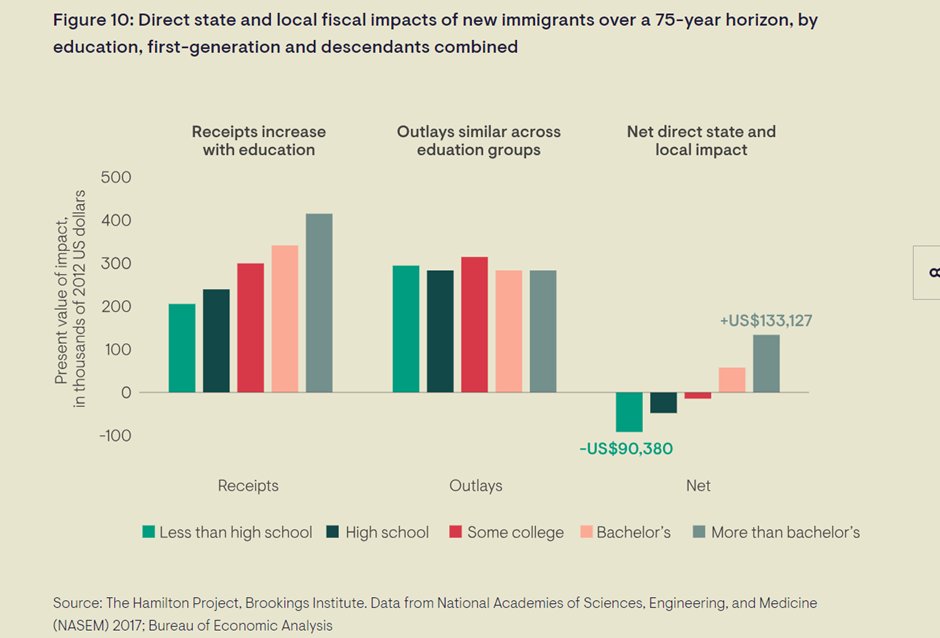

12/20 US cities like NYC especially have felt these challenges acutely. A surge in migrants pushed the city’s deficit to $12B, forcing cuts to services. Even as most New Yorkers I knew buried their hands in the sand, the mayor warned: “Every service is going to be impacted.” (12/20)

13/20 Low-wage migration were always going to be challenging for large, growing, and increasingly complex welfare states. The Brookings Hamilton study found that over a 75 year time horizon, migration did, in fact, generate positive fiscal effects, after incorporating higher wages from descendants. But only for people with bachelors degrees or higher. (13/20)

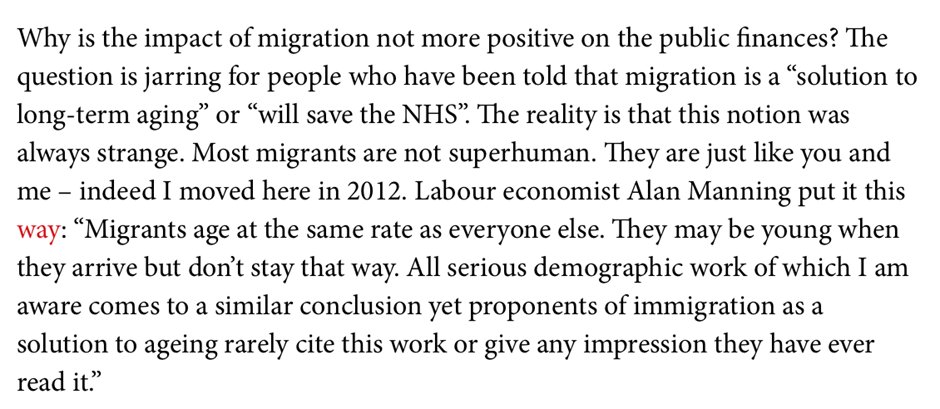

14/20 Migration has often been framed as a solution to aging populations or as a way of “saving the NHS” But the notion was always strange. Most migrants are not superhuman. They are just like you and me—indeed I moved here in 2012. (14/20)

15/20 As @alanmanning4pointed out, they may arrive young but they age at the same rate as everyone else. “All serious demographic work of which I am aware comes to a similar conclusion yet proponents of immigration as a solution to ageing rarely cite this work or give any impression they have ever read it.” (15/20)

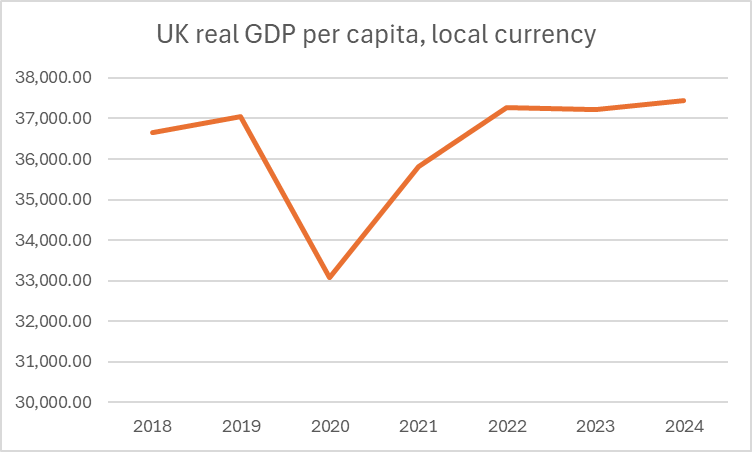

16/20 None of this will have troubled the central planners, who, at least until Trump's election victory, were patting themselves on the back for a job well done. You can sort of see why: the narrow fact is these measures “succeeded” in the short term. The U.S. avoided a recession in 2023, with nominal GDP growth of 5-6% in early 2024, falling inflation, and higher real GDP per capita, even though the higher price level and higher migration were central to Biden’s election defeat. (16/20)

17/20 In Britain, there is no real case to make that the “third lever” has been successful. @BorisJohnson recently pointed out that migration numbers were jacked up to “deal with inflation.” In fact, the ill-fated Health and Social Care visa was launched in August 2020, when wage inflation was just 0.1 per cent(!) In the US, migration was a cyclical lever pulled to avoid a recession; in Britain, the problem is deep and structural. Basically, the Treasury had prepared visas to get out of a short-term budget jam and bypass a failing financial settlement between local government and central government. The result? Real GDP per capita has been flat since 2019. This will have to be adjusted lower the more people we discover living in the country via ONS revisions. Rents are predictably soaring. (17/20)

18/20 This highlights the limits of relying on migration and fiscal policy without deeper reforms. The use of migration policy as a “third lever” of countercyclical policy is risky. Without matching investments in housing, infrastructure, and skills, it will dilute living standards and worsen fiscal sustainability--at a time when interest costs are rising and the term premium is likely on a steady ascent. (18/20)

19/20 Policymakers must take a long-term view . Treating migration as a third lever of fiscal policy not only fails to address structural challenges in economies and welfare systems but exacerbates their challenges. If we do not, financial reality will assert itself. As @JeffBezos pointed out, "reality is an undefeated champion." (19/20)

20/20 For the full 9000-word discussion on the Third Lever, please see the full paper on Ninety One Investment Institute 🧵(20/20)ninetyone.com/en/insights/th…

• • •

Missing some Tweet in this thread? You can try to

force a refresh