This man can predict the future:

In January 2020, he warned us the global economy would collapse.

Everyone ignored him.

But by March, COVID-19 had wiped out $30 Trillion in global markets.

Here's why Ray Dalio’s latest warning has Wall Street listening: 🧵

In January 2020, he warned us the global economy would collapse.

Everyone ignored him.

But by March, COVID-19 had wiped out $30 Trillion in global markets.

Here's why Ray Dalio’s latest warning has Wall Street listening: 🧵

Ray Dalio isn't just another Wall Street voice.

He founded Bridgewater Associates, the world's largest hedge fund.

But what truly sets him apart is his obsession with economic patterns.

He's spent decades studying how empires rise and fall...

What makes economies collapse...

He founded Bridgewater Associates, the world's largest hedge fund.

But what truly sets him apart is his obsession with economic patterns.

He's spent decades studying how empires rise and fall...

What makes economies collapse...

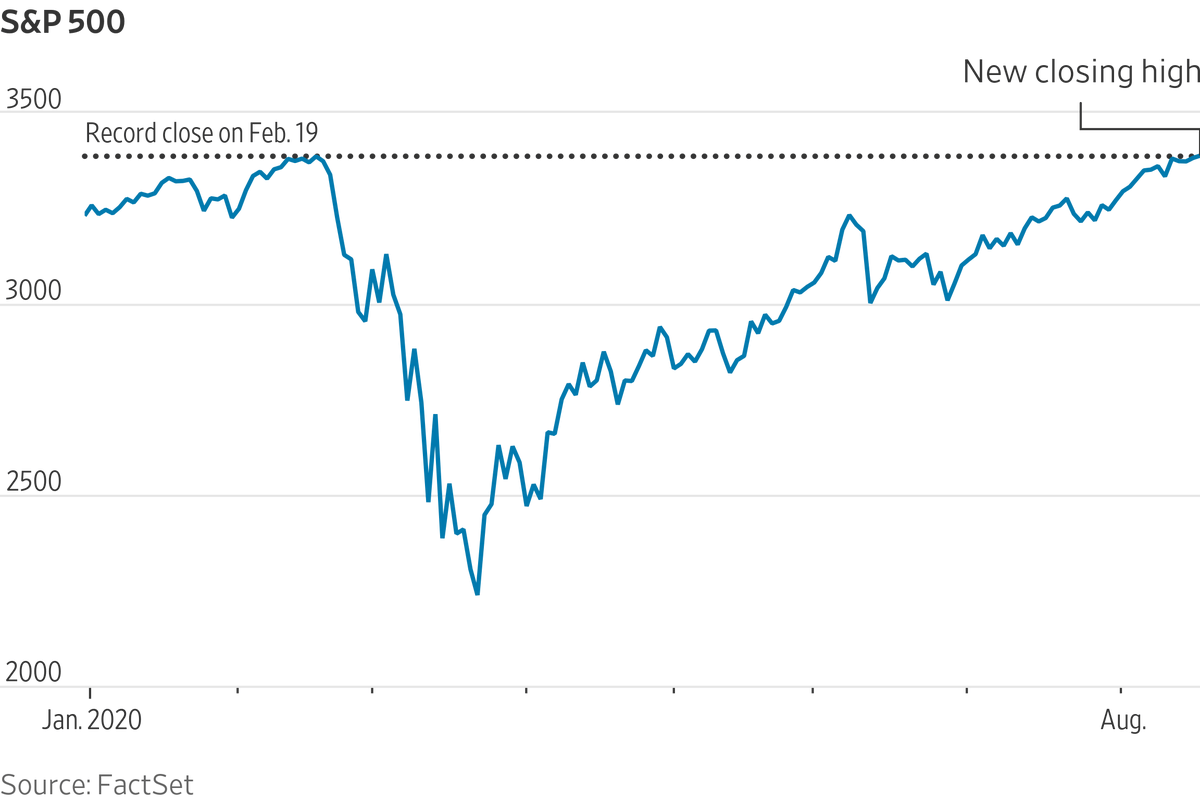

January 2020: Markets were euphoric.

The S&P 500 was hitting record highs. Investors were getting richer by the day.

Then Dalio published an essay that sent shockwaves through Wall Street:

"The World Has Gone Mad and the System Is Broken."

Most laughed. But not for long:

The S&P 500 was hitting record highs. Investors were getting richer by the day.

Then Dalio published an essay that sent shockwaves through Wall Street:

"The World Has Gone Mad and the System Is Broken."

Most laughed. But not for long:

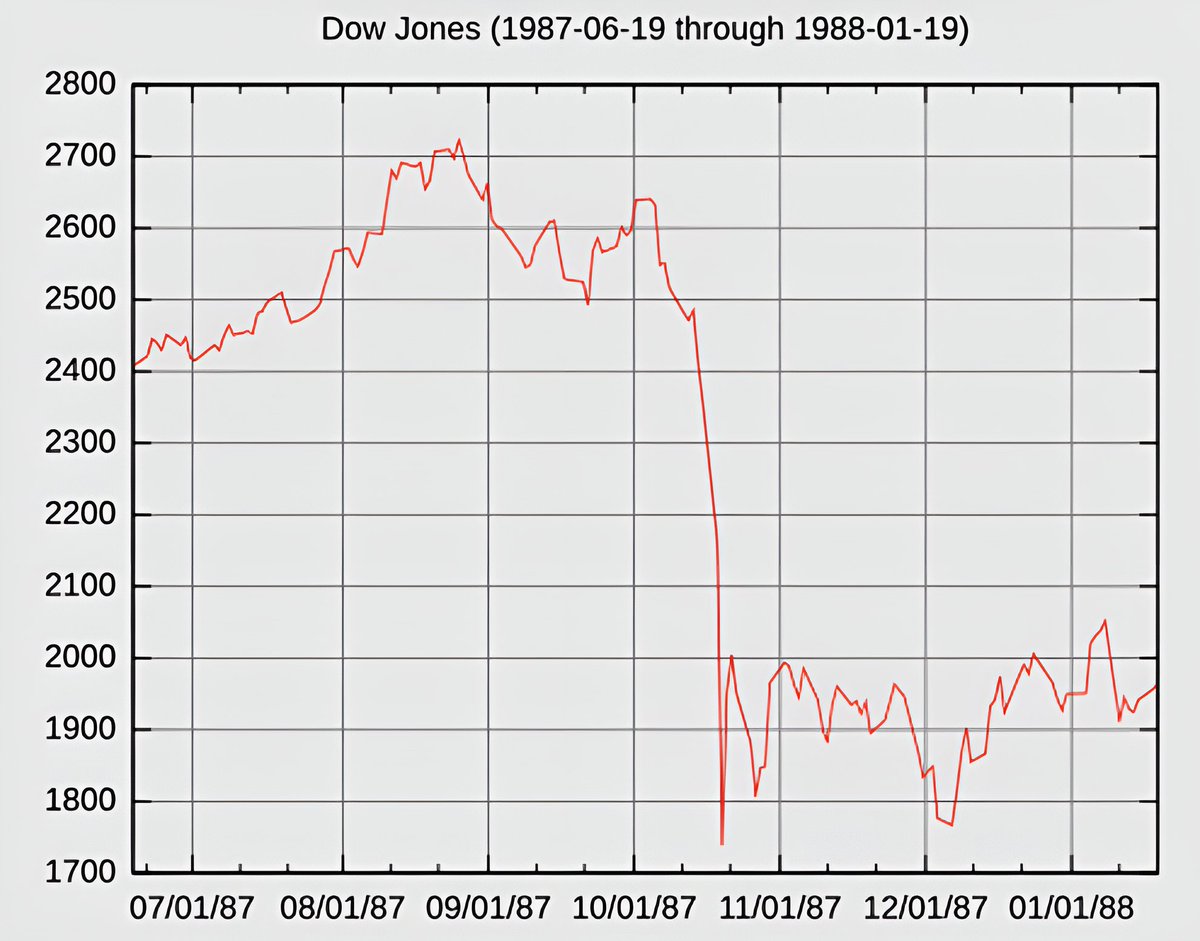

Within weeks, the fastest market crash in history began:

The S&P 500 plunged 34% from its February peak.

The Dow Jones saw its largest single-day point drop ever - losing nearly 3,000 points on March 16.

But here's what everyone missed: Dalio wasn't predicting COVID...

The S&P 500 plunged 34% from its February peak.

The Dow Jones saw its largest single-day point drop ever - losing nearly 3,000 points on March 16.

But here's what everyone missed: Dalio wasn't predicting COVID...

He saw fundamental cracks in the global economy:

• Global debt had reached $253 trillion (322% of global GDP)

• The wealth gap was creating dangerous social tensions

• Traditional money policy tools were losing impact

Think of the economy like a machine:

• Global debt had reached $253 trillion (322% of global GDP)

• The wealth gap was creating dangerous social tensions

• Traditional money policy tools were losing impact

Think of the economy like a machine:

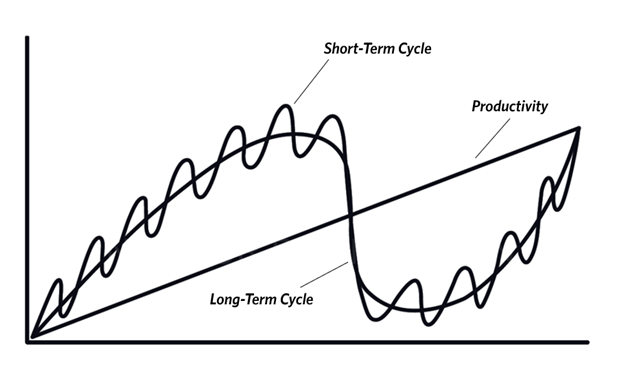

Dalio spent his life taking this machine apart, studying every gear and lever.

What he discovered was a pattern - what he calls "debt cycles" - that repeat throughout history.

And we're now entering the most dangerous phase:

The cycle works like this:

What he discovered was a pattern - what he calls "debt cycles" - that repeat throughout history.

And we're now entering the most dangerous phase:

The cycle works like this:

First, low interest rates encourage borrowing, fueling growth.

Then, debt levels become unsustainable as everyone - governments, companies, individuals - gorges on cheap money.

Finally, something breaks.

A shock exposes all the system's weaknesses at once.

Then, debt levels become unsustainable as everyone - governments, companies, individuals - gorges on cheap money.

Finally, something breaks.

A shock exposes all the system's weaknesses at once.

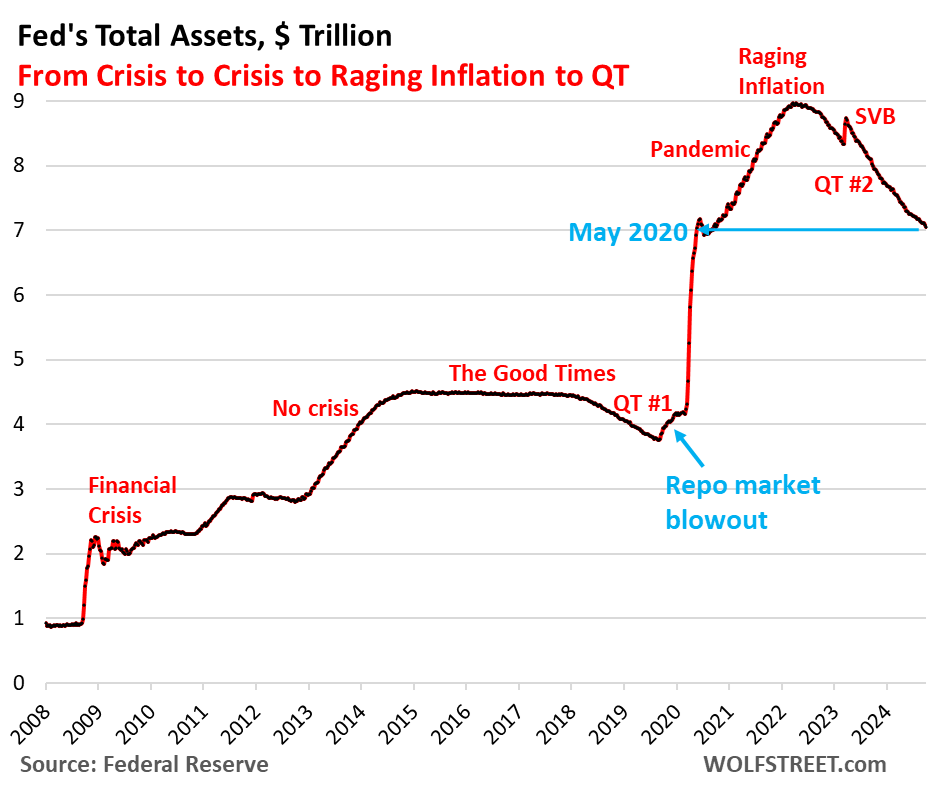

When COVID hit, governments responded with force:

The U.S. Federal Reserve's balance sheet exploded from $4 trillion to over $7 trillion in months.

They were fighting a debt crisis with... more debt.

Dalio warns this "solution" is like giving morphine to a cancer patient:

The U.S. Federal Reserve's balance sheet exploded from $4 trillion to over $7 trillion in months.

They were fighting a debt crisis with... more debt.

Dalio warns this "solution" is like giving morphine to a cancer patient:

It's called debt monetization - central banks buying government bonds to finance deficits.

Think of it like using one credit card to pay off another, then a third to pay the second.

Quick relief, but the core problem gets worse.

The addiction deepens:

Think of it like using one credit card to pay off another, then a third to pay the second.

Quick relief, but the core problem gets worse.

The addiction deepens:

This creates what Dalio calls a "paradigm shift":

The old rules of investing and economic management stop working:

• Interest rates can't go much lower.

• Printing money loses effectiveness.

• Stimulus creates bigger bubbles.

But there's an even darker consequence:

The old rules of investing and economic management stop working:

• Interest rates can't go much lower.

• Printing money loses effectiveness.

• Stimulus creates bigger bubbles.

But there's an even darker consequence:

The wealth gap becomes a chasm.

During COVID, this played out in real time:

While millions lost jobs in retail and hospitality, the stock market - fueled by stimulus - created unprecedented wealth for those who already had assets.

This isn't just unfair - it's destabilizing:

During COVID, this played out in real time:

While millions lost jobs in retail and hospitality, the stock market - fueled by stimulus - created unprecedented wealth for those who already had assets.

This isn't just unfair - it's destabilizing:

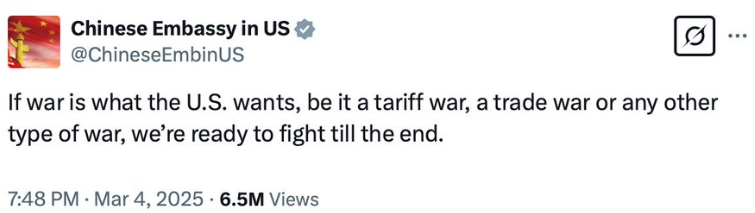

Throughout history, Dalio found extreme wealth inequality preceded major upheavals.

When people feel the system works against them, society fractures.

We see it now: political division, social unrest, lost faith in institutions.

But there's hope:

When people feel the system works against them, society fractures.

We see it now: political division, social unrest, lost faith in institutions.

But there's hope:

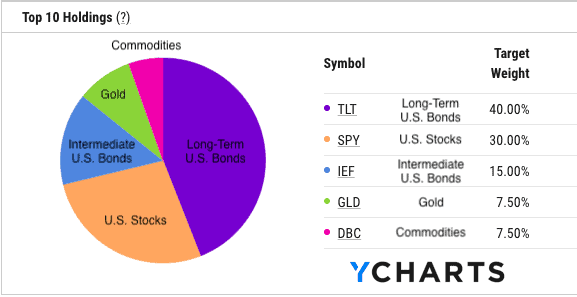

Dalio created what he calls the "All Weather Portfolio" - designed to survive any economic storm.

It's built on true diversification across:

• Stocks for growth

• Bonds for stability

• Commodities for inflation protection

But that's just defense:

It's built on true diversification across:

• Stocks for growth

• Bonds for stability

• Commodities for inflation protection

But that's just defense:

He emphasizes three critical steps:

• Prepare for inflation - traditional savings will be devastated

• Build cash reserves - opportunities emerge in crisis

• Avoid excessive debt - it becomes a trap when cycles turn

But his most crucial insight?

• Prepare for inflation - traditional savings will be devastated

• Build cash reserves - opportunities emerge in crisis

• Avoid excessive debt - it becomes a trap when cycles turn

But his most crucial insight?

"History doesn't repeat, but it rhymes."

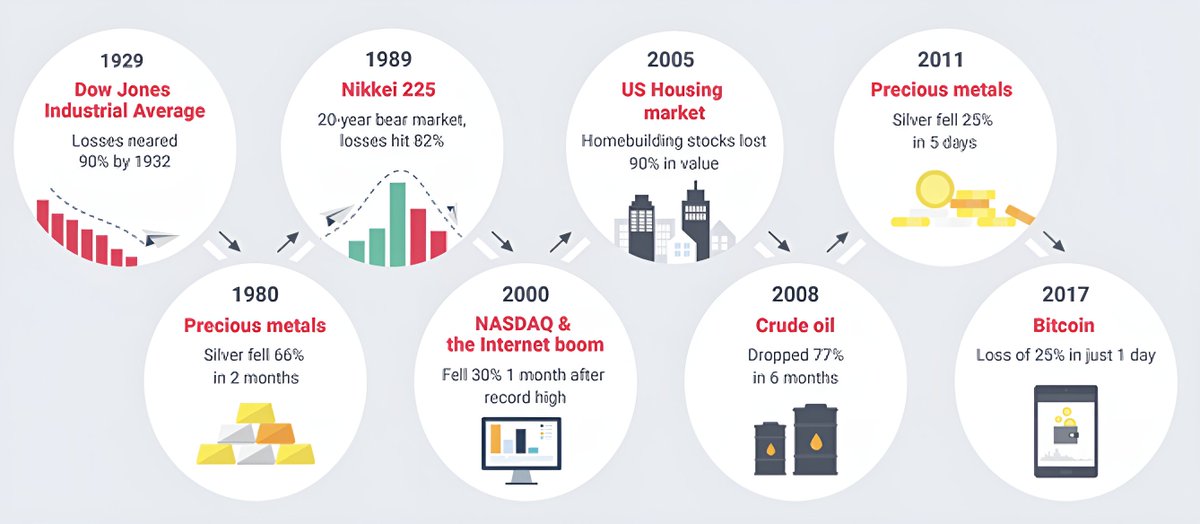

The patterns Dalio studies have played out across centuries.

Each time, similar forces were at work.

And those who understood the patterns were able to protect and grow their wealth.

The patterns Dalio studies have played out across centuries.

Each time, similar forces were at work.

And those who understood the patterns were able to protect and grow their wealth.

Most will ignore these warnings - just like in January 2020.

They'll trust that governments and central banks have everything under control.

But Dalio's research shows: When debt cycles reach extremes, the tools that worked before stop working.

We're in uncharted waters:

They'll trust that governments and central banks have everything under control.

But Dalio's research shows: When debt cycles reach extremes, the tools that worked before stop working.

We're in uncharted waters:

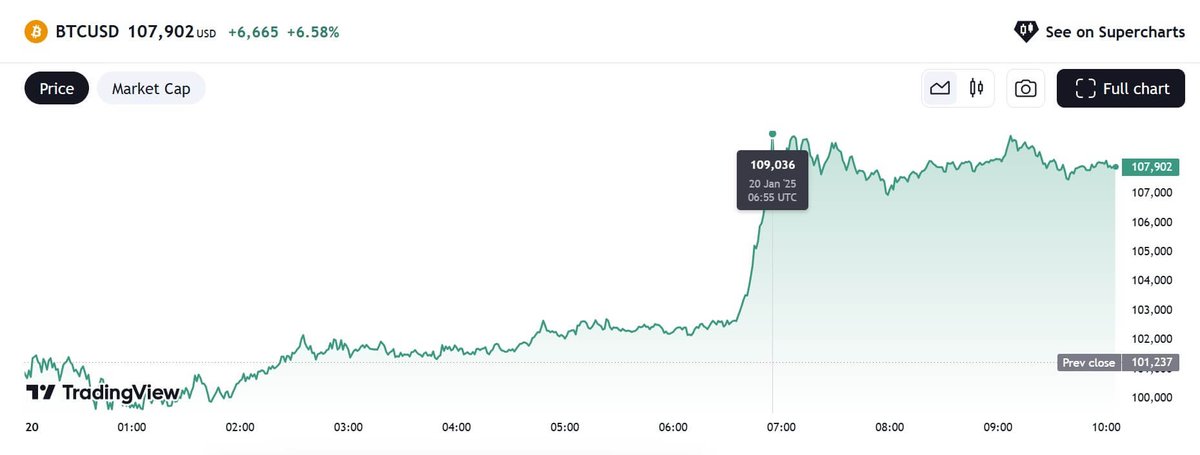

The next phase will likely bring:

• Sustained inflation

• Currency devaluation

• Market volatility

• Social upheaval

But remember: Those who understand these cycles can position themselves to benefit while others panic.

• Sustained inflation

• Currency devaluation

• Market volatility

• Social upheaval

But remember: Those who understand these cycles can position themselves to benefit while others panic.

Dalio's final warning is stark:

We're nearing the end of a long-term debt cycle that began in 1944.

What comes next will reshape the global economy.

The question isn't if it happens, but when.

And this time, we can't say we weren't warned.

We're nearing the end of a long-term debt cycle that began in 1944.

What comes next will reshape the global economy.

The question isn't if it happens, but when.

And this time, we can't say we weren't warned.

The parallels to trading are striking.

Just as Dalio studies economic cycles, successful traders need systematic approaches to navigate market cycles.

But here's what most traders miss: The system is only half the equation.

The other half?

Just as Dalio studies economic cycles, successful traders need systematic approaches to navigate market cycles.

But here's what most traders miss: The system is only half the equation.

The other half?

Psychology.

When markets get chaotic, most traders:

• Abandon their systems

• Make emotional decisions

• Chase losses

• Overtrade in panic

Sound familiar?

When markets get chaotic, most traders:

• Abandon their systems

• Make emotional decisions

• Chase losses

• Overtrade in panic

Sound familiar?

This is where mechanical trading systems become crucial:

They help us control our emotions, not eliminate them.

We learn to use productive emotions while managing destructive ones.

Like Dalio's "All Weather Portfolio," systems work in any market - if we have the right mindset.

They help us control our emotions, not eliminate them.

We learn to use productive emotions while managing destructive ones.

Like Dalio's "All Weather Portfolio," systems work in any market - if we have the right mindset.

After 30+ years of trading and mentoring traders, I've discovered:

The difference between success and failure isn't just about having a system.

It's about having the psychological framework to execute it consistently.

Ready to master both?

The difference between success and failure isn't just about having a system.

It's about having the psychological framework to execute it consistently.

Ready to master both?

Dive deeper into the psychology of profitable trading

• Join our community of 30K+ traders and investors.

• Stay updated on unflappable systems and learn from the best:

{id}

Play the infinite game.

Master yourself. Master your wealth. 📈🧠 sharewealthsys.krtra.com/t/qgpc4fZxns9c…

• Join our community of 30K+ traders and investors.

• Stay updated on unflappable systems and learn from the best:

{id}

Play the infinite game.

Master yourself. Master your wealth. 📈🧠 sharewealthsys.krtra.com/t/qgpc4fZxns9c…

I am Gary Stone:

• Trading psychology expert

• Creator of SPA3 Investor & Share Wealth Systems

• Passionate about helping traders master themselves

Follow for insights on becoming an unflappable investor.

Repost for your network 🔄

• Trading psychology expert

• Creator of SPA3 Investor & Share Wealth Systems

• Passionate about helping traders master themselves

Follow for insights on becoming an unflappable investor.

Repost for your network 🔄

https://twitter.com/73259781/status/1868705554337861976

• • •

Missing some Tweet in this thread? You can try to

force a refresh