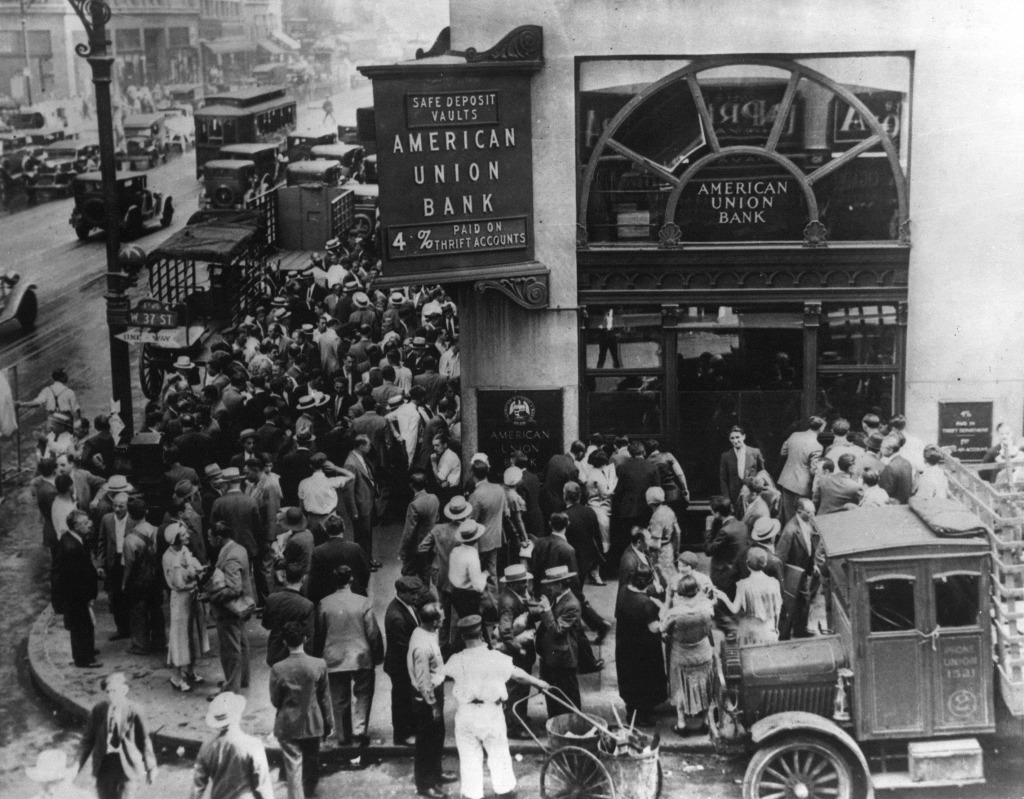

In 1945, Finland was poor and war-torn.

They owed 6% of their GDP to the Soviets—annually.

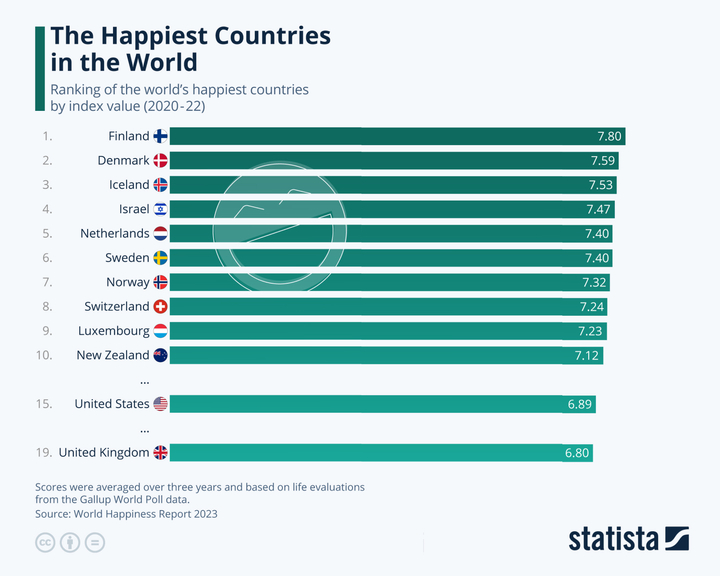

Today, it consistently ranks as the world's happiest country.

Meanwhile, America isn't even in the top 20.

Here's how Finland rebuilt from nothing:

They owed 6% of their GDP to the Soviets—annually.

Today, it consistently ranks as the world's happiest country.

Meanwhile, America isn't even in the top 20.

Here's how Finland rebuilt from nothing:

Finland lost 9% of its territory to the USSR after WWII.

Half a million Finns needed to be resettled, costing $300 million.

The country owed massive war reparations to the Soviets - between 2-6% of their GDP annually from 1945-1953.

But here's where it gets interesting...

Half a million Finns needed to be resettled, costing $300 million.

The country owed massive war reparations to the Soviets - between 2-6% of their GDP annually from 1945-1953.

But here's where it gets interesting...

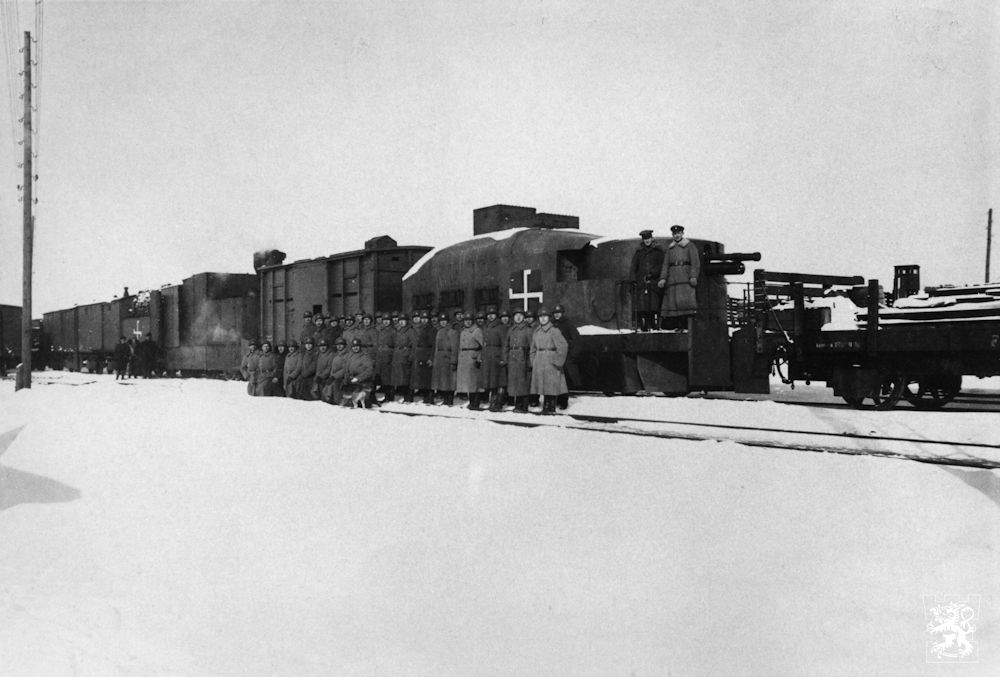

The Soviets demanded specific industrial products as payment:

Ships. Locomotives. Cables. Engines.

One problem... Finland had zero experience making these.

But instead of letting it break them, the demands sparked an industrial revolution that would change everything...

Ships. Locomotives. Cables. Engines.

One problem... Finland had zero experience making these.

But instead of letting it break them, the demands sparked an industrial revolution that would change everything...

The Finnish government went all in:

Providing capital, machinery, and training to industries.

Forced production became expertise.

Affected regions became more industrialized, with higher incomes and better education.

But the real transformation wasn't about machines...

Providing capital, machinery, and training to industries.

Forced production became expertise.

Affected regions became more industrialized, with higher incomes and better education.

But the real transformation wasn't about machines...

It was about trust.

Most nations guard their wealth, but Finland did something radical:

Built one of the world's most comprehensive social support systems.

Universal healthcare. Free education. Extensive social services.

Society grew with a high trust in their government.

Most nations guard their wealth, but Finland did something radical:

Built one of the world's most comprehensive social support systems.

Universal healthcare. Free education. Extensive social services.

Society grew with a high trust in their government.

This trust runs deep:

When Finns see a neighbor in trouble, they know help will come.

24-hour social services provide immediate assistance - no questions asked.

Emergency accommodation. Financial support. Mental health care.

All free at the point of need.

When Finns see a neighbor in trouble, they know help will come.

24-hour social services provide immediate assistance - no questions asked.

Emergency accommodation. Financial support. Mental health care.

All free at the point of need.

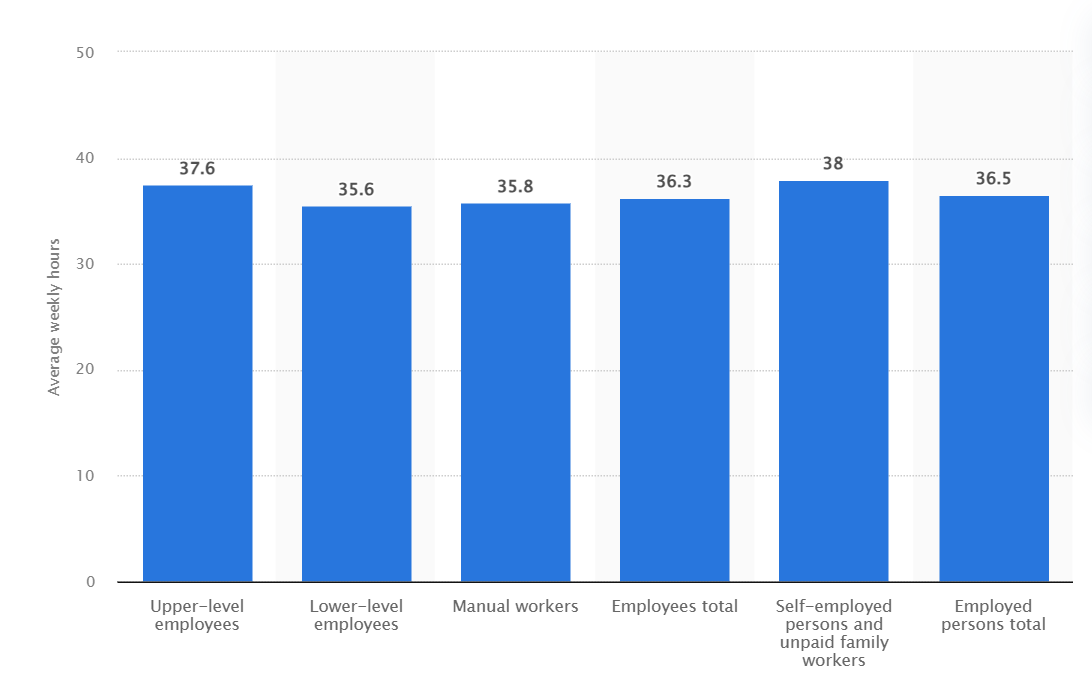

But Finland's biggest advantage is its work culture:

Most employees work 40 hours or less per week.

Up to 5 weeks of paid vacation is standard.

Many workplaces offer time during work hours for sports or cultural activities.

Their motto: Work to live, don't live to work.

Most employees work 40 hours or less per week.

Up to 5 weeks of paid vacation is standard.

Many workplaces offer time during work hours for sports or cultural activities.

Their motto: Work to live, don't live to work.

The results are stunning:

• Low stress levels

• Higher productivity

• Strong family bonds

• Better mental health

• High job satisfaction

Yet America still clings to its 24/7 hustle culture...

• Low stress levels

• Higher productivity

• Strong family bonds

• Better mental health

• High job satisfaction

Yet America still clings to its 24/7 hustle culture...

Then there's Finland's nature:

They turned the vast forests into a public health tool.

Free access to hiking, skiing, and fishing for everyone.

The country scores highly in environmental quality and access to nature.

But there's an even deeper lesson here:

They turned the vast forests into a public health tool.

Free access to hiking, skiing, and fishing for everyone.

The country scores highly in environmental quality and access to nature.

But there's an even deeper lesson here:

Finland proves that happiness isn't about GDP or military might.

It's about building a society where:

• Nature is accessible

• People trust each other

• Community comes first

• Everyone has a safety net

• Work serves life (not the other way around)

It's about building a society where:

• Nature is accessible

• People trust each other

• Community comes first

• Everyone has a safety net

• Work serves life (not the other way around)

The contrast with America is stark:

While we chase individual success at all costs...

Finland builds collective well-being.

While we work ourselves to exhaustion...

Finland prioritizes rest and recovery.

While we fear medical bills...

Finland ensures everyone's covered.

While we chase individual success at all costs...

Finland builds collective well-being.

While we work ourselves to exhaustion...

Finland prioritizes rest and recovery.

While we fear medical bills...

Finland ensures everyone's covered.

Here's the most powerful insight:

Finland's transformation started when they were still poor.

Production reached pre-war levels by 1947.

They built their social systems while still recovering.

They chose to prioritize collective well-being over individual wealth.

Finland's transformation started when they were still poor.

Production reached pre-war levels by 1947.

They built their social systems while still recovering.

They chose to prioritize collective well-being over individual wealth.

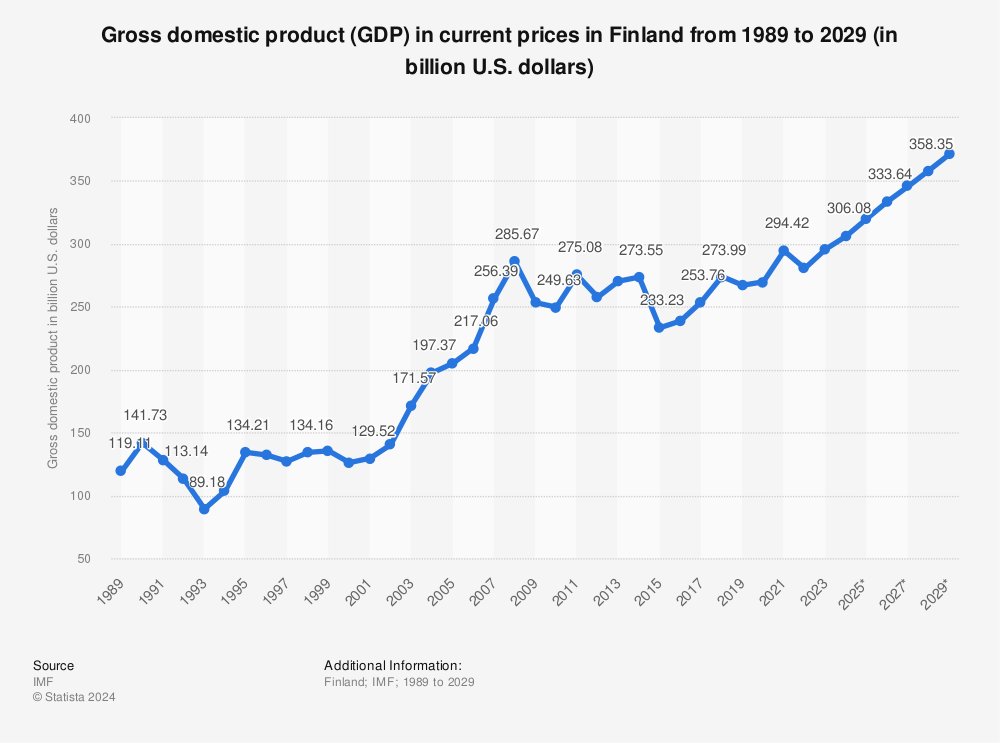

And Finland's approach actually created more prosperity, not less.

Their economy thrives because:

• Crime rates are minimal

• Healthcare costs are lower

• Workers are more productive

• Innovation flourishes in a low-stress environment

Their economy thrives because:

• Crime rates are minimal

• Healthcare costs are lower

• Workers are more productive

• Innovation flourishes in a low-stress environment

The lesson for America is that we don't need to be the richest to be the happiest.

We need to rebuild our social fabric.

Restore trust in institutions.

Put people before profits.

The Finnish model shows us how.

We need to rebuild our social fabric.

Restore trust in institutions.

Put people before profits.

The Finnish model shows us how.

Here's what fascinates me about Finland:

They prove that massive output doesn't require massive input.

Their GDP per hour worked is higher than most countries working longer hours.

So the path to success isn't about working more hours.

They prove that massive output doesn't require massive input.

Their GDP per hour worked is higher than most countries working longer hours.

So the path to success isn't about working more hours.

Success and growth come from:

• Building efficient systems

• Maximizing impact per hour

• Eliminating unnecessary work

• Creating sustainable processes

Just like Finland rebuilt their society...

• Building efficient systems

• Maximizing impact per hour

• Eliminating unnecessary work

• Creating sustainable processes

Just like Finland rebuilt their society...

You can rebuild your approach to business.

The key is to stop trying to outwork everyone.

Start building systems that work for you.

The key is to stop trying to outwork everyone.

Start building systems that work for you.

A bit about me:

I built 2 multimillion-dollar businesses without investment, selling my first for $60M after starting it in high school.

Now, I'm building a multi-million dollar gaming startup—and writing on X about how to do more with less.

I built 2 multimillion-dollar businesses without investment, selling my first for $60M after starting it in high school.

Now, I'm building a multi-million dollar gaming startup—and writing on X about how to do more with less.

Thanks for reading! If you enjoyed this:

1. Follow me @nealtaparia to learn how to be a work-less, do-more entrepreneur

2. Repost this thread if you found it helpful

1. Follow me @nealtaparia to learn how to be a work-less, do-more entrepreneur

2. Repost this thread if you found it helpful

https://twitter.com/970181882/status/1871233758248235275

• • •

Missing some Tweet in this thread? You can try to

force a refresh