🧵 The Federal Reserve: The Most Important Story You've Never Been Told

Ever wonder why your grandparents could afford a house on one income, but you can't? Why do prices keep rising but your paycheck doesn't keep up? Why does the American dream feel more like a fantasy? It all traces back to a "duck hunting trip" that changed America forever.

Ever wonder why your grandparents could afford a house on one income, but you can't? Why do prices keep rising but your paycheck doesn't keep up? Why does the American dream feel more like a fantasy? It all traces back to a "duck hunting trip" that changed America forever.

The year is 1910. Picture a private island off Georgia's coast called Jekyll Island. It is a place frozen in time; ancient Native American grounds have become playgrounds for America's richest families. But something happening here will shape the next century of human history.

Six of America's most powerful bankers are sneaking onto this island separately. They're using fake names, arriving at different times, and avoiding being seen together. Two even completely changed their identities. The secrecy is intense—and for good reason. What they're planning would outrage every American if word got out.

These were the super bankers. We've got Charles Norton running First National Bank, Frank Vanderlip heading National City Bank, Henry Davidson as JP Morgan's right-hand man, A.P. Andrew fresh from Treasury and Harvard, Benjamin Strong Jr from Bankers Trust, and Paul Warburg, heir to a German banking dynasty. Plus, Senator Nelson Aldrich is there to provide the government's blessing.

Why all the cloak-and-dagger? Americans hated central banks with good reason. We'd already killed three of them, and Andrew Jackson's biggest boast was destroying the last one. The banking system was wild—imagine 30,000 currencies floating around the country. It makes today's crypto market look organized. Banks were failing left and right, but at least the gold standard kept things real—maybe too real for some powerful people's taste.

Their timing was perfect. 1907 had just seen a massive banking panic. A San Francisco earthquake had triggered a chain of bank failures across the country. The system was melting down. But for our "duck hunters," this crisis wasn't a disaster—it was an opportunity—the perfect excuse to overhaul the entire American financial system.

You know how in Dune everyone fights over spice - that magical substance that powers their universe? Our world's version is credit. It lets you pull resources from the future into today, amounting to pure financial alchemy. And these guys were about to build the biggest spice harvester ever created: The Federal Reserve.

The genius was in the branding. Nobody would support another "central bank." But "Federal Reserve"? That sounds official and government-like. "Federal" suggests oversight, while "Reserve" implies safety, which is pure marketing gold. The meeting stayed secret for FIVE YEARS. When Vanderlip finally spilled the beans in a newspaper, their creation was already up and running.

Today, that small group's creation has become something beyond their wildest dreams. The Fed owns $9 trillion in assets—it's the biggest player in the mortgage market and the biggest owner of government debt, and it creates money with simple keystrokes. In 2024, its Chairman told the President straight up he couldn't be fired. No other agency can overrule it.

Want to see their power in action? Look at housing. They've pumped so much money into mortgages that house prices shot up 42% in just two years. Rents jumped 24% nationwide. The typical mortgage payment doubled from $1,404 to $2,408 in one year. A whole generation is locked out of homeownership while the Fed plays monopoly with real houses.

The human cost of this system is brutal, and the stories are heartbreaking. Take the brother of one man in Get Based's film- a successful real estate broker who lost everything in 2008. He spent a decade couch surfing, battling depression, unable to rebuild. Why? Because when the Fed's bubbles pop, regular folks take the hit while the big players get bailouts.

Speaking of bailouts, it's the Fed's favorite game. When banks make crazy bets that blow up, the Fed prints rescue money. You pay for it through inflation, watching your dollars buy less and less while the banks keep their profits. Then they do it all again. They call it "too big to fail," but it's become a creature too big to exist.

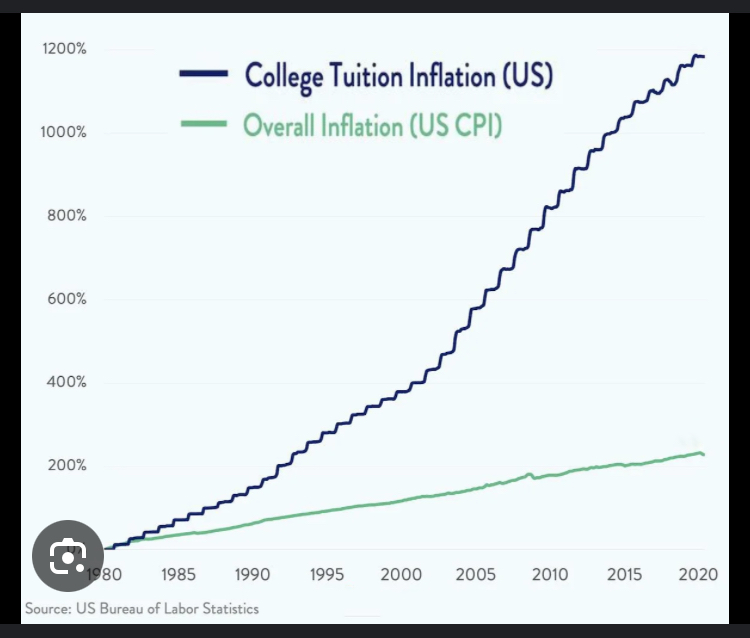

Think about your parents' or grandparents' time. One income could support a family. People could save money and get ahead. A regular job could buy a typical house. Not anymore. The Fed's policies have created the worst wealth gap since the French Revolution. They're not just stealing your money - they're stealing your time, your future, your ability to build the life your parents had.

The Fed supposedly has two jobs: keeping prices stable and maximizing employment. But as Griffin lays out in his book The Creature from Jekyll Island, this dual mandate is part of the problem. How can you trust an institution that can't achieve its basic goals, operates like a private club for bankers, enables endless wars through money printing, and destabilizes the system it's meant to protect?

The modern banking drama would shock those original Jekyll Island plotters. Zero interest rates punish savers while speculators get rich. Money printing has gone wild - that $9 trillion Fed balance sheet would've been unimaginable in 1910. They're even trying to push climate policy now. Talk about mission creep.

And it gets weirder. The Fed now pays banks NOT to lend money to regular people. They call it "interest on excess reserves," but really, it's just another way to funnel money to Wall Street while Main Street struggles. The numbers are staggering - we're talking about $3.1 trillion sitting idle, up seventyfold since 2007.

But here's the really wild part—there are solutions. Free banking worked great in the 1800s. From 1824 to the 1850s, America had the "Suffolk System," where banks kept each other honest. No bailouts were needed. The gold standard meant money couldn't be printed out of thin air. Banks had to be responsible without the Fed's easy money and bailouts.

Winfree's research shows we have options: We could return to commodity-backed money, implement a fixed growth rule for the money supply, or at least limit the Fed to focusing solely on price stability. But who fights these reforms tooth and nail? The very institutions profiting from the current system.

The incentives in this system are completely upside down. Save money? Watch it lose value. Work hard? Watch prices rise faster than your paycheck. Be prudent? Get punished by inflation. Take crazy risks? Get bailed out. It's like they've created an empire that rewards everything we used to consider dangerous and sinful.

Jefferson warned there were two ways to enslave a nation: by the sword or by debt. Those Jekyll Island "duck hunters" chose debt. They created a system where money is made from nothing, debt is forever, work buys less every year, and your future gets harder while the connected get richer.

This isn't ancient history - it's your life right now. Every dollar in your pocket, every price you pay, every rent check you write, every loan you take, every job you work, every dream you defer... it all traces back to those "duck hunters" on Jekyll Island.

Think about it: What started with six men pretending to hunt ducks became the most powerful institution in history. A private meeting on an island created a system that touches every aspect of our lives. They've built an empire of debt that would make ancient Rome blush.

And now you know the story that connects it all: why your savings lose value, why your rent keeps rising, why your parents had it more manageable, and why the system seems rigged. Because, in many ways, it is. The question isn't whether the Fed affects your life - it's in every aspect. The real question is: what are we going to do about it?

Want to learn more? Dive into these sources:

- "How The Federal Reserve Secretly Enslaved The World" by Get Based @getbasedtv gives the raw human impact

- The "Creature from Jekyll Island" exposes the whole historical plot

- Paul Winfree's @paulwinfree Federal Reserve analysis lays out the reform options

The story sounds too wild to be fiction - but it's too important to ignore.

/end

- "How The Federal Reserve Secretly Enslaved The World" by Get Based @getbasedtv gives the raw human impact

- The "Creature from Jekyll Island" exposes the whole historical plot

- Paul Winfree's @paulwinfree Federal Reserve analysis lays out the reform options

The story sounds too wild to be fiction - but it's too important to ignore.

/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh