1/ V. Important 🧵 if you are CONSULANT in England. This week I used my FREE modeller to identify & correct an error in #AnnualAllowance for 24/25 which I suspect may be a common error. It will save me over £2,600 from my AA liability, buckle up & see if you are affected

Ps RT

Ps RT

2/ As many of you will know Twitter/X is now really difficult to see the information you want to see from the people you follow so please help by RT, but also sending your colleagues on whatsap / FB groups if you think this will help them

3/ In preparation go onto ESR, download Mar '24, May '24 + Nov '24 payslips & 23/24 TRS (+/- 22/23 TRS) - and then I will talk you through IF you are also affected by this "misallocated arrears" error, tell you how to model the impact of this, and how to correct this

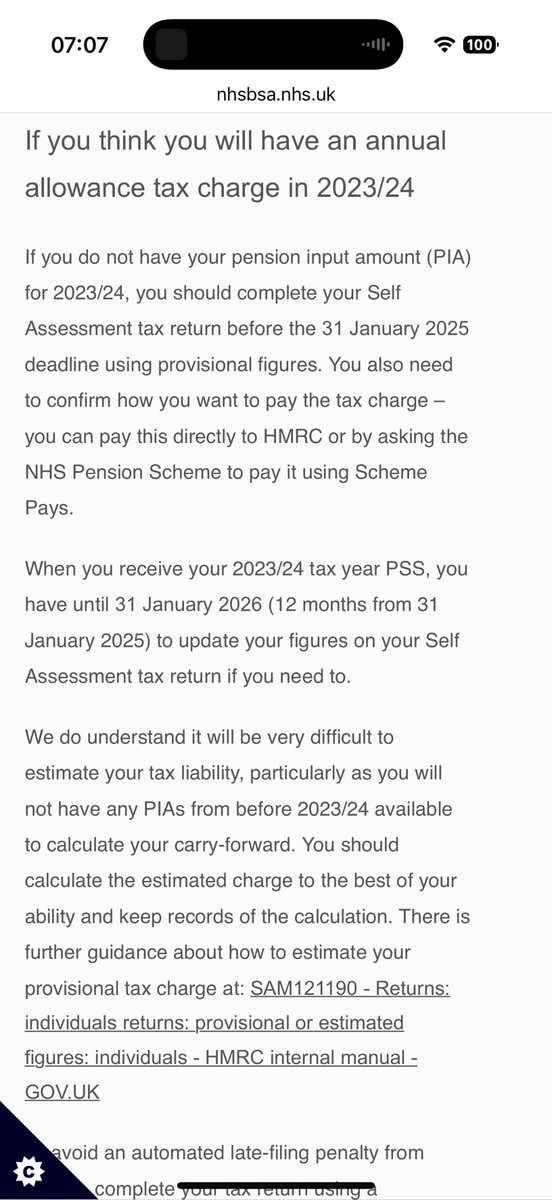

4/ You are going to need to my new free tool which models 23/24 and 24/25 AA since NHS pensions havent sent out "brown envelopes" for pension savings, and you need this for self assessment.

Instructional video: youtube.com/live/CNYcurbDw…

Free Tool: bit.ly/Goldstone2325P…

Instructional video: youtube.com/live/CNYcurbDw…

Free Tool: bit.ly/Goldstone2325P…

5/ I wont be covering how to use this free tool in this thread or the new video, so if you havent already download the tool and watch the instructional video first: youtube.com/live/CNYcurbDw…

Free Tool: bit.ly/Goldstone2325P…

Free Tool: bit.ly/Goldstone2325P…

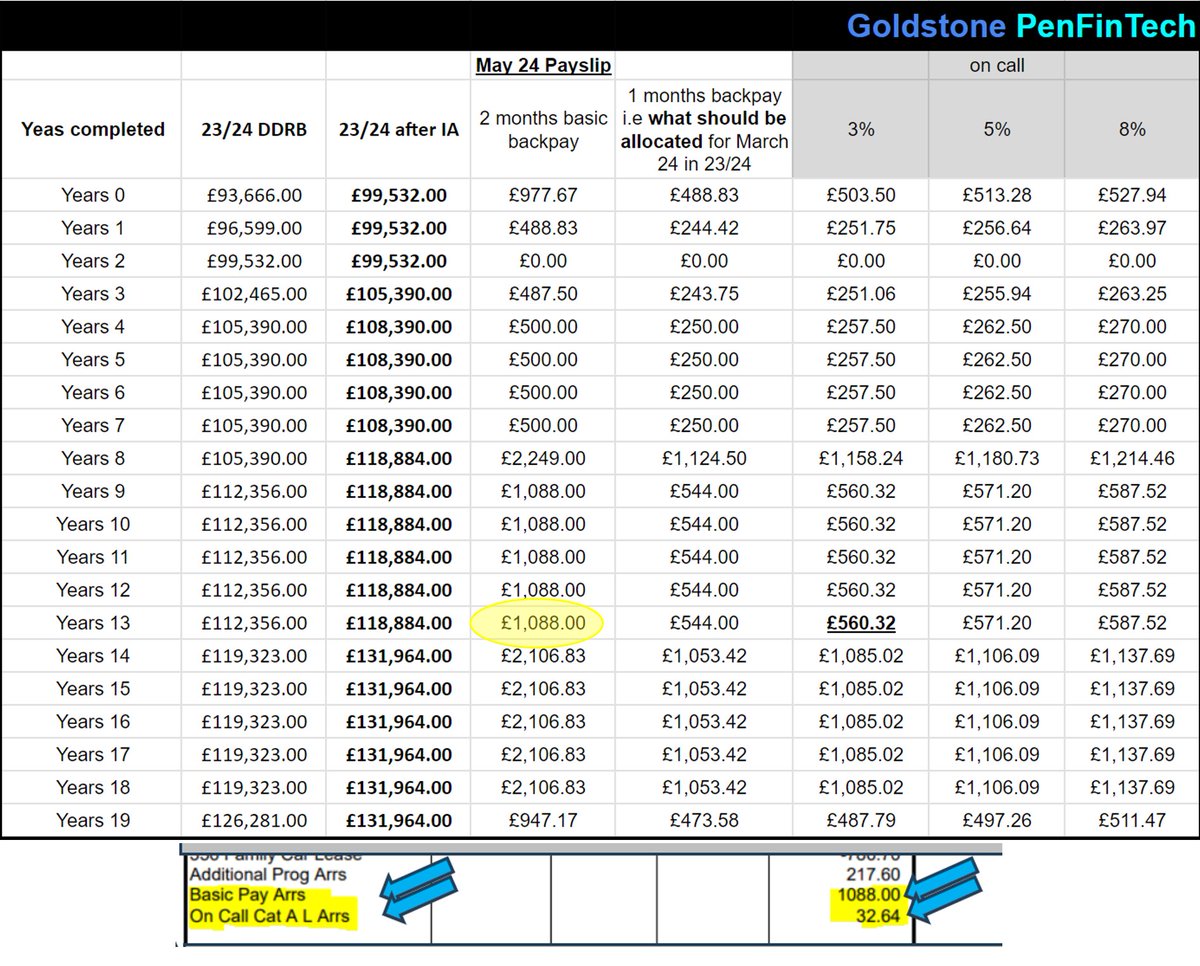

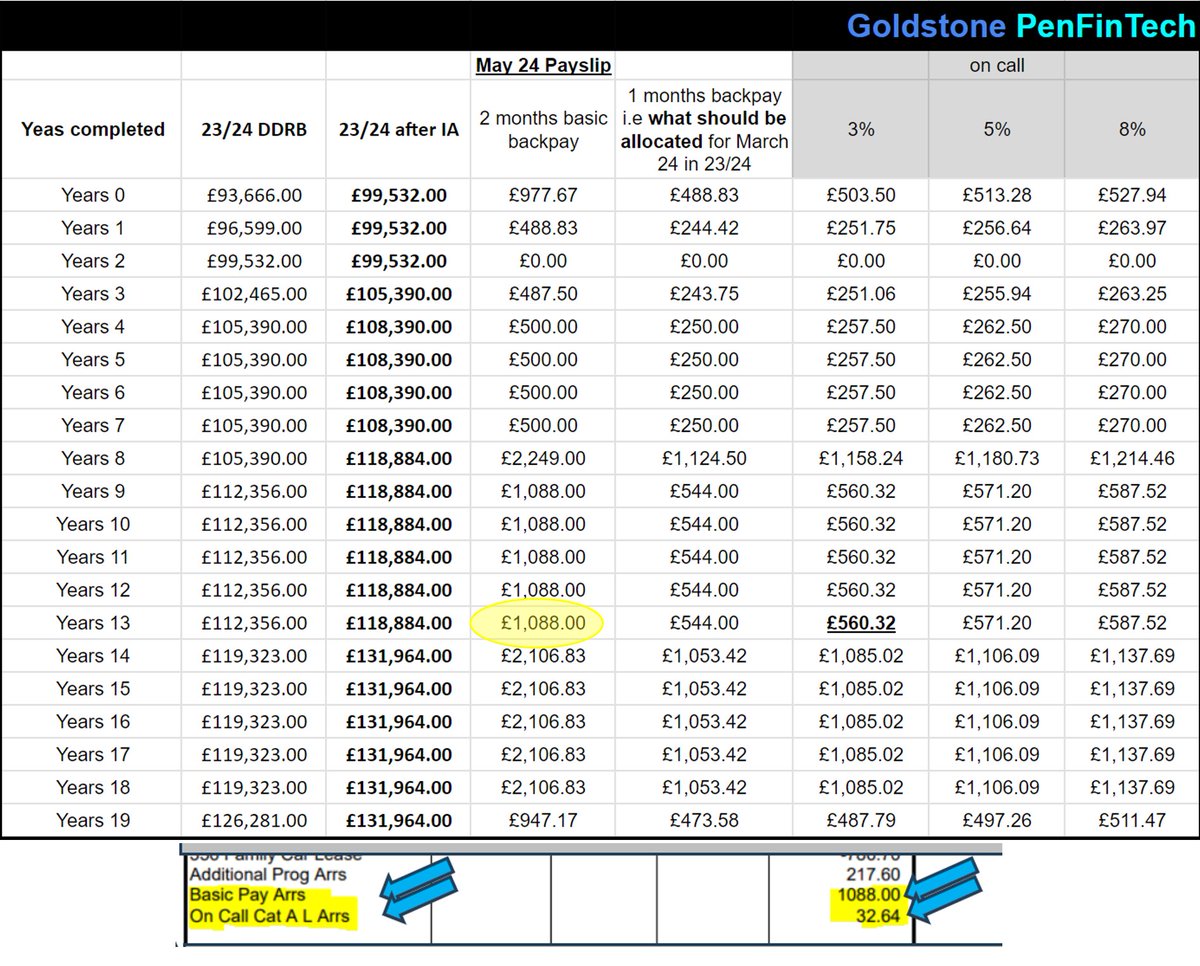

6/ Lets start by reviewing pay deal you voted on in England. Instead of getting 6% in 23/24 which would have been a HUGE PAYCUT vs very high inflation... you got the values in the final column which were different for different seniority. Crucially this was backpaid to Mar 24

7/ If you check your May '24 payslip (when most backpay arrears were paid) you should see an entry for basic pay arrears +/- on call arrears which are both PENSIONABLE

As your new pay was from MAY they needed to backpay TWO MONTHS (Mar 24 & Apr 24)

As your new pay was from MAY they needed to backpay TWO MONTHS (Mar 24 & Apr 24)

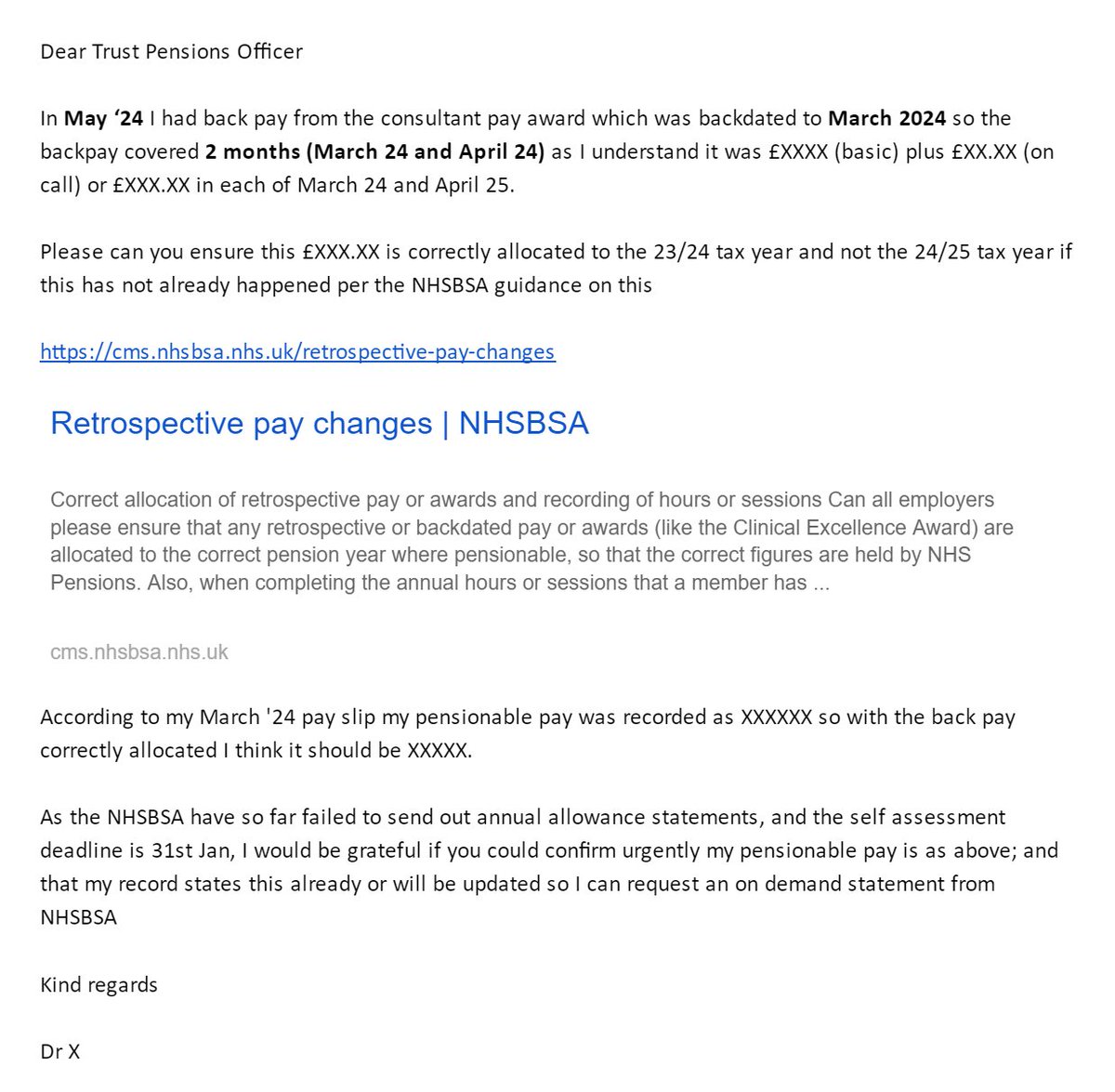

8/ Crucially you should note this 2 months back pay are March 24 and April 24 COMBINED.

*BUT* the March '24 should CORRECTLY be in the 23/24 tax year for pensions NOT the 24/25 tax year

*BUT* the March '24 should CORRECTLY be in the 23/24 tax year for pensions NOT the 24/25 tax year

9/ Now what *SHOULD* have happened, per the scheme administrators instruction is that 1 months back pay (from March 24)

"Can all employers please ensure that any retrospective or backdated pay ...are allocated to the correct pension year where pensionable, so that the correct figures are held by NHS Pensions"cms.nhsbsa.nhs.uk/retrospective-…

"Can all employers please ensure that any retrospective or backdated pay ...are allocated to the correct pension year where pensionable, so that the correct figures are held by NHS Pensions"cms.nhsbsa.nhs.uk/retrospective-…

10/ Furthermore NHS pensions acknowedge that if they dont correctly allocate it "Placing the pay in the incorrect years and having the incorrect sessions or hours recorded can have an effect on annual allowance"

11/ So next CRUCIAL step to see if youre affected by this, like I was (& suspect many others are).

If you are CONSULTANT in ENGLAND does your MAR '24 pen pay (or FTE if LTFT) *MATCH* TRS pay 23/24 1995 (red arrows) from TRS released last week = if so *YOU HAVE ARREARS PROBLEM*

If you are CONSULTANT in ENGLAND does your MAR '24 pen pay (or FTE if LTFT) *MATCH* TRS pay 23/24 1995 (red arrows) from TRS released last week = if so *YOU HAVE ARREARS PROBLEM*

12/ In that slide I show you how to work out what correct pay SHOULD be based on YOUR arrears payment. For full details of that & entire process suggest you watch new 20 min YouTube 👇covering whole process (suggest you bookmark this)

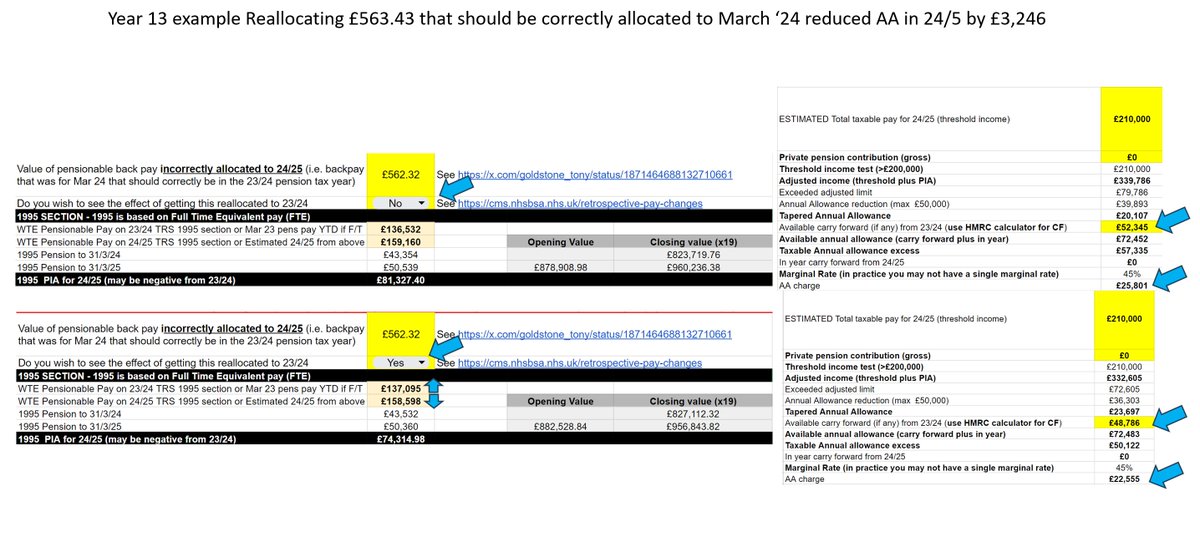

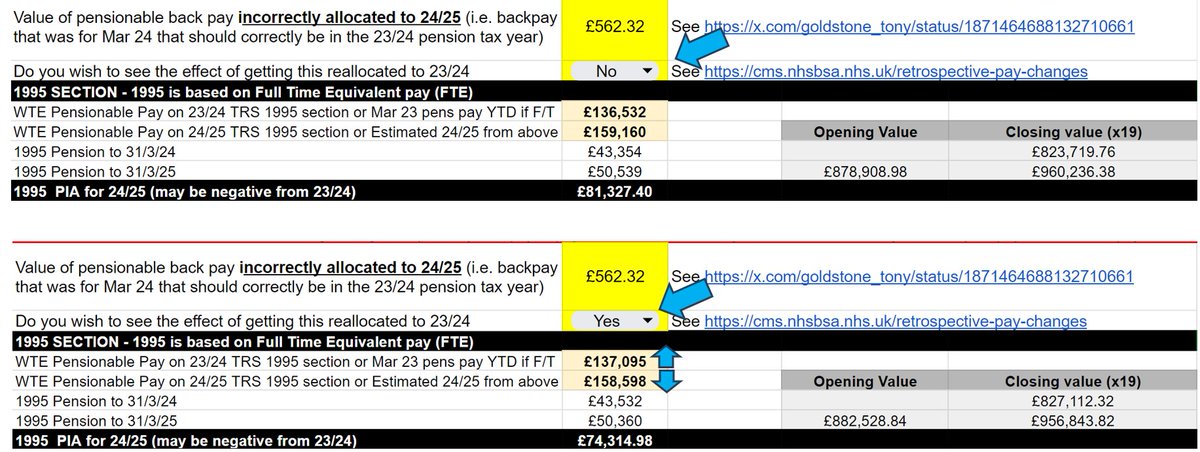

13/ Much more detail in the video but example year 13 saving below reducing tax charge by £3,246

[also see in the video in tweet 12 how tax charge can also be reduced +++ by not tapering]

Reduction in AA will depend on your exact circumstances - watch the video

[also see in the video in tweet 12 how tax charge can also be reduced +++ by not tapering]

Reduction in AA will depend on your exact circumstances - watch the video

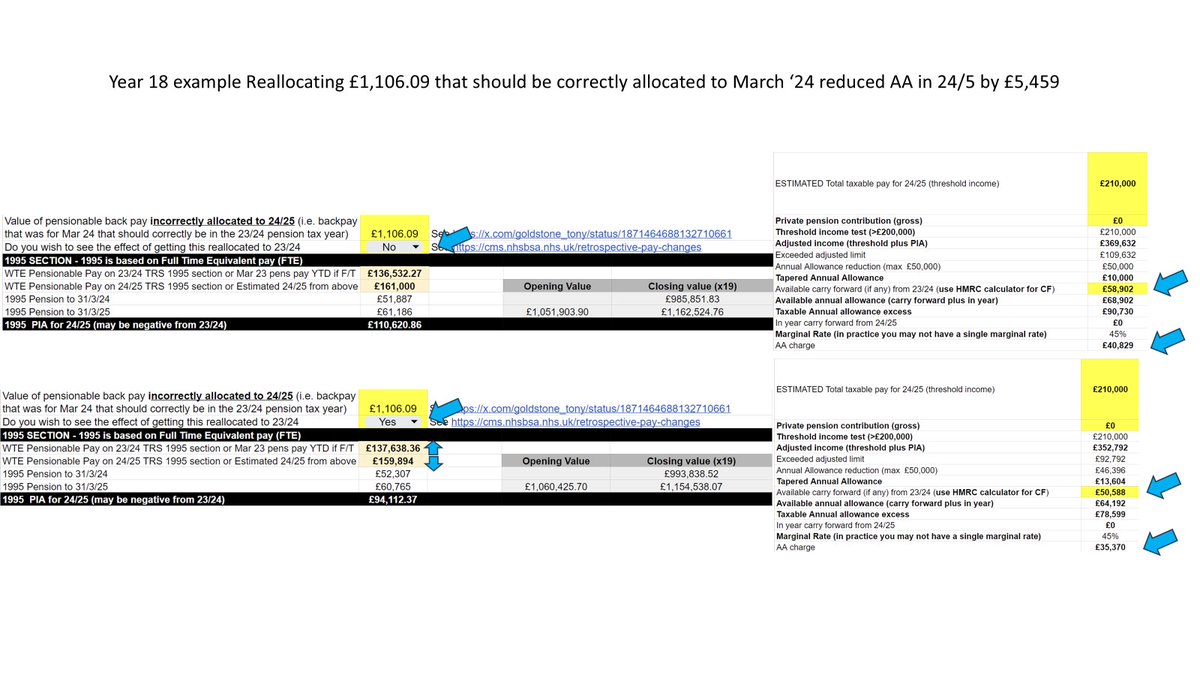

14/ Again more detail in video but example year 18 saving below reducing tax charge by £5,459

[also see in the video in tweet 12 how tax charge can also be reduced +++ by not tapering]

Reduction in AA will depend on your exact circumstances - watch the video

[also see in the video in tweet 12 how tax charge can also be reduced +++ by not tapering]

Reduction in AA will depend on your exact circumstances - watch the video

15/ You can get a ROUGH idea of potential max savings in the coloured cells on the right (based on "typical" 1995 service, or a slightly more refined "guestimate" by multiplying the TROF [Tax RIP OFF Factor] in the grey cells below by your 1995 years of service

16/ But you are strongly advised to actually model the affect of fixing this re-allocation using the new feature added to the free modeller 24/25 tab (see yellow cells and drop down) - watch video in tweet 12 for full details (note 23/24 and carry forward also affected)

17/ If after looking into this you wish to correct this "missalocated arrear error", you can ask your trust to fix this for you.

I sent the email below which you can copy from the link below (fill in your value using the video as a guide)

docs.google.com/document/d/1Hv…

I sent the email below which you can copy from the link below (fill in your value using the video as a guide)

docs.google.com/document/d/1Hv…

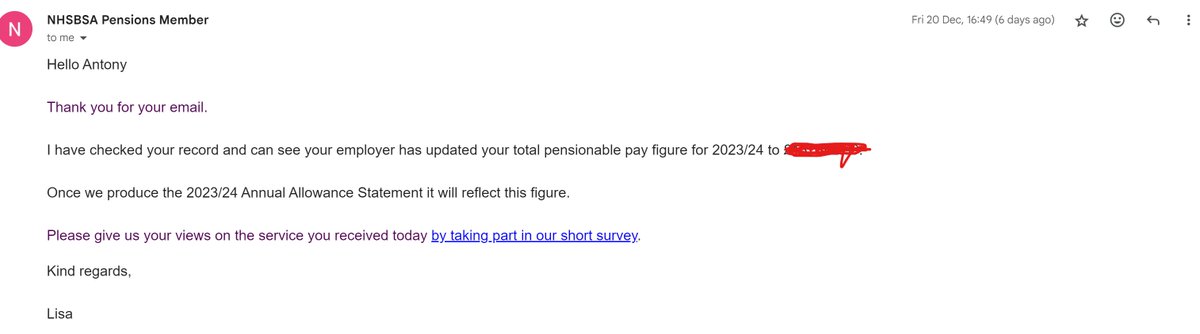

18/ My trust fixed this very quikcly for me and I emailed NHS pensions the following day asking them to send my "on demand" Pension Saving Statement for 23/24 ensuring the new amount and they also responded back really quickly

19/ So again the whole process is covered in this short 20 min video which talks you through how to model this, and correct this error. It "saved" me over £2,600 versus paying for non-existent growth I would never get in my pension retiring in >3 years

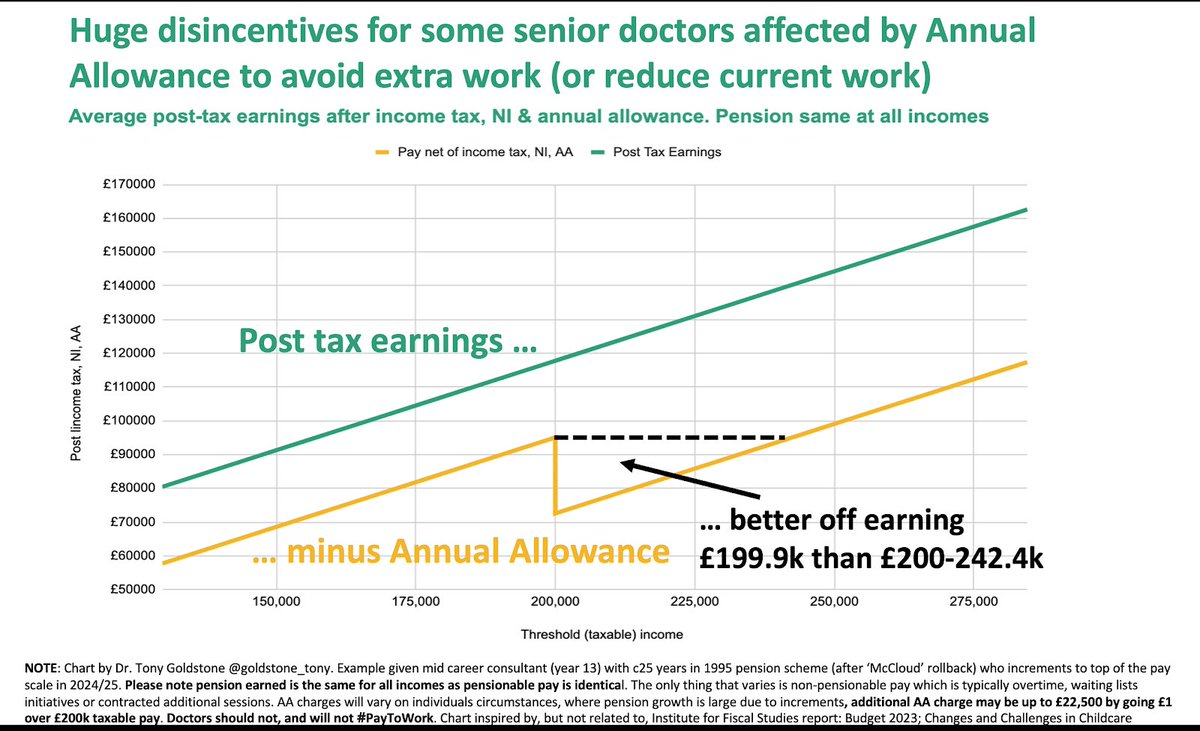

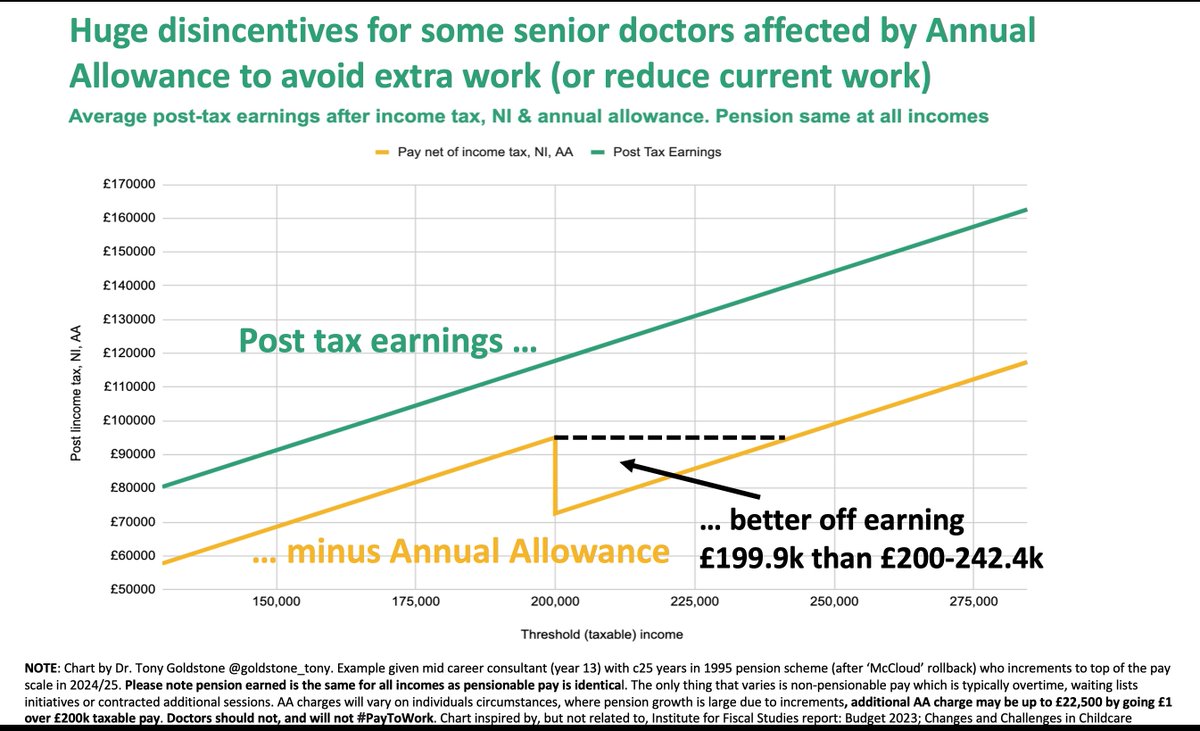

20/ All of this, once again, demonstrates how RIDICULOUS annual allowance is in "DB" schemes. That comparatively small amounts of pensionable pay (£500-1000) can distort pension growth in a wholly artificial spike, causing incorrect bills ££££ is a joke

21/22 Once again - twitter/X is a mess now so please ensure colleagues get to see this by quote RT first tweet, and if they are not on X, please share via FB / Whatsapp groups etc and subscribe to my YouTube to stay in touch

• • •

Missing some Tweet in this thread? You can try to

force a refresh