H-1B DATA MEGA-THREAD 🧵

I downloaded five years of H-1B data from the US DOL website (4M+ records) and spent the day crunching data.

I went into this with an open mind, but, to be honest, I'm now *extremely* skeptical of how this program works.

Here's what I found 👇

I downloaded five years of H-1B data from the US DOL website (4M+ records) and spent the day crunching data.

I went into this with an open mind, but, to be honest, I'm now *extremely* skeptical of how this program works.

Here's what I found 👇

Before I start, one note: All charts in this thread are for applications that were “certified” (in other words, approved for entry into the H-1B lottery). I filtered out applications the gov rejected.

All numbers here are therefore for visas employers actually and realistically attempted to obtain.

All numbers here are therefore for visas employers actually and realistically attempted to obtain.

To start with, this program is MASSIVELY popular with employers. The program has a statutory limit of 85,000 visas per year, but employers routinely receive approval for more than 800k applications per year (868k, or 10x the limit, in 2024).

Contrary to what I expected, the average salary for an H-1B is relatively low—slightly under $120k this year.

Given that much of the H-1B debate pertains to tech workers, I (incorrectly) assumed the average would be higher. But this is the beauty of data, right?

Given that much of the H-1B debate pertains to tech workers, I (incorrectly) assumed the average would be higher. But this is the beauty of data, right?

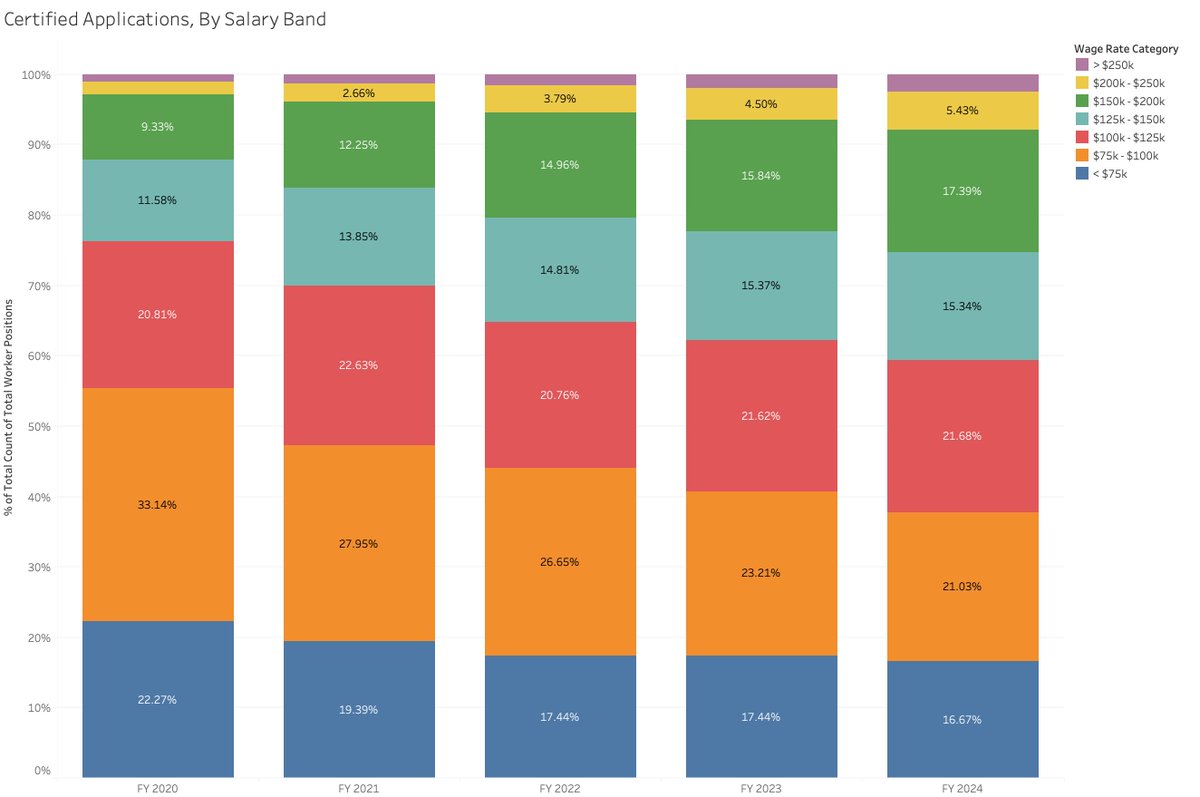

You can see that salaries are disproportionately weighted toward the lower bands:

17% are < $75k (blue)

21% are $75-100k (orange)

22% are $100-125k (pink)

15% are $125-150k (teal)

In other words, ~75% are jobs paying < $150k. Only 25% are $150k+, and, of those, only 2.5% are $250k+ (purple).

17% are < $75k (blue)

21% are $75-100k (orange)

22% are $100-125k (pink)

15% are $125-150k (teal)

In other words, ~75% are jobs paying < $150k. Only 25% are $150k+, and, of those, only 2.5% are $250k+ (purple).

I (roughly) categorized job descriptions into computer/software/IT-related roles (teal) and everything else (gray).

Almost all the prominent job categories are tech-related. The two top categories, for software developer roles, are 1.1M over five years by themselves.

Almost all the prominent job categories are tech-related. The two top categories, for software developer roles, are 1.1M over five years by themselves.

Basically every role with 30k+ H-1B applications is for a STEM field, with the exception of accountants and auditors (49k). Most of them IT-related, at that.

There’s a little more variety in roles with smaller numbers, but the overall tilt towards STEM remains throughout.

There’s a little more variety in roles with smaller numbers, but the overall tilt towards STEM remains throughout.

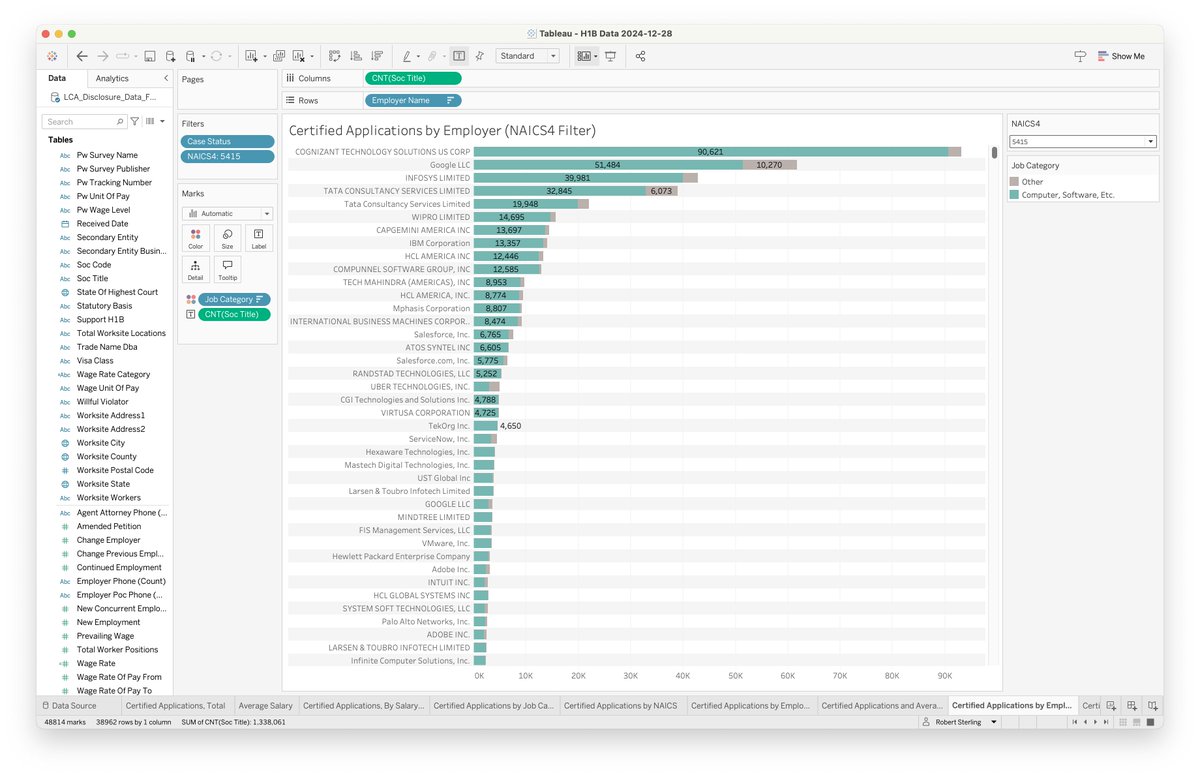

Let’s review applications by employer (again, with teal representing IT roles and gray being everything else).

There are some HUGE numbers here. 15 companies alone received approval for 20k+ applications each.

We’ll go back to employers momentarily.

There are some HUGE numbers here. 15 companies alone received approval for 20k+ applications each.

We’ll go back to employers momentarily.

Looking at applications by employer NAICS code, 5415 (computer systems design) absolutely dwarfs everything else: 1.2M applications over five years.

The next two largest are 6113 (universities) and 5416 (consulting).

As consultants like to say, let’s double-click into this.

The next two largest are 6113 (universities) and 5416 (consulting).

As consultants like to say, let’s double-click into this.

NAICS code 5415 (computer systems design) is the category for many of the larger employers we saw above. Some of the companies here—Google, IBM, Salesforce—are household names.

But what about the other large applicants here, which aren’t as familiar (Cognizant, Infosys, Tata)?

But what about the other large applicants here, which aren’t as familiar (Cognizant, Infosys, Tata)?

As it turns out, these are ALL Indian companies that import H-1B tech workers en masse:

Cognizant (93k)

Infosys (61k)

Tata Consultancy Services (60k)

Wipro

Capgemini

HCL

Compunnel

Tech Mahindra

Mphasis

These aren’t American companies that needed international talent to fill critical roles. They’re foreign companies that appear to have been founded to place overseas tech workers into US companies as contractors.

Cognizant (93k)

Infosys (61k)

Tata Consultancy Services (60k)

Wipro

Capgemini

HCL

Compunnel

Tech Mahindra

Mphasis

These aren’t American companies that needed international talent to fill critical roles. They’re foreign companies that appear to have been founded to place overseas tech workers into US companies as contractors.

What jobs are these companies seeking visas for?

A metric f**k ton of IT and software roles. Over the past five years, 80k+ computer systems analysts (Cognizant is the big player here). 50k+ systems engineers/architects (Cognizant + Tata). Programmers (looks like Wipro and Mphasis concentrate here) and IT project managers (Infosys).

A metric f**k ton of IT and software roles. Over the past five years, 80k+ computer systems analysts (Cognizant is the big player here). 50k+ systems engineers/architects (Cognizant + Tata). Programmers (looks like Wipro and Mphasis concentrate here) and IT project managers (Infosys).

The chart here shows each company’s average salary for each role. I’ve added a shaded gray band between $80-120k to highlight where the preponderance of salaries fall.

I’ve spent my career in M&A and corporate finance, and I’ve been involved in a lot of budget and hiring decisions. Unless we’ve overpaid every developer and IT person at every company I’ve ever worked for, $80-120k for roles like this is NOT market.

I’ve spent my career in M&A and corporate finance, and I’ve been involved in a lot of budget and hiring decisions. Unless we’ve overpaid every developer and IT person at every company I’ve ever worked for, $80-120k for roles like this is NOT market.

The H-1B program isn't just Indian companies requesting visas for IT workers, though.

The list of companies seeking visas for accountants is a who's who of Big Four and other prominent accounting firms. EY is crushing the competition with 16k+ applications.

The list of companies seeking visas for accountants is a who's who of Big Four and other prominent accounting firms. EY is crushing the competition with 16k+ applications.

EY also has the largest share of employers seeking visas for finance-related jobs, followed by investment banks Goldman Sachs, JP Morgan Chase, and Citibank.

Here are the roles for which EY sought visas, along with average salaries. Everything from accountants (16k) to computer systems analyst (7k) to actuaries (600 or so).

EY isn't even a major player in the world of actuaries! There's zero reason why they couldn't hire these people domestically.

EY isn't even a major player in the world of actuaries! There's zero reason why they couldn't hire these people domestically.

You can see where I’m going with this. A casual perusal of the data shows that this isn’t a program for the top 0.1% of talent, as it’s been described. This is simply a way to recruit hundreds of thousands of relatively lower-wage IT and financial services professionals.

America needs to be a destination for the world’s most elite talent. But the H-1B program isn’t the way to do that.

I’m going to stop posting for now, but let me know if there are any other visualizations that would be helpful.

If you made it this far, thanks for reading!

I’m going to stop posting for now, but let me know if there are any other visualizations that would be helpful.

If you made it this far, thanks for reading!

• • •

Missing some Tweet in this thread? You can try to

force a refresh