woah. ~300 redacted summary judgment google exhibits posted in TX. I've uploaded all. most eye-popping - we finally get Google-Facebook contract (aka Jedi Blue) alleged as bid rigging (yes, press was misled, it's still part of the claims). /1

If you need a definition for Match Rate, Google and Facebook include it with example of using the "encrypted blob" on mobile, feels very much like a fingerprint y'all. Here is the full contract, don't sleep on section dealing with monopoly enforcement. /2 storage.courtlistener.com/recap/gov.usco…

There are a ton of new exhibits from discovery with similar themes of Google secretly using projects to manipulate its black box auctions. "The first rule of Bernanke is we don't talk about Bernanke." /3

"the following kind of collusion is beneficial to bidders" is the analogy a redacted Google employee uses internally used to describe Bernanke (eg stop submitting a second price in an auction to effectively pay publishers the third price and then redeploy the margin). /4

Another secret project, Dynamic Revenue Sharing, continues to be one of the most infuriating. First, Google lowered its margins on individual auctions in order to capture marketshare then they launched v2 to recapture that margin by maintaining a publisher "debt" account. /5

Google's success metrics for DRS v2 are incremental revenue and profits for Google. And yes, more revenue to publishers vis a vis Google and less from other intermediaries. Incredibly dirty imho. /6

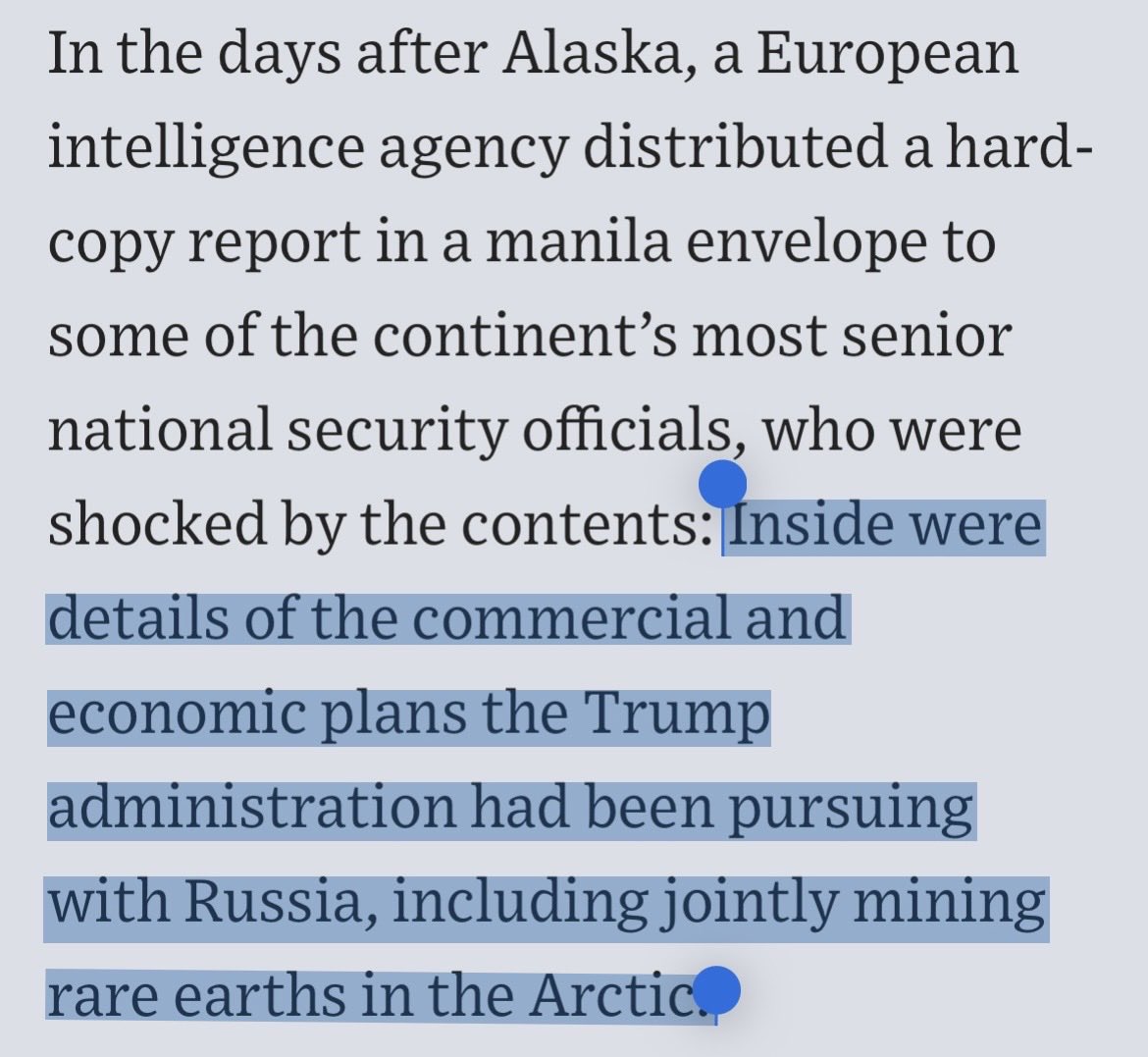

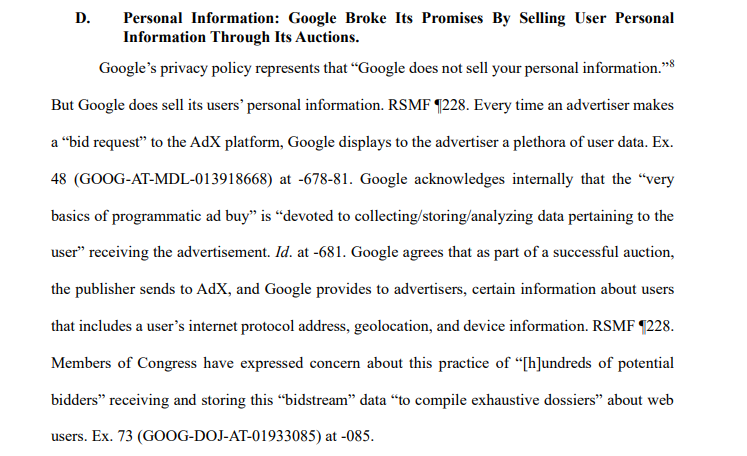

We still expect the US v Google decision in the parallel trial here in Virginia any day now but it's good to continue to see user data and surveillance capitalism play such a large role in the Texas lawsuit. Here is Texas describing how it alleges Google broke its promises. /7

In both trials, this "bundling" of two major changes to Google's auctions is deadly. We've seen other emails explaining the need to packages them. Here, Google even color codes what was good for Google (green) and good for pubs (blue). But what does that really mean? /8

Here it is put more simply, "One is good for us and bad for publishers. Other is bad for us and good for publishers. Can we combine them both?" /9

The secretive "g-Trade" team continues to feature widely in the exhibits. You may have heard Google previously suggest there was a firewall between its market leading buy-side and market-leading sell-side tech. Read this closely. /10

We saw this in the Virginia exhibits but again it's deadly evidence in yellow. There are other exhibits showing Google is trying to reverse a trend towards "open" with header bidding. But here they admit not so much that they hurt their AdX margins/leverage. /11

Jonathan Bellack was key on this testimony, and as a former employee, could have been the biggest difference maker in relaying Google's conduct in EDVA. Maybe it will happen in texas. he knew importance of bidstream data coupled with location, search, browsing, user data. /12

Anyway, all these decisions add up to Google playing God. Capturing share and margin while doing what they believe is best for the wider web. Read the blue below. Note: the Super Bowl is a perfect example of irrational/FOMO ad buying - and it's worth every penny for brands. /13

Finally, I will leave you with another exhibit - a 2015 Digiday report - which serves as a great example of Google misleading public/press. It's a scoop on G rolling out dynamic price floors but a source (yours truly IIRC) notes it requires "tying" the ad server and exchange. /14

Oh yes, there I am. Again, this report is an exhibit a decade later in a major antitrust lawsuit(s) to break up Google, for allegedly doing exactly what I expressed as a grave concern. Google never called. /15

Even internally they apparently tried to bury their own denial when called by fellow employees on it. This employee received a response internally suggesting the denial was about something else in the article. /17

But here is the exact thread where Google comms decides to feed the statement to Digiday to insert it into the Digiday report. Always bring the receipts. /18

Here is a link to all the exhibits (see docket 737-750 for tonight). Yes, Google prob timed its redactions for New Years' Eve (). Google's Summary Judgment arguments seem to be 2-sided market (Amex) and refusal to deal (Trinko). See you at trial, G. /19courtlistener.com/docket/1874931…

by the way, here is a link to Facebook's motion for Summary Judgment in the private antitrust lawsuit against it. Yes, it also filed today. And yes, pp 19-21 are focused on Jedi Blue, too. /20 storage.courtlistener.com/recap/gov.usco…

• • •

Missing some Tweet in this thread? You can try to

force a refresh