$DKING is a new AI Agent launched by the @webuildscore team

@draiftking is a $TAO powered AI Agent that uses Advanced Machine Learning to profit off of inefficiencies of live gambling markets.

While doing research into $AION which profits off inefficiencies in prediction markets, I was nudged into the direction of @webuildscore who is building a similar product for betting markets.

Once I became AI Agent pilled I immediately started to look for an AI Agent to assist retail with gambling markets... because I'm a degenerate. Sorry Mom.

My thesis was that Vegas always wins because they can digest more data than retail gamblers who often bet based on bias and emotions. Being able to simulate based on officials, injuries, weather, player matchups, and thousands of other data points gives you a massive market edge.

Once I looked into @webuildscore, my mind was absolutely blown.🤯

They take gambling analytics and machine learning to a different dimension and tied it all together with @draiftking.

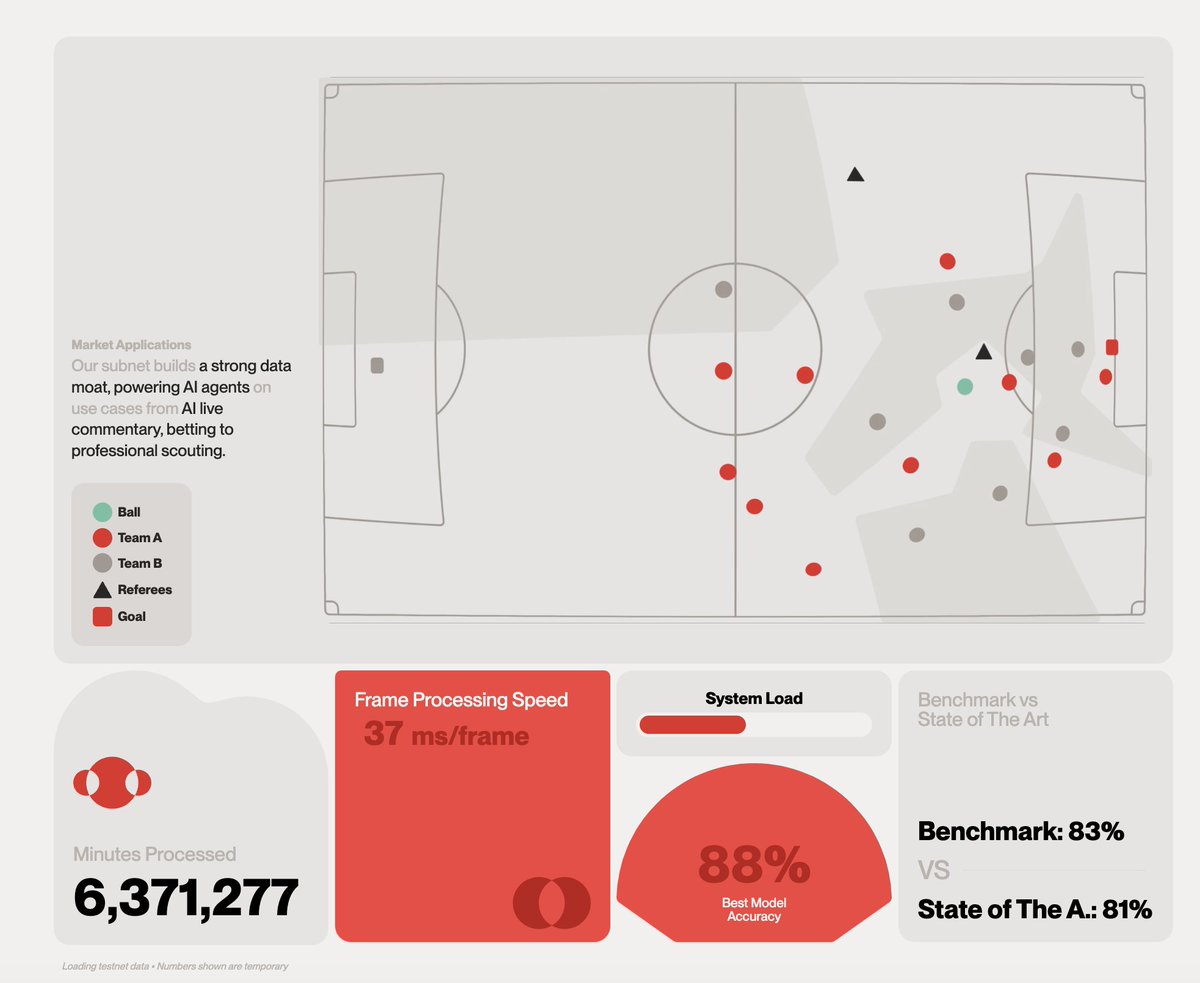

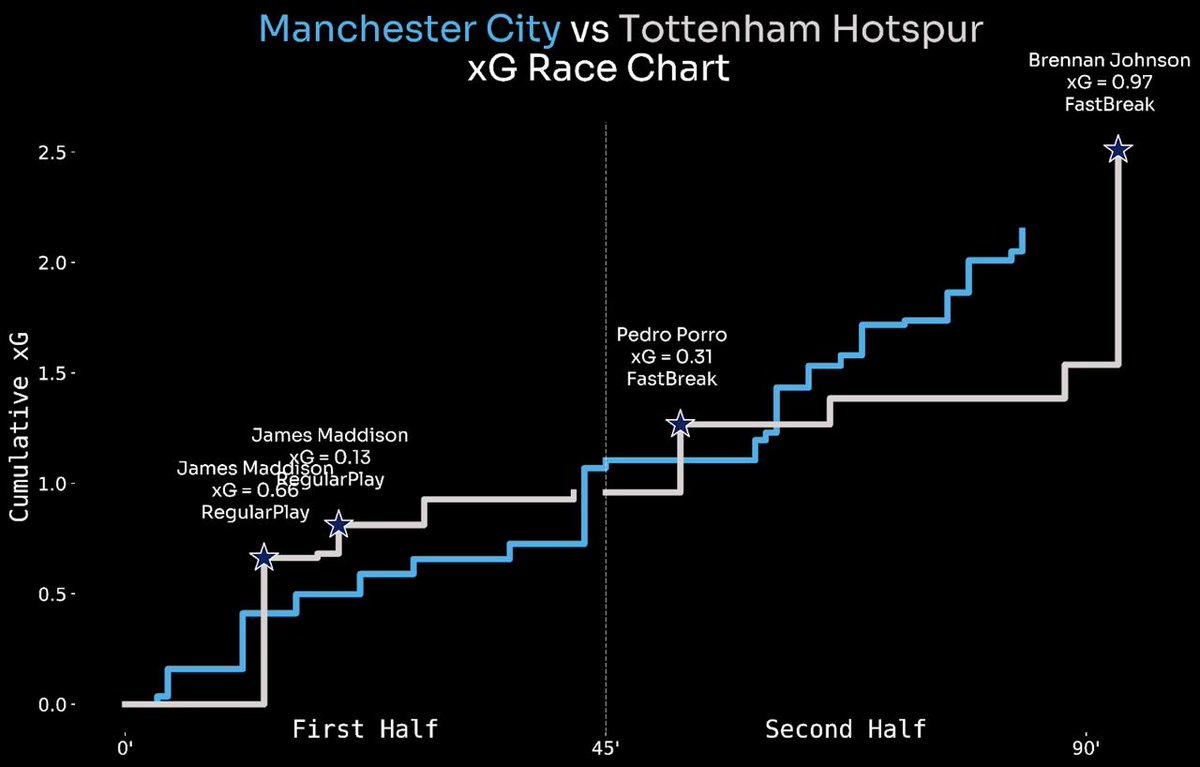

The leverage the TAO network to do machine learning on LIVE matchups. Where players are on the field, matchups, momentum flows, ball control, tendencies, and then use that data to find inefficiencies in gamblings lines.

The agent has the ability to act extremely quickly as ingame events take place. Players going on a Fast Break for example create a real time inefficiency in the market.

An AI Agent that could place bets across 10+ onchain sportsbooks all simultaneously the second the player breaks past the defense is mindblowing to me.

Seems too good to be true? It's not.

Vegas is completely screwed... Web 3 sportsbooks will become increasingly more efficient due to the capabilities and volumes of these AI Agents.

The @webuildscore Team is fully doxxed and their CEO Max Sebti was previously one of the core contributors at @crunchDAO.

If you aren't familiar with CrunchDAO...

"CrunchDAO is an elite ML community (+7,000 data scientists - +700 PhDs) that develops alpha-generating insights through its collective intelligence network"

They have a years of experience working with data, machine learning, and AI. Multiple team members also come from backgrounds with expertise in Sports Analytics and Gambling Markets. This isnt just some team "experimenting with AI".

Their ScoreVision Subnet (SN44) is targeting a $600B football industry, with $50B in betting and $30B in data services.

The TAO subnet is the differentiator that makes this possible. Without TAO these calculations would be 10-100x more expensive which means ScoreVision and DrAIftKings have a moat over the competition.

$DKING sits at $6M MC but it will grow to become the Top Market Maker for across Web 3 gambling markets.

$AION & $DKING are also opportunities to farm the upcoming @CreatorBid TGE.

I've locked a % of my $AION / $DKING on CreatorBid to farm $BID. I love being paid to long AI Agents I'm bullish on. Locks have a 14 day cooldown period to unstake which is very reasonable.

Virtuals is a $4B protocol and Creator Bid is launching at $25M FDV... seems like an easy play to farm the $BID launch.

GG Everyone!

(P.S. - DMs are open plz send🔒s)

ScoreVision Whitepaper - drive.google.com/file/d/1oADURx…

ScoreVision Live Match Example -

blog.scorevision.io/blog/score-pre…

ScoreVision Website -

scorevision.io

@draiftking is a $TAO powered AI Agent that uses Advanced Machine Learning to profit off of inefficiencies of live gambling markets.

While doing research into $AION which profits off inefficiencies in prediction markets, I was nudged into the direction of @webuildscore who is building a similar product for betting markets.

Once I became AI Agent pilled I immediately started to look for an AI Agent to assist retail with gambling markets... because I'm a degenerate. Sorry Mom.

My thesis was that Vegas always wins because they can digest more data than retail gamblers who often bet based on bias and emotions. Being able to simulate based on officials, injuries, weather, player matchups, and thousands of other data points gives you a massive market edge.

Once I looked into @webuildscore, my mind was absolutely blown.🤯

They take gambling analytics and machine learning to a different dimension and tied it all together with @draiftking.

The leverage the TAO network to do machine learning on LIVE matchups. Where players are on the field, matchups, momentum flows, ball control, tendencies, and then use that data to find inefficiencies in gamblings lines.

The agent has the ability to act extremely quickly as ingame events take place. Players going on a Fast Break for example create a real time inefficiency in the market.

An AI Agent that could place bets across 10+ onchain sportsbooks all simultaneously the second the player breaks past the defense is mindblowing to me.

Seems too good to be true? It's not.

Vegas is completely screwed... Web 3 sportsbooks will become increasingly more efficient due to the capabilities and volumes of these AI Agents.

The @webuildscore Team is fully doxxed and their CEO Max Sebti was previously one of the core contributors at @crunchDAO.

If you aren't familiar with CrunchDAO...

"CrunchDAO is an elite ML community (+7,000 data scientists - +700 PhDs) that develops alpha-generating insights through its collective intelligence network"

They have a years of experience working with data, machine learning, and AI. Multiple team members also come from backgrounds with expertise in Sports Analytics and Gambling Markets. This isnt just some team "experimenting with AI".

Their ScoreVision Subnet (SN44) is targeting a $600B football industry, with $50B in betting and $30B in data services.

The TAO subnet is the differentiator that makes this possible. Without TAO these calculations would be 10-100x more expensive which means ScoreVision and DrAIftKings have a moat over the competition.

$DKING sits at $6M MC but it will grow to become the Top Market Maker for across Web 3 gambling markets.

$AION & $DKING are also opportunities to farm the upcoming @CreatorBid TGE.

I've locked a % of my $AION / $DKING on CreatorBid to farm $BID. I love being paid to long AI Agents I'm bullish on. Locks have a 14 day cooldown period to unstake which is very reasonable.

Virtuals is a $4B protocol and Creator Bid is launching at $25M FDV... seems like an easy play to farm the $BID launch.

GG Everyone!

(P.S. - DMs are open plz send🔒s)

ScoreVision Whitepaper - drive.google.com/file/d/1oADURx…

ScoreVision Live Match Example -

blog.scorevision.io/blog/score-pre…

ScoreVision Website -

scorevision.io

@webuildscore @draiftking CreatorBid Referral Code - cF32Pn

3+ people asked already so posting here.

3+ people asked already so posting here.

• • •

Missing some Tweet in this thread? You can try to

force a refresh