woah. This Friday? Too much moving on court dockets so I will surface for you. This matters, in this mega-Facebook case, as highly respected Chenault was Chairman of Facebook's board during its biggest scandals. WSJ reported he left board after disagreements with Zuckerberg. /1

Here is the report on his departure, it includes reports of disagreements with Peter Thiel, too, over elections policies and "clashes" over moderation policies.

Btw, highly relevant to the last 24hrs of news. /2 wsj.com/articles/chena…

Btw, highly relevant to the last 24hrs of news. /2 wsj.com/articles/chena…

Moving on, Zuckerberg has also been noticed for deposition after "alleged wrongdoing on a truly colossal scale." He was already deposed last month in Hawaii for 7hrs. I would expect SEC closely compares transcripts to their 2019 depo which @zamaan_qureshi managed to unseal. /3

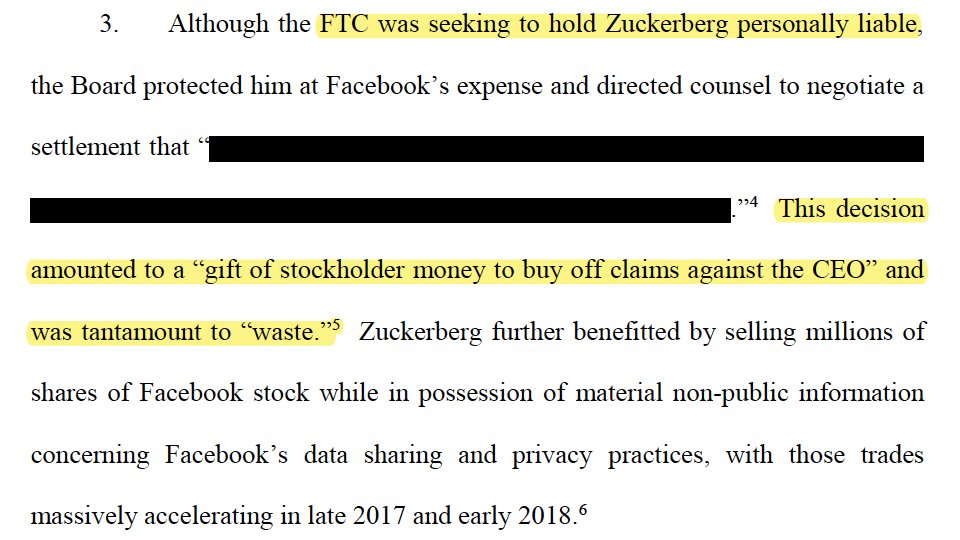

@zamaan_qureshi This was all uncomfortable to him likely as it involves attempts to hold him personally liable in the scandal. First, in his failure to protect consumers. Now, in allegedly (over)paying off the FTC and SEC to make personal risk go away while profiting off the stock. /4

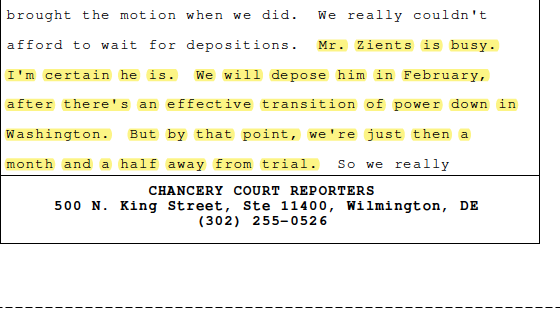

@zamaan_qureshi Board members during the time including Marc Andreessen, Sheryl Sandberg, Peter Thiel were already deposed according to the docket. Jeff Zients looks to be next month recognizing he's a bit busy right now (Biden's Chief of Staff). /5

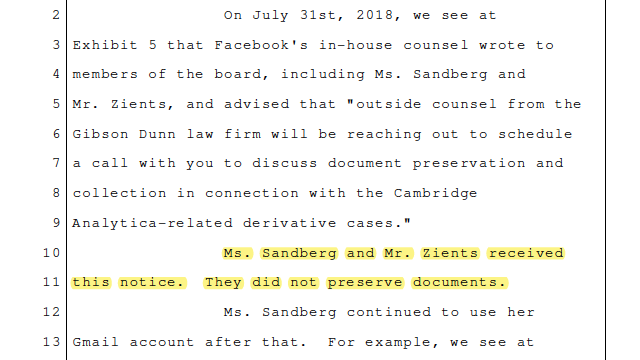

@zamaan_qureshi Zients also appears in sanctions motions against him and Sheryl Sandberg for not preserving emails. Plaintiffs note this isn't some new form of comms (Signal, Google chats, etc) but simply, albeit sensitive, emails they were told to preserve and they failed to do it. /6

@zamaan_qureshi Read closely. In the case of Sandberg, this is allegedly her gmail account where she discussed sensitive matters. Here, getting outside advice on her and Mark's risk.

Wow. "I am raising a double fisted red flag now just to be 100% sure you're in double-fisted red flag mode."

/7

Wow. "I am raising a double fisted red flag now just to be 100% sure you're in double-fisted red flag mode."

/7

It should be noted that the allegations are Zients just let his emails autodelete during the litigation hold whereas Sandberg proactively deleted her emails. /8

Sandberg and Facebook's attorneys have argued that all of super sensitive personal emails were also copied to someone else at Facebook intentionally to make sure there was access to them. I find this to be a compelling counterpoint to why that answer shouldn't be trusted. /9

Some of these Sandberg emails on her pseudonymous gmail account were highly relevant, sensitive topics at the time. Interesting in March 2017 there were emails about Cambridge Analytica since I believe Zuckerberg told SEC and House the scandal hit his radar in March 2018. /10

@AOC On Zients, it's more a question whether there really would have only been two emails considering the global investigations of Facebook and his role on the board of directors and the highly sensitive board committee to settle them. /11

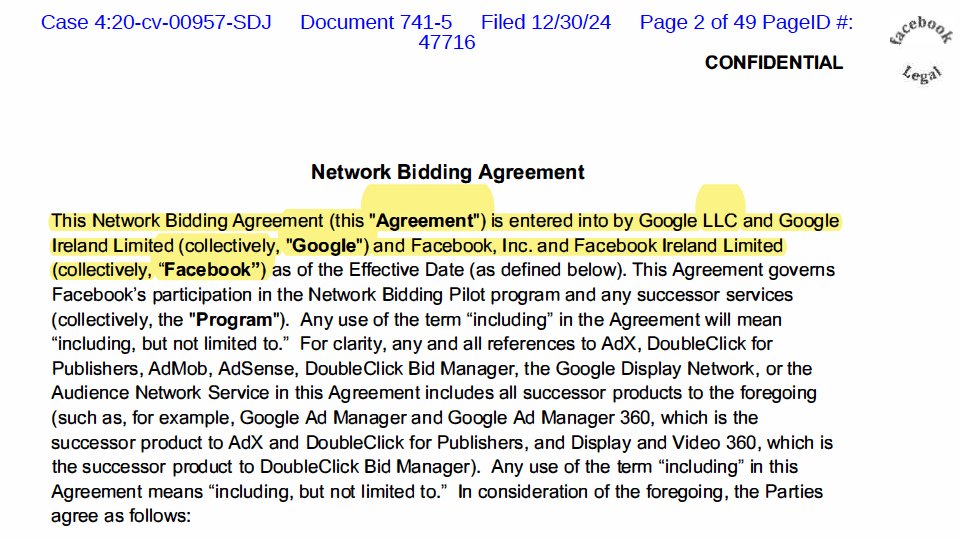

@AOC I mean he was on the actual committee that was formed to stamp Zuckerberg's deal for $5B+ with the FTC and SEC to settle the complaints and remove any personal liability for Zuckerberg. Presumably these are the two emails he did receive - other sensitive matters. /12

@AOC I'll stop. But again just trying to bubble up this very active docket in DE. In addition to SCOTUS deciding Friday if it grants cert in FB's inflated reach fraud case, the securities case in NdCal which SCOTUS just pushed back to district court, and FTC breakup April trial. /13

@AOC Great. Bloomberg Law wrote about the case over holidays so it was missed including by me! news.bloomberglaw.com/business-and-p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh