Guys.

We — as in Californian voters who voted in 1988 — voted for a system where every time an insurance company wants to raise rates for automobiles or homes, they have to have a public hearing and an elected insurance commissioner has to approve that rate increase.

We — as in Californian voters who voted in 1988 — voted for a system where every time an insurance company wants to raise rates for automobiles or homes, they have to have a public hearing and an elected insurance commissioner has to approve that rate increase.

Even better, the non-profit, Consumer Watchdog, that ran the ballot initiative that voters voted for, wrote in a way that it could earn intervenor fees when it contested rate increases. amp.sacbee.com/article1262790…

Before the wildfire crisis, the insurance commissioner job used to be a stepping stone with great name recognition for higher office. But now it’s a political graveyard because no one wants to do the unpopular job of raising homeowners’ insurance premiums. politico.com/news/2023/09/2…

Lara has stalled on allowing insurance companies to factor in catastrophic modeling and reinsurance rates, which has caused 7 of the 12 top insurance companies to stop issuing new policies in California. Even today, I get emails on local mailing lists from homeowners trying to find coverage after they get non-renewed.

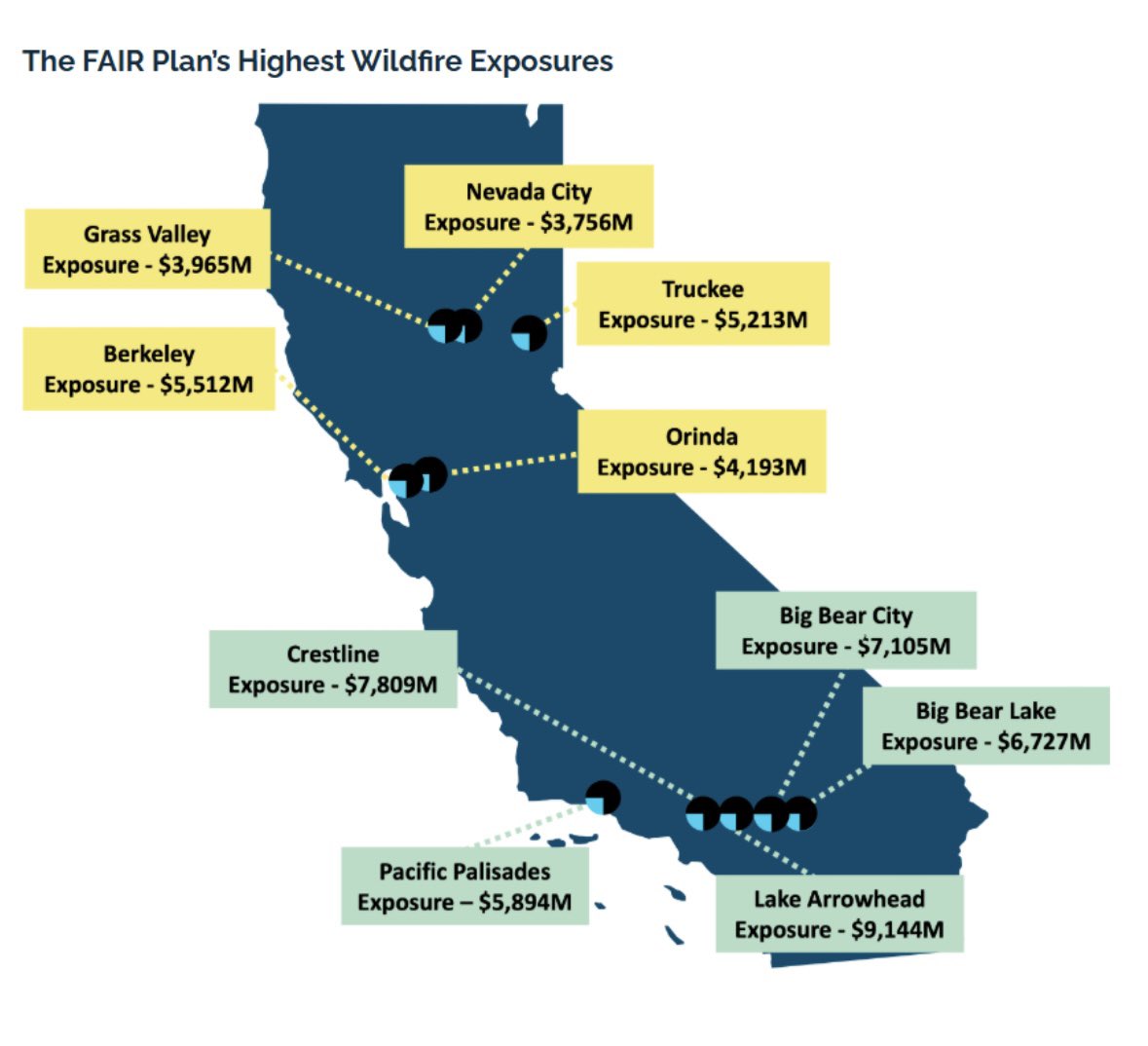

As a result, our state plan of last resort, FAIR (which offers barebones fire insurance, meaning homeowners still have to find wraparound coverage for other risks) has tripled in size over the last five years and now has $458B in exposure. bloomberg.com/opinion/articl…

Over the summer, FAIR testified it only had about $385 million in unreserved funds available to pay claims and $2.5B in reinsurance. But the @sfchronicle today looked at zip codes around the various LA fires and noted it could have up to $24B of exposure. sfchronicle.com/california-wil…

“When the FAIR Plan runs out of money to pay claims, it’s allowed to split its remaining costs amongst all of the licensed insurers in the state, with costs allocated according to each company’s market share.”

This is why insurance companies were non-renewing customers that were living far away from fire zones. It’s because they didn’t want the FAIR exposure.

This is why insurance companies were non-renewing customers that were living far away from fire zones. It’s because they didn’t want the FAIR exposure.

@sfchronicle In July, Lara announced a new plan to handle the FAIR liability.

For the first $1B each of residential and commercial claims, insurers would be required to pay half themselves, with the option of passing on the other half to their customers.

sfchronicle.com/california/art…

For the first $1B each of residential and commercial claims, insurers would be required to pay half themselves, with the option of passing on the other half to their customers.

sfchronicle.com/california/art…

How much is this going to cost you?

Consumer Watchdog (LOL, the same group that ran the 1988 initiative) said this summer that a major wildfire could force FAIR to impose a surcharge of $1,000 on insurance policies throughout CA. Multiple wildfires could be $3,700. eenews.net/articles/calif…

Consumer Watchdog (LOL, the same group that ran the 1988 initiative) said this summer that a major wildfire could force FAIR to impose a surcharge of $1,000 on insurance policies throughout CA. Multiple wildfires could be $3,700. eenews.net/articles/calif…

@sfchronicle But if they don’t allow a surcharge, it’s hard to see how insurance companies would come back to California and we’d become uninsurable, tanking our property values and tax revenues.

There’s also a weird alternate universe where Consumer Watchdog (this fucking non-profit) didn’t happen to be on the same August 2023 Southwest flight as some lobbyists, then secretly record their conversation, leak it to Politico and tank this agreement and maybe it would’ve been effective a whole year earlier and prevented more Palisades customer hemorrhaging to FAIR throughout 2024.

politico.com/news/2023/08/3…

politico.com/news/2023/08/3…

@sfchronicle Consumer Watchdog strikes again!

https://x.com/mattyglesias/status/1877803287774110181?s=46&t=vyOI1rf-DdqAp1j2A8JFGQ

@sfchronicle Well this sucks.

https://twitter.com/otter401/status/1878248853498900782

@sfchronicle Also, for those that say Republicans could have run the state better, Lara's GOP opponent's said the entire state should have a "basic flat rate" for wildfire insurance: calmatters.org/california-vot…

• • •

Missing some Tweet in this thread? You can try to

force a refresh