Undervalued Microcap Stock.

Can this stock become 2x multibagger in 2 years?

Techno-Funda Analysis below: 👇

Can this stock become 2x multibagger in 2 years?

Techno-Funda Analysis below: 👇

(1) About company:

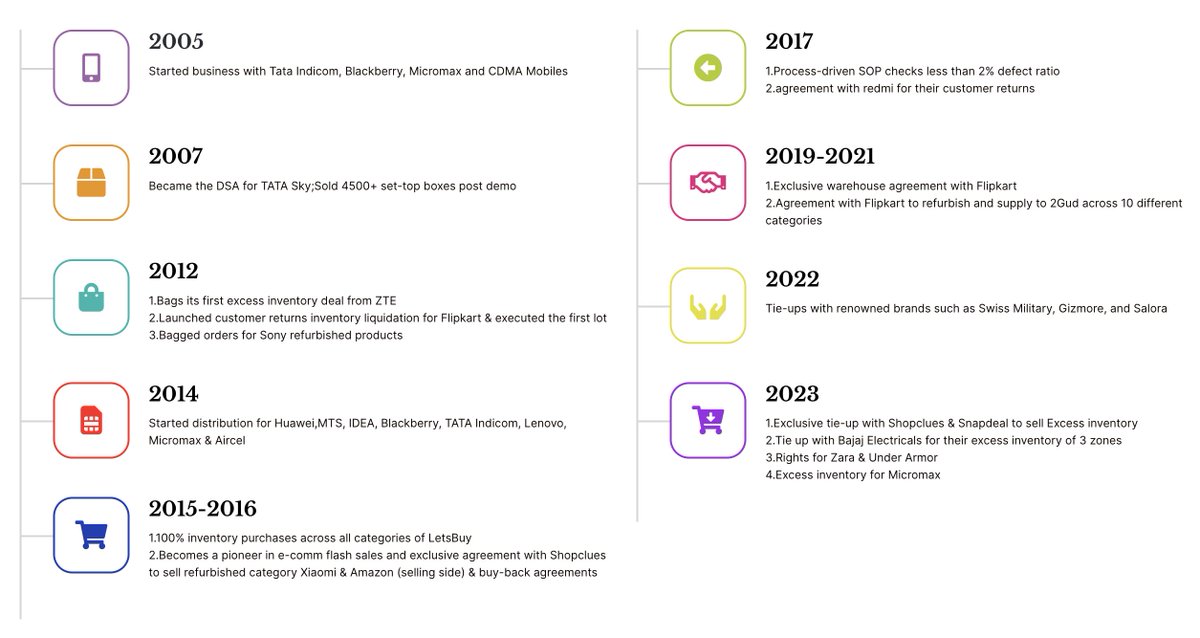

Rockingdeals Circular Economy Limited, previously Technix Electronics Limited, is a B2B recommerce company that deals in bulk trading of surplus, open-box, and refurbished items.

Founded in 2002, it began its operations in 2005, providing products such as home appliances, apparel, and electronics.

Rockingdeals Circular Economy Limited, previously Technix Electronics Limited, is a B2B recommerce company that deals in bulk trading of surplus, open-box, and refurbished items.

Founded in 2002, it began its operations in 2005, providing products such as home appliances, apparel, and electronics.

(2) Sector & Industry outlook:

- Global recommerce market is expected to reach $355 billion by 2025, growing at an annual rate of 21%.

- Infogence Global Research estimated India's re-commerce market at USD 29.54 billion in 2022, forecasting a yearly growth of 6.15% by 2027.

- Grant Thornton report states that India's refurbished furniture and appliance market, valued at $5.7 billion in 2020, is predicted to reach nearly $9.8 billion by 2025.

- Refurbished electronics market was valued at about US$ 5 billion in March 2021 and is expected to reach US$ 11 billion by March 2026, showing a growth of over 2x in five years, with an annual growth rate of around 17%.

- Global recommerce market is expected to reach $355 billion by 2025, growing at an annual rate of 21%.

- Infogence Global Research estimated India's re-commerce market at USD 29.54 billion in 2022, forecasting a yearly growth of 6.15% by 2027.

- Grant Thornton report states that India's refurbished furniture and appliance market, valued at $5.7 billion in 2020, is predicted to reach nearly $9.8 billion by 2025.

- Refurbished electronics market was valued at about US$ 5 billion in March 2021 and is expected to reach US$ 11 billion by March 2026, showing a growth of over 2x in five years, with an annual growth rate of around 17%.

(3) Company's future outlook:

- Company targets a 100% annual growth rate.

- Company believes the second half of the year will outperform the first, and next year will show even more growth.

- Business plans to open 100 franchise stores over the next two years as part of its retail expansion.

- Expanding middle class and increased internet usage create opportunities for re-commerce platforms in India, where customers look for cost-effective alternatives to new products.

- Company plans to enter new regions to expand its customer reach.

- Company is branching out into new product categories such as furniture, IT and telecom, and FMCG goods close to expiry.

- Company targets a 100% annual growth rate.

- Company believes the second half of the year will outperform the first, and next year will show even more growth.

- Business plans to open 100 franchise stores over the next two years as part of its retail expansion.

- Expanding middle class and increased internet usage create opportunities for re-commerce platforms in India, where customers look for cost-effective alternatives to new products.

- Company plans to enter new regions to expand its customer reach.

- Company is branching out into new product categories such as furniture, IT and telecom, and FMCG goods close to expiry.

(7) Preferential allotment:

Company issued 5,98,650 shares at Rs. 535, and now the share price is Rs. 600.

Company issued 5,98,650 shares at Rs. 535, and now the share price is Rs. 600.

(8) Financial Metrics:

■ CMP: 600

■ Mcap: 340 crores

■ TTM PE: 48

■ ROCE: 69%

■ ROE: 75%

■ D/E Ratio: 0.00

■ OPM: 18.89%

■ NPM: 10.5%

■ Promoter holdings: 65%

■ 3 years sales, profit growth: 67% and 374%

■ CMP: 600

■ Mcap: 340 crores

■ TTM PE: 48

■ ROCE: 69%

■ ROE: 75%

■ D/E Ratio: 0.00

■ OPM: 18.89%

■ NPM: 10.5%

■ Promoter holdings: 65%

■ 3 years sales, profit growth: 67% and 374%

(9) Chart overview:

Stock is in a sideways pattern.

Once breakout the upper range, we can expect big move on the upside.

PS: Not a buy/sell recommendation. Please do your own due diligence before investing.

Stock is in a sideways pattern.

Once breakout the upper range, we can expect big move on the upside.

PS: Not a buy/sell recommendation. Please do your own due diligence before investing.

That's a wrap!

If you found this useful:

(1) Follow @rohaninvestor for more such threads.

(2) Bookmark this thread for future.

If you found this useful:

(1) Follow @rohaninvestor for more such threads.

(2) Bookmark this thread for future.

https://x.com/rohaninvestor/status/1877599573948113246

• • •

Missing some Tweet in this thread? You can try to

force a refresh