There are understandably a lot of "DeFai" (AiFi?) skeptics, but I do think there are merits to simplifying DeFi interactions through ai agents.

We all agree that DeFi is amazing - you can trustlessly borrow money, earn yield, and trade assets without needing to go through a middleman.

However, interfacing with DeFi applications right now is often too complex or confusing for the average user (even crypto natives!). It's very unlikely that retail users will buy ETH from a CEX, move their ETH onchain, deposit it into Lido, and take the resulting stETH and deposit that into Aave/Balancer/Yearn/etc to earn bonus yield.

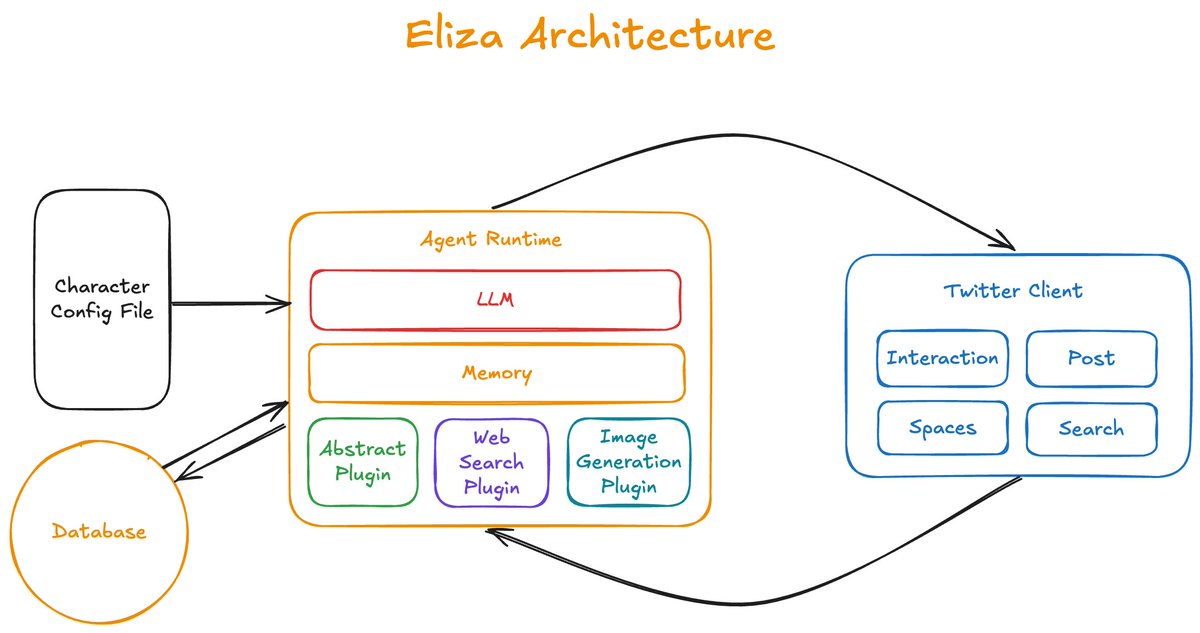

Imagine a world where you can tell an ai agent "find a way to earn 8% yield on my ETH with minimal risk" and it goes an executes everything autonomously behind the scenes. That's much simpler for the user, and they won't have to go through the staking/deposit/transfer process manually.

I think this could be a big unlock for DeFi teams looking to find more reach outside of the current crypto space. Obviously a lot more advancements would need to be made on the agent side, but this could make DeFi accessible to a new cohort of users.

We all agree that DeFi is amazing - you can trustlessly borrow money, earn yield, and trade assets without needing to go through a middleman.

However, interfacing with DeFi applications right now is often too complex or confusing for the average user (even crypto natives!). It's very unlikely that retail users will buy ETH from a CEX, move their ETH onchain, deposit it into Lido, and take the resulting stETH and deposit that into Aave/Balancer/Yearn/etc to earn bonus yield.

Imagine a world where you can tell an ai agent "find a way to earn 8% yield on my ETH with minimal risk" and it goes an executes everything autonomously behind the scenes. That's much simpler for the user, and they won't have to go through the staking/deposit/transfer process manually.

I think this could be a big unlock for DeFi teams looking to find more reach outside of the current crypto space. Obviously a lot more advancements would need to be made on the agent side, but this could make DeFi accessible to a new cohort of users.

I'm not familiar with the current defai projects that are popular, so don't treat this as me calling them legitimate.

I just want to portray a future where I can see agents being useful in the defi space.

I just want to portray a future where I can see agents being useful in the defi space.

• • •

Missing some Tweet in this thread? You can try to

force a refresh