This is why rollups lose btw.

Not just to Solana, but to high performance altDA chains and/or Based rollups.

• MegaETH will cater to the Solana/Hyperliquid UX crowd.

• Based rollups will cater to the Ethereum maxis who want mainnet to scale and their L1 assets to be composable - just with better UX.

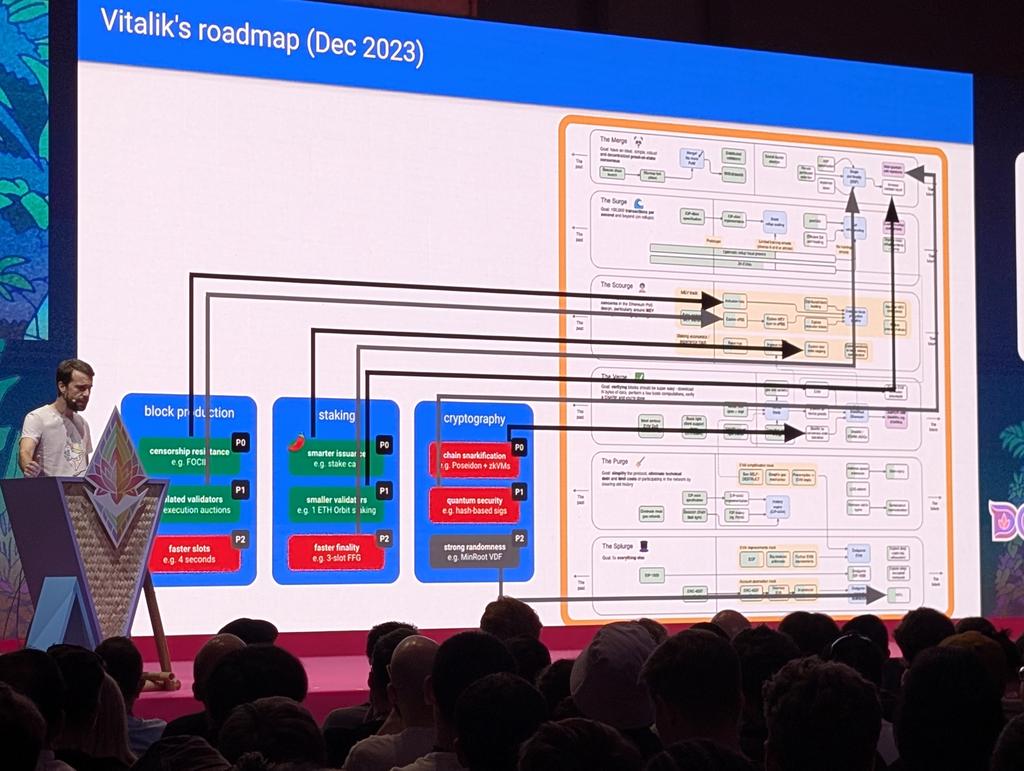

Rollups will forever have their upper bound in performance be capped by Ethereum upgrade iteration speed and I'm exceedingly skeptical they keep up with global demand.

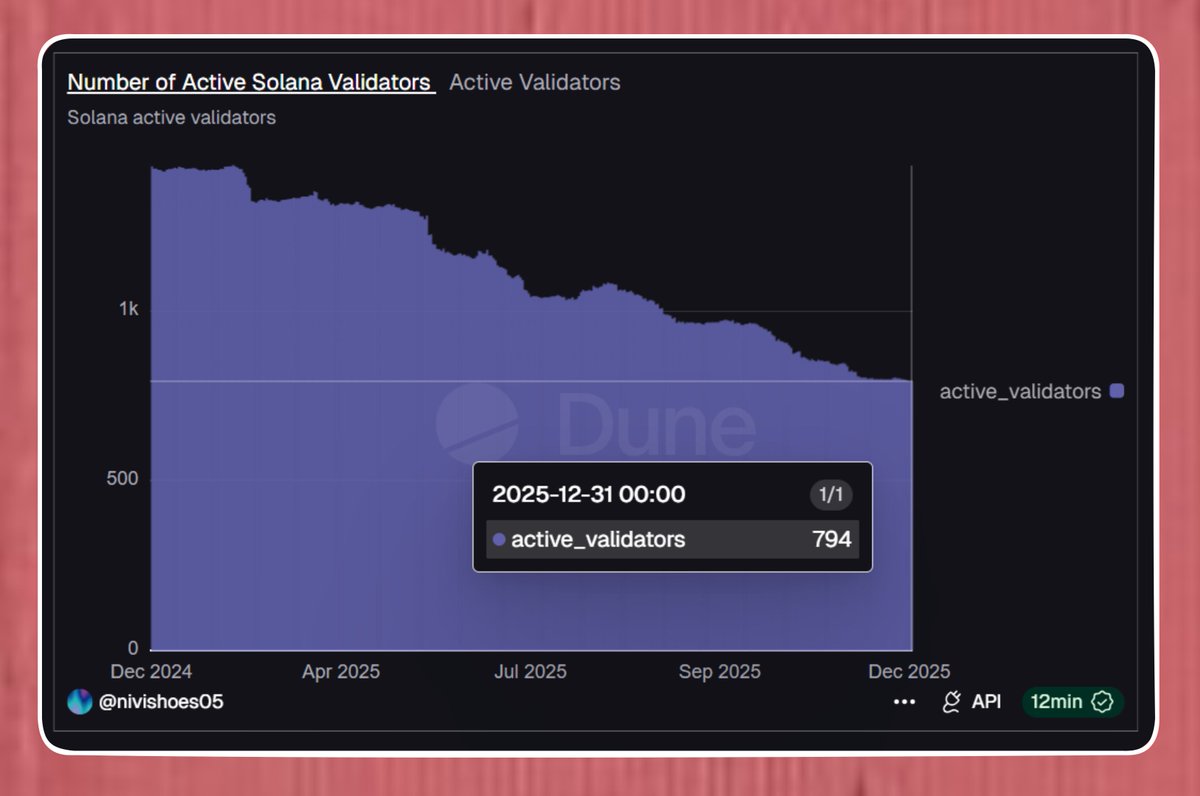

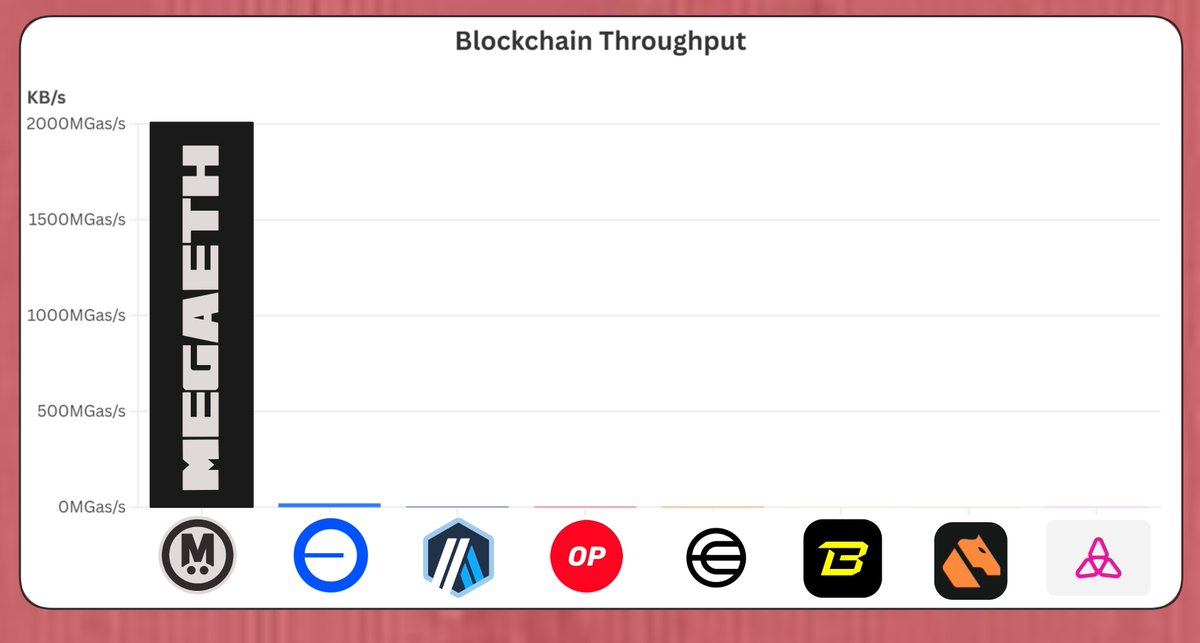

Again; look at these numbers.

THE COMBINATION OF ALL ROLLUPS IN 2027 WILL BE DOING THE SAME TPS AS SOLANA TODAY.

Solana will not stop IBRL'ing between now and then. Hell, they have Firedancer and Async execution in the roadmap for 2025. Even if we push that to 2026 and account for the time it'll take for FD validators to get enough stake that's still literally hundreds of times more performant.

Lol. lmao even.

Additional trust assumptions should not be taken lightly, but MegaETH is coming to do the lifting that ~all of the current top L2s are going to have a very hard time doing without breaking aLiGnMeNt.

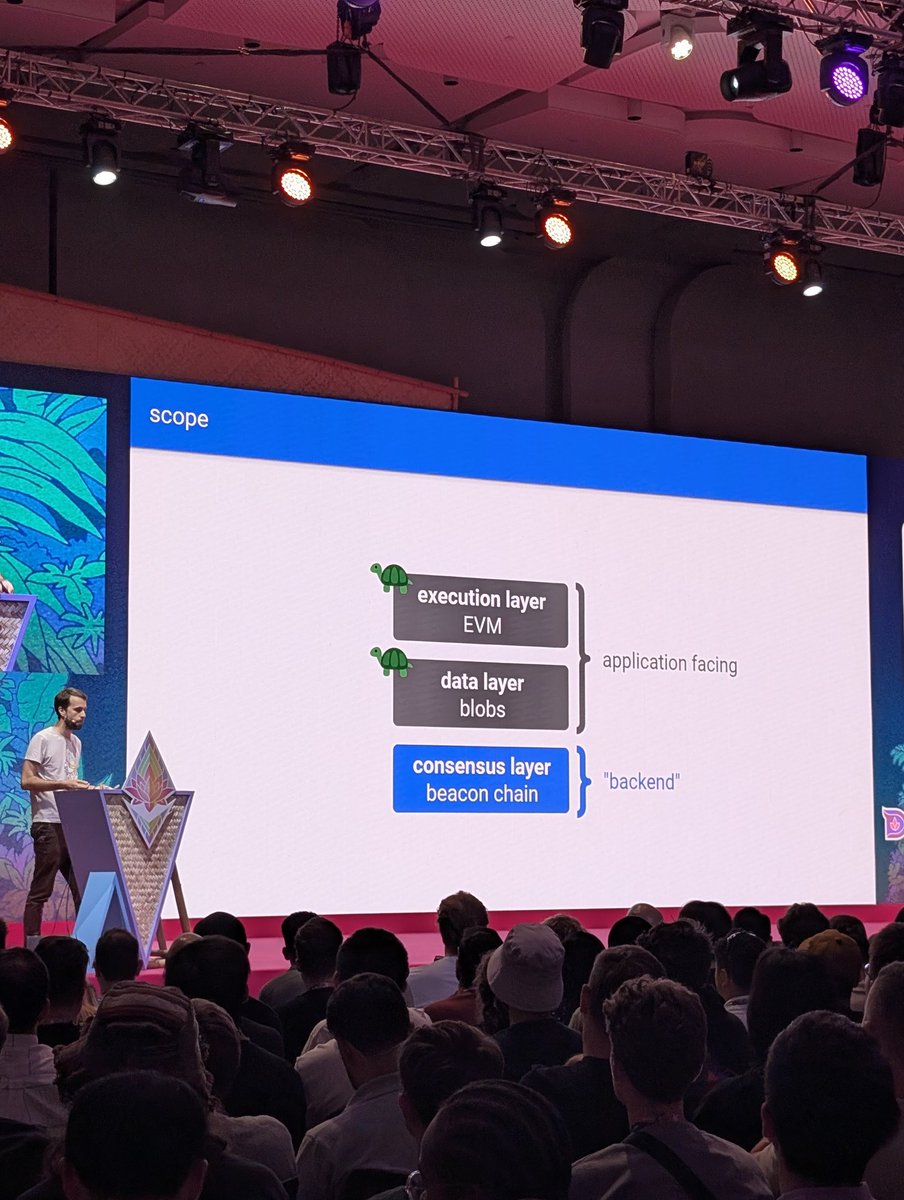

Base is being openly hyper aggressive with their scaling ambitions, opting for a GETH as a new client and pushing their current throughput by 1MGas/s/wk, but it doesn't matter how hard they push because they'll always be capped by Ethereum blobspace.

They will either fall beyond the performance race or break away from Ethereum blobs as DA - there is no two ways about it on this current trajectory.

Again, I remind you of the scale we're talking about here. Our target is to hit mainnet in the not-so-distant future with the ability to handle ~2GGas/s of throughput, and ambitions to scale to double-digits quickly.

Current top capacity L2s on @growthepie_eth, pictured:

Hitting these targets comes with trade-offs, but if Ethereum wants to compete in the high performance arena then this is how it has to be done. At least in any timeframe measured in months.

We're coming bros.

Not just to Solana, but to high performance altDA chains and/or Based rollups.

• MegaETH will cater to the Solana/Hyperliquid UX crowd.

• Based rollups will cater to the Ethereum maxis who want mainnet to scale and their L1 assets to be composable - just with better UX.

Rollups will forever have their upper bound in performance be capped by Ethereum upgrade iteration speed and I'm exceedingly skeptical they keep up with global demand.

Again; look at these numbers.

THE COMBINATION OF ALL ROLLUPS IN 2027 WILL BE DOING THE SAME TPS AS SOLANA TODAY.

Solana will not stop IBRL'ing between now and then. Hell, they have Firedancer and Async execution in the roadmap for 2025. Even if we push that to 2026 and account for the time it'll take for FD validators to get enough stake that's still literally hundreds of times more performant.

Lol. lmao even.

Additional trust assumptions should not be taken lightly, but MegaETH is coming to do the lifting that ~all of the current top L2s are going to have a very hard time doing without breaking aLiGnMeNt.

Base is being openly hyper aggressive with their scaling ambitions, opting for a GETH as a new client and pushing their current throughput by 1MGas/s/wk, but it doesn't matter how hard they push because they'll always be capped by Ethereum blobspace.

They will either fall beyond the performance race or break away from Ethereum blobs as DA - there is no two ways about it on this current trajectory.

Again, I remind you of the scale we're talking about here. Our target is to hit mainnet in the not-so-distant future with the ability to handle ~2GGas/s of throughput, and ambitions to scale to double-digits quickly.

Current top capacity L2s on @growthepie_eth, pictured:

Hitting these targets comes with trade-offs, but if Ethereum wants to compete in the high performance arena then this is how it has to be done. At least in any timeframe measured in months.

We're coming bros.

• • •

Missing some Tweet in this thread? You can try to

force a refresh