Congrats @JupiterExchange for 50% of fees to buyback $JUP.

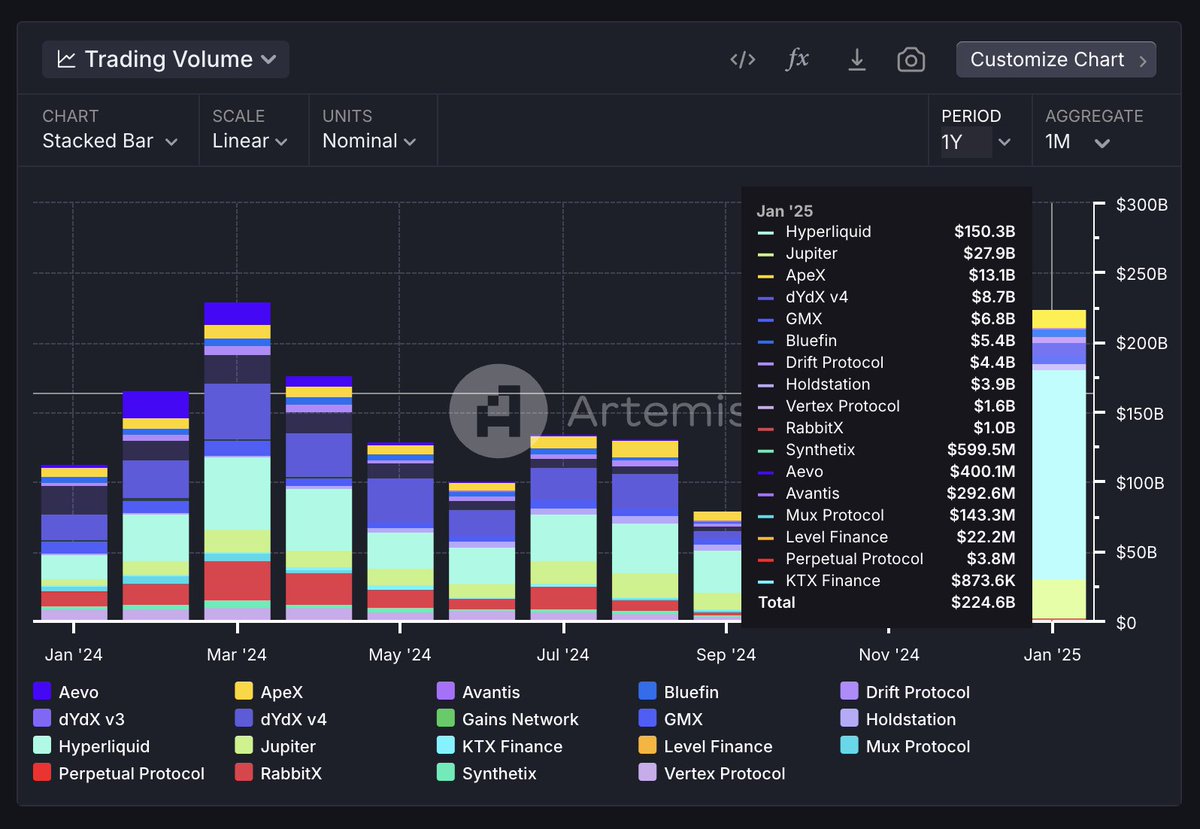

We see on Artemis there's ~$80B of aggregator volume + ~$20B of perp volume per month = ~$100B monthly total volume on Jupiter.

$100B monthly volume * 0.1% * 50% is roughly $600m of annualized buyback.

At $2.4B of circulating marketcap that's roughly 25% of marketcap.

Impressive.

We see on Artemis there's ~$80B of aggregator volume + ~$20B of perp volume per month = ~$100B monthly total volume on Jupiter.

$100B monthly volume * 0.1% * 50% is roughly $600m of annualized buyback.

At $2.4B of circulating marketcap that's roughly 25% of marketcap.

Impressive.

• • •

Missing some Tweet in this thread? You can try to

force a refresh