THIS COULD GET WORSE!

A lot of people on my timeline believe that the @deepseek_ai issue could be confined to traditional markets - THEY ARE WRONG!

Let me break it down for you.

🧵

A lot of people on my timeline believe that the @deepseek_ai issue could be confined to traditional markets - THEY ARE WRONG!

Let me break it down for you.

🧵

Deepseek is a Chinese AI that can compete with the likes of OPENAI, META, CLAUDE and the others.

However instead of costing billion of $$ to develop it allegedly cost $5,5m.

The model also requires a fraction of the computation to run and train.

Whilst this is a great breakthrough and will make AI faster and more affordable, there is an issue

However instead of costing billion of $$ to develop it allegedly cost $5,5m.

The model also requires a fraction of the computation to run and train.

Whilst this is a great breakthrough and will make AI faster and more affordable, there is an issue

The majority of the gains in the US markets were created by AI returns and by the expected profitability of these companies.

As an example, NVDA is priced full as the major provider of all the hardware and infrastructure..

As an example, NVDA is priced full as the major provider of all the hardware and infrastructure..

The issue now is that we may not need it as much and therefore the current price is not justified and needs to come down.

So how will this spread to crypto?

The largest wealth creator in the last 24 months has been the tech market and the AI stocks.

They have created Trillions of dollars of paper wealth.

This wealth has allowed people to move higher up the risk curve and into crypto.

If these stocks take a hit, people will lose fortunes and this could crash all risk markets as people scramble out of risk.

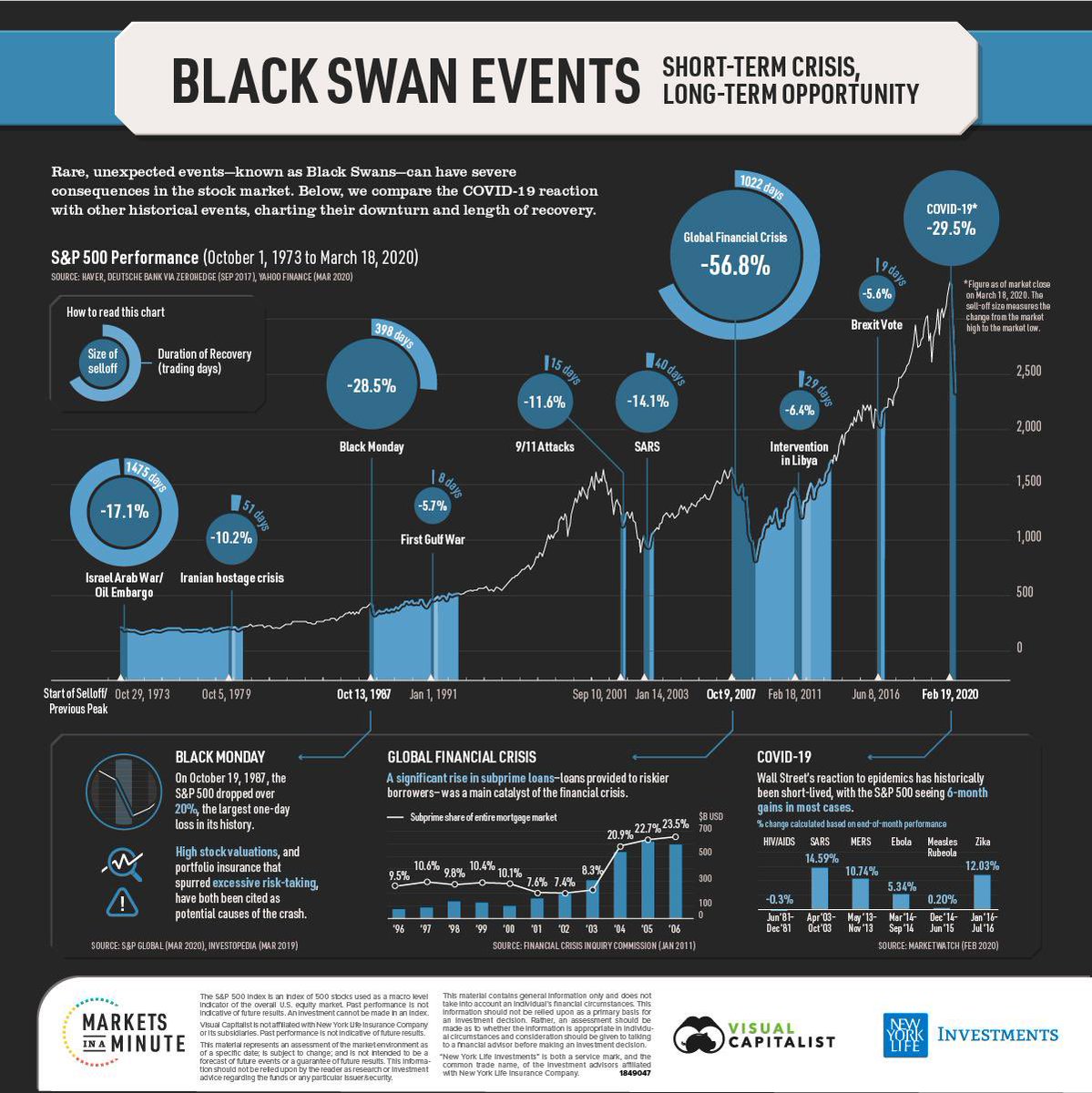

Make no mistake , this could be a black swan. It’s completely unexpected and caught everyone by surprise.

The magnitude is also huge.

The largest wealth creator in the last 24 months has been the tech market and the AI stocks.

They have created Trillions of dollars of paper wealth.

This wealth has allowed people to move higher up the risk curve and into crypto.

If these stocks take a hit, people will lose fortunes and this could crash all risk markets as people scramble out of risk.

Make no mistake , this could be a black swan. It’s completely unexpected and caught everyone by surprise.

The magnitude is also huge.

So what happens next?

The market needs to properly evaluate this tech and the implications.

It could also be trickery by the Chinese as we know they are so good at.

If it is a black swan, it may be the reason governments are eventually forced to print money again.

The market needs to properly evaluate this tech and the implications.

It could also be trickery by the Chinese as we know they are so good at.

If it is a black swan, it may be the reason governments are eventually forced to print money again.

https://twitter.com/cryptohayes/status/1883682062647038370

Either way I expect it to get worse before it gets better. Hold on tight. Make sure you’re holding quality!!!!

This is a potential repricing event and is actually great for economies in the long term….

This is a potential repricing event and is actually great for economies in the long term….

I don’t normally write long threads because of my ADD. If you enjoyed it, please like and share….

• • •

Missing some Tweet in this thread? You can try to

force a refresh