We are witnessing the unwind of the WW2 economic order.

What's happening now is much bigger than tariffs. For nearly 80 years the US exported dollars while importing goods & debt. That system is failing.

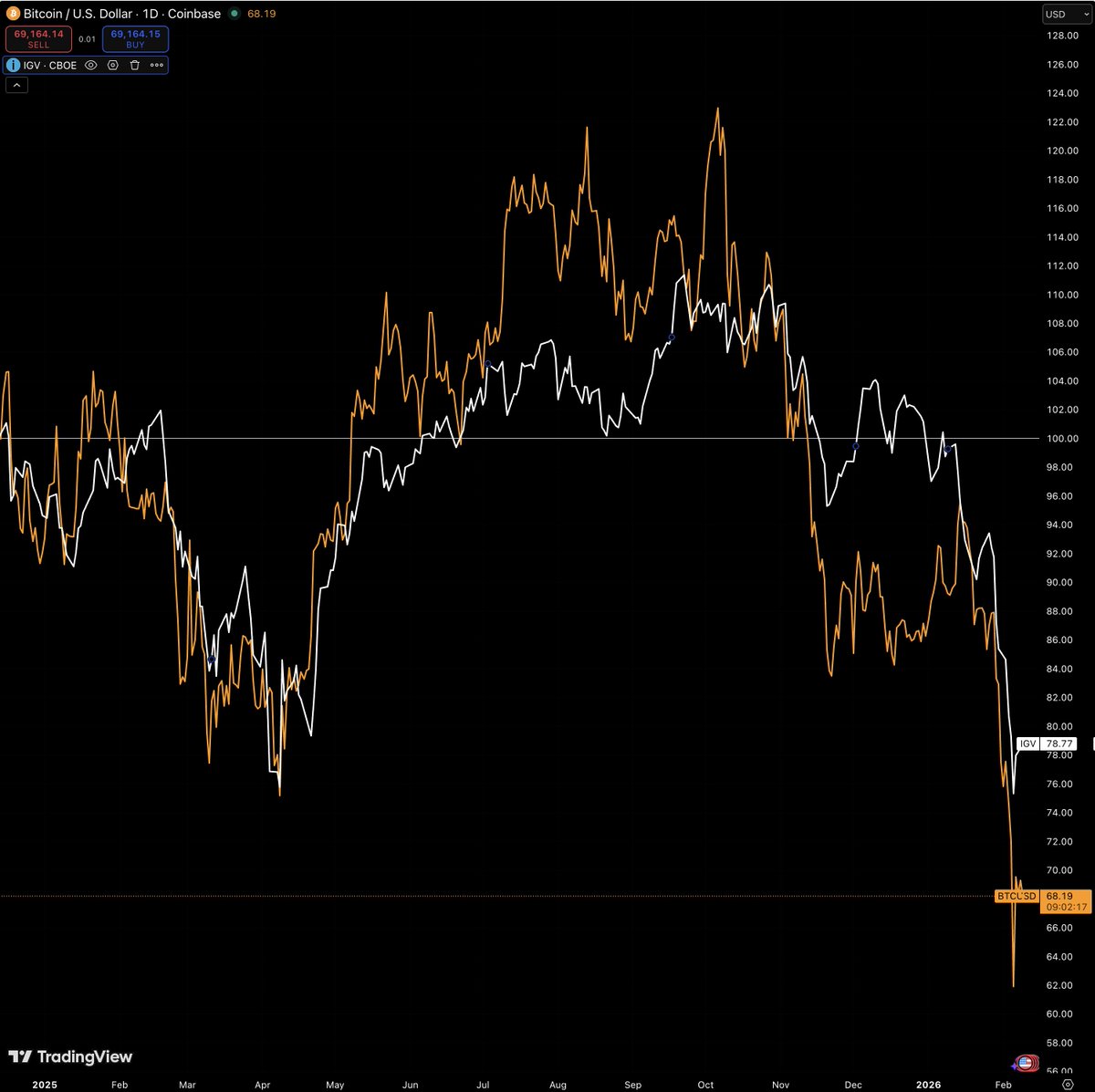

What's next? A move back to a neutral reserve currency. Got #Bitcoin?

What's happening now is much bigger than tariffs. For nearly 80 years the US exported dollars while importing goods & debt. That system is failing.

What's next? A move back to a neutral reserve currency. Got #Bitcoin?

After WW2, the world was decimated.

The US was the only industrial power left standing. Europe and Japan were in ruins. The world needed to rebuild, and the US took the lead.

How? The US funded global reconstruction with efforts like the Marshall Plan and Bretton Woods.

The US was the only industrial power left standing. Europe and Japan were in ruins. The world needed to rebuild, and the US took the lead.

How? The US funded global reconstruction with efforts like the Marshall Plan and Bretton Woods.

The idea was simple:

The US would buy foreign goods, run trade deficits, send dollars abroad, and let other countries produce stuff.

In return, other countries would use the dollar as the global reserve currency, accumulating US debt as their savings.

In essence: the world gets dollars, the US gets goods.

The US would buy foreign goods, run trade deficits, send dollars abroad, and let other countries produce stuff.

In return, other countries would use the dollar as the global reserve currency, accumulating US debt as their savings.

In essence: the world gets dollars, the US gets goods.

This system did what it was supposed to do and fueled decades of global growth. Japan, Germany, South Korea, and eventually China all industrialized by producing goods for Americans.

The US kept printing dollars, and the world kept accepting them (because they sort of had no other choice).

The US kept printing dollars, and the world kept accepting them (because they sort of had no other choice).

The issue was this wasn't sustainable. Printing pieces of paper and not doing any real work couldn't last forever. No way! Who would've thought?

The US was sending dollars out while manufacturing left the country.

Over time, the US became a consumer, not a producer.

The US was sending dollars out while manufacturing left the country.

Over time, the US became a consumer, not a producer.

In summary, the problem is the US can’t run permanent trade deficits forever.

The US deindustrialized itself. Manufacturing jobs gone. Middle class crushed. Meanwhile, China rose by taking over global production.

All the while, the US racked up $35+ trillion in debt, and other nations began to question the system.

Why hold US debt as reserves while USD loses value?

The US deindustrialized itself. Manufacturing jobs gone. Middle class crushed. Meanwhile, China rose by taking over global production.

All the while, the US racked up $35+ trillion in debt, and other nations began to question the system.

Why hold US debt as reserves while USD loses value?

This is where the Triffin Dilemma comes in.

If the US dollar is the global reserve, the US must run deficits to supply the world with dollars. But doing this hollows out the domestic economy, forcing the US to import more than it exports.

The global demand for dollars keeps the dollar artificially strong, making US goods less competitive and pushing manufacturing overseas.

It’s a trap. And finally, it is failing.

If the US dollar is the global reserve, the US must run deficits to supply the world with dollars. But doing this hollows out the domestic economy, forcing the US to import more than it exports.

The global demand for dollars keeps the dollar artificially strong, making US goods less competitive and pushing manufacturing overseas.

It’s a trap. And finally, it is failing.

This is why the US needs to re-shore production and weaken the dollar.

If the US wants to bring back manufacturing, it needs to make American production competitive again. That means two things:

1) Tariffs: Force companies to stop offshoring production.

2) A weaker dollar: Make US exports cheaper and more attractive.

This is exactly what Trump and this new administration is pushing for.

If the US wants to bring back manufacturing, it needs to make American production competitive again. That means two things:

1) Tariffs: Force companies to stop offshoring production.

2) A weaker dollar: Make US exports cheaper and more attractive.

This is exactly what Trump and this new administration is pushing for.

You see, tariffs are not just about trade, they're part of a larger strategy to shift the US economic model. A weaker dollar makes US exports more competitive and also helps inflate away its debt.

However, one problem Trump has run into is Jerome Powell. The US Government doesn't control the US dollar, a private bank does.

The Fed isn't cutting rates fast enough for Trump to keep his campaign promises and execute his plan.

This is where Trump’s battle with the Fed begins.

However, one problem Trump has run into is Jerome Powell. The US Government doesn't control the US dollar, a private bank does.

The Fed isn't cutting rates fast enough for Trump to keep his campaign promises and execute his plan.

This is where Trump’s battle with the Fed begins.

Trump needs lower rates because it benefits real estate, debtors, and economic growth.

But Powell has been keeping rates higher for longer, slowing the economy, and fighting inflation. Trump can’t get his weaker dollar until Powell cuts rates aggressively.

So how does Trump force Powell’s hand?

But Powell has been keeping rates higher for longer, slowing the economy, and fighting inflation. Trump can’t get his weaker dollar until Powell cuts rates aggressively.

So how does Trump force Powell’s hand?

If the Fed won’t cut voluntarily, Trump will create conditions where they don't have a choice.

By pushing tariffs and other economic pressure, Trump can manufacture a mini financial crisis if Powell doesn't play along. He'll have to act. All of this came right after Powell spoke on Wednesday, by the way. Coincidence? I think not.

The Fed doesn’t want the death of Pax Americana, so eventually, they’ll cave and cut rates. That’s when the dollar weakens, and the real devaluation begins.

Trump knows this by the way. He mentioned the short term pain being worth it last night. This is what we are living through as I'm typing out this tweet storm.

By pushing tariffs and other economic pressure, Trump can manufacture a mini financial crisis if Powell doesn't play along. He'll have to act. All of this came right after Powell spoke on Wednesday, by the way. Coincidence? I think not.

The Fed doesn’t want the death of Pax Americana, so eventually, they’ll cave and cut rates. That’s when the dollar weakens, and the real devaluation begins.

Trump knows this by the way. He mentioned the short term pain being worth it last night. This is what we are living through as I'm typing out this tweet storm.

At the same time, it's no secret the rest of the world is moving away from the dollar.

China, Russia, and even Saudi Arabia no longer want to rely on USD for trade. The BRICS nations are exploring alternatives. Countries are selling US Treasuries and reducing their dollar reserves.

This means we’re heading back to a neutral reserve currency system, one way or another.

#Bitcoin 😉

China, Russia, and even Saudi Arabia no longer want to rely on USD for trade. The BRICS nations are exploring alternatives. Countries are selling US Treasuries and reducing their dollar reserves.

This means we’re heading back to a neutral reserve currency system, one way or another.

#Bitcoin 😉

Historically, global reserve currencies were neutral assets, like gold under the Bretton Woods system.

The problem? In today's digital economy of 8 billion people, Gold requires trust to work. Gold cannot achieve transaction finality without a trusted intermediary. For that reason, it has centralized and is easy to manipulate.

x.com/jackmallers/st…

The problem? In today's digital economy of 8 billion people, Gold requires trust to work. Gold cannot achieve transaction finality without a trusted intermediary. For that reason, it has centralized and is easy to manipulate.

x.com/jackmallers/st…

Zoom out. We're watching the global monetary order reset in real-time:

- The WW2 economic model is breaking down

- The US is reshoring & weakening the dollar

- The world is de-dollarizing

- The Fed will be forced to cut rates

- The US will inflate away its debt

#Bitcoin is will absorb the shift. This isn’t just another trade war, it’s a global monetary realignment.

- The WW2 economic model is breaking down

- The US is reshoring & weakening the dollar

- The world is de-dollarizing

- The Fed will be forced to cut rates

- The US will inflate away its debt

#Bitcoin is will absorb the shift. This isn’t just another trade war, it’s a global monetary realignment.

People think tariffs are just about trade, or that the Fed will hold rates forever to "fight inflation". They don’t understand how deep this shift really is.

The post-WW2 economic system is dead. The US is reindustrializing. The dollar is going lower.

For the first time in human history, we the people have engineered a monetary system accessible to all that protects us. Bitcoin will be the biggest winner in this new era.

Buy the dip. Long live Satoshi. Long live #Bitcoin

The post-WW2 economic system is dead. The US is reindustrializing. The dollar is going lower.

For the first time in human history, we the people have engineered a monetary system accessible to all that protects us. Bitcoin will be the biggest winner in this new era.

Buy the dip. Long live Satoshi. Long live #Bitcoin

Going live now to break this down and answer questions:

• • •

Missing some Tweet in this thread? You can try to

force a refresh