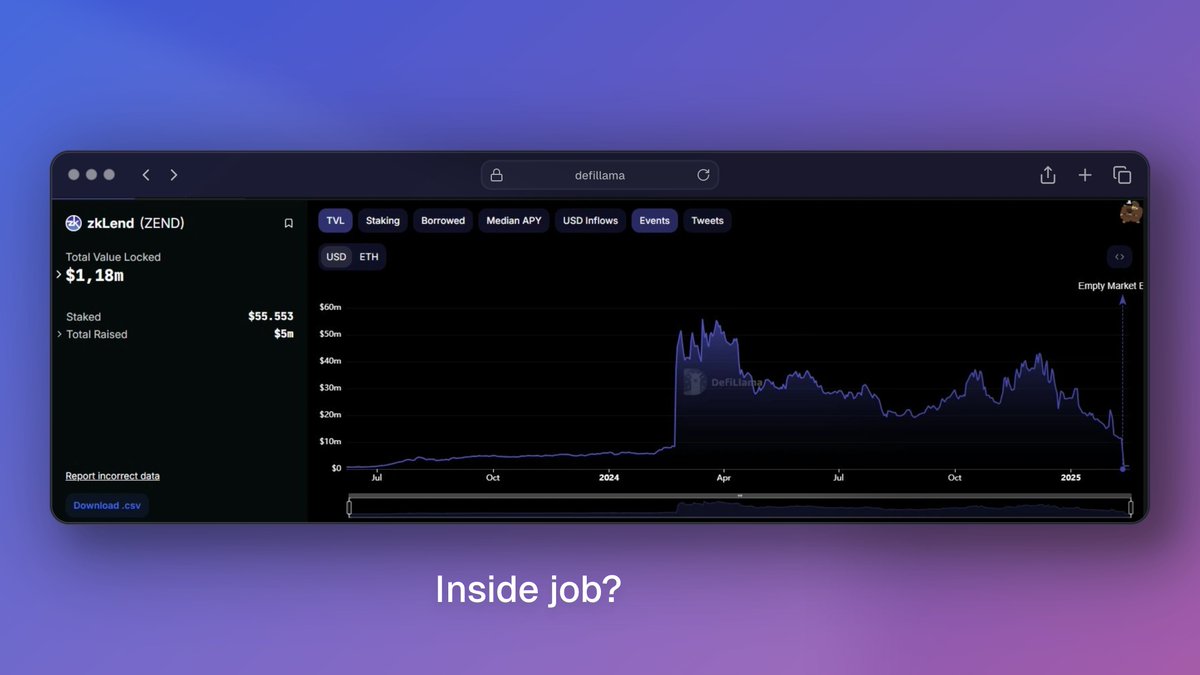

The @zkLend exploit/hack which resulted in over $9M stolen is alleged to be in connection with @LinearFinance and @Athos_Finance.

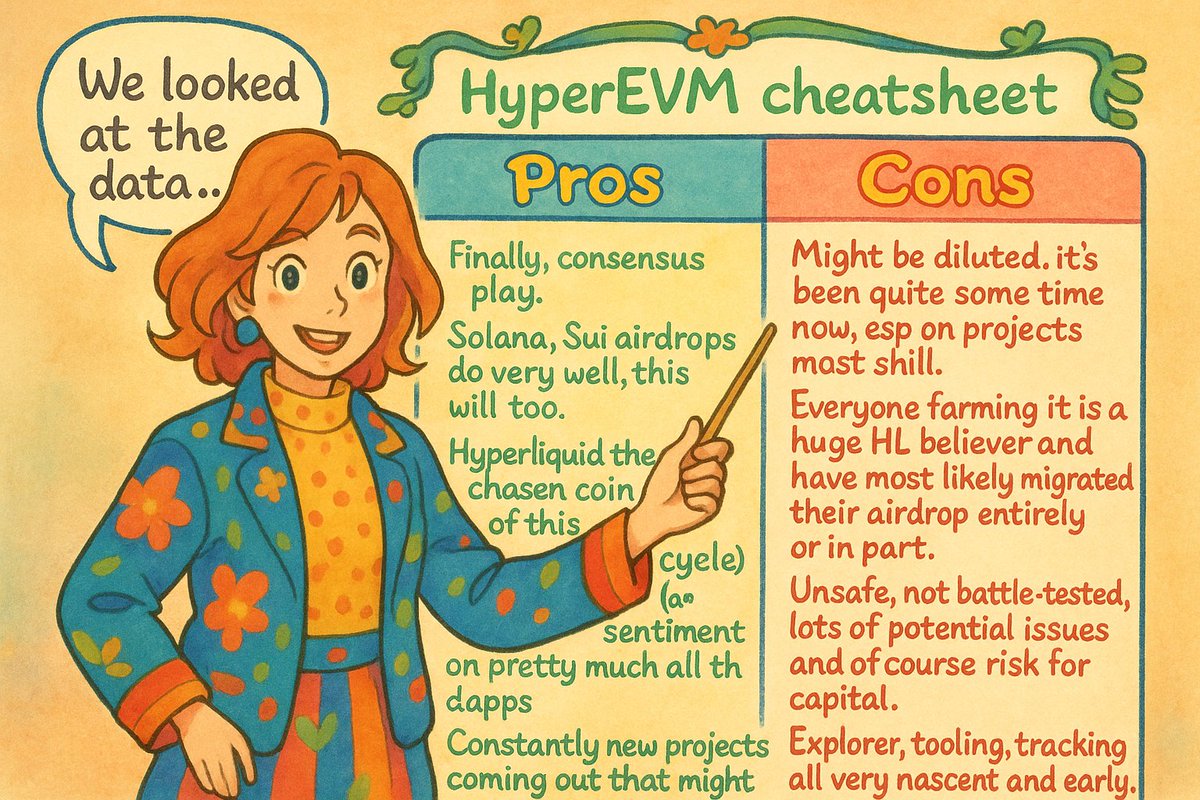

That's what the Chinese are saying on the grapevine, given the recently surfaced data and scrubbing 👇🧵

That's what the Chinese are saying on the grapevine, given the recently surfaced data and scrubbing 👇🧵

First brought to attention by the Chinese on-chain sleuth @bigcockfuckass, the connection is rather simple.

https://x.com/bigcockfuckass/status/1889528269541618168

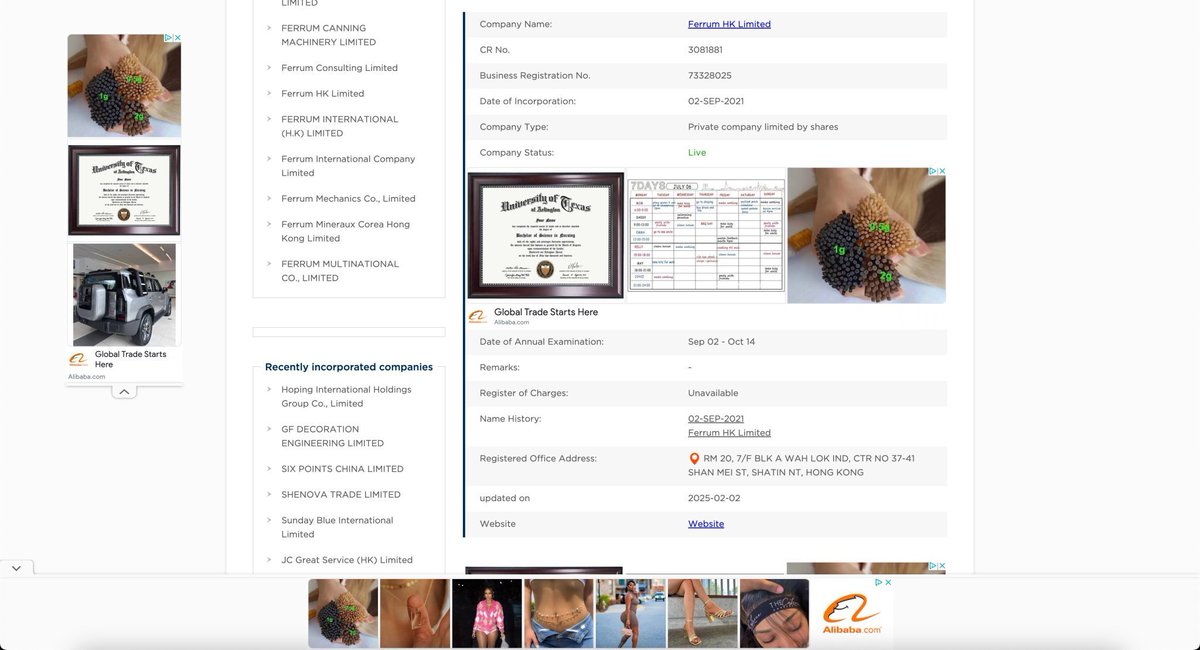

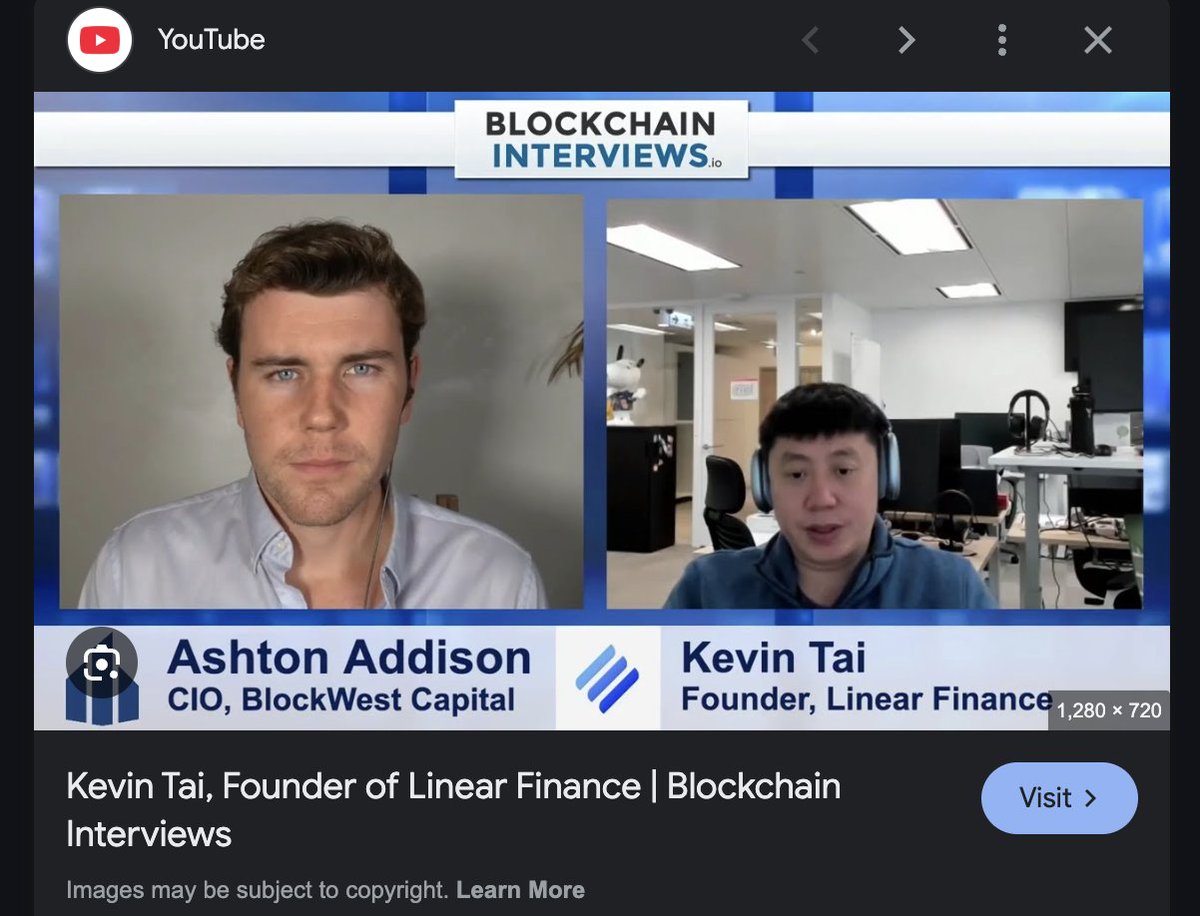

They assert that the same company people under the shell company named Ferrum HK Limited was behind @LinearFinance (a HK team/project which was once very popular on BSC back in the day), and also @zkLend.

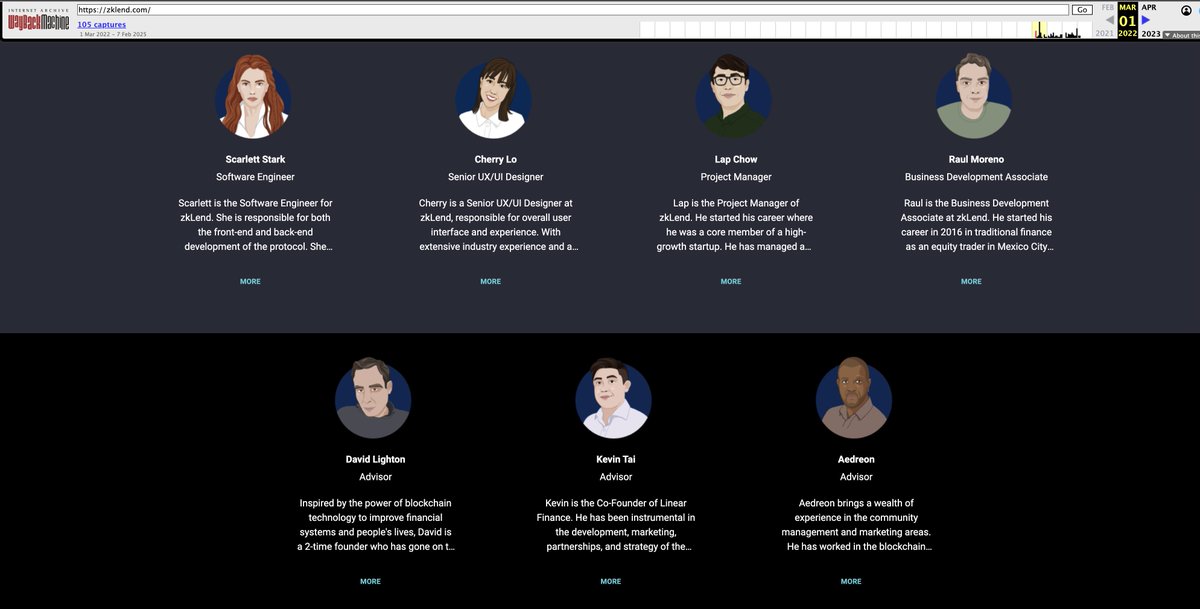

In this old 2022 WebArchive, we see that Kevin Tai (CEO of Linear, $LINA) was once listed as an advisor to the project.

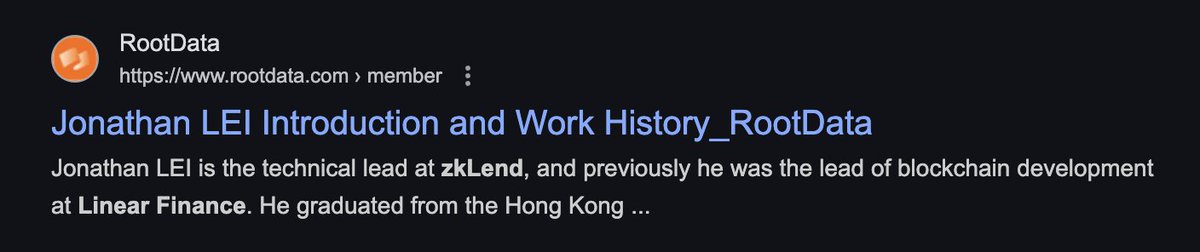

Not only that, but there's similarities in the dev team too, by googling the words "zklend" and "linear finance", an overlap exists here too - by the name of Jonathan Lei.

Source: web.archive.org/web/2022030110…

Not only that, but there's similarities in the dev team too, by googling the words "zklend" and "linear finance", an overlap exists here too - by the name of Jonathan Lei.

Source: web.archive.org/web/2022030110…

Of course, this is nothing too big or too upsetting, there's not a lot of talent in crypto and a lot of them indeed have multiple jobs at once.

But..as @bigcockfuckass says:

"jonathan lei, kevin tai , jane ma , brian fu 4 co founders share many other rug projects"

Big coincidence?

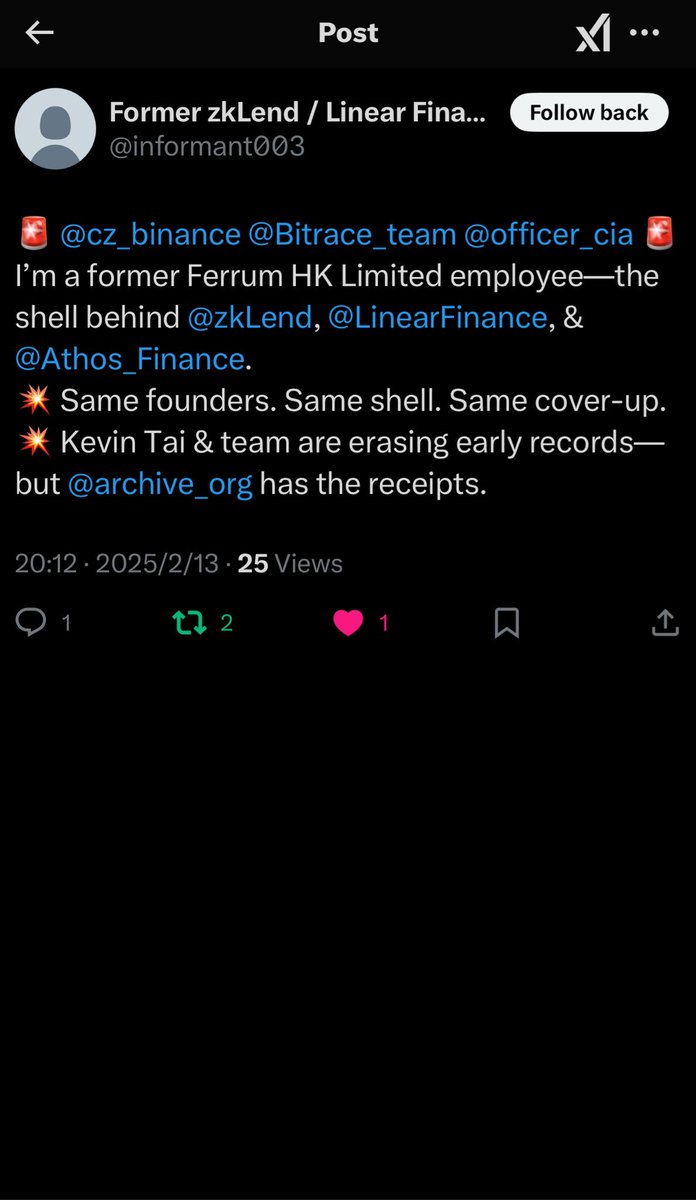

There's now also an informant/insider talking about the scrubbing of this information from the public domain, post-exploit?

The account going by the name of @informant003 alleges this.

But..as @bigcockfuckass says:

"jonathan lei, kevin tai , jane ma , brian fu 4 co founders share many other rug projects"

Big coincidence?

There's now also an informant/insider talking about the scrubbing of this information from the public domain, post-exploit?

The account going by the name of @informant003 alleges this.

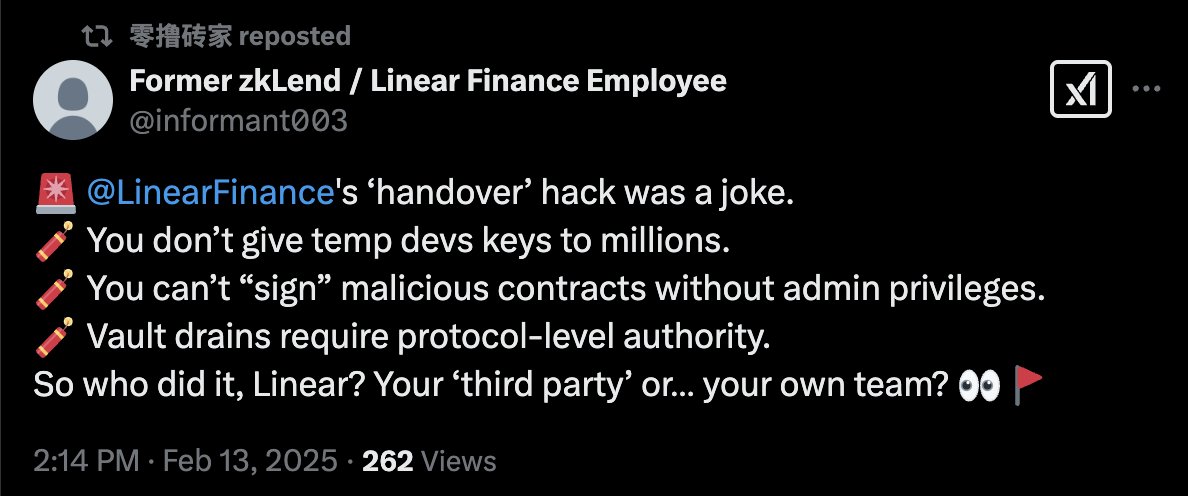

The whistleblower account addresses similarities between the 2023 Linear exploit too, albeit that one was much smaller in scope: 250k USD or so, give or take.

binance.com/sl/square/post…

binance.com/sl/square/post…

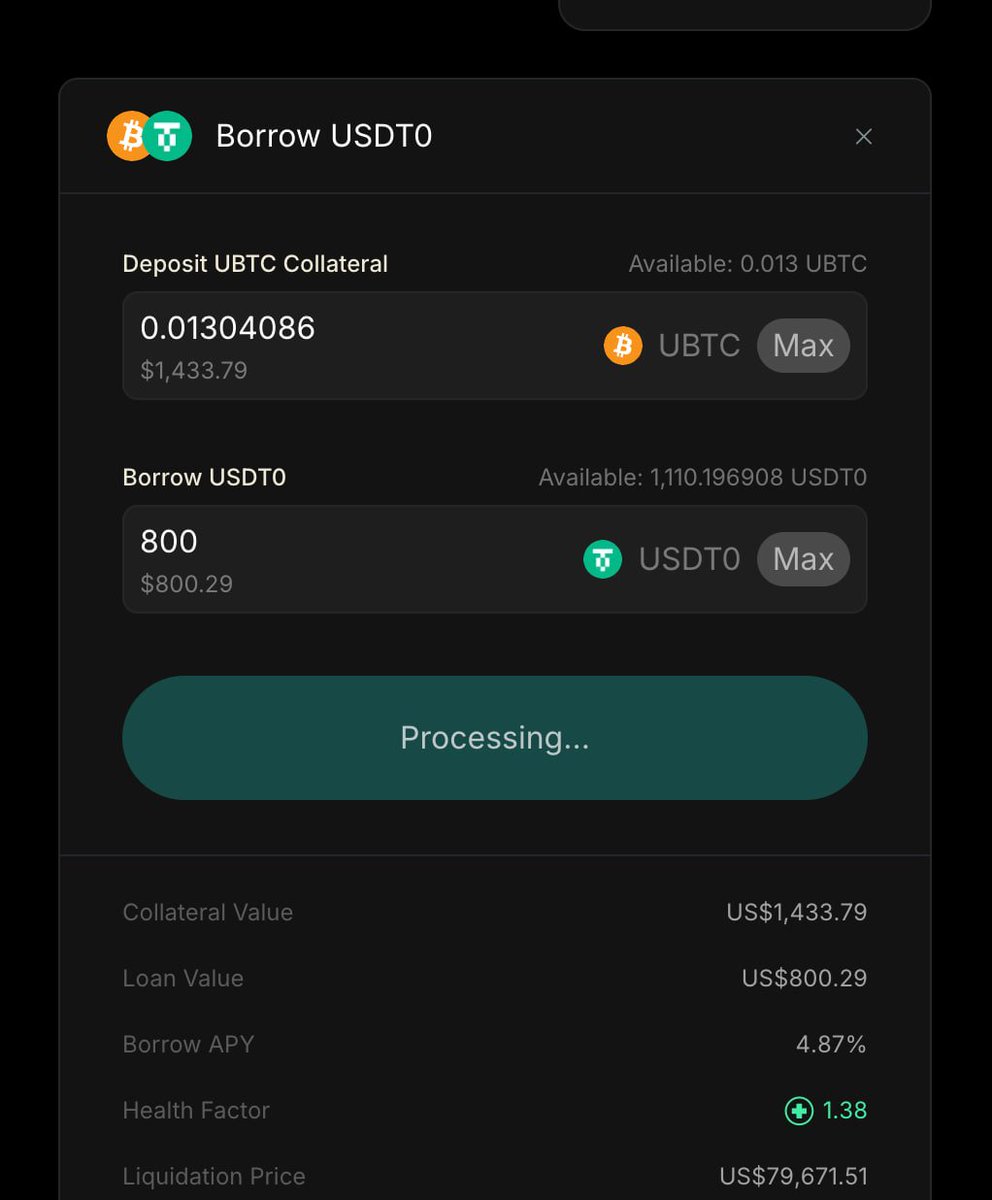

The credence to this being orchestrated at best or just gross negligence at best comes from this screenshot too - the CMs/admins telling people everything is normal when indeed things weren't normal.

Even if this were indeed just 3rd world CMs on a weekend, the fact that @Starknet has not stepped in any way to save their #1 protocol tells you all that you need to know.

Even if this were indeed just 3rd world CMs on a weekend, the fact that @Starknet has not stepped in any way to save their #1 protocol tells you all that you need to know.

This is very sad, as a lot of people have lost money and put their trust into @StarknetFndn to do due diligence, especially on their #1 protocol.

This is the same as if AAVE or Kamino on Solana got hacked, and shows the negligence of the Starknet officials (as if a -95% governance token wasn't enough..)

Some have already reported on this rug and how stupid it is to not have the foundation do anything, rightfully so.

x.com/ruggedpikachu/…

This is the same as if AAVE or Kamino on Solana got hacked, and shows the negligence of the Starknet officials (as if a -95% governance token wasn't enough..)

Some have already reported on this rug and how stupid it is to not have the foundation do anything, rightfully so.

x.com/ruggedpikachu/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh