1/ What are the effects of SIMD 96 one week after going live?

- SOL inflation is up

- Token holder net income is down

- Median priority fees remain unchanged

Let's dive into the data 🧵

- SOL inflation is up

- Token holder net income is down

- Median priority fees remain unchanged

Let's dive into the data 🧵

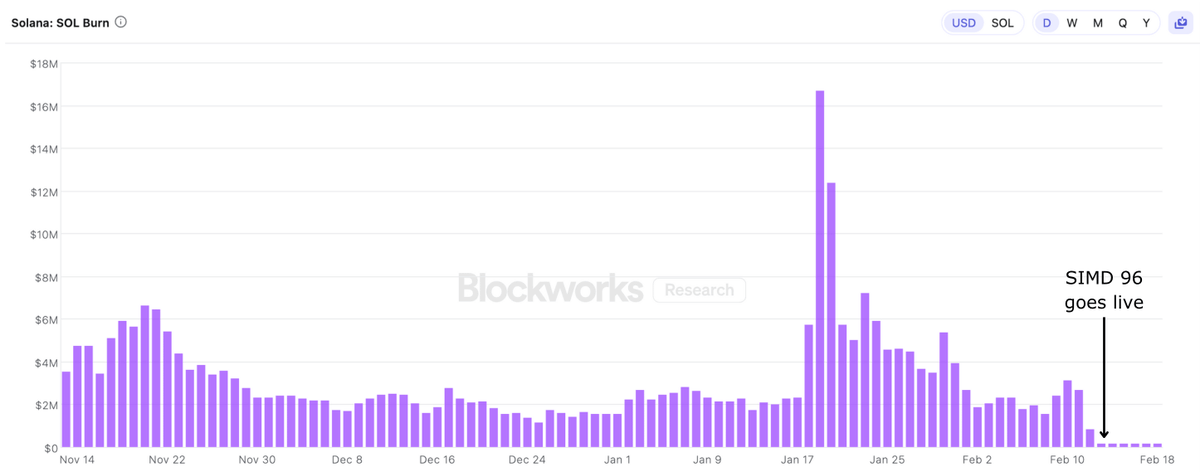

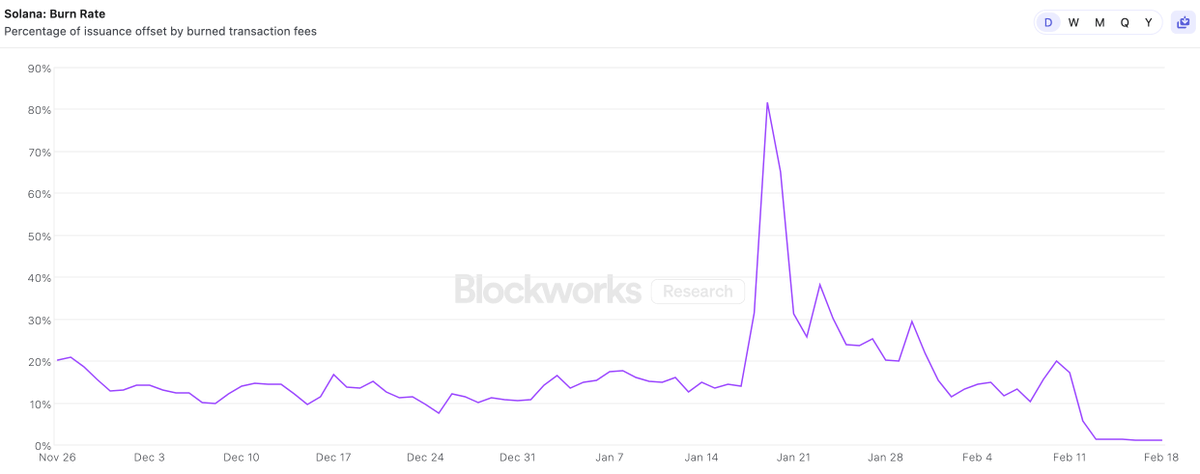

2/ SOL burn rate is now ~1%.

In the 30 days prior to the activation of SIMD 96:

- 76,500 SOL issued daily

- 17,700 SOL burned daily

- Annualized Inflation = 3.6%

Since the activation of SIMD 96:

- 77,650 SOL issued daily

- 1,000 SOL burned daily

- Annualized Inflation = 4.7%❗️

All eyes should be on SIMD 228 now, which seeks to reform SOL's inflation mechanism from a fixed emission schedule to a dynamic rate based on a target staking ratio.

In the 30 days prior to the activation of SIMD 96:

- 76,500 SOL issued daily

- 17,700 SOL burned daily

- Annualized Inflation = 3.6%

Since the activation of SIMD 96:

- 77,650 SOL issued daily

- 1,000 SOL burned daily

- Annualized Inflation = 4.7%❗️

All eyes should be on SIMD 228 now, which seeks to reform SOL's inflation mechanism from a fixed emission schedule to a dynamic rate based on a target staking ratio.

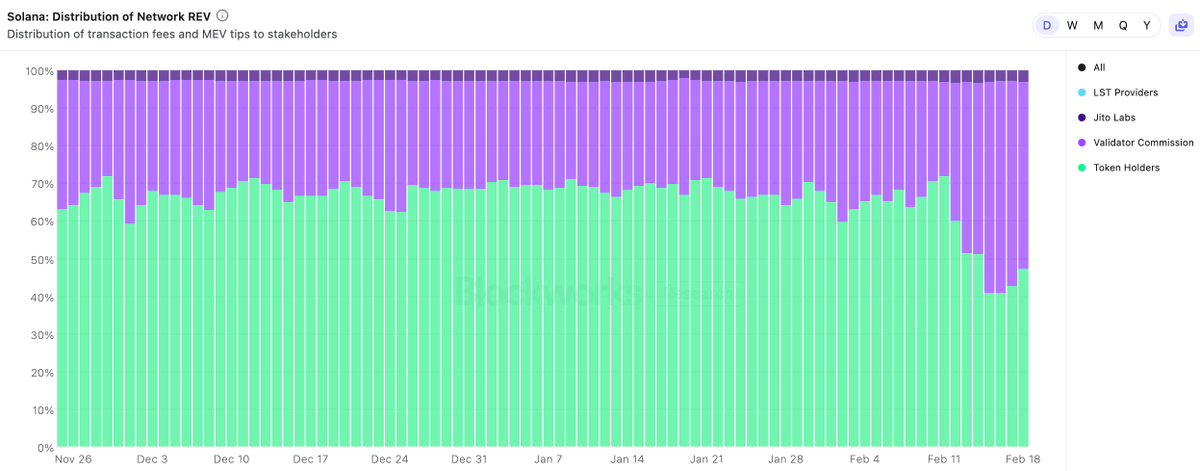

3/ The chart below shows the distribution of network REV (fees and tips to stakeholders).

In the 30 days prior to the activation of SIMD 96:

- Token Holders: 67%

- Validators: 30%

Since the activation of SIMD 96:

- Token Holders: 46%

- Validators: 51%❗️

In the coming weeks, validators will hopefully start using Jito's TipRouter to distribute priority fees to stakers. Notably, SIMD 123 would create an in-protocol solution to share priority fees with stakers natively, but this development is likely months away.

In the 30 days prior to the activation of SIMD 96:

- Token Holders: 67%

- Validators: 30%

Since the activation of SIMD 96:

- Token Holders: 46%

- Validators: 51%❗️

In the coming weeks, validators will hopefully start using Jito's TipRouter to distribute priority fees to stakers. Notably, SIMD 123 would create an in-protocol solution to share priority fees with stakers natively, but this development is likely months away.

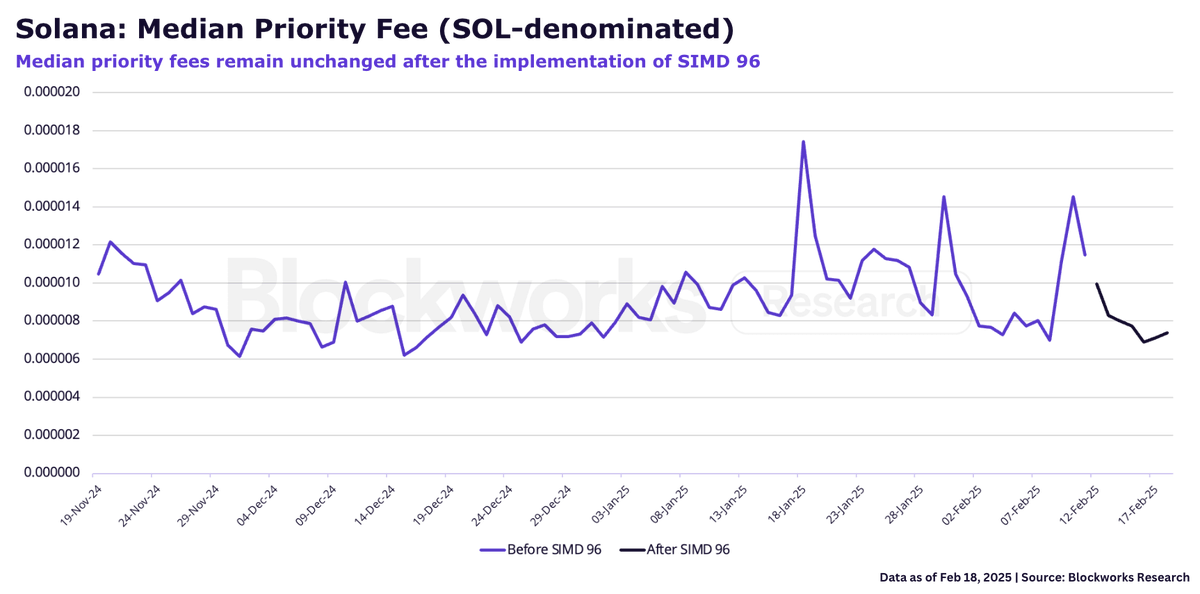

4/ Some people, including me, argued that SIMD 96 could lead to a reduction in priority fees.

That hasn't been the case. Aside from spikes caused by recent volatility events (TRUMP, LIBRA), the median priority fee remains flat in SOL terms.

Could this change going forward?

That hasn't been the case. Aside from spikes caused by recent volatility events (TRUMP, LIBRA), the median priority fee remains flat in SOL terms.

Could this change going forward?

5/ End of thread. All data from @blockworksres :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh