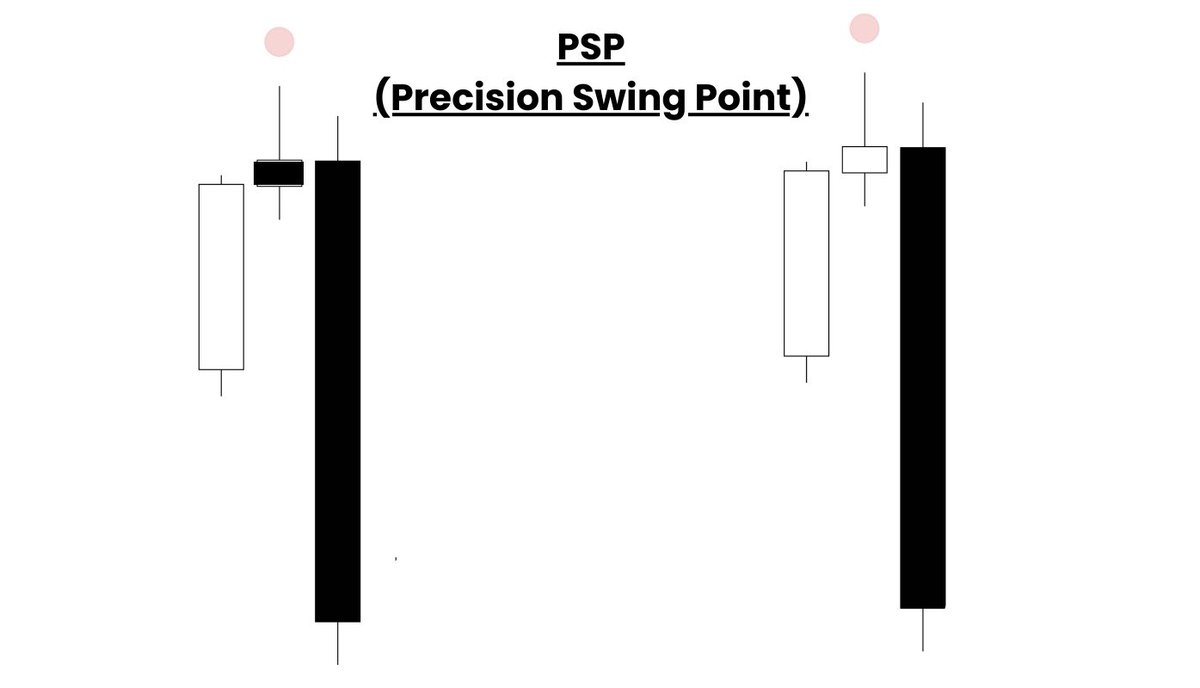

What is a PSP?

A PSP (Precision Swing Point) is the formation of a classic swing point, as you all know it. However “candle 2” (the candle that forms the swing point) closes differently among closely correlated assets.

For example:

Bullish closure on NQ

Bearish closure on ES

A PSP (Precision Swing Point) is the formation of a classic swing point, as you all know it. However “candle 2” (the candle that forms the swing point) closes differently among closely correlated assets.

For example:

Bullish closure on NQ

Bearish closure on ES

How can we use a PSP?

PSPs can be used in multiple ways:

- Reversals

- Continuation

- Consolidation

I will explain how you can use them in each of these conditions.

PSPs can be used in multiple ways:

- Reversals

- Continuation

- Consolidation

I will explain how you can use them in each of these conditions.

(Reversal PSP)

When looking for a reversal PSP, you first want to see a SSMT form. Once the SSMT is in place, you then wait for the PSP to form, either on the candle that forms the SSMT or a few candles afterwards.

When looking for a reversal PSP, you first want to see a SSMT form. Once the SSMT is in place, you then wait for the PSP to form, either on the candle that forms the SSMT or a few candles afterwards.

(Continuation PSP)

To find a continuation PSP, first identify the current order flow and directional bias. Then, wait for a PSP to form and treat it like an order block. Look for LTF cracks inside the HTF PSP for a continuation of price.

To find a continuation PSP, first identify the current order flow and directional bias. Then, wait for a PSP to form and treat it like an order block. Look for LTF cracks inside the HTF PSP for a continuation of price.

(Consolidation PSP)

In order to identify if price is low probability and most likely in a consolidation, you’re looking for multiple PSPs to form back to back.

You will experience the cleanest moves from singular PSPs, not lots of them back to back.

In order to identify if price is low probability and most likely in a consolidation, you’re looking for multiple PSPs to form back to back.

You will experience the cleanest moves from singular PSPs, not lots of them back to back.

How to enter after a PSP has formed?

There are multiple ways to enter after a PSP forms:

-Enter immediately after candle 3 closes, with your stop on the PSP candle.

- Treat the PSP like an OB, wait for price to trade into it, and find a LTF entry inside the PSP.

There are multiple ways to enter after a PSP forms:

-Enter immediately after candle 3 closes, with your stop on the PSP candle.

- Treat the PSP like an OB, wait for price to trade into it, and find a LTF entry inside the PSP.

How to identity a high probability PSP?

The highest probability PSPs will have a LTF PSP inside of them.

For example if we see a 1H PSP form, we want to see a 15M PSP inside of the hourly PSP.

This is how we can anticipate a PSP to form before they actually do.

The highest probability PSPs will have a LTF PSP inside of them.

For example if we see a 1H PSP form, we want to see a 15M PSP inside of the hourly PSP.

This is how we can anticipate a PSP to form before they actually do.

If you found this thread helpful & took value from it, i’d really appreciate a like & retweet!

Also if you are interested in seeing more of these Quarterly Theory threads, comment down below. 👇

Join the discord: discord.gg/4KnsD9KmNy

My socials: linktr.ee/buckotrades

Also if you are interested in seeing more of these Quarterly Theory threads, comment down below. 👇

Join the discord: discord.gg/4KnsD9KmNy

My socials: linktr.ee/buckotrades

• • •

Missing some Tweet in this thread? You can try to

force a refresh