What is SMT-Fill?

For a SMT-Fill you need to be viewing closely correlated assets, they then both need to form a gap at exactly the same time. You then want to see one asset trade into the gap, and have the other closely correlated asset fail to trade into the gap.

For a SMT-Fill you need to be viewing closely correlated assets, they then both need to form a gap at exactly the same time. You then want to see one asset trade into the gap, and have the other closely correlated asset fail to trade into the gap.

Different variations of an SMT-Fill.

There are a couple more variations of an SMT-Fill that can occur, here they both are:

- One asset trades above 50% of the gap, one asset below 50%.

- One asset fills the gap completely, one asset fails to fill the gap completely.

There are a couple more variations of an SMT-Fill that can occur, here they both are:

- One asset trades above 50% of the gap, one asset below 50%.

- One asset fills the gap completely, one asset fails to fill the gap completely.

What are the best scenarios to use an SMT-Fill?

There are two ways in which you can utilise an SMT-Fill:

- Entries

- HTF analysis

There are two ways in which you can utilise an SMT-Fill:

- Entries

- HTF analysis

SMT-Fill entries (1)

Before looking for an SMT-Fill entry, there first needs to be context behind the trade idea.

I personally like to wait for a SSMT to occur, I then wait on gap to form after the SSMT, followed by a SMT-Fill entry within the gap.

Before looking for an SMT-Fill entry, there first needs to be context behind the trade idea.

I personally like to wait for a SSMT to occur, I then wait on gap to form after the SSMT, followed by a SMT-Fill entry within the gap.

SMT-Fill entries (2)

Another way in which you can utilise a SMT-Fill entry without using a SSMT, is by having a strong, obvious DOL, once you have identified that you’re then trying to catch the OHLC/OLHC of a candle.

Another way in which you can utilise a SMT-Fill entry without using a SSMT, is by having a strong, obvious DOL, once you have identified that you’re then trying to catch the OHLC/OLHC of a candle.

For example if you’re expecting a bearish hourly candle, you would then want to see the candle open up high, form a 5M SMT-Fill, then trade lower from there.

SMT-Fill HTF Analysis.

The way you can utilise SMT-Fill for your analysis is by looking at a HTF gap that is there on at least two closely correlated assets, you then want to see a SMT-Fill occur within the gap, followed by another LTF cic after the HTF SMT-Fill.

The way you can utilise SMT-Fill for your analysis is by looking at a HTF gap that is there on at least two closely correlated assets, you then want to see a SMT-Fill occur within the gap, followed by another LTF cic after the HTF SMT-Fill.

For example:

- 4H SMT-Fill

- Daily Cycle SSMT

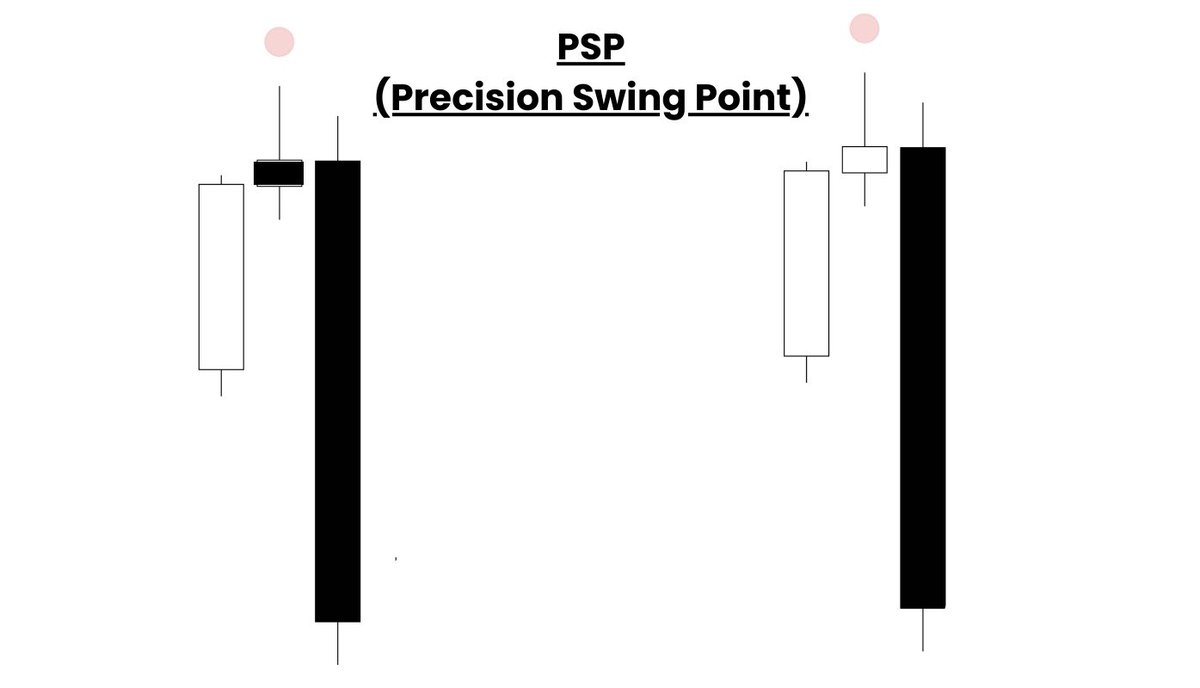

- 1H / 15M PSP

or

- 1D SMT-Fill

- Weekly Cycle SSMT

- 4H / 1H PSP.

- 4H SMT-Fill

- Daily Cycle SSMT

- 1H / 15M PSP

or

- 1D SMT-Fill

- Weekly Cycle SSMT

- 4H / 1H PSP.

If you found this thread helpful & took value from it, i’d really appreciate a like & retweet!

Also if you are interested in seeing more of these Quarterly Theory threads, comment down below. 👇

Join the discord: discord.gg/4KnsD9KmNy

My socials: linktr.ee/buckotrades

Also if you are interested in seeing more of these Quarterly Theory threads, comment down below. 👇

Join the discord: discord.gg/4KnsD9KmNy

My socials: linktr.ee/buckotrades

• • •

Missing some Tweet in this thread? You can try to

force a refresh