I tried using orbs

I tried Supply and Demand.

I even tried using Elliott Waves.

but trading did not click for me until I started studying the greats and noticed a pattern...

Below you can steal the exact strategy that makes me 50/k month:🧵

I tried Supply and Demand.

I even tried using Elliott Waves.

but trading did not click for me until I started studying the greats and noticed a pattern...

Below you can steal the exact strategy that makes me 50/k month:🧵

To start off, we have to understand the point of this strategy..

The goal is to simplify trading and look for repeatable patterns to trade

We want to take advantage of strong market trends & use the leverage of options for a low risk high reward approach

Using big momentum swings in the markets we can catch the biggest moves to either side

The goal is to simplify trading and look for repeatable patterns to trade

We want to take advantage of strong market trends & use the leverage of options for a low risk high reward approach

Using big momentum swings in the markets we can catch the biggest moves to either side

studying some of the best traders I noticed that instead of day trading and taking small time frame setups... they waited for the markets to become primed for a big move

1. Finding market strength and weakness

The easiest way to figure out the trend of the markets is to use EMA's

Pull up a chart on tradingview.com

and add the 8, 21, 50 EMA's

EMA's can be used as a momentum gauge for when the markets are weaker and will push lower and when markets are strong and stocks will follow through higher

The easiest way to figure out the trend of the markets is to use EMA's

Pull up a chart on tradingview.com

and add the 8, 21, 50 EMA's

EMA's can be used as a momentum gauge for when the markets are weaker and will push lower and when markets are strong and stocks will follow through higher

2. Framework

Now that we have the EMA's on the chart, we can make some rules for when we want to be active in the markets.

Use $SPY / $QQQ

1) Whenever $SPY / $QQQ are above the 8/21/50 EMA's, we want to be long with full size/conviction

2) Whenever $SPY / $QQQ are below the 8/21/50 EMA's, we want to trade stocks to the downside

We can also use this on the individual names we are trading to narrow down our criteria.

Now that we have the EMA's on the chart, we can make some rules for when we want to be active in the markets.

Use $SPY / $QQQ

1) Whenever $SPY / $QQQ are above the 8/21/50 EMA's, we want to be long with full size/conviction

2) Whenever $SPY / $QQQ are below the 8/21/50 EMA's, we want to trade stocks to the downside

We can also use this on the individual names we are trading to narrow down our criteria.

once we establish which way the market is trending, we can start to scan for the strongest stocks(in an uptrend) or the weakest stocks (in a downtrend)

we can see the market is now below the moving averages, so we want to look for the weakest stocks in the market that are leading weakness lower.

we can see the market is now below the moving averages, so we want to look for the weakest stocks in the market that are leading weakness lower.

3. Scanning for leading stocks

Easiest way to scan for weakness leaders is to use: tradingview.com

Click on screener(bottom left)

We want to narrow it down to search for liquid stocks that are leading the market lower on volume

Here are the parameters I use in my scan:

Price: Over $3

Market cap: Over $300m+

Volume: Over 500k

Relative volume: Over 1

Change: below 0

And most importantly, the 8,21,50 EMA's above price to find weakness leaders

Easiest way to scan for weakness leaders is to use: tradingview.com

Click on screener(bottom left)

We want to narrow it down to search for liquid stocks that are leading the market lower on volume

Here are the parameters I use in my scan:

Price: Over $3

Market cap: Over $300m+

Volume: Over 500k

Relative volume: Over 1

Change: below 0

And most importantly, the 8,21,50 EMA's above price to find weakness leaders

Now we have a list of the weakest stocks in the market

Sort the list by volume highest

What I love about this scan is that you only get about 200-300 stocks so you can narrow it down to the leaders pretty quickly

Sort the list by volume highest

What I love about this scan is that you only get about 200-300 stocks so you can narrow it down to the leaders pretty quickly

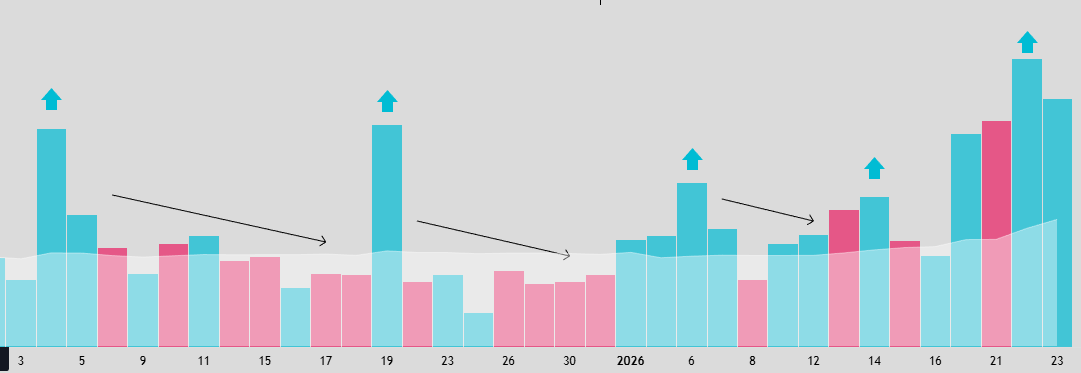

4. Setup

You are now looking for a chart that is setting up in a tight base with a tight pattern forming

The goal is to find names that are either just breaking down or about to breakdown out of tight bases

Use this checklist

1. Tight pattern or base

2. distribution volume patterns

3. consolidating near the lows

Below are some examples of setups I look for

You are now looking for a chart that is setting up in a tight base with a tight pattern forming

The goal is to find names that are either just breaking down or about to breakdown out of tight bases

Use this checklist

1. Tight pattern or base

2. distribution volume patterns

3. consolidating near the lows

Below are some examples of setups I look for

The goal is to scan through all these stocks and look for setups that match our criteria

we want to find 4-5 of the best looking setups and create something called a focus list:

a focus list is a more in depth watchlist consisting of a few of the best looking charts in the market.

by focusing on only a few of the best setups in the markets we can stop ourselves from overtrading and focus on executing our plan.

we want to find 4-5 of the best looking setups and create something called a focus list:

a focus list is a more in depth watchlist consisting of a few of the best looking charts in the market.

by focusing on only a few of the best setups in the markets we can stop ourselves from overtrading and focus on executing our plan.

A name that caught my attention on my scan: $ENPH

The stock is breaking down out of a big base

Weakness leader in weak sector solar

volume decreasing in consolidation and increasing on the breakdown

The stock is breaking down out of a big base

Weakness leader in weak sector solar

volume decreasing in consolidation and increasing on the breakdown

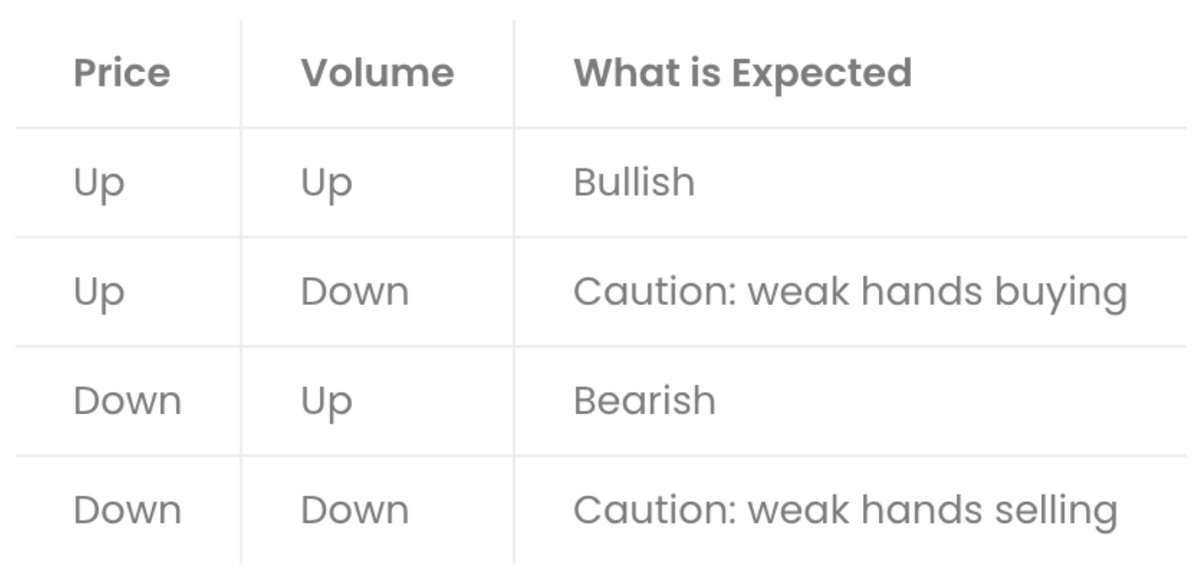

5. Entry

The easiest way to enter is to find a trigger level for the breakout

What i look for is the high or low of the base to break that will trigger a big move

In this example, you can see the $58.5 price level has held multiple times

If price breaks under that level, then we can assume a daily breakdown will occur

We want to confirm the breakout with lots of volume

The easiest way to enter is to find a trigger level for the breakout

What i look for is the high or low of the base to break that will trigger a big move

In this example, you can see the $58.5 price level has held multiple times

If price breaks under that level, then we can assume a daily breakdown will occur

We want to confirm the breakout with lots of volume

Entry is taken on a break below the trigger

For confirmation, we want to see high volume on a break out of the base.

For example $MSTR recent base breakdown:

-Weak sector

-breaking down out of a big base

Enter puts at the break below the the trigger level

For confirmation, we want to see high volume on a break out of the base.

For example $MSTR recent base breakdown:

-Weak sector

-breaking down out of a big base

Enter puts at the break below the the trigger level

Stop loss is placed at the high of the daily candle that broke trigger

to make sure that we manage our risk in case of a failed breakout

to make sure that we manage our risk in case of a failed breakout

7. Targets

Take profits at previous support levels

My scale out strategy is 25% of the position at a time and moving up stop to break even after first trim.

after third trim you leave runners with a trailing stop If markets aren't following through, I trim 50% on the first target.

Take profits at previous support levels

My scale out strategy is 25% of the position at a time and moving up stop to break even after first trim.

after third trim you leave runners with a trailing stop If markets aren't following through, I trim 50% on the first target.

This sets you up for a huge r/r trade

for breakouts/breakdowns we do not want the stock to comeback to our entry level

the strongest moves will lockout traders and keep running

this is why my scale strategy works so well to hold winners

for breakouts/breakdowns we do not want the stock to comeback to our entry level

the strongest moves will lockout traders and keep running

this is why my scale strategy works so well to hold winners

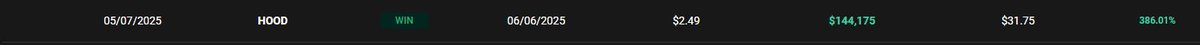

Like any other strategy this is not a holy grail strategy but there's a reason why some of the best traders in the world swing strong names, and buy leading stocks in leading sectors.

I've personally used this strategy to catch huge trades this year:

$MSTR +1000%

$TSLA +500%

$QQQ +500%

I've personally used this strategy to catch huge trades this year:

$MSTR +1000%

$TSLA +500%

$QQQ +500%

I post these setups every night on my twitter with trigger levels, option contracts, and targets.

So you can follow along, and learn the strategy.

If you enjoyed and learned something from this thread LIKE+RT❤️for more trade plans and educational threads.

So you can follow along, and learn the strategy.

If you enjoyed and learned something from this thread LIKE+RT❤️for more trade plans and educational threads.

I also posted a video on this exact strategy on my tiktok: tiktok.com/@sean.rechtman…

• • •

Missing some Tweet in this thread? You can try to

force a refresh