Ive been using volume since I started trading

but just like most I was reading it completely WRONG

learning to to read volume the RIGHT way helped me double my win rate

Below I'll show you exactly how I use it to make 6 figures trading🧵👇

but just like most I was reading it completely WRONG

learning to to read volume the RIGHT way helped me double my win rate

Below I'll show you exactly how I use it to make 6 figures trading🧵👇

Volume is a critical indicator in trading because it provides insight into the strength and conviction behind price movements.

Most importantly volume does not lie, you can see every order that is executed printed in the volume

This creates patterns in the volume just like price

Most importantly volume does not lie, you can see every order that is executed printed in the volume

This creates patterns in the volume just like price

These volume patterns are referred to as VPA(Volume Price Analysis) and we can use them to determine if institutions are accumulating or distributing a position.

as well as the strength of the move and how likely we are to see follow through.

as well as the strength of the move and how likely we are to see follow through.

1. Volume indicator

Any charting platform will have the volume indicator available

volume will indicate how many shares were traded during a specific candle(1m, 5m, 15m, 1d)

I find that volume patterns are best to identify on the bigger time frames like the weekly and daily

since institutors can take weeks and even months to accumulate or distribute

Any charting platform will have the volume indicator available

volume will indicate how many shares were traded during a specific candle(1m, 5m, 15m, 1d)

I find that volume patterns are best to identify on the bigger time frames like the weekly and daily

since institutors can take weeks and even months to accumulate or distribute

i like to add the MA cloud to my volume indicator this way i can easily spot if a stock is trading on higher than average volume

whenever volume shows above the cloud this indicates higher than average volume for the time frame we are on

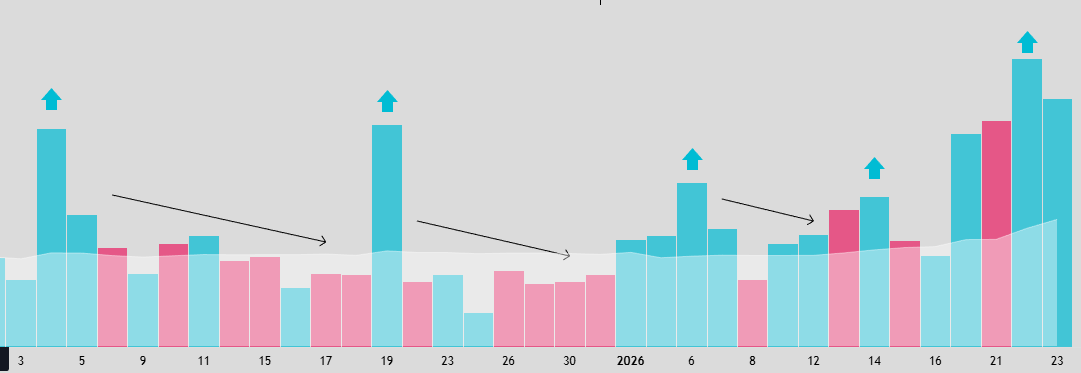

2. Accumulation

accumulation refers to a period of time where institutions begin to add(accumulate) a stock

On this chart we can see that accumulation patterns were taking place

Higher volume as price gets bought up off the lows and lower volume on normal trading days indicating accumulation is happening

Pullbacks most be on low volume

accumulation refers to a period of time where institutions begin to add(accumulate) a stock

On this chart we can see that accumulation patterns were taking place

Higher volume as price gets bought up off the lows and lower volume on normal trading days indicating accumulation is happening

Pullbacks most be on low volume

3. Volume patterns

The strongest volume patterns

should look like this:

-super high volume ignition candle(indicating initial position from institutions)

-low volume pullbacks

-volume returning as price moves in the direction of the trend

The strongest volume patterns

should look like this:

-super high volume ignition candle(indicating initial position from institutions)

-low volume pullbacks

-volume returning as price moves in the direction of the trend

4. Setup

Once you start noticing a stock showing these type of volume patterns

we want to combine price action with volume analysis

When looking for price action patterns

you want to start looking for a range, a base, or any tight consolidation pattern

these can be:

-bullflags

-wedges

-pennants

Once you start noticing a stock showing these type of volume patterns

we want to combine price action with volume analysis

When looking for price action patterns

you want to start looking for a range, a base, or any tight consolidation pattern

these can be:

-bullflags

-wedges

-pennants

5. Entries

The easiest way to enter is to find a trigger level for the breakout

What I look for, is a previous level of resistance that price has rejected multiple times

In this example, you can see the $146 price level has rejected multiple times

If price breaks over that level, then we can assume a daily breakout is likely to occur

We want to confirm the breakout with lots of volume over the trigger level

The easiest way to enter is to find a trigger level for the breakout

What I look for, is a previous level of resistance that price has rejected multiple times

In this example, you can see the $146 price level has rejected multiple times

If price breaks over that level, then we can assume a daily breakout is likely to occur

We want to confirm the breakout with lots of volume over the trigger level

We can use the 5m time frame to confirm our entry.

First 5m close above our level triggers long entry.

Stop loss is placed on the low of the daily candle that broke trigger

to make sure that we manage our risk in case of a failed breakout

First 5m close above our level triggers long entry.

Stop loss is placed on the low of the daily candle that broke trigger

to make sure that we manage our risk in case of a failed breakout

7. Targets

Take profits at previous resistance levels

If price is making new all time highs, use Fibonacci levels to scale out.

My scale out strategy is 25% of the position at a time and moving up stop to break even after first trim

Take profits at previous resistance levels

If price is making new all time highs, use Fibonacci levels to scale out.

My scale out strategy is 25% of the position at a time and moving up stop to break even after first trim

This sets you up for a huge r/r trade

for breakouts we do not want the stock to comeback to our entry level

the strongest stocks will lockout traders and keep running

this is why my scale strategy works so well to hold winners

for breakouts we do not want the stock to comeback to our entry level

the strongest stocks will lockout traders and keep running

this is why my scale strategy works so well to hold winners

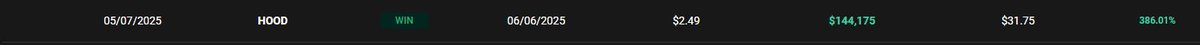

Like any other strategy this is not a holy grail strategy but there's a reason why some of the best traders in the world swing strong stocks with great volume patterns

volume tells all

I've personally used this strategy to catch:

huge winners over the last 4 years:

$SMCI $200-$1000

$NVDA $50-$100+

$MSTR $150-$450

$TSLA $270-$480

volume tells all

I've personally used this strategy to catch:

huge winners over the last 4 years:

$SMCI $200-$1000

$NVDA $50-$100+

$MSTR $150-$450

$TSLA $270-$480

I post these setups every night on my twitter with trigger levels, option contracts, and targets.

So you can follow along, and learn the strategy.

If you enjoyed and learned something from this thread LIKE+RT❤️

for more trade plans and educational threads.

So you can follow along, and learn the strategy.

If you enjoyed and learned something from this thread LIKE+RT❤️

for more trade plans and educational threads.

I also made a short video breaking this strategy down on Instagram:

this should help to visualize it: instagram.com/reel/DHOu3v5Rz…

this should help to visualize it: instagram.com/reel/DHOu3v5Rz…

• • •

Missing some Tweet in this thread? You can try to

force a refresh