🚨

Here's a thread about ALUMINIUM.

Why this commonplace metal is actually pretty extraordinary.

How the process of making it is a modern miracle...

... which also teaches you some profound lessons about the trade war being waged by Donald Trump. And why it might be doomed.

🧵

Here's a thread about ALUMINIUM.

Why this commonplace metal is actually pretty extraordinary.

How the process of making it is a modern miracle...

... which also teaches you some profound lessons about the trade war being waged by Donald Trump. And why it might be doomed.

🧵

Aluminium is totally amazing.

It's strong but also very light, as metals go.

Essentially rust proof, highly electrically conductive. It is one of the foundations of modern civilisation.

No aluminium: no planes, no electricity grids.

A very different world.

It's strong but also very light, as metals go.

Essentially rust proof, highly electrically conductive. It is one of the foundations of modern civilisation.

No aluminium: no planes, no electricity grids.

A very different world.

Yet, commonplace as it is today, up until the 19th century no one had even set eyes on aluminium. Unlike most other major metals we didn't work out how to refine it until surprisingly recently.

The upshot is it used to be VERY precious. More than gold!

The upshot is it used to be VERY precious. More than gold!

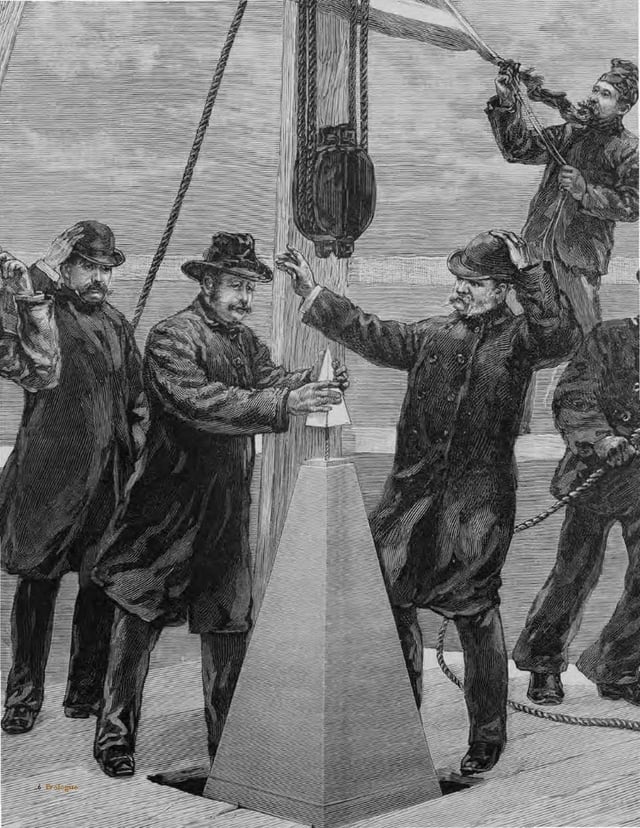

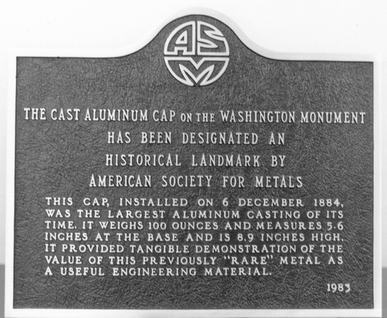

When Napoleon III wanted to really impress his guests he would serve them food on aluminium plates since they were more valuable than silver. When the Washington Monument was capped in aluminium that tiny capstone was the single biggest piece of aluminium in the world.

Metals refining essentially involves taking ore, which usually means a rock where your metal is bonded to other chemicals, invariably inc oxygen, and finding a way to break those bonds. In the case of steel and copper you can often do that by heating them REALLY hot - smelting.

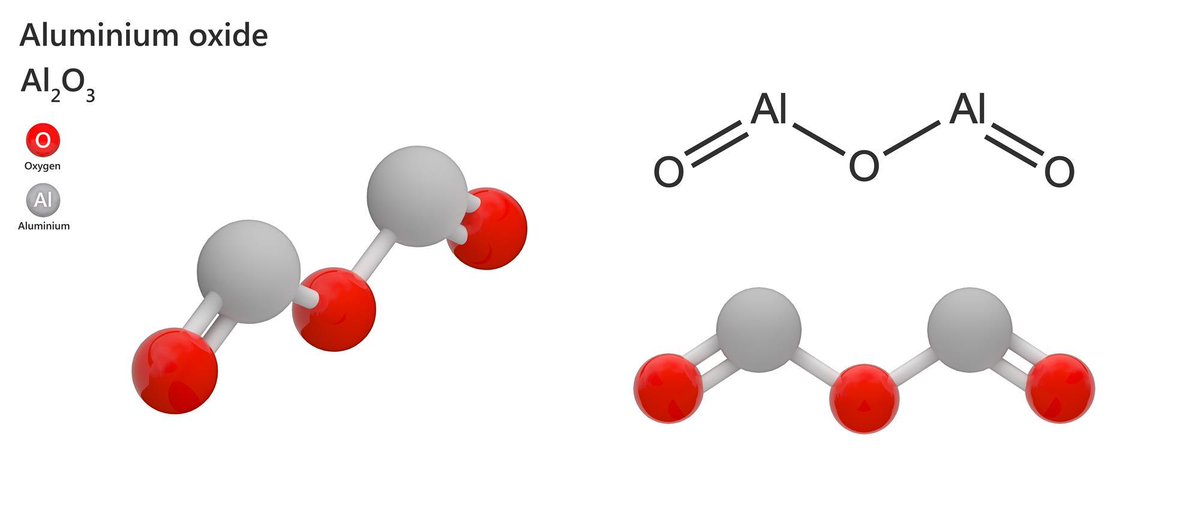

The challenge with aluminium is not that it's particularly rare. Actually there's lots of it in the earth's crust. It's that whenever it shows up in natural form it's usually bonded INCREDIBLY tightly to oxygen. No blast furnace could break those bonds...

The breakthrough came with the invention of electricity, which opened the door to ELECTROLYSIS. Run a large current through electrodes and it can create chemical reactions you just don't get any other way. So it was for aluminium.

Scientist experimented with electrolysing aluminium oxide powder (alumina, a somewhat refined product of bauxite) for decades.

They managed to eke out tiny amounts of aluminium.

For the first time, humanity could see this wonder metal!

But it was V expensive. Hence Napoleon.

They managed to eke out tiny amounts of aluminium.

For the first time, humanity could see this wonder metal!

But it was V expensive. Hence Napoleon.

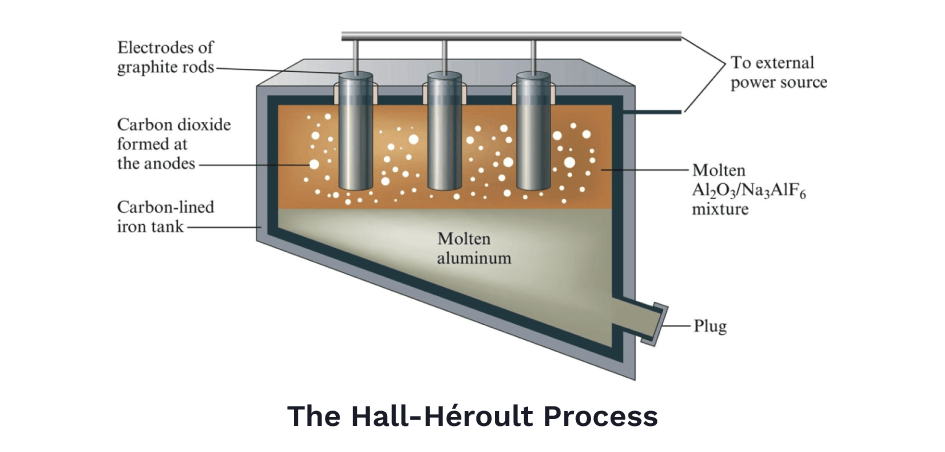

The breakthrough came in 1886 when two men independently cracked it.

If you dissolved alumina in cryolite, an aluminium salt which lowers its melting point, and then ran a current through it via carbon electrodes, voila: large quantities of aluminium.

This was a very big deal.

If you dissolved alumina in cryolite, an aluminium salt which lowers its melting point, and then ran a current through it via carbon electrodes, voila: large quantities of aluminium.

This was a very big deal.

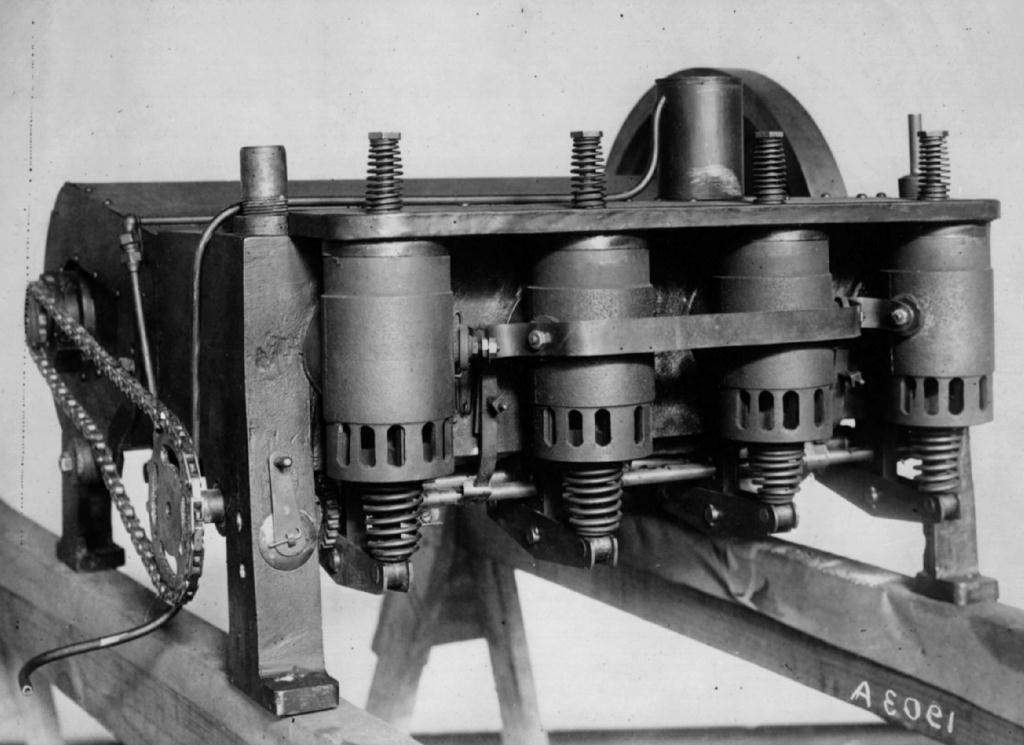

If it weren't for the Hall–Héroult process, as it was known, the Wright brothers would never have been able to achieve take off barely a decade and a half later.

Their engine was made of aluminium.

Thanks to that process we could have enormous amounts of this wonder metal.

Their engine was made of aluminium.

Thanks to that process we could have enormous amounts of this wonder metal.

The only limit was... power.

This is the first important thing you need to remember about aluminium. Making it consumes ENORMOUS amounts of power. Because even today the way we make this metal is fundamentally the same as in 1886. In big electrolysis cells.

This is the first important thing you need to remember about aluminium. Making it consumes ENORMOUS amounts of power. Because even today the way we make this metal is fundamentally the same as in 1886. In big electrolysis cells.

The other week I got to visit an aluminium plant for the first time. It was very exciting (for me at least). All the more so because this plant, Britain's last, is actually pretty unusual, as aluminium plants go.

More on that in a mo. For the time being, here's the cell room

More on that in a mo. For the time being, here's the cell room

What you see on the left is a row of those cells.

Each one has massive electrodes in the top, pulling a HUGE current & running it through alumina which looks like a white sand.

You can't seen the aluminium because it sinks. But beneath the floor level is tonnes of molten metal.

Each one has massive electrodes in the top, pulling a HUGE current & running it through alumina which looks like a white sand.

You can't seen the aluminium because it sinks. But beneath the floor level is tonnes of molten metal.

The aluminium is siphoned up and poured into containers, then taken to the casting room, where alloy ingredients are added, and it's then sent off elsewhere, usually in the form of enormous, heavy slabs.

Then it goes off to other companies who process it further.

Then it goes off to other companies who process it further.

The molten aluminium looks a lot like the T1000 in Terminator 2. It's very cool.

Look at this vid. This is recently poured molten aluminium. Still about 900 degrees. Looks almost solid, but look closely and you'll see a bubble.

Look at this vid. This is recently poured molten aluminium. Still about 900 degrees. Looks almost solid, but look closely and you'll see a bubble.

Anyway, at this point you're poss wondering: how, given heavy energy-intensive industry has struggled so much in this country, has this place survived so long?

Scotland used to be one of the world's biggest producers of aluminium.

Now this place is the last one standing. Why?

Scotland used to be one of the world's biggest producers of aluminium.

Now this place is the last one standing. Why?

For the answer, we need to go backwards.

What's powering that cell room?

These massive hydroelectric turbines, five of them, which together represent one of the UK's biggest hydro power plants.

And where does the water powering them come from?

What's powering that cell room?

These massive hydroelectric turbines, five of them, which together represent one of the UK's biggest hydro power plants.

And where does the water powering them come from?

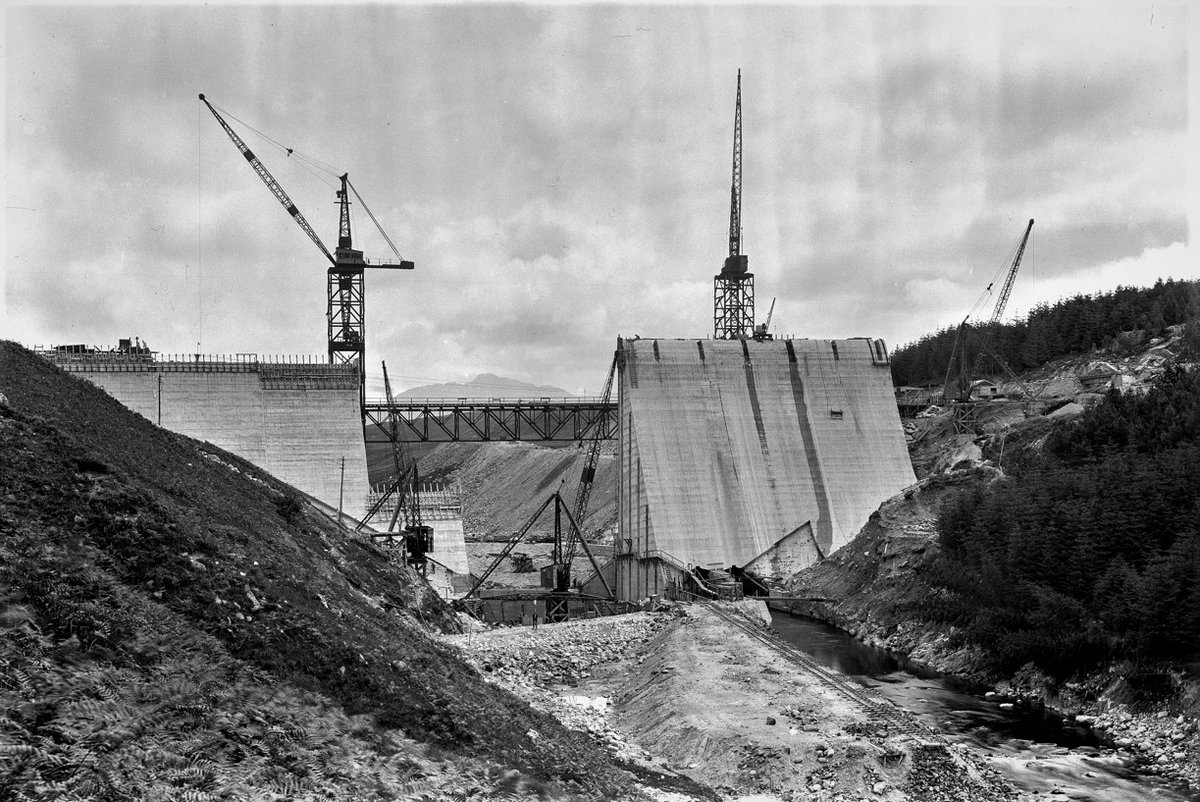

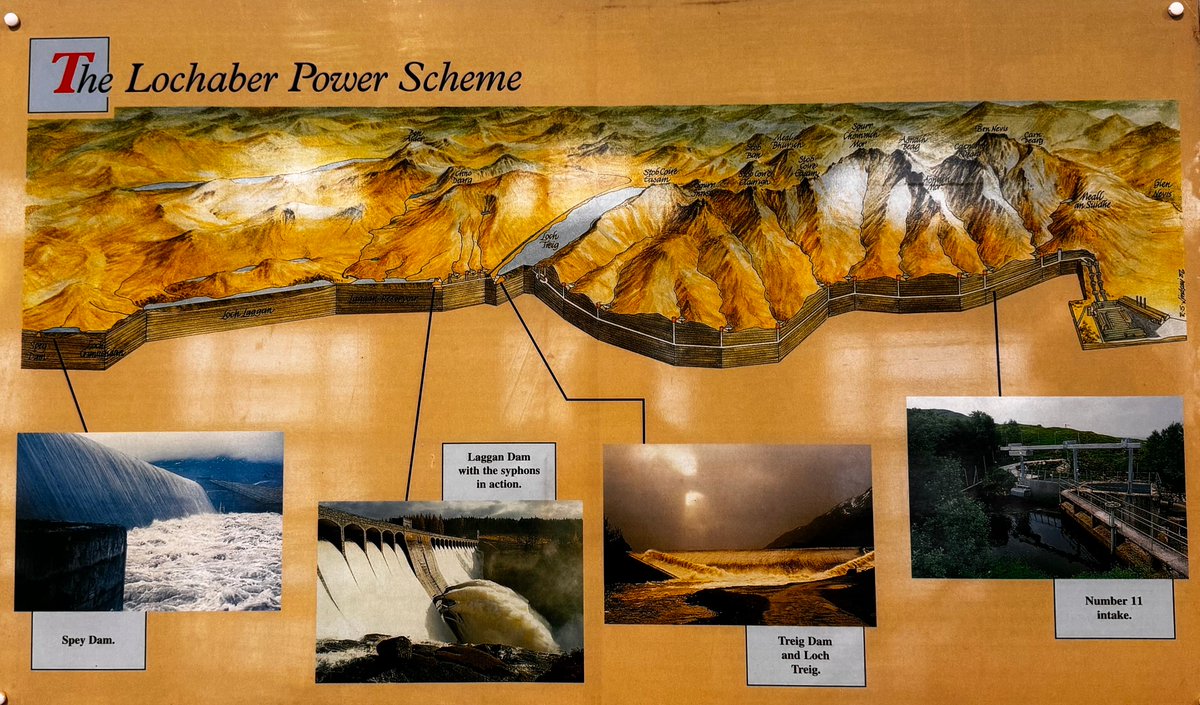

Answer: not a single river or dam, as is the case for most hydro, but from something else.

The pipes here, that feed the hydro turbines, are actually the end point of an extraordinary network of dams and tunnels that stretch 16 miles through the Scottish highlands.

The pipes here, that feed the hydro turbines, are actually the end point of an extraordinary network of dams and tunnels that stretch 16 miles through the Scottish highlands.

When these tunnels were built, back in the 1920s they were the longest underground water tunnels in the world. It was a totally unprecedented scheme.

Go to one of these dams, the Laggan Dam, and you see a plaque commemorating the achievement.

It was visionary stuff.

Go to one of these dams, the Laggan Dam, and you see a plaque commemorating the achievement.

It was visionary stuff.

Until I visited I had no idea of the sophistication of the scheme.

I assumed each dam had its own power plant & sent that power to the smelter.

No. Each dam is there to store rainwater from streams and channel it under the mountains to those five pipes running into the plant.

I assumed each dam had its own power plant & sent that power to the smelter.

No. Each dam is there to store rainwater from streams and channel it under the mountains to those five pipes running into the plant.

All of which raises a question: why on earth go to such lengths?

For the answer, we need to cover the second most important thing you need to know about making aluminium: you must never, EVER turn off the cells.

If they lose power... BIG problem.

For the answer, we need to cover the second most important thing you need to know about making aluminium: you must never, EVER turn off the cells.

If they lose power... BIG problem.

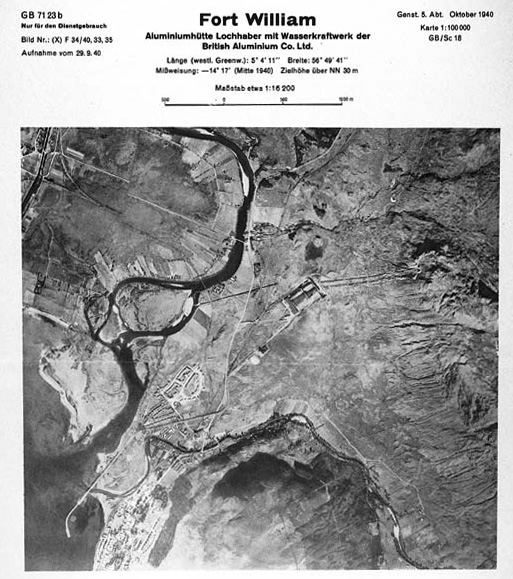

If the power is off for 5hrs the molten metal in those cells freezes and you have to rebuild the entire plant.

In WWII, when this place supplied 80% of the metal in Spitfires, the Nazis targeted it precisely because a shutdown would be disastrous.

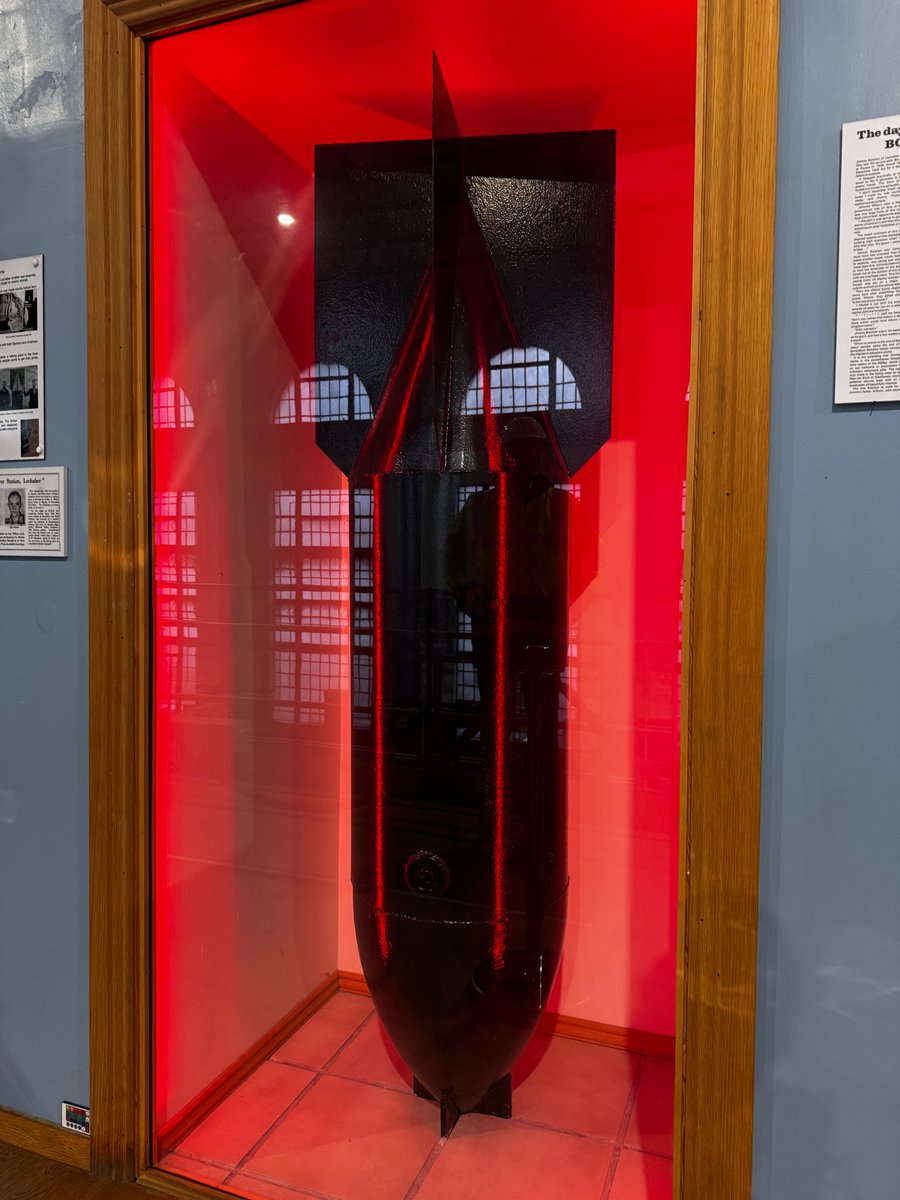

Their reconnaissance map👇

In WWII, when this place supplied 80% of the metal in Spitfires, the Nazis targeted it precisely because a shutdown would be disastrous.

Their reconnaissance map👇

The Nazis did actually drop a bomb on the site but luckily for those working here it failed to detonate. It's kept as an exhibit right here in the turbine hall even today...

Anyway. Key thing:

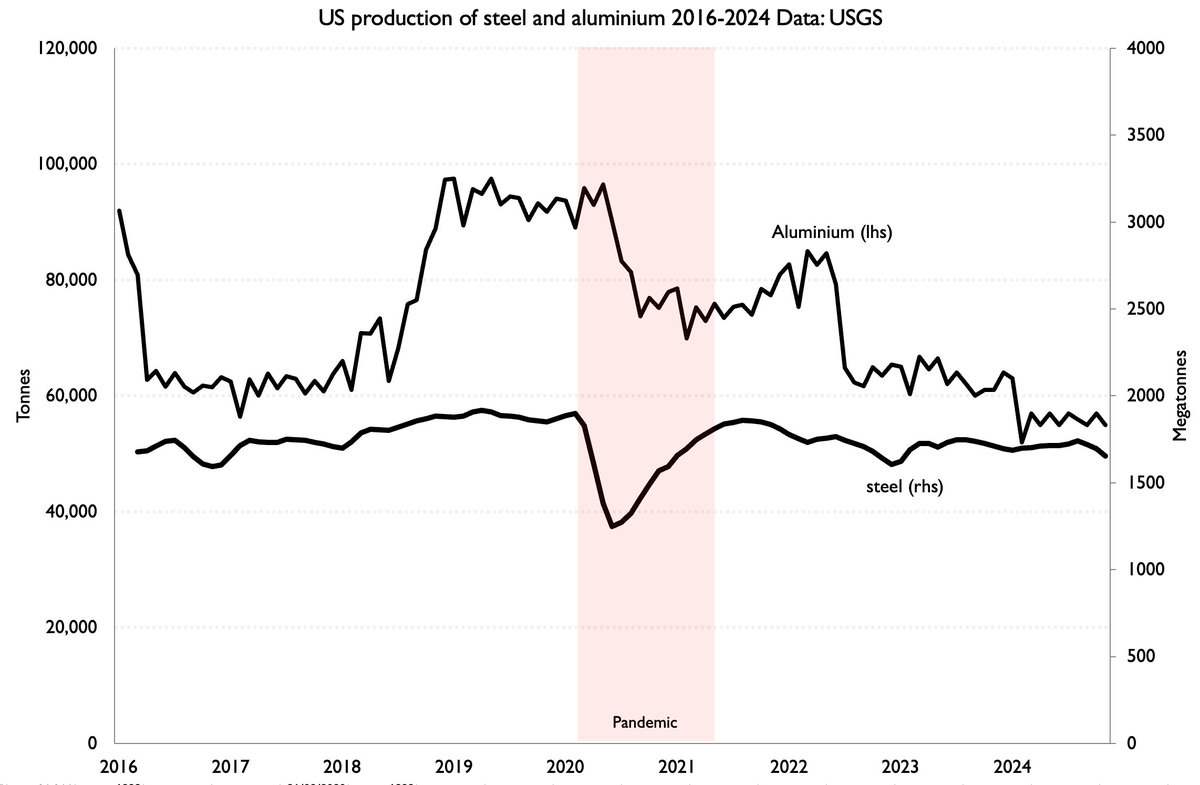

You can turn steelmaking electric arc furnaces off and on. You can't do the same for aluminium. Once it's off it's off for good.

Note how US steel production dipped down during the pandemic and then quickly recovered. Not so for aluminium.

You can turn steelmaking electric arc furnaces off and on. You can't do the same for aluminium. Once it's off it's off for good.

Note how US steel production dipped down during the pandemic and then quickly recovered. Not so for aluminium.

Anyway, this shutdown risk is why EVERY aluminium plant in the world is plugged into a STABLE source of power.

Often that means a nuclear plant. Sometimes it means coal or gas, in countries with a cheap reliable supply of fuel.

In many countries, such as Canada, it means hydro.

Often that means a nuclear plant. Sometimes it means coal or gas, in countries with a cheap reliable supply of fuel.

In many countries, such as Canada, it means hydro.

Consider the Alouette smelter in Quebec - the single biggest plant in North America.

Its power comes from the James Bay Project, a series of hydroelectric dams harnessing the extraordinary flow of the La Grande River. Some power goes to the plant, some goes to the wider grid.

Its power comes from the James Bay Project, a series of hydroelectric dams harnessing the extraordinary flow of the La Grande River. Some power goes to the plant, some goes to the wider grid.

But while the Lochaber plant in Scotland is also hydro, it is subtly but importantly different. Scotland has hills and rain, but no rivers with anything like the power of the La Grande, or the Colorado or the Columbia. Hence all those diversionary dams.

The entire estate, all 114,000 acres, is devoted to providing all the water from all the nearby streams and watersheds and diverting it all into those pipes. Scotland didn't have the Yangtze River but it did have ingenuity and engineering daring.

Why am I banging on about this?

Because it underlines just how much a constant, reliable stream of POWER matters for aluminium manufacture. This is why smelters are ALWAYS where the power is (and why they can't work on intermittent renewables).

Aluminium IS power.

Because it underlines just how much a constant, reliable stream of POWER matters for aluminium manufacture. This is why smelters are ALWAYS where the power is (and why they can't work on intermittent renewables).

Aluminium IS power.

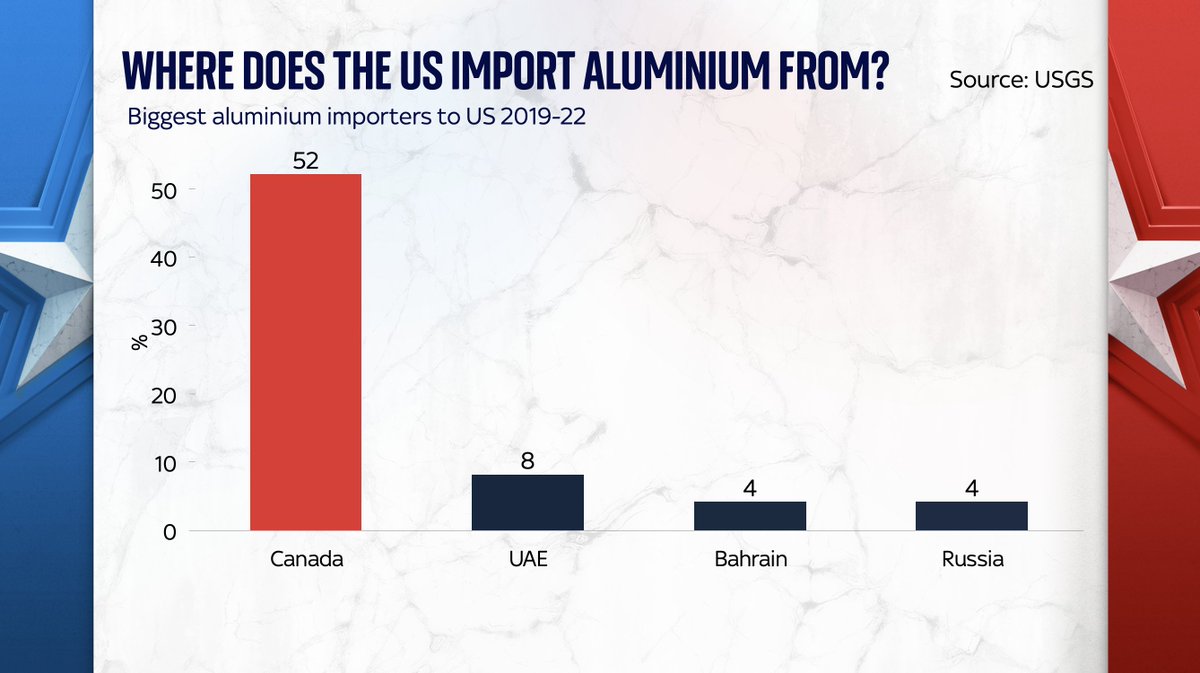

Anyway, that brings us to where we are today. Donald Trump has just imposed tariffs on aluminium imports from all countries. No exceptions.

And this time around it's 25%, not the 10% it was in 2018.

Why? Because he says he wants to bring aluminium production back to the US.

And this time around it's 25%, not the 10% it was in 2018.

Why? Because he says he wants to bring aluminium production back to the US.

The challenge he faces is that the vast majority of imported American aluminium comes from, guess where, CANADA.

Why?

Not because they're that much better at it (everyone just does Hall-Heroult).

It's BECAUSE THAT'S WHERE THE DAMS ARE.

Where the stream of reliable power is.

Why?

Not because they're that much better at it (everyone just does Hall-Heroult).

It's BECAUSE THAT'S WHERE THE DAMS ARE.

Where the stream of reliable power is.

In other words, if America is going to bring all that Canadian production to the US it won't just mean building aluminium plants.

It will mean building a MASSIVE amount of extra power production.

& since the US has dammed most of its most powerful rivers that prob means nuclear.

It will mean building a MASSIVE amount of extra power production.

& since the US has dammed most of its most powerful rivers that prob means nuclear.

You're talking maybe five or six entire new nuclear power stations, purely to replace those Canadian aluminium exports.

Perhaps you're starting to see the problem here. Because nuclear power is VERY expensive.

Hopefully it won't be in future. But right now: expensive.

Perhaps you're starting to see the problem here. Because nuclear power is VERY expensive.

Hopefully it won't be in future. But right now: expensive.

All of which is to say, there was a reason the aluminium tariff was 10% last time.

There was a reason Trump eventually excluded Canada altogether.

It simply pushed up prices for consumers without getting much domestic smelting happening again. For all the reasons you now know.

There was a reason Trump eventually excluded Canada altogether.

It simply pushed up prices for consumers without getting much domestic smelting happening again. For all the reasons you now know.

Sometimes it's helpful to think not just of the macro arguments but to look at the situation from the ground up.

That was the whole point of the book I wrote about this kind of thing, Material World (sorry, had to get a plug in there).

This isn't just economics. It's physics.

That was the whole point of the book I wrote about this kind of thing, Material World (sorry, had to get a plug in there).

This isn't just economics. It's physics.

Anyway, if you've read this far, thank you (didn't expect it to go quite so long!)

For more of this kind of thinking, read my book, all about thinking about the world this way.

And WATCH our film about tariffs which takes you inside some of these places👇

For more of this kind of thinking, read my book, all about thinking about the world this way.

And WATCH our film about tariffs which takes you inside some of these places👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh