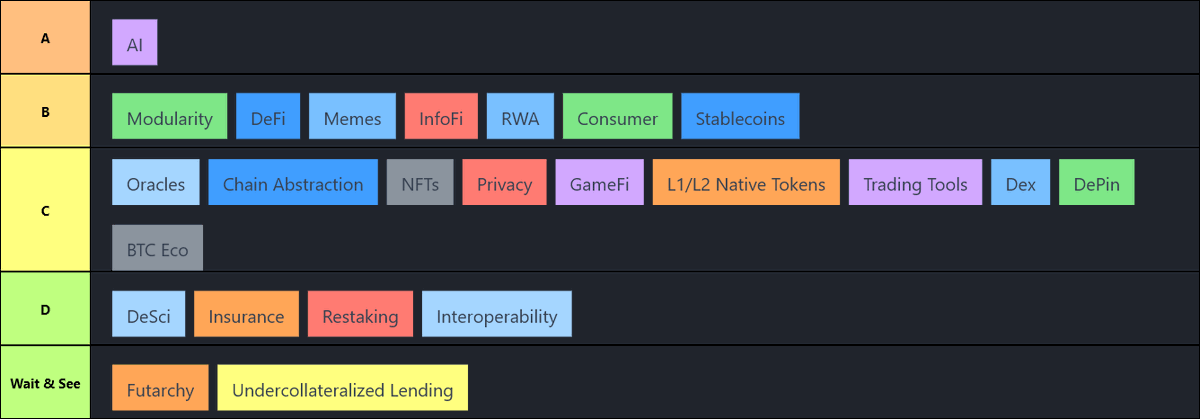

My Top Narrative Tier List

A Tier

AI- Agents will have a second wind but hype will be centered around new agents. Declining cost of compute coupled with new developments like MCP will enable new autonomous use cases.

B Tier

Modularity- As demand for blob space grows, think there is a potential narrative to form around alt DAs like Celestia.

DeFi- There may be a second wind for efficient apps as new stablecoin issuers compete for users with incentives.

Memes- Hard to believe memes will ever be done.

InfoFi- Kaito is a blueprint to creating more transparent alignment between protocol & community marketing. Hard to believe the narrative ends here.

RWA- One of the most compelling use cases for crypto but hard to tell which protocol will emerge as the leader.

Consumer- As a whole, DeFi has become much easier to use before with new UX layers. Think protocols that can abstract away the fragmentation could be big.

Stablecoins- This will be the big use case for crypto but hard to tell which protocol will benefit the most.

C Tier

Oracles- Crucial infra but hard to monetize effectively.

NFTs- Have a feeling NFTs will make a comeback but needs more experimentation to build new experiences.

Privacy- Important but hard to monetize effectively.

GameFi- There will probably be a few GameFi projects that will pop off but so many to choose from.

L1/L2 Native Tokens- Too many chains not enough users to sustain valuations.

BTC Eco- Could have a second wind but there hasn't been much momentum yet.

Dex- There are a few Dexes that are worth looking into (Ekubo, Euler, Curve) but most gains will be made with few winners.

DePin- Potentially a big use case for crypto but hard for protocols to attract users without incentives.

D Tier

DeSci- Haven't seen any meaningful momentum. Will change my opinion if we can get one breakthrough app.

Insurance- Feels like a dead narrative

Restaking- Vision just hasn't played out.

Interoperability- Too many competitors with no clear adoption standard.

Wait & See

Futarchy- Innovative solution to governance but hasn't caught on yet.

Undercollateralized Lending- Big potential with zkTLS but not sure how feasible it is.

A Tier

AI- Agents will have a second wind but hype will be centered around new agents. Declining cost of compute coupled with new developments like MCP will enable new autonomous use cases.

B Tier

Modularity- As demand for blob space grows, think there is a potential narrative to form around alt DAs like Celestia.

DeFi- There may be a second wind for efficient apps as new stablecoin issuers compete for users with incentives.

Memes- Hard to believe memes will ever be done.

InfoFi- Kaito is a blueprint to creating more transparent alignment between protocol & community marketing. Hard to believe the narrative ends here.

RWA- One of the most compelling use cases for crypto but hard to tell which protocol will emerge as the leader.

Consumer- As a whole, DeFi has become much easier to use before with new UX layers. Think protocols that can abstract away the fragmentation could be big.

Stablecoins- This will be the big use case for crypto but hard to tell which protocol will benefit the most.

C Tier

Oracles- Crucial infra but hard to monetize effectively.

NFTs- Have a feeling NFTs will make a comeback but needs more experimentation to build new experiences.

Privacy- Important but hard to monetize effectively.

GameFi- There will probably be a few GameFi projects that will pop off but so many to choose from.

L1/L2 Native Tokens- Too many chains not enough users to sustain valuations.

BTC Eco- Could have a second wind but there hasn't been much momentum yet.

Dex- There are a few Dexes that are worth looking into (Ekubo, Euler, Curve) but most gains will be made with few winners.

DePin- Potentially a big use case for crypto but hard for protocols to attract users without incentives.

D Tier

DeSci- Haven't seen any meaningful momentum. Will change my opinion if we can get one breakthrough app.

Insurance- Feels like a dead narrative

Restaking- Vision just hasn't played out.

Interoperability- Too many competitors with no clear adoption standard.

Wait & See

Futarchy- Innovative solution to governance but hasn't caught on yet.

Undercollateralized Lending- Big potential with zkTLS but not sure how feasible it is.

• • •

Missing some Tweet in this thread? You can try to

force a refresh