How often do you hesitate before entering a trade and miss the entire move? Let's fix this ASAP.

Where to Enter Your Trades 🧵

Where to Enter Your Trades 🧵

1/ Intro

New traders get analysis paralysis because they don't know when to enter. This used to be me until I simplified my strategy and have clear criteria on when to enter a trade.

New traders get analysis paralysis because they don't know when to enter. This used to be me until I simplified my strategy and have clear criteria on when to enter a trade.

2/ Trend

Trend is the backbone of any strategy, because it shows where money is going and where money is leaving. Retail can't move the market only Hedge Funds. If a stock is trending up its because funds are buying. Trending down means funds are selling. We just follow them.

Trend is the backbone of any strategy, because it shows where money is going and where money is leaving. Retail can't move the market only Hedge Funds. If a stock is trending up its because funds are buying. Trending down means funds are selling. We just follow them.

3/ The L E (Elly) Model

I simplified my entry criteria to just 2 things.

1) Entry off a Level (The "L" in L E Model)

2) Entry off an Ema (The "E" in L E Model)

There is no more guessing.

I simplified my entry criteria to just 2 things.

1) Entry off a Level (The "L" in L E Model)

2) Entry off an Ema (The "E" in L E Model)

There is no more guessing.

4/ Entry off a Level

I enter off one of the 4 Levels

1) Pre-Market High (PMH)

2) Pre-Market Low (PML)

3) Previous Day High (PDH)

4) Previous Day Low (PDL)

I enter off one of the 4 Levels

1) Pre-Market High (PMH)

2) Pre-Market Low (PML)

3) Previous Day High (PDH)

4) Previous Day Low (PDL)

5) What Time Frame?

I trade off the 10m chart because I find anything lower is difficult for me and moves too fast. The 10m chart forces me to be patient and let my trades work! If you're struggling with stop outs try this time frame. I put a comparison below.

I trade off the 10m chart because I find anything lower is difficult for me and moves too fast. The 10m chart forces me to be patient and let my trades work! If you're struggling with stop outs try this time frame. I put a comparison below.

6) Example of Bearish "L" Entry

We can see on the chart below the stock broke PDL. The trend is bearish as it broke the low therefore its going "lower" ie bearish. So we wait for a pop to our level to take an entry, see green arrow.

We can see on the chart below the stock broke PDL. The trend is bearish as it broke the low therefore its going "lower" ie bearish. So we wait for a pop to our level to take an entry, see green arrow.

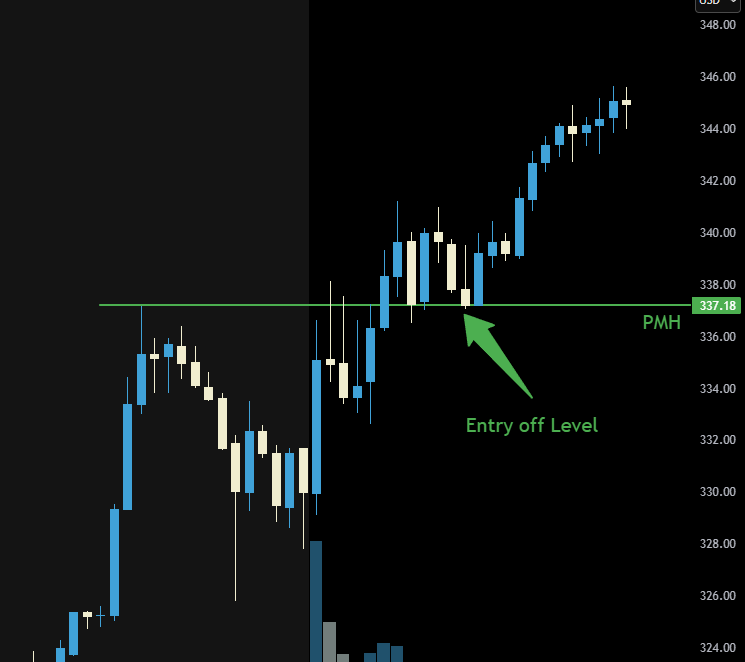

7/ Example of Bullish "L" Entry

We can see on the chart below the stock broke PMH. The trend is bullish as broke the highs therefore its going "higher" ie Bullish. So we wait for dip to our level to take an entry, see green arrow.

We can see on the chart below the stock broke PMH. The trend is bullish as broke the highs therefore its going "higher" ie Bullish. So we wait for dip to our level to take an entry, see green arrow.

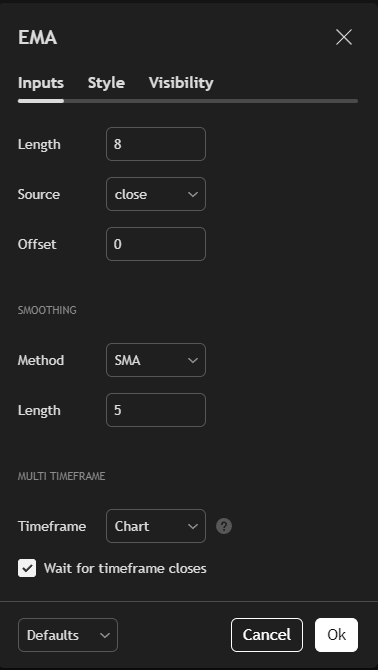

8/ Entry off an Ema

I only use one ema which is the 8ema or the magical 🟣line. This ema acts like a reactive short term trend line, without me having to draw. Its important to under the EMA rules, BEFORE putting it on your charts. Here are my settings.

I only use one ema which is the 8ema or the magical 🟣line. This ema acts like a reactive short term trend line, without me having to draw. Its important to under the EMA rules, BEFORE putting it on your charts. Here are my settings.

9/ EMA Rules

Before EMAs come into play a stock MUST break one of the 4 levels listed above. Then we use the following rules:

Candles above 🟣= Buy Calls

Candles below 🟣= Buy Puts

Before EMAs come into play a stock MUST break one of the 4 levels listed above. Then we use the following rules:

Candles above 🟣= Buy Calls

Candles below 🟣= Buy Puts

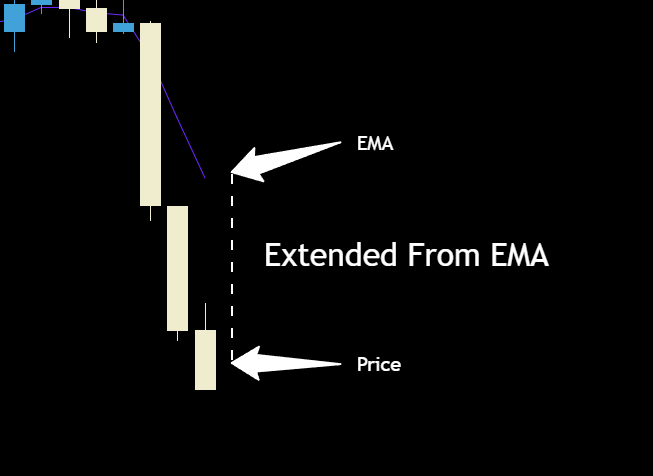

10/ Entry of an EMA

We want to enter a position as close to the EMA as possible for the tightest risk possible. When a stock is far away from the EMA its the higher the risk as a stock is extended. If you find yourself chasing, this will help.

We want to enter a position as close to the EMA as possible for the tightest risk possible. When a stock is far away from the EMA its the higher the risk as a stock is extended. If you find yourself chasing, this will help.

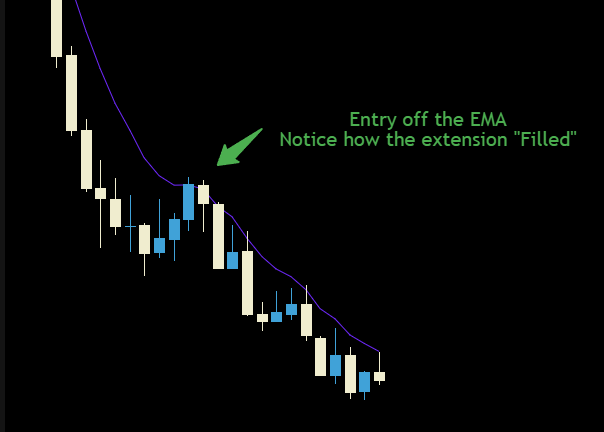

11/ Example of Bearish "E" Entry

We can see the stock was making lows so its a bearish trend. We don't want to FOMO in we just wait for price to touch the 10m EMA, see the green arrow on the chart below.

We can see the stock was making lows so its a bearish trend. We don't want to FOMO in we just wait for price to touch the 10m EMA, see the green arrow on the chart below.

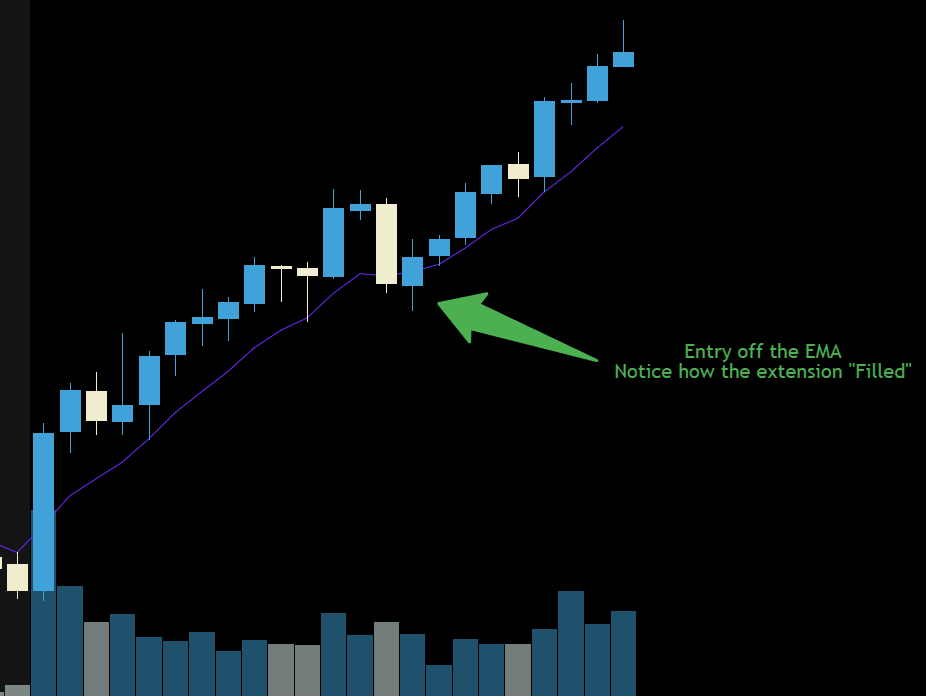

12/ Example of Bullish "E" Entry

We can see the stock was making highs so we are looking for a dip to get the best A+ entry. Remember in a bullish trend its buy the dip not buy the highs. We look for dips to the 8ema for entry.

We can see the stock was making highs so we are looking for a dip to get the best A+ entry. Remember in a bullish trend its buy the dip not buy the highs. We look for dips to the 8ema for entry.

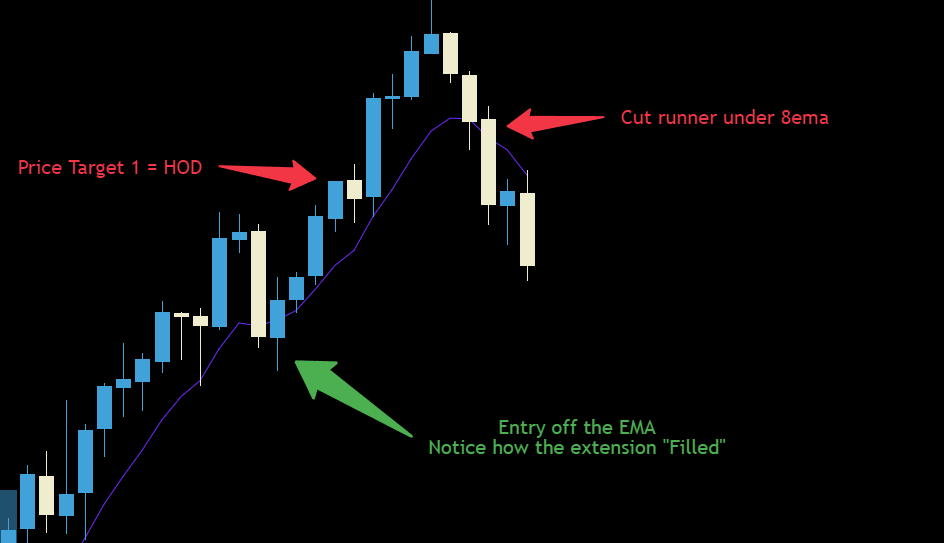

13/ Price Targets

Your price target is almost always the High or Low of the day. This is where you take off majority of your position and leave a runner. You trail your runner with the 8ema until it breaks, see chart below.

Your price target is almost always the High or Low of the day. This is where you take off majority of your position and leave a runner. You trail your runner with the 8ema until it breaks, see chart below.

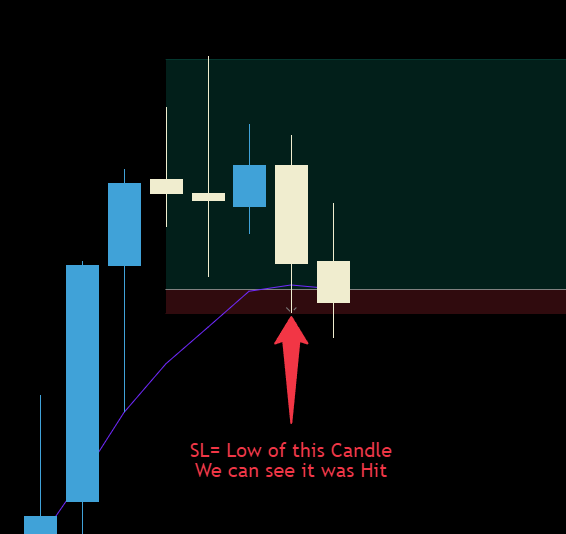

14/ Stop Loss

Your stop loss is almost always the low/high of the 10m candle. This means at most you will lose 20% on your contracts. If the low/high hits you're out because there's no HL/LH forming aka no continuation. Here is an example of a stop out.

Your stop loss is almost always the low/high of the 10m candle. This means at most you will lose 20% on your contracts. If the low/high hits you're out because there's no HL/LH forming aka no continuation. Here is an example of a stop out.

15/ Conclusion

I hope you enjoyed this thread, if you're looking for more personalized help with applying this strategy to your trading? DM me the word "Strategy"

I hope you enjoyed this thread, if you're looking for more personalized help with applying this strategy to your trading? DM me the word "Strategy"

• • •

Missing some Tweet in this thread? You can try to

force a refresh