🚨 The U.S. Bond Yield Drop

A Game Changer

U.S. 10-year yields fell from 4.8% to 4.02%, saving $300B on a $37T debt! Each 0.01% drop saves $37B. With $9T to renew, yields may hit 3.02%

could this spark a shift to markets like India? 🌍 🧵👇

@rishibagree

A Game Changer

U.S. 10-year yields fell from 4.8% to 4.02%, saving $300B on a $37T debt! Each 0.01% drop saves $37B. With $9T to renew, yields may hit 3.02%

could this spark a shift to markets like India? 🌍 🧵👇

@rishibagree

📈

India joins the FTSE Russell index in Sep 2025, expecting $20-25B in inflows (9.35% of a $4.7T index).

At 6.8% yield vs. USA's 4.02%, 2.78% gap is huge!

India joins the FTSE Russell index in Sep 2025, expecting $20-25B in inflows (9.35% of a $4.7T index).

At 6.8% yield vs. USA's 4.02%, 2.78% gap is huge!

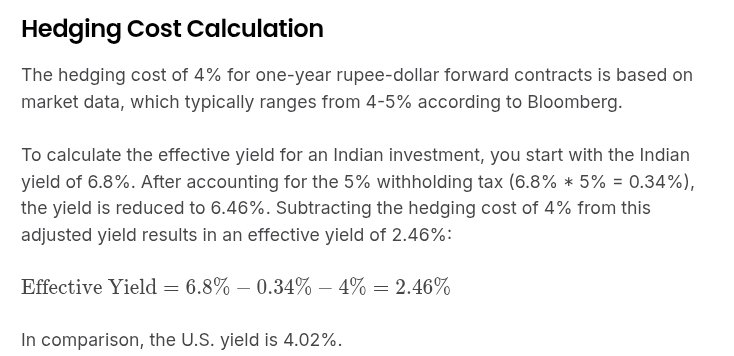

🙅Why India Lags Behind USA

Challenges:

Rupee at 87 vs USD hedging costs 4%, cutting yield to 2.46% (vs. U.S. 4.02%).

Liquidity: India’s ₹50K Cr/day vs. U.S.’s $600B/day.

BBB- rating vs. U.S.’s AAA.

Challenges:

Rupee at 87 vs USD hedging costs 4%, cutting yield to 2.46% (vs. U.S. 4.02%).

Liquidity: India’s ₹50K Cr/day vs. U.S.’s $600B/day.

BBB- rating vs. U.S.’s AAA.

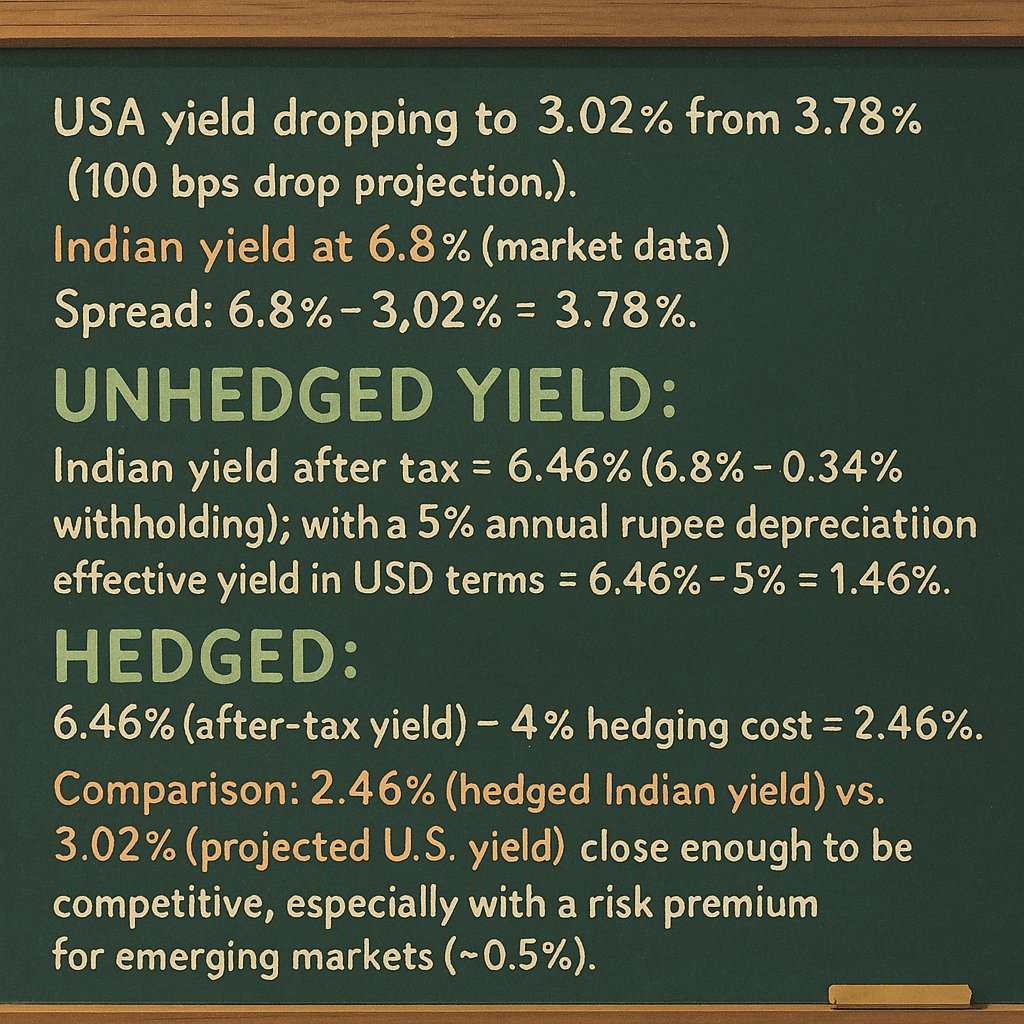

Yield Spread

A Golden Opportunity?

U.S. yields at 3.02% widen the spread to 3.78%. But rupee risk hurts: unhedged yield drops to 1.46%.

Hedged, it’s 2.46% competitive if U.S. hits 3.02%. India must act fast! ⚖️

A Golden Opportunity?

U.S. yields at 3.02% widen the spread to 3.78%. But rupee risk hurts: unhedged yield drops to 1.46%.

Hedged, it’s 2.46% competitive if U.S. hits 3.02%. India must act fast! ⚖️

How India Can Win

1️⃣ Trade in rupees with Russia, UAE.

2️⃣ Stabilize rupee at 86-88 with $704B reserves.

3️⃣ Boost liquidity via repo market.

4️⃣ Issue green bonds for $35T ESG market.

@nsitharaman @RBI

1️⃣ Trade in rupees with Russia, UAE.

2️⃣ Stabilize rupee at 86-88 with $704B reserves.

3️⃣ Boost liquidity via repo market.

4️⃣ Issue green bonds for $35T ESG market.

@nsitharaman @RBI

A stronger bond market saves ₹72,500 Cr/year that’s 10 new IITs or 5,000 km of highways! 🚀

Clock is ticking to fuel India’s $5T dream by 2027

your support can make India a financial hub!

Clock is ticking to fuel India’s $5T dream by 2027

your support can make India a financial hub!

• • •

Missing some Tweet in this thread? You can try to

force a refresh