Many waking up today to tales the trade and capital war are over and the pro-growth admin everyone hoped for is now here.

Markets are pricing in near certainty of this path when there are plenty of signs the admin's negative-growth policies are still firmly in place.

Thread.

Markets are pricing in near certainty of this path when there are plenty of signs the admin's negative-growth policies are still firmly in place.

Thread.

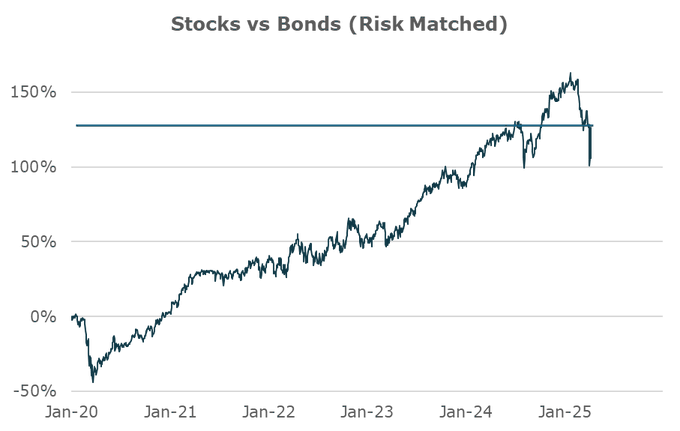

Market expectations of growth ahead surged following the tariff "delay" announcement yesterday bringing stock vs bond pricing to levels on par with just before the election and reversing all the tariff-related pain from the last few weeks.

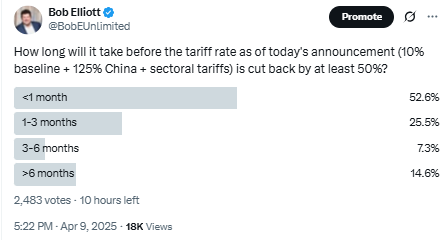

While tariff policies remain in place, the vast majority of investors are quickly inferring that even the tariffs that remain will be swiftly removed with nearly 80% expecting them cut by at least half within the next 90d pause period.

That's a notable reversal in expectations at a time when the actual reduction in tariffs announced with the pause are pretty modest.

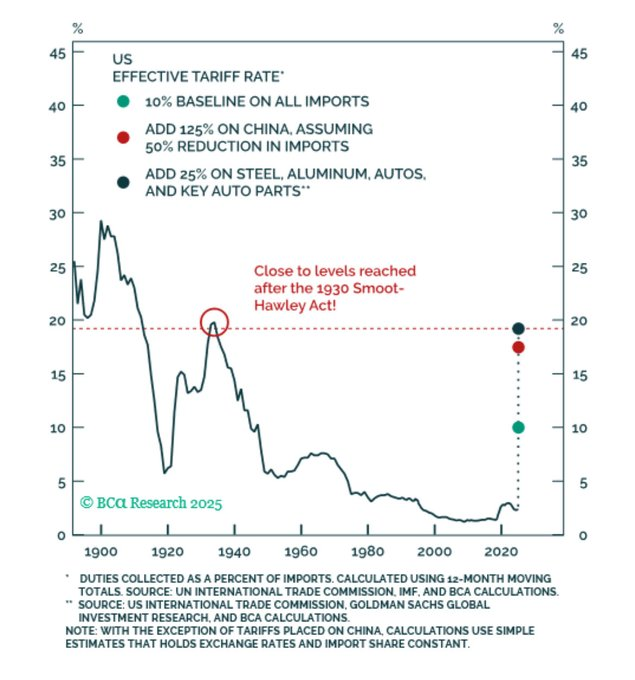

While there is some significant complexity in calculating this stuff given the elasticity of previously untested rates, its still ~20%.

While there is some significant complexity in calculating this stuff given the elasticity of previously untested rates, its still ~20%.

.@AnnaEconomist's work suggests roughly similar levels of tariffs under the new announcement. Certainly not looking like a big relief here.

Those estimates assume most Chinese tariffs are going to be hit at the announced rate. Assuming producers are fully able to route around those to other jurisdictions (hard at least for stuff on the water now), still looking at a 0.75% hit to GDP.

https://x.com/BobEUnlimited/status/1910036624265662610

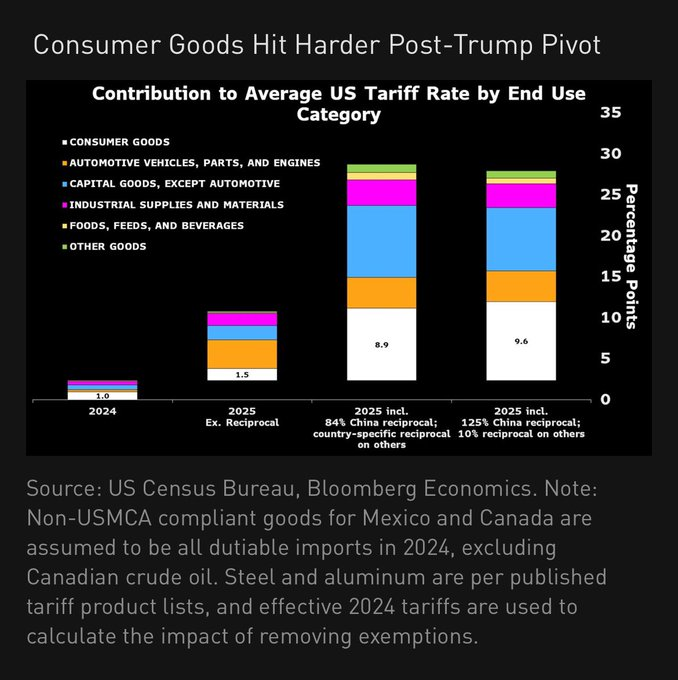

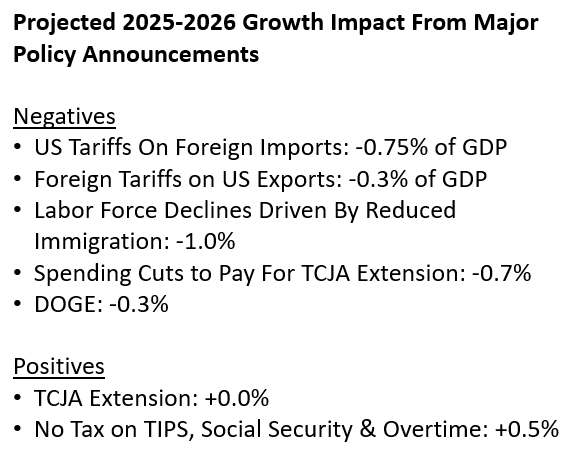

Even adjusting these figures down, when put in context with all the other negative growth policies being proposed, there is still a massive negative shock ahead if these policies aren't reversed.

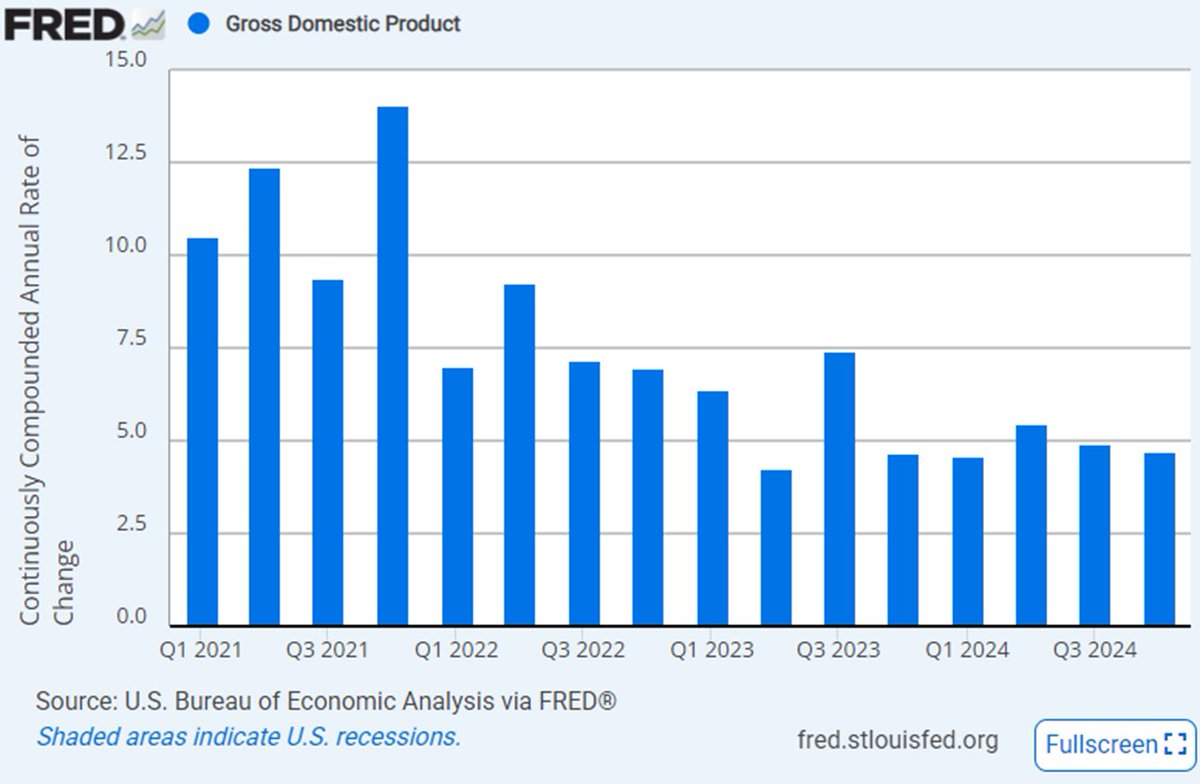

That's a 2.5%-3% negative growth shock in the context of an economy that is only running at about 5% nominal coming into these policies.

While the media headlines and the market pricing suggest the storm clouds have fully cleared, the reality is far from that.

Even with quite rosy expectations, the administrations current set of policies is set to put the US into recession. A reality far from priced in.

Even with quite rosy expectations, the administrations current set of policies is set to put the US into recession. A reality far from priced in.

Until there are signs of a far more substantial change in policy stance, at these market levels it remains far more appropriate to sell the rip rather than buy the dip.

• • •

Missing some Tweet in this thread? You can try to

force a refresh