Trump’s tariffs were designed to kill China.

But here’s the twist: China’s MASSIVE domestic market will keep it afloat.

The real economic fallout is happening in a different bloc—one that depends FAR MORE on exports.

And it’s already starting to crack: 🧵

But here’s the twist: China’s MASSIVE domestic market will keep it afloat.

The real economic fallout is happening in a different bloc—one that depends FAR MORE on exports.

And it’s already starting to crack: 🧵

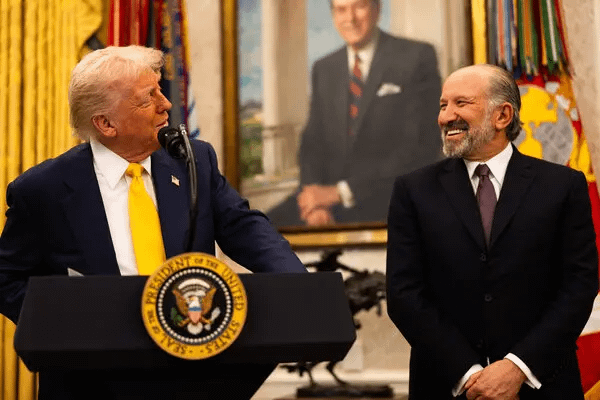

April 2nd, 2025 has been proclaimed "Liberation Day" by President Trump.

He's announced sweeping tariffs on China, Mexico, and Canada.

- 20% tariff on all Chinese imports.

- 25% tariff on most Mexican goods.

- 10-25% tariff on Canadian imports.

Here's what will ensue...

He's announced sweeping tariffs on China, Mexico, and Canada.

- 20% tariff on all Chinese imports.

- 25% tariff on most Mexican goods.

- 10-25% tariff on Canadian imports.

Here's what will ensue...

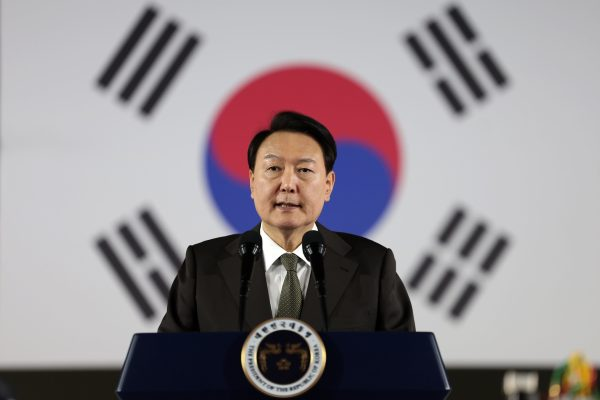

China, Japan, and South Korea - three nations with centuries of tension - have formed an economic alliance in direct response.

These aren't small players.

They collectively make most of your electronics, vehicles, and pharmaceuticals.

This changes everything...

These aren't small players.

They collectively make most of your electronics, vehicles, and pharmaceuticals.

This changes everything...

Let me put this in perspective.

These three Asian nations represent:

• 24% of global GDP

• The world's largest semiconductor production

• Three of America's top five trading partners

And they've just decided to work together.

But why is this such a seismic shift?

These three Asian nations represent:

• 24% of global GDP

• The world's largest semiconductor production

• Three of America's top five trading partners

And they've just decided to work together.

But why is this such a seismic shift?

Historically, these nations have been rivals.

Japan colonized SK.

China and Japan fought brutal wars.

SK and China have competing interests.

Their cooperation has been limited at best, hostile at worst.

Until now. Trump's tariffs accomplished what diplomacy couldn't:

Japan colonized SK.

China and Japan fought brutal wars.

SK and China have competing interests.

Their cooperation has been limited at best, hostile at worst.

Until now. Trump's tariffs accomplished what diplomacy couldn't:

They've committed to "closely collaborate" on a trilateral free trade agreement.

They're banding together to protect their economies from US tariffs.

The HVF Method predicted this...

They're banding together to protect their economies from US tariffs.

The HVF Method predicted this...

When certain market forces are competing and applying market pressure, a market squeeze in price behaviour may occur, sometimes delivering a Hunt Volatility Funnel.

Large forces in opposition create pressure that eventually breaks through.

We told our community months ago that trade barriers would trigger new alliances, and ignite certain trades.

Now let's analyze what this means for your wallet:

Large forces in opposition create pressure that eventually breaks through.

We told our community months ago that trade barriers would trigger new alliances, and ignite certain trades.

Now let's analyze what this means for your wallet:

First, electronics.

Taiwan, South Korea, and Japan control 87% of global semiconductors.

China assembles most consumer tech.

With 20-25% tariffs PLUS this alliance, expect:

• 30-40% price hikes on devices

• Supply constraints in 2026

• Component shortages

Taiwan, South Korea, and Japan control 87% of global semiconductors.

China assembles most consumer tech.

With 20-25% tariffs PLUS this alliance, expect:

• 30-40% price hikes on devices

• Supply constraints in 2026

• Component shortages

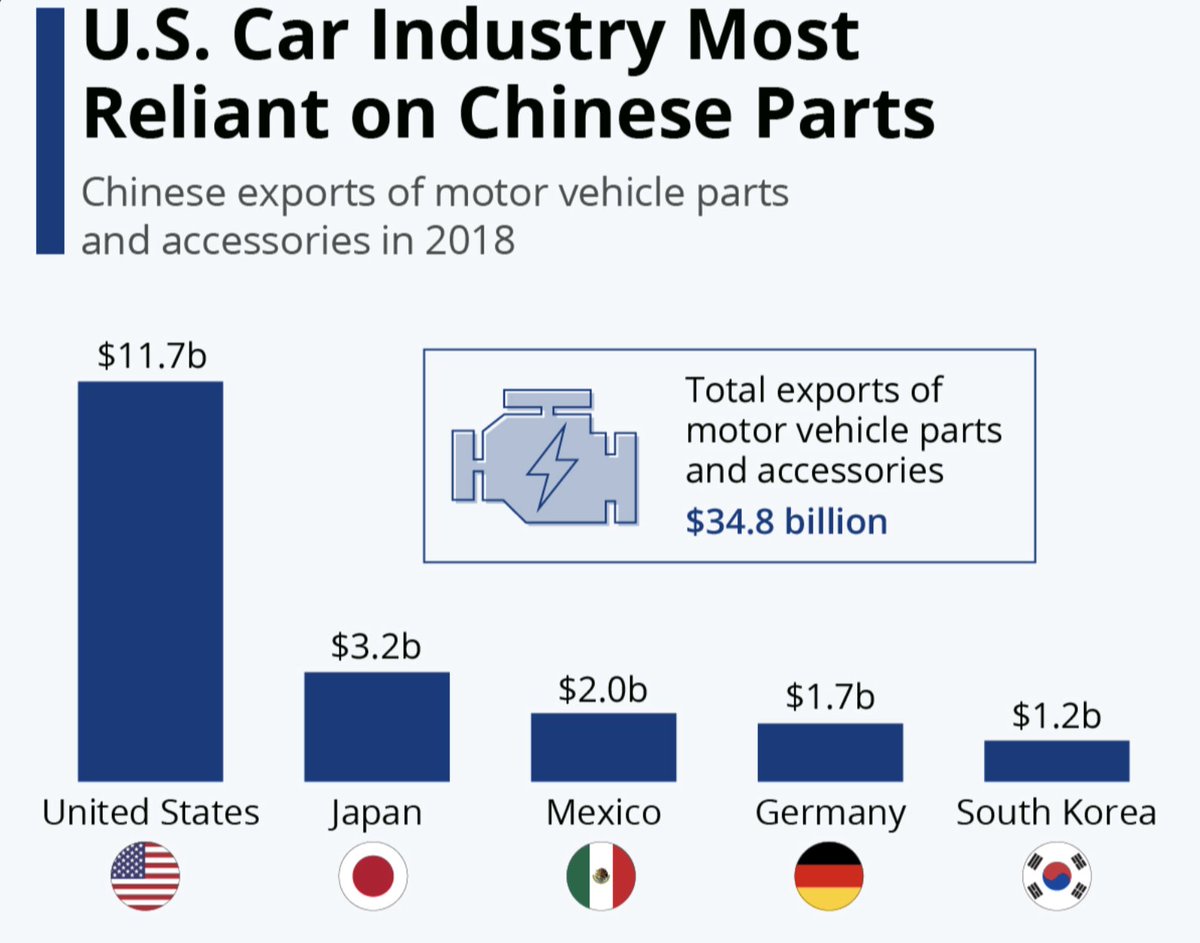

Second, automobiles.

Japanese and Korean makers produce 38% of vehicles sold in America.

Many "domestic" cars contain parts from these nations.

The alliance means:

• Coordinated supply chains

• Joint manufacturing

• Higher costs for consumers

Japanese and Korean makers produce 38% of vehicles sold in America.

Many "domestic" cars contain parts from these nations.

The alliance means:

• Coordinated supply chains

• Joint manufacturing

• Higher costs for consumers

Third, pharmaceuticals.

China produces nearly half of all pharmaceutical ingredients.

Japan excels in formulation and patents.

Korea is expanding biopharmaceutical capabilities.

This alliance creates a juggernaut that can control prices.

The volatility is just beginning...

China produces nearly half of all pharmaceutical ingredients.

Japan excels in formulation and patents.

Korea is expanding biopharmaceutical capabilities.

This alliance creates a juggernaut that can control prices.

The volatility is just beginning...

How does this affect you?

The tariffs would raise consumer prices.

But this Asian alliance creates an even bigger ripple effect.

They can now coordinate amongst themselves:

• Raw materials

• Manufacturing

• Supply chains

• Technology transfer

The tariffs would raise consumer prices.

But this Asian alliance creates an even bigger ripple effect.

They can now coordinate amongst themselves:

• Raw materials

• Manufacturing

• Supply chains

• Technology transfer

The market hasn't priced this in yet.

The alliance was just announced.

Few understand the implications.

This is where asymmetric risk-reward opportunities emerge for HVF traders who know when to strike...

The alliance was just announced.

Few understand the implications.

This is where asymmetric risk-reward opportunities emerge for HVF traders who know when to strike...

My prediction: by Q3 2025, we'll see major price moves in:

• Semiconductor stocks

• Electronics retailers

• Pharma manufacturers

• Asian currency pairs

This happens at key inflection points...

• Semiconductor stocks

• Electronics retailers

• Pharma manufacturers

• Asian currency pairs

This happens at key inflection points...

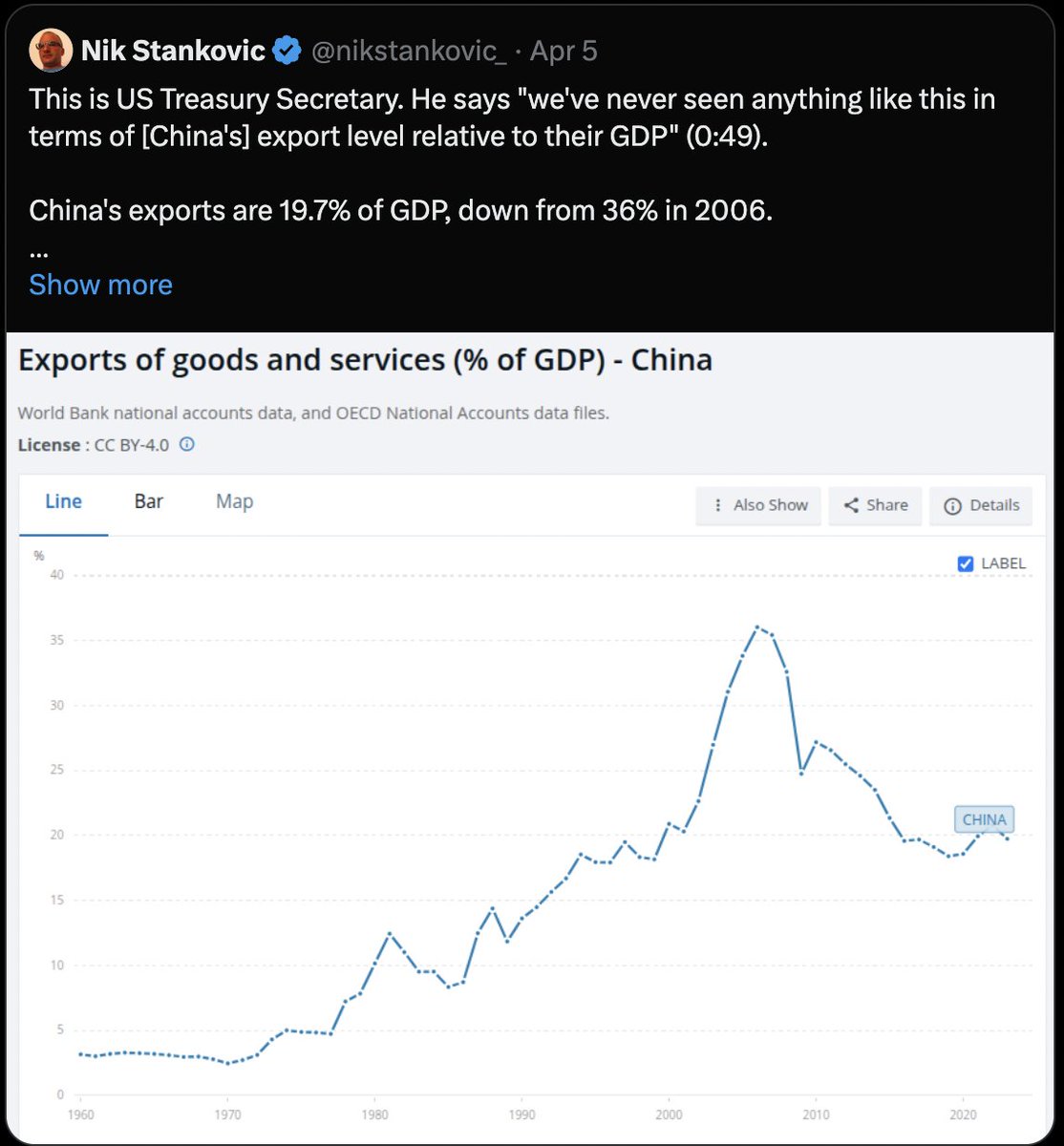

Let's remember:

China is a 19% Export to GDP economy (down from 36% in 2006)

While everyone is focused on the way these tariffs affect China...the real truth lies in Europe (and Vietnam a possible Chinese goods proxy)

China is a 19% Export to GDP economy (down from 36% in 2006)

While everyone is focused on the way these tariffs affect China...the real truth lies in Europe (and Vietnam a possible Chinese goods proxy)

The US is at around 11% exports to GDP.

Japan is at 21.8%, Israel at 30.6%, UK at 31.7%, Turkey at 31.9%, Italy at 33.7%, France 34.3%, Spain 38.1%, Germany 43.4%, South Korea 44%, Vietnam 87.2%, Netherlands 88.5%.

Europe, and South Korea is clearly exposed by tariffs.

The World average is 29.3%.

China may not be such an export oriented economy. Could it now be mostly domestic consumption.

Japan is at 21.8%, Israel at 30.6%, UK at 31.7%, Turkey at 31.9%, Italy at 33.7%, France 34.3%, Spain 38.1%, Germany 43.4%, South Korea 44%, Vietnam 87.2%, Netherlands 88.5%.

Europe, and South Korea is clearly exposed by tariffs.

The World average is 29.3%.

China may not be such an export oriented economy. Could it now be mostly domestic consumption.

But - some may argue, 19% exports to GDP for China, isn't the whole picture - due to the way China has sidestepped the trade war by assembling in Other nations from Vietnam others like it, and proximity to US market nations like Mexico.

(Evidence of this may be found by the Peso's [MXN] surprisingly firm performance over the period post CV19 into Mid 2024 against the dollar. Chart below USDMXN weekly chart, see blue line)

A possible fair point - the numbers may be skewed slightly on China's true export percentage. But...

(Evidence of this may be found by the Peso's [MXN] surprisingly firm performance over the period post CV19 into Mid 2024 against the dollar. Chart below USDMXN weekly chart, see blue line)

A possible fair point - the numbers may be skewed slightly on China's true export percentage. But...

Tariffs will hit these nations far harder:

Germany 43.4%

South Korea 44%

Vietnam 87.2% [Offered 0% on US Goods]

Netherlands 88.5%

Netherlands [88.5%], Germany [43.4%] & South Korea [44%] are in deep trouble.

Germany 43.4%

South Korea 44%

Vietnam 87.2% [Offered 0% on US Goods]

Netherlands 88.5%

Netherlands [88.5%], Germany [43.4%] & South Korea [44%] are in deep trouble.

So while the headlines say US/China trade war...it's missing the point

Yes, China gets a slap on the wrist...

But Europe's getting a kick between the legs.

Here is Trumps dismissive tone taken towards the EU.

Yes, China gets a slap on the wrist...

But Europe's getting a kick between the legs.

Here is Trumps dismissive tone taken towards the EU.

Remember our HVF principles:

1. Wait for volatility constriction to create opportunity.

Before you enter a trade:

2. Know your asymmetric reward to risk ratio

3. Always know your entry

4. Always know your stop

5. Always know your take profit level

This new alliance creates market conditions where fortunes can be made or lost.

1. Wait for volatility constriction to create opportunity.

Before you enter a trade:

2. Know your asymmetric reward to risk ratio

3. Always know your entry

4. Always know your stop

5. Always know your take profit level

This new alliance creates market conditions where fortunes can be made or lost.

The tariffs alone would be inflationary.

A fresh 20% tax on Chinese goods would raise prices across the board.

#Inflation

But this alliance creates a multiplier effect.

These nations can now coordinate responses to minimize their damage while maximizing leverage.

A fresh 20% tax on Chinese goods would raise prices across the board.

#Inflation

But this alliance creates a multiplier effect.

These nations can now coordinate responses to minimize their damage while maximizing leverage.

The technology angle is fascinating.

Japan and Korea need semiconductor materials from China.

China needs advanced chip tech from Japan and Korea.

Together, they create a tech ecosystem independent of Western influence.

Japan and Korea need semiconductor materials from China.

China needs advanced chip tech from Japan and Korea.

Together, they create a tech ecosystem independent of Western influence.

For decades, America's tech dominance was unchallenged.

But this alliance creates a potential rival with:

• Massive manufacturing capacity

• Tech sophistication

• Huge internal markets

• Less dependency on US tech

The geopolitical chessboard is changing.

But this alliance creates a potential rival with:

• Massive manufacturing capacity

• Tech sophistication

• Huge internal markets

• Less dependency on US tech

The geopolitical chessboard is changing.

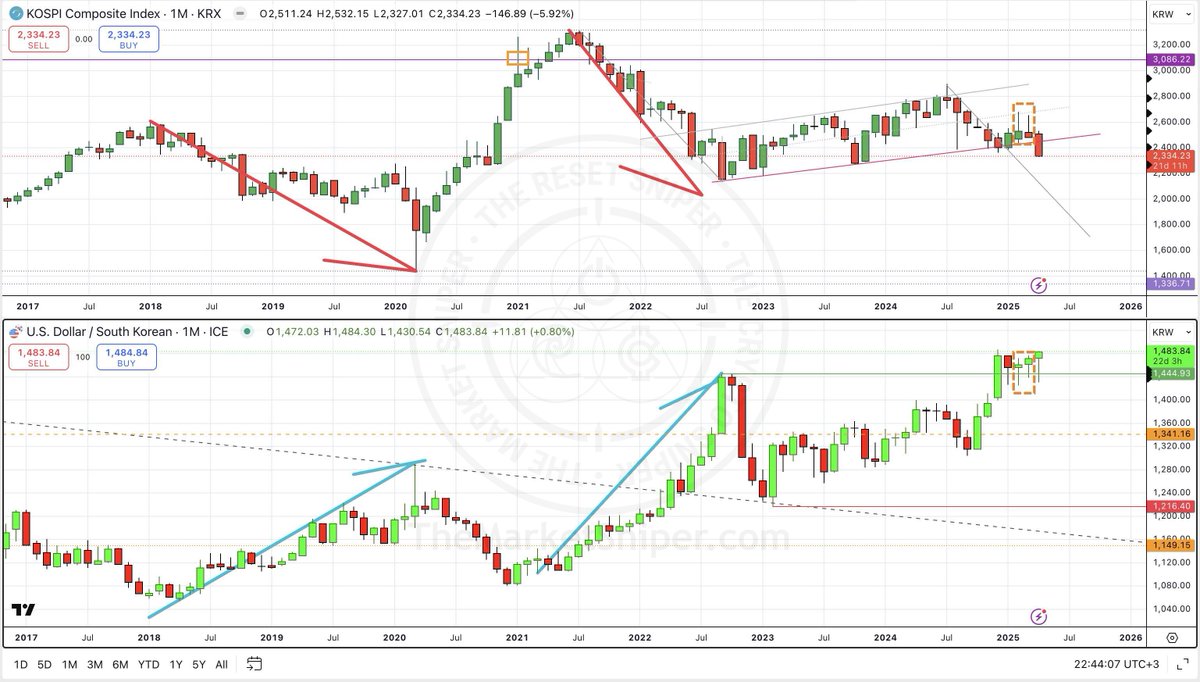

The KOSPI and USD/KRW are closely linked.

When Korea's economic outlook turns negative, foreign capital exits rapidly, leading to a sharp sell-off in equities (KOSPI) and a simultaneous depreciation of the Korean Won.

This capital flight reflects investors returning to USD as a safe haven.

Chart Below Monthly Kospi/USDKRW - "Flight Capital Effect"

When Korea's economic outlook turns negative, foreign capital exits rapidly, leading to a sharp sell-off in equities (KOSPI) and a simultaneous depreciation of the Korean Won.

This capital flight reflects investors returning to USD as a safe haven.

Chart Below Monthly Kospi/USDKRW - "Flight Capital Effect"

I've long advocated for precious metals in your portfolio.

When fiat currencies face pressure from trade wars and shifting alliances, gold serves as wealth preservation.

Not financial advice, but worth considering as these events unfold.

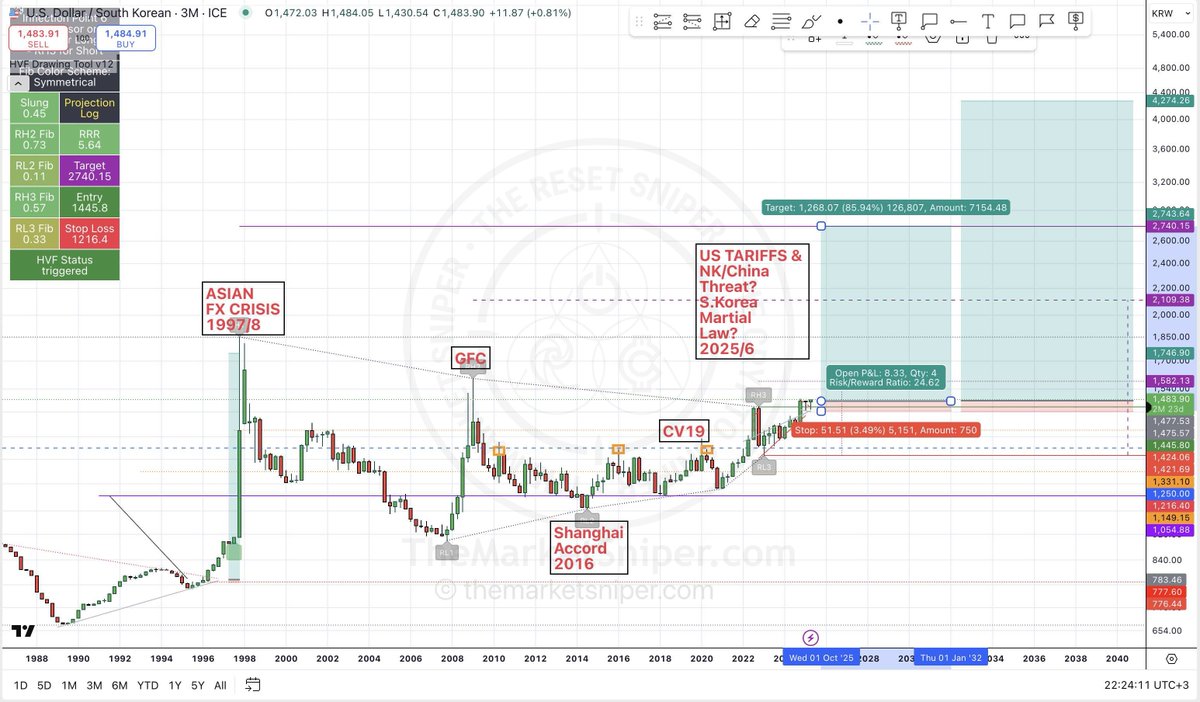

Will the South Korean Fold?

We have a possible 'halvening' as a target. The Quarterly USDKRW

#USDKRW

When fiat currencies face pressure from trade wars and shifting alliances, gold serves as wealth preservation.

Not financial advice, but worth considering as these events unfold.

Will the South Korean Fold?

We have a possible 'halvening' as a target. The Quarterly USDKRW

#USDKRW

The HVF Method teaches us to stay objective.

Political opinions aside, these forces create volatility - and volatility creates opportunity for disciplined traders.

What matters is seeing waves before they crest, not their political direction.

Political opinions aside, these forces create volatility - and volatility creates opportunity for disciplined traders.

What matters is seeing waves before they crest, not their political direction.

To summarize:

1. Tariffs trigger a counter-alliance

2. The alliance amplifies economic impacts

3. Consumer prices rise beyond tariff levels

4. New trading opportunities emerge

5. Traditional safety nets like gold become relevant

This is just the beginning...

1. Tariffs trigger a counter-alliance

2. The alliance amplifies economic impacts

3. Consumer prices rise beyond tariff levels

4. New trading opportunities emerge

5. Traditional safety nets like gold become relevant

This is just the beginning...

Successful trading isn't about predicting the future.

It's about seeing patterns, managing risk, and taking trades when odds favour you.

This Asian alliance may create such conditions across markets.

Are you prepared?

It's about seeing patterns, managing risk, and taking trades when odds favour you.

This Asian alliance may create such conditions across markets.

Are you prepared?

This trend is not just about tariffs—it’s part of a broader USD/KRW trade dynamic.

A technical breakdown in KOSPI often signals further Won depreciation.

The recent sell-off, marked by a red candle in KOSPI, could mean a green candle (strength) in USD/KRW, showing capital outflow from Korea to the U.S.

A technical breakdown in KOSPI often signals further Won depreciation.

The recent sell-off, marked by a red candle in KOSPI, could mean a green candle (strength) in USD/KRW, showing capital outflow from Korea to the U.S.

The ability to stay patient while others panic separates pros from amateurs.

Most rush into trades at the wrong time.

They fear volatility instead of leveraging it.

This situation is a perfect example of a volatility funnel forming...

Most rush into trades at the wrong time.

They fear volatility instead of leveraging it.

This situation is a perfect example of a volatility funnel forming...

Most traders will:

• Rush to hedge against price hikes

• Panic-sell affected sectors

• Chase obvious moves

HVF traders will:

• Wait for specific patterns

• Enter with precise risk limits

• Target asymmetric returns

The difference? A process-driven method.

• Rush to hedge against price hikes

• Panic-sell affected sectors

• Chase obvious moves

HVF traders will:

• Wait for specific patterns

• Enter with precise risk limits

• Target asymmetric returns

The difference? A process-driven method.

I've spent years refining the HVF Method to identify these conditions and exploit them with minimal risk.

Our community has navigated similar disruptions consistently using this approach.

This isn't guessing - it's systematic execution.

Our community has navigated similar disruptions consistently using this approach.

This isn't guessing - it's systematic execution.

Ready to trade through volatility with confidence?

Book a call with me today. I'll break down how we're approaching this market disruption.

Call link:

Limited spots for serious traders who want to master volatility.marketsniper.me/3RLjfxr

Book a call with me today. I'll break down how we're approaching this market disruption.

Call link:

Limited spots for serious traders who want to master volatility.marketsniper.me/3RLjfxr

Liked this?

See Also:

Debt Based Collapse Thread: x.com/themarketsnipe…

Whitney Webb Thread: x.com/themarketsnipe…

Lutnick Thread: x.com/themarketsnipe…

See Also:

Debt Based Collapse Thread: x.com/themarketsnipe…

Whitney Webb Thread: x.com/themarketsnipe…

Lutnick Thread: x.com/themarketsnipe…

Video/Image Credits:

- Youtube: The White House - "My fellow Americans, this is Liberation Day. April 2, 2025..." –President Donald J. Trump 🇺🇸🦅

- Youtube: Frobes Breakking News - ‘Sickening’: Courtney Reacts To China, Japan, And South Korea Announcing ‘Anti-US Tariff Initiative’

- Youtube: REUTERS - China, Japan, S. Korea to strengthen trade as Trump tariffs loom

- Youtube: CNN - Trump threatens additional 50% tariff on China as trade war escalates

- X - atrupar

- Jung Yeon-je, AFP - South Korea's Trade, Industry and Energy Minister Ahn Duk-geun (centre) poses for a photo with Japan's Economy

- Statista - UN Comtrade Database

- Getty Images Sam Yeh/AFP - China has become a pharmaceutical powerhouse over the past 20 years

- Youtube: The White House - "My fellow Americans, this is Liberation Day. April 2, 2025..." –President Donald J. Trump 🇺🇸🦅

- Youtube: Frobes Breakking News - ‘Sickening’: Courtney Reacts To China, Japan, And South Korea Announcing ‘Anti-US Tariff Initiative’

- Youtube: REUTERS - China, Japan, S. Korea to strengthen trade as Trump tariffs loom

- Youtube: CNN - Trump threatens additional 50% tariff on China as trade war escalates

- X - atrupar

- Jung Yeon-je, AFP - South Korea's Trade, Industry and Energy Minister Ahn Duk-geun (centre) poses for a photo with Japan's Economy

- Statista - UN Comtrade Database

- Getty Images Sam Yeh/AFP - China has become a pharmaceutical powerhouse over the past 20 years

• • •

Missing some Tweet in this thread? You can try to

force a refresh