The US Wrecking Ball policy stance still has a long ways to go to before its reflected in asset markets.

Moves so far mostly have mostly just reversed the euphoria around the election of the new admin. It'll take much larger moves to reflect today's policy reality.

Thread.

Moves so far mostly have mostly just reversed the euphoria around the election of the new admin. It'll take much larger moves to reflect today's policy reality.

Thread.

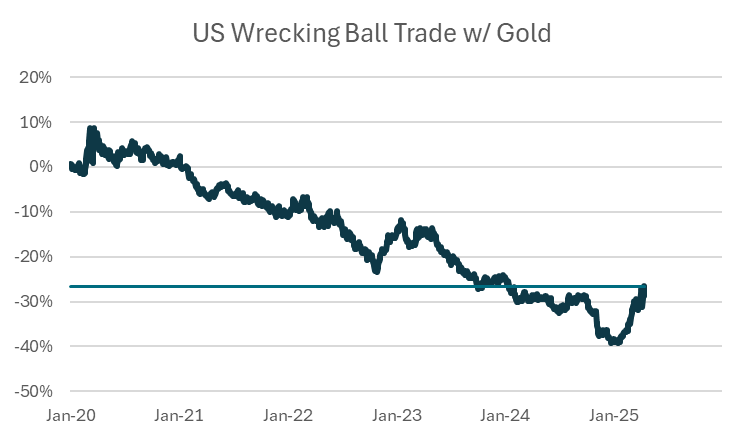

For a months I've described the combination of the series of negative-growth federal government policies with a Fed that will be behind the curve in response as a Wrecking Ball.

That's because that mix is not only terrible for asset markets, but it is bad for the economy.

That's because that mix is not only terrible for asset markets, but it is bad for the economy.

And I should note that this doesn't include the very real possibility of a more extreme tail outcome possibilities like loss of faith in the federal reserve independence, a capital war, or a kinetic war. Not something to bet on, but outcomes that would exacerbate these dynamics.

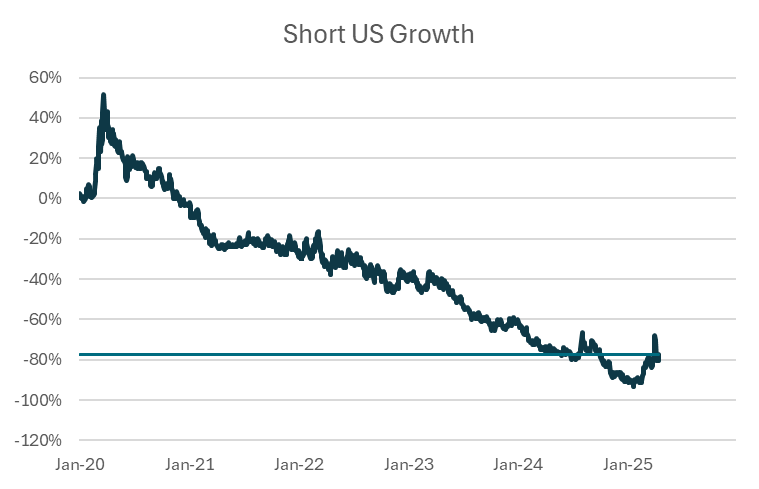

These impacts have yet to be really reflected in markets. Take market based measure of growth here. A short US growth portfolio of long LT nominals and reals and short stocks is merely back to where we were just before the election.

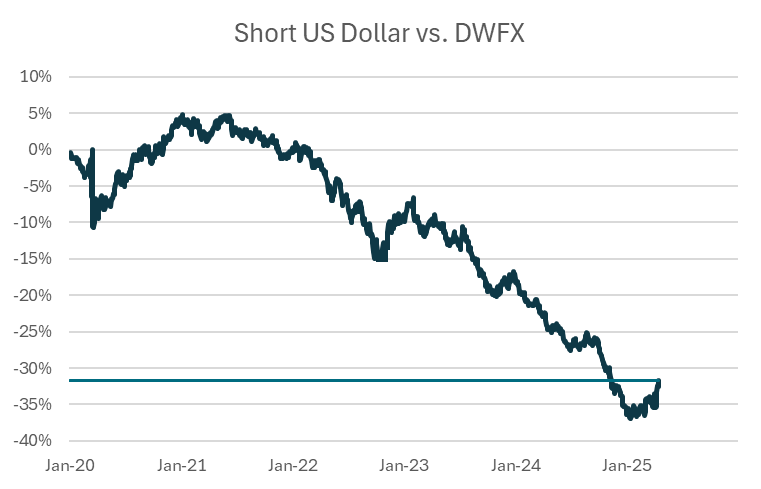

While there has been a lot of talk about foreign investors pulling money out of the US, particularly among our DW world capital partner, the dollar has hardly moved in any longer-term context.

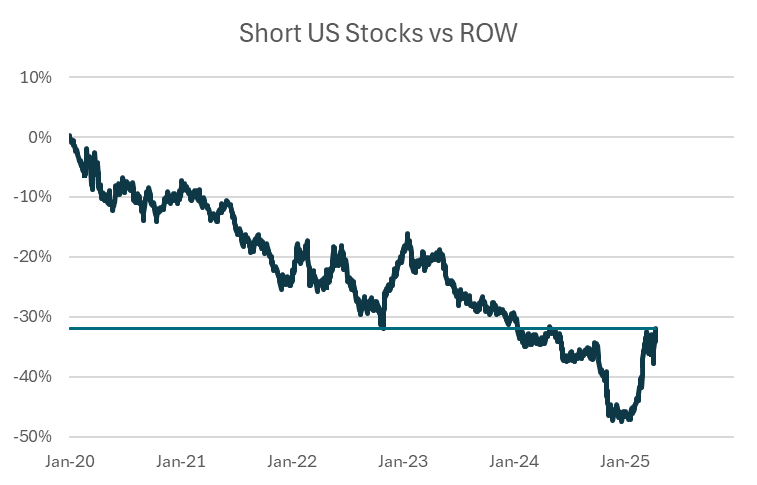

And the reversal of the US exceptionalism trade has merely unwound moves from just after the election. A pretty big move over the short-term but only retracing a small part of the post covid move up until the election.

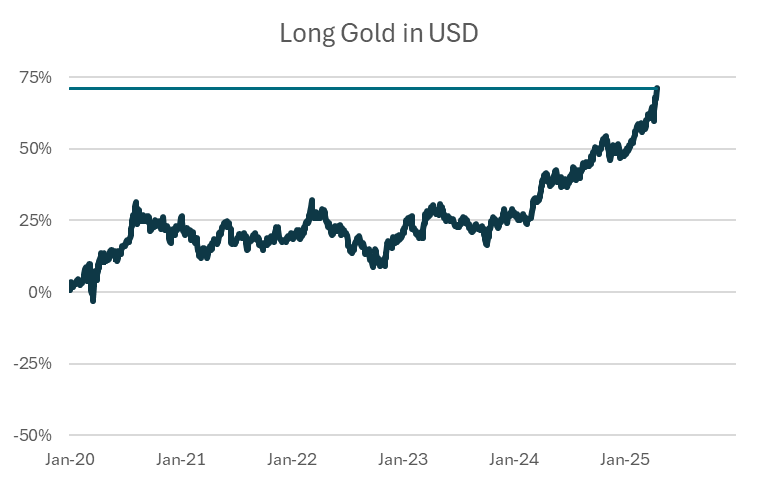

Gold is really the only asset that has had significant moves reflecting these dynamics, up 25% or so since the election. But still in the context of an asset that has in past times of stress doubled or tripled, these are pretty modest moves.

Taken together a "US Wrecking Ball" position mix remains vastly underwater relative to the start of 2020. While the moves have felt large up close, this mix is still only a couple percent higher than in the lead up to the election.

Hardly a scratch given the policy mix today.

Hardly a scratch given the policy mix today.

In a high volatility environment you either have to be 1) extremely agile or 2) positioned in a way that is well balanced to reflect the larger trend.

It's very hard to do the first, particularly in size. The Wrecking Ball mix above is likely well positioned for the second.

It's very hard to do the first, particularly in size. The Wrecking Ball mix above is likely well positioned for the second.

Financial assets are still trading on high hopes that this policy environment will be short lived even as most signs indicate further entrenchment from all sides.

So while this mix has made for a good trade in recent weeks, it looks like there is still plenty of room to run.

So while this mix has made for a good trade in recent weeks, it looks like there is still plenty of room to run.

PS - the consolidated portfolio looks roughly like:

- 30% long-term US bonds (equal weighted between TIPS and nominals)

- 30% long equities ex-US

- 15% long gold

- 30% short USD

- 60% short US stocks

(for roughly 10% target vol)

- 30% long-term US bonds (equal weighted between TIPS and nominals)

- 30% long equities ex-US

- 15% long gold

- 30% short USD

- 60% short US stocks

(for roughly 10% target vol)

• • •

Missing some Tweet in this thread? You can try to

force a refresh