(1/🧵) What If the SEC Lawsuit Was Never About XRP — But About Buying Time?

A thread that might change the way you see the Ripple case:

What if the goal wasn’t to stop XRP…

…but to stall it just long enough?

Let’s connect the dots.

🧵👇

A thread that might change the way you see the Ripple case:

What if the goal wasn’t to stop XRP…

…but to stall it just long enough?

Let’s connect the dots.

🧵👇

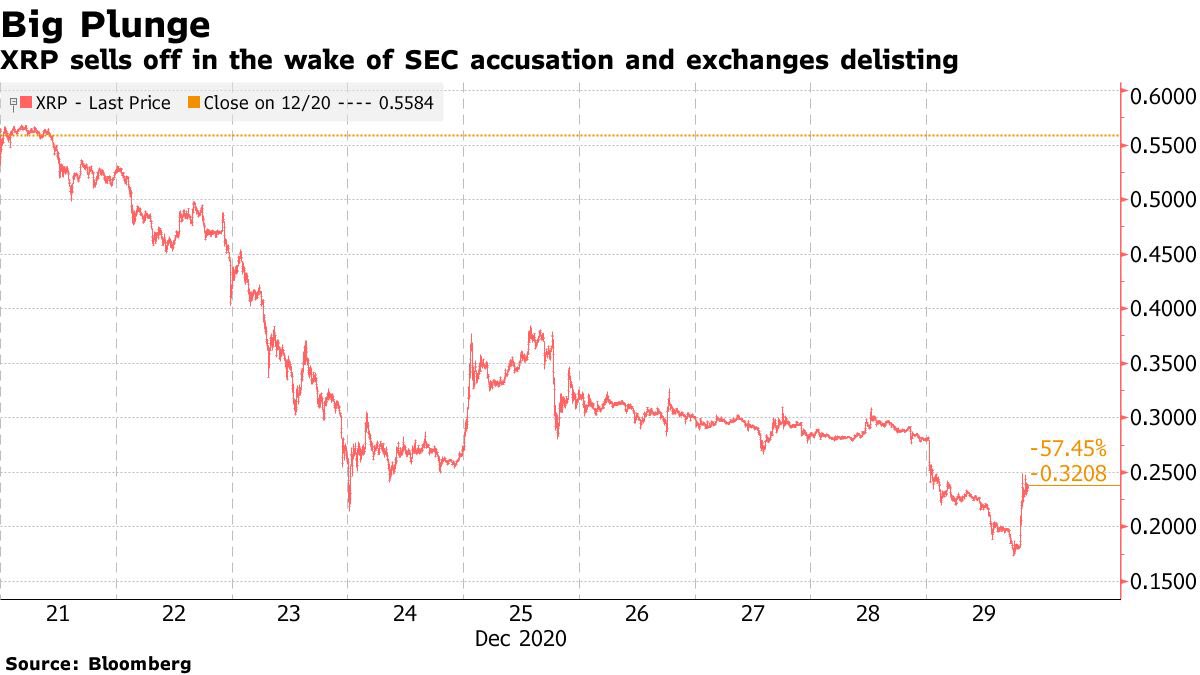

(2/🧵) XRP was gaining momentum in late 2020.

• Ripple had global partnerships

• ODL usage was growing

• Banks were trialing RippleNet

• ISO 20022 implementation was just around the corner

Then, out of nowhere, the SEC filed its lawsuit — just before Christmas 2020.

Suspicious timing?

• Ripple had global partnerships

• ODL usage was growing

• Banks were trialing RippleNet

• ISO 20022 implementation was just around the corner

Then, out of nowhere, the SEC filed its lawsuit — just before Christmas 2020.

Suspicious timing?

(3/🧵) This wasn’t a civil lawsuit — this was a chokehold.

• It wiped XRP off major U.S. exchanges

• Froze institutional adoption

• Put a target on Ripple while other tokens were booming

Meanwhile, Bitcoin and Ethereum were labeled as “not securities.”

Why isolate XRP?

• It wiped XRP off major U.S. exchanges

• Froze institutional adoption

• Put a target on Ripple while other tokens were booming

Meanwhile, Bitcoin and Ethereum were labeled as “not securities.”

Why isolate XRP?

(4/🧵) Fast forward: Ripple fights back… and wins some big milestones.

• Judge Torres rules XRP is NOT a security in secondary markets

• Ripple continues expanding outside the U.S.

• Global momentum grows

So what does the SEC do?

They ask for a pause.

60 days.

• Judge Torres rules XRP is NOT a security in secondary markets

• Ripple continues expanding outside the U.S.

• Global momentum grows

So what does the SEC do?

They ask for a pause.

60 days.

(5/🧵) That’s right. As of April 2024,

The SEC requested — and was granted — a 60-day pause in proceedings.

Why?

They claim it’s for “remedies discussion.”

But what if it’s not that simple?

What if this delay is strategic?

The SEC requested — and was granted — a 60-day pause in proceedings.

Why?

They claim it’s for “remedies discussion.”

But what if it’s not that simple?

What if this delay is strategic?

(6/🧵) Consider this: The U.S. is rushing to deploy FedNow, pilot CBDCs, and define stablecoin laws.

Ripple is already years ahead in infrastructure:

• Liquidity on demand (ODL)

• Private ledgers for CBDCs

• Interoperability with ISO 20022

• Cross-border payment rails live

Ripple is already years ahead in infrastructure:

• Liquidity on demand (ODL)

• Private ledgers for CBDCs

• Interoperability with ISO 20022

• Cross-border payment rails live

(7/🧵) So here’s the theory: The lawsuit was never about “protecting investors.”

It was about stalling XRP until the U.S. could catch up.

Ripple wasn’t just ahead — it was too ahead.

And letting it run free would’ve made government and banking infrastructure look… outdated.

It was about stalling XRP until the U.S. could catch up.

Ripple wasn’t just ahead — it was too ahead.

And letting it run free would’ve made government and banking infrastructure look… outdated.

(8/🧵) It’s no coincidence:

• Lawsuit filed as ISO 20022 neared

• Pauses requested during key milestones

• FedNow launched mid-lawsuit

• U.S. CBDC conversations surged during the pause

• Ripple kept building outside U.S. control

A legal speed bump, not a blockade.

• Lawsuit filed as ISO 20022 neared

• Pauses requested during key milestones

• FedNow launched mid-lawsuit

• U.S. CBDC conversations surged during the pause

• Ripple kept building outside U.S. control

A legal speed bump, not a blockade.

(9/🧵) The SEC kept XRP in limbo. But Ripple never stopped:

• XRP ODL volume increased globally

• Partnerships with banks and fintechs grew

• Private XRP ledger tested for CBDCs

• Stellar and XRP both sat quietly on ISO-ready infrastructure

The U.S. slowed the narrative — but couldn’t stop the build.

• XRP ODL volume increased globally

• Partnerships with banks and fintechs grew

• Private XRP ledger tested for CBDCs

• Stellar and XRP both sat quietly on ISO-ready infrastructure

The U.S. slowed the narrative — but couldn’t stop the build.

(10/🧵) Final thought:

If XRP truly posed a risk to investors, why hasn’t the SEC pursued exchanges listing it post-judgment?

Why delay remedies now?

Why freeze… when they already lost?

Simple:

They weren’t trying to win.

They were trying to wait.

If XRP truly posed a risk to investors, why hasn’t the SEC pursued exchanges listing it post-judgment?

Why delay remedies now?

Why freeze… when they already lost?

Simple:

They weren’t trying to win.

They were trying to wait.

(11/11) The Ripple case may end soon — but what it revealed might be bigger:

Regulators don’t always act to stop something.

Sometimes…

they act to stall something, until they can control it.

Are you ready once the switch flips?

Regulators don’t always act to stop something.

Sometimes…

they act to stall something, until they can control it.

Are you ready once the switch flips?

• • •

Missing some Tweet in this thread? You can try to

force a refresh