🧵Autism rates have exploded, becoming a massive financial enterprise and while framed as support, the reality involves billions in profits. Let’s explore who benefits and how.

In 2000, CDC data showed 1 in 150 children diagnosed with autism. By 2023, it’s 1 in 36—an unprecedented 317% increase. Improved diagnostics alone can’t explain this growth.

Source: cdc.gov/autism/data-re…

Source: cdc.gov/autism/data-re…

Autism-related costs in the U.S. reached a staggering $223 billion annually in 2020, projected to be $589 billion by 2030. Expenses include healthcare, special education, therapies, and productivity losses.

Source: mindd.org/research/alarm…

Source: mindd.org/research/alarm…

Applied Behavior Analysis (ABA) is the primary therapy for autism, derived from behavior modification theories. Despite controversies and comparisons to coercive methods, ABA dominates due to its profitability, structured around billable therapy hours.

Sources: gminsights.com/industry-analy…

Sources: gminsights.com/industry-analy…

Private Equity Dominance in Autism Care

Private equity firms have aggressively acquired ABA clinics, consolidating them into large, profitable chains. High insurance reimbursements and limited oversight attract investors aiming for significant returns.

Private equity firms have aggressively acquired ABA clinics, consolidating them into large, profitable chains. High insurance reimbursements and limited oversight attract investors aiming for significant returns.

“The flood of insurance and taxpayer money pouring into the ‘market for autism services’ has quickly flowed into the pockets of Wall Street financiers. Autism advocates won health insurance and Medicaid coverage for intensive autism services, especially Applied Behavior Analysis (ABA), which is the most widely recognized evidence-based approach. The more intensive services, requiring more hours of therapy each week, allow for higher reimbursement opportunities compared to other approaches or to other developmental disorders.”

Source: cepr.net/publications/p…

Source: cepr.net/publications/p…

The ABA Therapy Profit Model

ABA therapy typically involves 20–40 billable hours weekly per child. This model encourages ongoing dependence, creating “lifelong customers” rather than promoting independent coping strategies.

Source: autismspeaks.org/applied-behavi…

ABA therapy typically involves 20–40 billable hours weekly per child. This model encourages ongoing dependence, creating “lifelong customers” rather than promoting independent coping strategies.

Source: autismspeaks.org/applied-behavi…

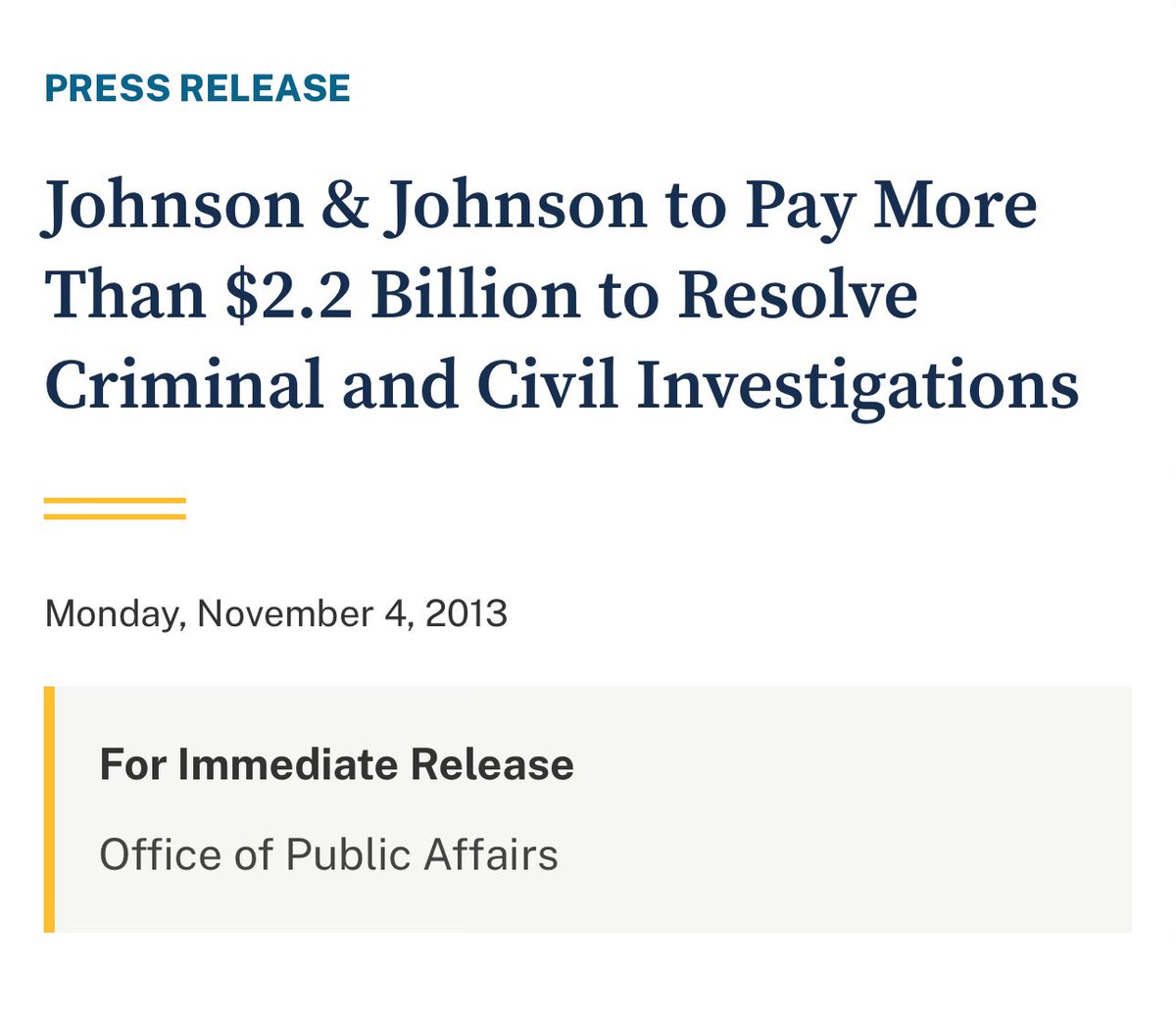

Pharmaceutical companies profit substantially from medications prescribed for autism symptoms, such as irritability and anxiety. For example, Risperdal, an antipsychotic by Johnson & Johnson, is widely prescribed despite severe side effects.

Source: precedenceresearch.com/autism-spectru…

Source: precedenceresearch.com/autism-spectru…

Back in 2013 Johnson & Johnson had to pay $2.2 Billion because of off-label marketing of Risperdal.

“The complaint alleges that J&J and Janssen knew that Risperdal posed certain health risks to children, including the risk of elevated levels of prolactin, a hormone that can stimulate breast development and milk production. Nonetheless, one of Janssen’s Key Base Business Goals was to grow and protect the drug’s market share with child/adolescent patients. Janssen instructed its sales representatives to call on child psychiatrists, as well as mental health facilities that primarily treated children, and to market Risperdal as safe and effective for symptoms of various childhood disorders, such as attention deficit hyperactivity disorder, oppositional defiant disorder, obsessive-compulsive disorder and autism.”

Source: justice.gov/archives/opa/p…

“The complaint alleges that J&J and Janssen knew that Risperdal posed certain health risks to children, including the risk of elevated levels of prolactin, a hormone that can stimulate breast development and milk production. Nonetheless, one of Janssen’s Key Base Business Goals was to grow and protect the drug’s market share with child/adolescent patients. Janssen instructed its sales representatives to call on child psychiatrists, as well as mental health facilities that primarily treated children, and to market Risperdal as safe and effective for symptoms of various childhood disorders, such as attention deficit hyperactivity disorder, oppositional defiant disorder, obsessive-compulsive disorder and autism.”

Source: justice.gov/archives/opa/p…

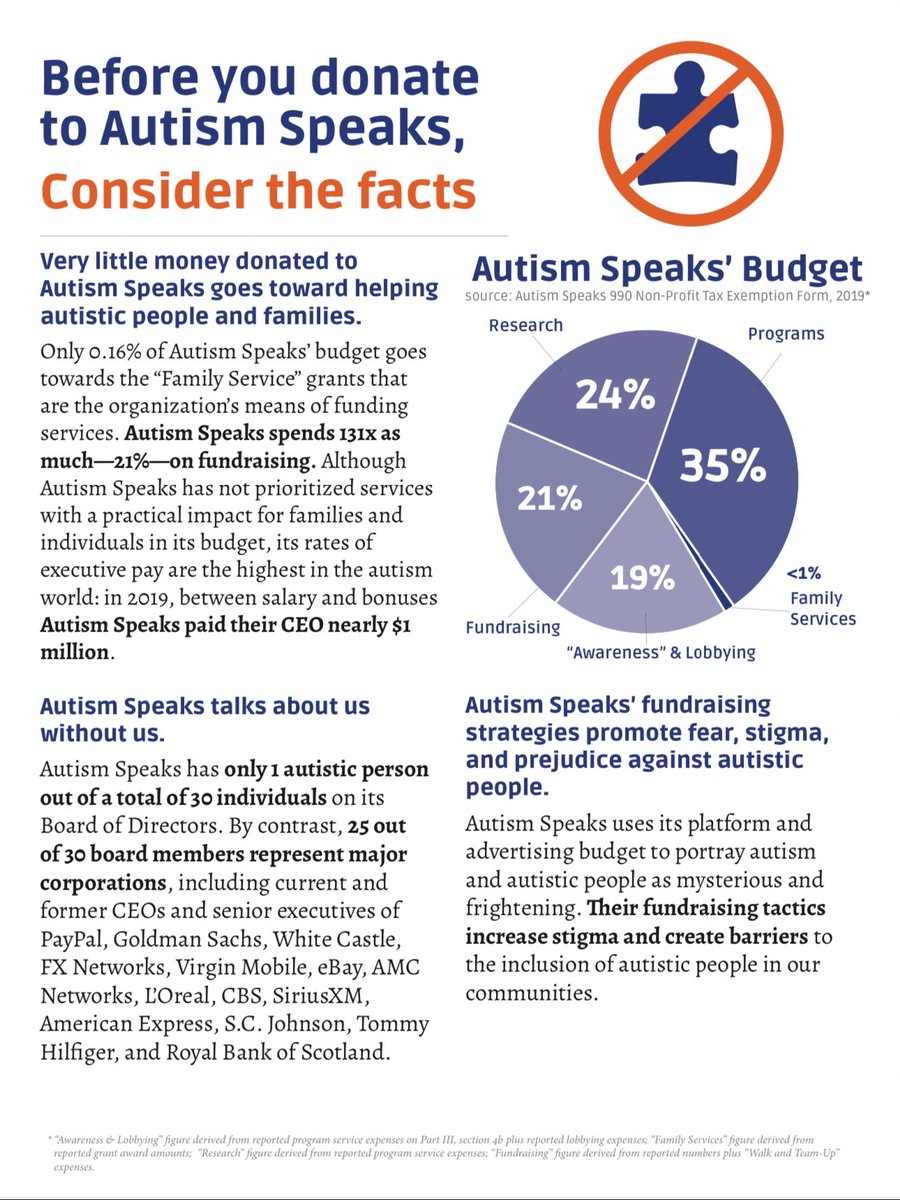

Autism Nonprofits and Corporate Influence

Organizations like Autism Speaks attract large donations but face criticism for high executive pay and limited direct service spending. In 2019, Autism Speaks’ CEO received nearly $1 million in compensation.

Sources: autisticadvocacy.org/wp-content/upl…

Organizations like Autism Speaks attract large donations but face criticism for high executive pay and limited direct service spending. In 2019, Autism Speaks’ CEO received nearly $1 million in compensation.

Sources: autisticadvocacy.org/wp-content/upl…

The Autism Impact Fund has raised $60 million specifically targeting startups focused on autism and neurodevelopmental disorders, highlighting profit potential beyond traditional healthcare.

Source: axios.com/2024/04/03/aut…

Source: axios.com/2024/04/03/aut…

Autism diagnoses are based on subjective behavioral observations, not definitive medical tests, increasing potential overdiagnosis. Diagnostic ambiguity benefits industries that thrive on treatment demand.

As previously referenced insurance mandates across all 50 states require coverage for autism therapies, significantly increasing demand and profitability. ABA therapy in particular has seen explosive growth due to these mandates.

Source: ncsl.org/health/autism-…

As previously referenced insurance mandates across all 50 states require coverage for autism therapies, significantly increasing demand and profitability. ABA therapy in particular has seen explosive growth due to these mandates.

Source: ncsl.org/health/autism-…

Millions in NIH grants fund autism research, creating financial incentives for institutions to continue research cycles that rarely yield breakthroughs in autism causation or prevention. Since 2008 taxpayer funded research has grown from $118 million to an estimated total $330 million a year.

Source: report.nih.gov/funding/catego…

Source: report.nih.gov/funding/catego…

The major beneficiaries of all this money being spent and made isn’t the children caught in the middle of this grotesque profit seeking epidemic, it is the industry that has been built around them by:

•Private equity investors like Blackstone.

•ABA therapy conglomerates like Centria, BlueSprig.

•Pharmaceutical companies like Johnson & Johnson.

•Nonprofits tied to corporate interests like Autism Speaks.

•Academic institutions benefiting from continuous grant funding financed by taxpayers with little if any significant progress made.

•Private equity investors like Blackstone.

•ABA therapy conglomerates like Centria, BlueSprig.

•Pharmaceutical companies like Johnson & Johnson.

•Nonprofits tied to corporate interests like Autism Speaks.

•Academic institutions benefiting from continuous grant funding financed by taxpayers with little if any significant progress made.

Families face heavy financial burdens and stress, taxpayers fund expensive treatments via Medicaid, and autistic individuals risk long-term dependency on services designed more for profit than empowerment.

The Autism Industrial Complex operates on a cycle of diagnosis, treatment dependency, and profit maximization, often sidelining genuine, holistic support and independence for autistic individuals.

When factoring pharmaceutical sales and auxiliary support industries, annual profits likely approach $10–15 billion.

This is what I call Systemic Capture and it is undeniable. All this money for a disease that no one seems to know where it comes from but has a multi-billion dollar industry behind it.

Quite convenient and most of all profitable.

The Autism Industrial Complex operates on a cycle of diagnosis, treatment dependency, and profit maximization, often sidelining genuine, holistic support and independence for autistic individuals.

When factoring pharmaceutical sales and auxiliary support industries, annual profits likely approach $10–15 billion.

This is what I call Systemic Capture and it is undeniable. All this money for a disease that no one seems to know where it comes from but has a multi-billion dollar industry behind it.

Quite convenient and most of all profitable.

Thanks for reading.

Follow me @joshwalkos for more threads and info in the future.

Follow me @joshwalkos for more threads and info in the future.

• • •

Missing some Tweet in this thread? You can try to

force a refresh